AA 13 - Montana State University Billings

advertisement

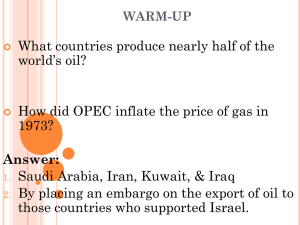

Ch13 Surp+Short March20 1 Armen Alchian 1999 Chapter 13 SHORTAGES, SURPLUSES AND PRICES An investigation of "shortages" and "surpluses" will show they are results of restraints on rights to buy and sell at mutually agreeable prices. As we'll see, those restraints on price competition increase the weight of non-money forms of competition, such as social and political status, and personal characteristics. They also reduce productivity. The analysis of these effects is a good way to develop your ability to apply economic analysis. To do that, in this chapter we’ll explore the somewhat surprising meaning of “shortages” and “surpluses” that have been caused by price controls on housing, petroleum, gasoline, water and agricultural products. Shortages and Price Ceilings; Rent Controls, Shortages and Non-Monetary Competition We start with an increased demand for housing space in some area. We can suppose population has increased, or some people have suddenly become wealthier. Their demand curves have shifted upward or to the right. The demand by the people who were already in the community or whose incomes had not increased are unaffected. In Figure 1, the line, labeled Da+Db, represents the community's initial demand for housing space, which here is the sum of the demands by the two groups. A and B, labeled Da and Db. The market clearing rental price is indicated by the intersection of the total demand and supply lines, and is denoted by P1. Because we are assuming the total stock of existing housing is not significantly affected by the rental price during the time covered in this analysis, the supply is indicated by a vertical straight line, labeled SS, at the existing amount of housing. The increased demand for housing, say by the Bs, as a result of an increase in the population or wealth is represented by shifting the Bs’ demand line for housing, labeled Db', toward the right (larger amounts at any given rent). The As’ demand for housing has not increased. The new total demand, shown by line Da + Db', is larger, so it is above or to the right of the old demand curve, and therefore intersects the vertical (fixed amount) supply line at a higher price, P2. Our first step was to relate the population or income growth to a shift in the demand. As the graph shows this implies a higher equilibrating price at which the amounts demanded equal the amount available. This equality at the same old amount supplied is achieved by the higher price which causes everyone (both As and Bs) to restrain the amount demanded at the old price. The amount they demand at the higher price is reduced. Ch13 Surp+Short March20 2 Figure 1: Shortages by Price Controls When demand by members of group B increases while that of group A does not, the increased total market demand implies a higher equilibrium price of housing. Housing space, indicated by the distance Xb'- Xb would be transferred to the higher valuing group B members from group A. If, however, rentals were held by law at the old level, a shortage of housing would be created. More housing would be demanded at the old, restrained, rental price -- more than exists. Allowing rents to rise avoids the shortage. Many cities have imposed rent controls, with a shortage being created immediately. (It is often proposed that the rent controls be retained until the shortage disappears. When will it disappear?) If rents are allowed to rise in response to the increased demand for housing, the B group is able to bid space away from other present or potential occupants (those in the A group) by offering higher rents. The As end up with less housing space. Housing owners receive higher rents for the same amount of space; the space is worth more, shown by the shaded area in Figure 2. Almost everyone would blame the owners for raising rents, but in fact the Bs’ increased demands caused the higher rent. Housing owners are merely intermediaries, like auctioneers, letting the demanding tenants, the As and the Bs, compete for space. The As and Bs can be neighbors and possibly friends who complain and sympathize with each other about the higher rents, never blaming themselves for their competition for the now more highly valued space (which is what an increased demand means). Ch13 Surp+Short March20 3 Figure 2: Wealth Transfer by Price Controls One effect of price controls is a transfer of wealth, in the form of a greater value of housing space, from owners to existing renters. Without price controls, initial renters would pay more for the housing space (shown as the shaded area in the diagram). Subsequent renters incur costs of other forms of competition in seeking and competing for rental space. It's almost, but not entirely, like the earlier automobile example. A difference is that the rent is paid to the housing owner, not to a former renter who "sub-leases" the apartment and moves out and relinquishes some space to the new renter. This wealth effect on tenants could be modified, of course, if everyone had to own their house (i.e., renting was not allowed.) Then the analysis would be equivalent to the automobile case. However, in the housing case, the renters are not always the owners. The owners gain by a wealth transfer in the form of higher rents, and those renters whose demands have increased gain by the right to compete for more space by offering higher rents, while the displaced renters are worse off. (However, it can be shown that the gains to the owners and to the increased demanders exceed any losses to the displaced. That is small consolation to the displaced, but it is an important reason for permitting people to compete by offering higher prices in the market.) Shifts to Non-Price Competition If the permissible prices are legally restrained so as not to exceed some value (less