A high-risk instrument

advertisement

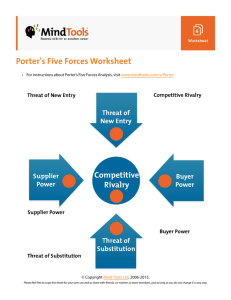

Corporate Financial Strategy 4th edition Dr Ruth Bender Chapter 4 Linking corporate and financial strategies Corporate Financial Strategy Linking corporate and financial strategies: contents Learning objectives Business risks reflect the volatility of results Elements of business risk Porter’s five forces Environmental analysis – PESTLE Resource-based theory Developing strategies to enhance shareholder value Decisions in financial strategy Risk from different perspectives Balancing business and financial risk Balancing business and financial risk in private companies Pecking order Corporate Financial Strategy 2 Learning objectives 1. Distinguish business risk and financial risk, and explain why there should be an inverse relationship between them. 2. Explain the different elements of financial strategy. 3. Assess how risky a particular business is, with a view to understanding how it should be financed. 4. Understand the seven drivers of value, and how they can be related to business strategy in order to increase value. 5. Discuss how the elements of financial strategy might apply differently to public and privately owned companies. Corporate Financial Strategy 3 Business risk reflects the variability of results Price Volume Sales – Costs = Profits Products Markets Fixed Variable Committed Corporate Financial Strategy 4 Elements of business risk Demand volatility Input cost volatility Growth drivers Selling price volatility Expense volatility Industry analysis Currency exposures Corporate governance Working capital needs Corporate Financial Strategy 5 Porter’s five forces New entrants Suppliers Rivalry Substitutes Corporate Financial Strategy Porter, M. (2004). Competitive Strategy, 6 Customers Environmental analysis – PESTLE Political Economic Social Technological Legal Environmental Corporate Financial Strategy 7 Resource-based theory aluable are mperfectly imitable on-substitutable Corporate Financial Strategy 8 Developing strategies to enhance shareholder value External forces STRATEGY Management ability Corporate governance SHAREHOLDER VALUE Resources KPIs Targets Corporate Financial Strategy 9 Market views of the company VALUE DRIVERS Decisions in financial strategy How large should the asset base be? Corporate Financial Strategy How much of the finance should be debt? How much should be paid in dividends? 10 Should we issue new shares? Risk from different perspectives Debt Features for Issuer (the Company) Features for Investor Corporate Financial Strategy Equity Interest must be paid Can choose whether to pay Repayments must be made dividends Lender might have the right No repayment obligation to repossess assets A high-risk instrument A low-risk instrument Interest is contractual Repayment is contractual The lender might obtain security Dividends are at the discretion of the company No requirement to repay capital A low-risk instrument A high-risk instrument 11 Balancing business risk and financial risk High Business risk Low Low Corporate Financial Strategy Financial risk 12 High Balancing business risk and financial risk in private companies High ? Business risk Low Low Corporate Financial Strategy Financial risk 13 High Pecking order Corporate Financial Strategy 14

![[These nine clues] are noteworthy not so much because they foretell](http://s3.studylib.net/store/data/007474937_1-e53aa8c533cc905a5dc2eeb5aef2d7bb-300x300.png)