than what the new market clearing price would be), there are significant effects on behavior as people shift to other non-money forms of competition while they seek the price-controlled goods. If demanders are not allowed to offer more money than the initial rental price, a "shortage" will occur. With the new increased aggregate demand, the amount demanded at the old and restricted price exceeds the amount available. This implication is revealed in the graph by the excess of the amount demanded at the old price and the new aggregate demand over the existing supply. At the constrained price people cannot get the Ch13 Surp+Short March20 4 amount of housing space now demanded at that money price. Immediately complaints would occur about a shortage or housing crisis. Normal vacancies, which arise at market clearing rents and help people adapt and move to new locations, would disappear. Since rent is now controlled below the market clearing price, more non-money forms of competition come into effect. People would complain about "inadequate housing" and capricious, discriminatory behavior by housing owners, who now in selecting renters discriminate more by gender, marital status, age, creed, color, pet ownership, eating and drinking habits, personalities, etc. That means the full price now is more heavily loaded with non-money features. Laws passed with the intention of preventing the resulting discrimination are impossible to enforce fully. And in any event, only some stated impermissible forms of competition are affected. The fact is that “shortages” require selective allocation, and such allocation -- however conducted, whether by income, willingness to pay or color of eyes -- entails discrimination. The more pertinent issue is, "What forms of discrimination and competition for scarce resources are appropriate?" With rent controls, people who already are renting will be able to continue to occupy the rented quarters without paying more. They cannot be induced to move to smaller quarters if rent can't be raised. Therefore, rent controls are popular with people already in a rented unit who expect not to be moving. They are able to use their prior status as a renter as an effective competitive factor against newcomers seeking space, who would offer higher rents. If new demanders are prohibited from offering higher money prices, they will seek to compete in any other permissible ways to get more space from the present occupants (so long as the worth to them of what they would get exceeds the restricted permissible money price). No frustrated demander or newcomer will idly let others get or keep something worth more than the restricted money price. Their marginal personal worth of space in excess of the permissible market price, is how much cost -- beyond payment of that money price -- they are willing to incur in other forms of competition to curry the supplier's favor and displace or reduce the space for existing occupants. Demanders will compete in non-money offers or methods and drive up the non-money elements in the full price to the higher worth of more housing space. At the same time, the sellers will, if they are restricted from accepting more money, begin to accept more of the other forms of value or rewards offered by competing demanders. Demanders richest in good looks, color, personality, congeniality will find these features more effective in getting the suppliers favor. Gender, race, drinking and smoking habits, marital status, etc., will play a greater role. Formerly, with unrestrained money price competition, the people who are less well endowed with these other personal and cultural attributes could offset their disadvantages by offering more money. With price controls, they are not allowed to compete in that way, thereby giving non-price features greater weight. Whether that is proper cannot be decided on the basis of economic analysis. Whether or not you like that will probably depend upon your initial situation and your ability to compete in non-monetary forms. (When competitive success turns largely on beauty, grace, charm, intelligence and personality, you may do well -- but others may have great difficulties.) The point of this paragraph can be summarized: Price controls don't hold down the price, they change the form in which the price is paid. Wealth Transfers vs. Costly Competitive Activity The demanders now can't compete by offering more money to the suppliers. Instead they compete in other costly ways that are of less value to the suppliers. If these other methods were worth more to the suppliers, that behavior would already have been present and would have lowered the initial free-market money rent as a component of the full price. How much value does a supplier get by seeing customers compete by waiting in queues, rather than by receiving more money? The supplier would prefer to be paid with a transfer of money rather than have the demanders compete in ways that are worth less to suppliers. The demanders could, at no more cost to themselves, have provided more benefit to the seller simply by transferring money, without using up time or real resources. But the price control prohibits that. So, the demanders compete in more expensive ways, worth less to suppliers. That's a reason the increase in non-price competition caused by price controls is usually considered wasteful. But, since they compete in other ways, such as "waiting", people whose time is of lower value are "richer" in that form of payment and may be benefited by price controls. (Warning: don't jump to the conclusion that what is wasteful is necessarily "wrong" by all criteria.) Ch13 Surp+Short March20 5 Rationing by Coupons Some of the wastes of non-price competition under price controls can be avoided by rationing using coupons that entitle a person to buy a maximum amount of the good. But not everyone would have equal marginal worths at the amounts they were allotted by the ration coupons. The people with lower marginal worths would prefer to sell their coupons to higher-valuing people. Therefore, it has been widely proposed that ration coupons should be salable. This would benefit the person selling the coupon (who values what could be obtained with the money more than what could be had with the coupon) and would also benefit the purchaser of the coupon. Such an exchange, however, clearly reveals that the effective full price of the good is not being kept down to the official limited price. If a market develops for coupons, then the ration coupon will be worth the difference between the official price of the good and what its freemarket price would be. That difference is forsaken by anyone who uses the coupon rather than selling it. Therefore, the full price for every consumer (money price plus coupon value) equals what the free-market price would be. Changes in Supply Over Time So far we have considered only the span of time in which the supply of housing will not have changed. If the price were controlled below the costs of maintaining the present supply and quality of houses, no increase in the amount of housing would occur despite the increased demand and higher (concealed by the controlled rent) value of housing. In fact the amount supplied would decrease in time. Typically, price controls have been placed on housing at a time when the cost of maintaining and producing housing has increased, as in times of inflation. The controlled rent is almost always less than the cost of maintaining the existing supply and quality of housing. That's not enough to make it worthwhile for the owners to replace, let alone, increase housing. Therefore, the price controls will lead to not only an immediate "shortage", but also an eventual reduction in the stock of housing -- unless some special circumstances exist about the value of the land on which the buildings are located. (We defer an explanation of this possible exception until later chapters for an explanation of "capital value" principles which connect land values to rental values.) Ultimately, it might be the case that the quality of housing deteriorates to where it's worth only the lower rent controlled value. While that would eliminate the "shortage"(!), the outcome of deteriorated housing is the result of the price controls. The Energy “Crisis”: A Vivid Illustration – to Your Parents – of the Power of Economic Analysis In 1973 the amount of oil supplied for use was reduced by major crude oil producing countries. Though that was a long time ago, the same kind of situation for other goods occurs often on a smaller scale. The situation was widely misinterpreted. To see why, let's apply the analysis. That reduction in supply is portrayed by shifting the vertical supply line back to the left in Figure 3, which guides the interpretation. In conformity with our initial supposition, the straight vertical line indicates the amount supplied will not respond to the price -- at least not for the interval we'll be examining. The vertical supply curve is shifted to the left, indicating a reduced supply over the pertinent range of prices. The new reduced supply curve intersects demand at a higher market-clearing price. At the old price the amount demanded would have exceeded the new smaller rate of supply. As soon as the price began to rise, the permissible price was restricted at Po by governmental imposed price controls. The highest permitted price – “ceiling price” – was below the new equilibrium price. As with the earlier examined price controls on housing, here the amount of gasoline (refined from the crude oil) demanded (at that legally permissible price) was not restrained sufficiently to match the reduced amount supplied. The result was called a "shortage". That term may seem plausible in this situation, since the supply of gasoline supplied was reduced. However, it was the price controls, not the reduced supply, that caused the shortage with its altered form of competition for the supplied amount. If price had been allowed to rise as people competed for the oil and gasoline, the price would have risen high enough to restrict the amount people demanded to where they then could buy as much as they wanted at that price. That's true of all goods when prices are unconstrained. We'd all demand more of everything – Rolls Royces, private airplanes, and luxurious homes – if their market prices were lower. It's their high prices that make most of us not demand them. Ch13 Surp+Short March20 6 But when the money price was kept down by price controls, everyone had a marginal worth of another gallon higher than the legal price. So they began to compete more by non-money methods. Some people hired students (whose cost of time was low) to take their cars to the service station and wait in the lines. Some people rented cars with full gas tanks, siphoned off the gas, and returned the undriven rented cars. But everyone had to engage in additional nonmonetary forms of competition for the gasoline – just as they do for price-controlled housing. They waited in line meekly and longer, tolerating shorter hours, poorer service, and paying the seller more for other things (e.g., a lube job) – up to where the full price (money plus these other costs) equals the higher marginal personal worth of the reduced amount of gasoline. To repeat the implication, price controls – not a reduced supply – create a shortage and change the form of the competition and the full price. They don't hold down the full-price; instead, people incur costs of engaging in more of other distasteful, less preferred competitive activity. People who can engage more cheaply in those additional forms of competition tend to benefit. Where being patient and waiting in a queue is a method of competing retired people or very young people, with lower alternative values of time, will be more willing to wait in line longer. More important, almost all the non-money competition to get favored status will be of trivial value to sellers relative to a payment of money, and it is a diversion of productive power from production of more valuable marketable goods. In that sense, these other forms of competition definitely are wasteful. Competition’s is not eliminated. Its form and components are changed, and they become part of the higher full price. This idea and principle is so important as to deserve more elaboration. It implies something far more basic and important than appears at first sight. It is that “Cost Is Derived From Product Value”, which at first thought seems to reverse the truth, but it doesn’t. It says the value of productive inputs is derived from the sales value of its final products. Almost everyone thinks it's the other way around – that the cost or value of inputs determines the final product consumer price – the market value of the product. . You don’t want to fall into the very common, almost universal, error of believing that paying a newly found star basketball athlete an enormous salary will require the team’s owner to raise the ticket prices. That’s got the force completely in reverse. It’s the fact that the public’s demand for the super athlete services is high and will be competed into obtaining that athlete’s services by raising the salary offered the athlete that enables the admission price to be raised. The higher demand raises the admission price, and the athlete is thereby paid more. The sporting event prices are high because “we” fans place a high value of the thrill of watching the athletes perform. Don’t blame the athletes or the team owners for high prices; blame yourself! Don’t confuse the timing of contracts and price changes with the direction of cause and effect. As a very obvious example of that error, if you have costs of $30,000 for painting an old car, do you assume you could sell it for that high a price? We hope you don't believe that if you record some music on compact disks your costs of production will determine what their selling price will be! Similarly you will certainly hear that housing developers force up the price of land when bidding for land on which to build houses. In fact, the high demand for houses on that land induces higher values of the land on which to build houses, and that’s why the price of housing on that land is high. Always the price of something reflects the demand for it. The resulting price of housing then depends on the supplied amount of housing on that land. This effect of the developers supplying more houses is that of making the prices lower than they otherwise would be. Price Controls on Inputs (Petroleum) Do Not Reduce the Price of Outputs (Gasoline) Another example of the extent of this confusion is provided by political actions during the oil price rise of the 1970’s. The President, Congress, and very, very many business executives argued incorrectly that the high price of gasoline could be lowered by restricting the price of petroleum, the major input in gasoline producing refineries. So the maximum legally permissible price was set at the low price of $10 a barrel, far below the free market price of about $30 to $40per barrel at that time. But that price control couldn’t reduce the price of the product (gasoline) – unless it increased the supply curve of gasoline relative to the demand curve for gasoline. As always, the product price depends on the supply of, and the demand for, the final product. Holding down the input price won't increase supply of that input. So long as the demand and supply are unaffected by that limit placed on the permissible selling price of petroleum, without affecting the supply of petroleum, that won’t lower the price of gasoline. Ch13 Surp+Short March20 7 A Statement of A Basic Principle: "Higher Demand Induces and Enables Higher Costs, Not the Reverse – in which Cost Determines Values" To illustrate in arithmetic detail, suppose that the products derived from a barrel of crude oil (gasoline, kerosene, fuel oil, plastics, asphalt, chemicals, drugs, rubber, etc.) have a market value of $50, at their free market prices to consumers. And suppose the permissible price of a barrel of petroleum is restricted by law to $10. See Figure 3 to help you follow, or deduce, what would happen. Restraining the price of an input for producing a final product neither increases the input's supply nor lowers its value. The amount of output produced with the input is not increased, and therefore its price is not reduced by restraining prices of the inputs. Here, restricting the permissible price of a barrel of petroleum to only $10 does not increase the supply of oil and, therefore, does not change the price of gasoline. Indeed, if that restriction does anything, it reduces the amount of petroleum supplied, which reduces the amount of gasoline supplied thereby raising the price of gasoline. An effect of the restriction on the price of the input is to increase the profit of the refiners who do get the underpriced oil. But even then, competition for that underpriced oil results in higher costs to refiners in their effort to get more of the underpriced oil. (As practice in applying economic analysis to competition, ask yourself whether a refinery owner would try to pay more "under the table" to get more of the underpriced oil? Would petroleum oil producers try to buy refineries to capture the higher refinery profits – which reflect the higher value of the oil? Or would refineries try to buy the oil well? Or would the two integrate into one firm? With refining, transporting and retailing costs of $33, the remainder, $17 (= $50 price -$33) is how much a barrel of petroleum is worth to a refiner. Competition among refiners to get petroleum that is worth $17 would drive its price up to $17, its value derived from the final consumer products. The value of an input is the value derived from its Ch13 Surp+Short March20 8 contribution to final consumer products. Its price will be driven up to that value as people compete to get more of that input. In the present example, the input is worth $17 to a refiner – the remainder of the consumption value of the final consumer product, after deducting refining and distribution costs. But then, why is it the value of crude oil, rather than some other input, (like the refinery), whose value is affected? The answer is that the best alternative use values of every input must be matched if that input is to be attracted. Steel, labor and other resources have valuable uses in producing other goods. They must be paid the value of what they can do elsewhere, or they won't be used to refine the oil. However, almost all of the crude oil supplied has no alternative worth other than being used in a refinery. Therefore, crude oil is worth only what is left after the necessary costs of maintaining the supply of other resources that do have alternative use values. Any refiner who could get petroleum at a price less than $17 would make a profit equal to the petroleum's derived value in excess of the $10 restricted price. No matter how low (or how high) the legal or official imposed price for a barrel of petroleum, its market value is $17. We have seen in the above example that as surely as the tide comes in, holding the price of an input down will not increase the supply of consumer products derived from the supply of that input. The oil supplier is being induced to produce less! Curtailing the price of petroleum will not increase the supply of petroleum and, therefore, will not increase the supply of refined products – gasoline, heating oil, plastics – and thus will not hold down the price of the product. None of that prevents the product's price from rising to the market clearing price. The price restriction on the petroleum merely transfers some of the petroleum's value from the producer of petroleum to any refiner who can get the petroleum at that restricted lower price. Where the legally restrained price of petroleum is $10, the refiner who was lucky to get it at that price would be obtaining a $7 wealth transfer from the producers of the petroleum that is worth $17. To repeat, controlling the price of any input without affecting the amount supplied of that input would not increase the amount of final consumer products. Therefore, that would not change the price of its consumer-products, because the supplied amount of that price-controlled input is not increased. The Oil Industry Divided – Some Attacking and Others Defending Petroleum Price Controls Returning to price controls on petroleum, it can now be seen it was fallacious to argue that removing the controls on petroleum (an input) would result in a rise in the price of gasoline (a product). In the first place, not even the money price of gasoline would be kept down by price controls on petroleum. Second, price controls on petroleum tended to reduce the amount of petroleum extracted from the oil wells. Producers simply waited until the controls were removed before producing more. So for two reasons the removal of price controls on petroleum would not result in higher gasoline prices. As it happened, when price controls were removed on domestic petroleum, the price of gasoline, instead of rising, actually fell. (Test your understanding of this application of economic theory by explaining why gasoline prices fell.) It should now be no wonder the so-called oil industry fought both for and against price controls on crude oil. The "oil industry" is not a monolithic group all with the same interests. The crude oil producers (e.g., Exxon, BP, Texaco) fought against price controls on crude oil without much success. At the same time the users of crude, the refiners (who were allotted crude oil at that low price and refined gasoline from it (e.g., Ashland Oil) loved the price controls – except that they too suffered from the “shortage” of crude. They demanded more than was available at the controlled price. So they, like consumers of gasoline, competed in new ways to get a larger share of the supplied petroleum. Some refiners, arguing they were small and therefore more deserving of help, were "given" special extra rights to get more, called quotas, some of which were promptly sold to other refiners at the higher worth of the crude. All the refiners began to compete more intensively in the political market for allocations by the federal government agencies that were assigning the supply. After all there was a shortage, so someone had to allocate the oil among the refiners who were demanding more than was available " – according to the popular myth. The refiners funded politicians to maintain price controls and to get more quotas. The crude producers funded the same politicians to try to eliminate the controls. Those are not costless activities. As economic analysis implies, politicians knew that with price controls, politicians would acquire valuable authority to determine who gets the price-controlled goods. Why Are Water Prices Kept So Low? As the population increases and rainfall does not, some areas are discovering that in some years water supplies don't match the amounts demanded at the existing unchanged price of water. The amount of water demanded is not Ch13 Surp+Short March20 9 independent of price. At a higher price, people will demand, need, want, and use less water, because consuming less water is not as unpleasant as continuing to use the same amount at a higher price when that greater amount of money paid for water could be used for more of other things instead. A higher money price of water doesn't make things as pleasant as if more water really were available. But it does eliminate the lower valued uses of the water more accurately and effectively according to each person's worth of water for various purposes. It does that more effectively than if the price of water were held down and water rationed and used according to politically derived opinions about the best uses of water. From time to time, and increasingly so, California suffers from a reduced supply of water as a result of lower than normal rainfall. But the price of water is not raised, so a "shortage" develops. Immediately, political authorities impose "rationing" on quantities and permissible uses by governmental edicts, such as prohibiting watering of gardens, washing cars, or fountains, etc. However, in Arizona, where the supply of water is far less, no shortage exists and no rationing rules are imposed. Instead, the price of water in Arizona has been allowed to rise to a market clearing level at which the public can use however much water for whatever purpose it wishes. The higher price fosters conservation of water in Arizona. However, in California the price of water to farmers has been kept very low and is less than 1% of the worth to domestic city users. As a result, the marginal worth of water for agricultural purposes is certainly lower than for city dwellers. And most of the water goes to farming, despite the higher worth to urban dwellers. One might argue that in California some political authorities (especially state water control boards) like low prices because that gives them more power. However, on that line of argument, prices should likewise be too low in Arizona, unless you believe Arizona political authorities are different! In any event, as the population grows and the supply of water does not, the worth of the water rises substantially, so that the prices charged to users reflect only the distribution costs rather than the worth of the water. It will probably take some time for the water authorities to raise the price of water, especially if they don't own the water and therefore are not motivated by the ability to capture that value as their wealth. We conjecture (though we admit we have no special powers of conjecture) that as political authorities begin to realize they can raise the price to reflect that higher water value and use the proceeds as a source of revenue to cover government expenditures, they will raise the water price. (We presume the demand for water is of sufficiently low elasticity that the total revenue will be increased, rather than decreased!) Surpluses and Price Floors We hope it is obvious by now that if what is typically called a “surplus” must be one in which the price is not allowed to be as low as the market clearing price. In other words, if the price must be above the market clearing level, a surplus will be created. This limit on how low the price may be is often called a “price floor”, in contrast to a “price ceiling” which is an upper limit on legally allowable prices. Figure 4 shows the essential idea. Here, we simply take it for granted that the cost per unit of output is higher at greater rates of production. This is represented by a supply curve that slopes upward from left to right – in contrast to a demand curve with its negative slope. As the diagram reveals, a surplus is the result of the price restriction, not of some physically “excessive” supply. The surplus would be eliminated as soon as the market price was not restricted. What’s “excessive” in the case of surplus is the price, below which transactions are not allowed. What is “deficient” in the case of a shortage is the allowable price. Yet, almost always a “surplus” will be interpreted as if the supply were “too large”, greater than the “demand” – as if price didn’t matter. It’s even been contended that the producers are so “efficient” that they’re producing “too much”, hence the surplus! It’s then been contended production controls have to be placed on the producers to eliminate the “excessive” production (rather than letting the price fall). Ch13 Surp+Short March20 10 Figure 4: Surpluses Caused By Preventing Price From Falling to Market Clearing Level In this diagram the amount supplied is responsive to price rather than constant. However, the analysis and implications are the same whether the supply is a fixed total (vertical line) or is sloped upward with larger amounts supplied at higher prices. Any price above the market clearing price will result in a surplus, wherein the amount demanded will be less than the supplied amount supplied at that price. The surplus would be eliminated if the price were allowed to fall in response to the demand and supply forces in the market, increasing the amount demanded (and reducing the amount supplied when the amount supplied is responsive to the price, as in this diagram). Perhaps the most common and general price floors are for agricultural products. In almost every nation, farmers have managed to induce legislation controlling farm product prices at a high level – above the market clearing level. The resulting “surplus” is then “solved” by limiting the permissible amount of production by farmers, as with peanuts, tobacco, raisins and several other products – varying with alterations in legislation by the government. In the United States the prices of milk, butter, sugar, raisins, lemons, sugar, tobacco, wheat, and peanuts, to name some, are officially set at higher than free market prices. A resulting difficulty is that announcing a minimum price and making the market clearing price be that price are two different things. If the price is higher than the market clearing price, there is then the problem of getting rid of the surplus. The “easy” economic way is to eliminate the price floor, except that it’s too difficult politically. So there are three and only three options. (1) A lower permissible price, or (2) the output and the amount that is offered for sale must be restrained, or (3) the excess of the amount supplied over the amount demanded must be destroyed or disposed of “elsewhere.” Since the choice to not implement the first alternative is the source of the problem, the other two are the pertinent alternatives. The surplus at that controlled price (often called the “support price”) is sometime purchased by the government at that high price, as with milk products. The surplus is then stored as cheese or powdered milk or distributed as aid to the poor countries, or redistributed as "free" cheese to senior citizens or other “needy” groups. The cost is borne by the purchasers of the higher priced milk products sold in the markets, and by the tax payers who finance the purchase of the “excess” milk products. Another response is to force the producers to reduce production, by putting a tax on the “excess production” as is done for some farm products. In some cases, the permissible production is restricted by legislation (often called “agricultural marketing orders”) in an attempt to maintain a sufficiently small supply and maintain the desired high price in the otherwise free market (at the cost of higher prices Ch13 Surp+Short March20 11 to consumers). That is what is done for tobacco, raisins, cotton, peanuts, lemons, and many, many other agricultural commodities. Anyone who produces or offers to sell more can be severely penalized by a fine or tax on the excess production or sales. The nature of the farm price legislation varies from nation to nation and from year to year (or from one session of Congress to another. Competitive Behavior During A “Surplus” As with shortages, it’s the same with surpluses, but in the opposite direction. While the restriction and resulting surplus exists, suppliers compete more in ways other than just the dollar price. The price restriction is usually on just the money amount paid, but the “product” being sold can be improved. The sellers offer more side benefits and amenities, thereby increasing the “full product” worth to match the high price the buyer must pay. Free delivery, free credit, stronger guarantees, free supplementary goods and services are examples. Decades ago when the airlines colluded with the federal government to control airfares at a high level, almost every flight had “surplus” capacity in the form of empty seats. Each airline competed in other than explicit dollar fares. They increased services, size of planes, number of flights, free companion flights, better dinners and free alcoholic drinks. Once the air fares were freed from lower limits, the surplus capacity disappeared. With too high a fixed price, the producers, not being able to sell all their output at that price, will compete by offering more or better goods or by concealed or camouflaged price reductions. The price controlled products can be bundled with other non-price controlled goods and services – as a “tie in” in which the added goods are offered at less than their competitive price. The whole package then has a competitive price. Or associated services for which fees normally are charged will be provided "free." It’s the exact reverse of “minimum price controls” that create “‘shortages” and competitive reductions in quality and associated services. All you have to do to detect the competitive forces at work is to reverse the earlier explained incentives and competition for housing during rent controls. The amount offered for “trade-ins” to buyers of new cars would be competed up high enough to offset the excessively high minimum permissible price on the newly purchased item. The added features and adjustments are concealed “pricecuts” to evade the price restriction. Implications The implications of all the preceding examples are that imposed price restrictions (1) make the amount demanded at the money price exceed or fall short of the amount available; (2) restrain exchange from lower- to higher-valuing users; (3) reduce the quality and quantity of goods; (4) induce wealth-wasting forms of competition by altering the full price components; and (5) increase non-monetary discrimination in competing for goods. Finally, (6) they do not keep the full price low – they change the composition of the full price, increasing the non-money costs until the full price is an equilibrium price more heavily weighted with non-money types of discrimination. And restrictions that require the price be higher than the market equilibrium price lead to what are called surpluses. The examples in this chapter are all cases of shortages or surpluses resulting from imposed restrictions on prices. (As we’ll see in later chapters, shortages and surpluses can also arise from very sensible voluntary refusals by sellers to raise price in the face of shortages or to lower prices when there are surpluses.) Before getting into that, we should take note of situations in which it seems markets do not work as heretofore explained. However, in fact, it’s not that markets don’t work. Instead, they aren’t allowed to work. That happens when private property rights to some goods are not well specified or enforced and, therefore, they can’t be bought or sold or controlled as private property. That’s not a “defect” of markets. It’s an absence of markets for those goods. It’s been impossible or prohibitively costly to define and enforce private property rights over some goods, such as the air, and for land with respect to noise and views. So, later, after exploring markets for goods controlled by private property rights, we’ll take a look, in the next chapter, at some of the consequences on uses of resources that are not controlled by private property rights. Then, in still later chapters (on governments) we’ll explore alternative means of controlling uses of resources that are not privately owned.