Personal Finance Syllabus

advertisement

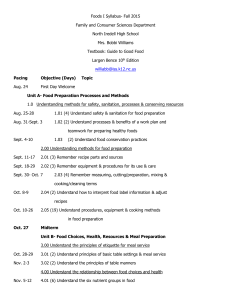

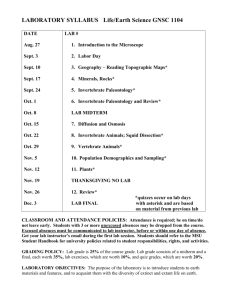

Personal Finance SYLLABUS Course Name: Personal Finance Number of Credits: Elective course Instructor Name and Contact Information Name: Mrs. Cynthia Bradshaw Office Location: Room 118 Office Hours: 2nd block planning (10:10-11:42) or afterschool Telephone: 336-570-6100 Email: cynthia_bradshaw@abss.k12.nc.us Classroom Meeting Times and Location: 1st, 3rd, and 4th blocks room 118 Supplements: Ever Fi ( Certification) Course Description and Course Goals Personal Finance is a course designed to help students understand the impact of individual choices on occupational goals and future earnings potential. Real world topics covered will include income, money management, spending and credit, as well as saving and investing. Students will design personal and household budgets; simulate use of checking and saving accounts; demonstrate knowledge of finance, debt, and credit management; and evaluate and understand insurance and taxes. This course will provide a foundational understanding for making informed personal financial decisions. Course Policies Grading (ABSS has a 7 point grading scale) Sample: % Grade Grade Test= 25% 100-93 A Quiz= 15% 92-85 B Participation= 60% 84-77 C 76-70 D 69 and below F ***Note*** Penalty for Late work is minus 10 points Attendance: Students are expected to attend school daily and on time in order to be successful. Tardies are not acceptable (1st tardy=verbal, warning, 2nd tardy=verbal warning, 3rd blocks of ISS, 4th= day of ISS, 5th= Parent Conference before allowed back to school Assignment Due Dates Students will need to follow the guidelines as indicated in the student handbook for making up work with excused absences. It is the sole responsibility of the student to make up any missed assignments, tests, or quizzes. Your grades will be uploaded at least twice a week. Lab Work Students are required to complete his/her assignment during class time. Students are to be respectful of ABSS equipment and tools at all time. Any abuse will be reported immediately to the administrators. No food or drink in lab. Learning Center My Learning Center Day is on Mondays from 3:20-4:30pm. This is an opportunity to makeup work such as: quizzes, tests, and missed assignments. Additionally, this is chance to get assistance if you are struggling. Supply List Each student will need a 2 inch binder/notebook, wide-ruled notebook paper, writing supplies (pens, pencils, and markers), at least 2.0 GB USB/flash drive and most of all, a positive attitude towards learning. Hand sanitizer and Kleenex appreciated. Classroom Mannerism Students will demonstrate respect to the teacher and it will be reciprocated. Students will also show respect to other students, faculty, and staff at all times. Otherwise, you will be referred to administration that will result in disciplinary action. Classroom rules are posted. Teacher dismisses the class; not the bell. Pacing Guide- Mrs. C. Bradshaw COURSE BLUEPRINT for 8726 Personal Finance Fall Semester 2013 (Recommended hours of instruction: 135 – 180) ES# Obj# PF01.00 PF01.01 PF01.02 PF02.00 PF02.01 PF08.00 PF08.02 PF08.01 PF02.00 Unit Titles/Essential Standards and Objective Statements Understand economic activities of individuals and families. Understand responsible earning, spending, saving, and borrowing. Understand characteristics of financial goals, steps in decision making, and factors that affect financial decisions. Understand economic challenges of individuals and families. Understand lifestyle conditions and typical incomes, needs, and expenses at various stages of life. Apply procedures for managing personal finances. Understand personal financial planning. Understand options for saving and investing. Understand economic challenges of individuals and families. Course Approx. Dates to Weight Number of Days Cover 12% 4 5% Aug 28- Sept 3 6 7% Sept 4 – Sept 11 11% Sept 12- Sept 18 5 6% 12% 2 3% Sept 19- Sept 20 3 4% Sept 23- Sept 25 11% PF02.02 PF07.00 PF07.02 PF07.03 PF05.00 PF05.01 PF07.00 PF07.04 PF08.00 PF08.03 PF04.00 PF04.02 PF06.00 PF06.01 PF05.00 PF05.02 PF06.00 PF06.02 PF06.03 PF03.00 PF03.01 PF03.02 PF03.03 PF04.00 PF04.01 PF07.00 PF07.01 Understand threats to financial security. Understand ways to protect personal and family resources. Understand ways to protect personal credit. Understand ways to avoid identity theft. Understand consumer rights, responsibilities, and information. Understand rights and responsibilities of consumers. Understand ways to protect personal and family resources. Exemplify persuasive methods used in advertising and sales. Apply procedures for managing personal finances. Apply procedures to manage personal income and expenditures. Understand financial services and forms used in independent living. Understand services available from financial institutions and forms of payment for purchases. Understand shopping options and practices for meeting consumer needs. Understand basic shopping options and effective shopping practices. Understand consumer rights, responsibilities, and information. Compare consumer information for food, apparel, personal hygiene, and medicinal drug products. Understand shopping options and practices for meeting consumer needs. Understand options and practices for meeting transportation needs. Understand options and practices for meeting housing needs. Understand lifestyle goals, choices, and job search procedures. Classify strategies for making personal, education, and job/career choices to achieve lifestyle goals. Understand strategies for researching career options and comparing job offers. Understand procedures for a successful job search. Understand financial services and forms used in independent living. Understand types of work compensation and forms used for work and income tax purposes. Understand ways to protect personal and family resources. Classify types of health and life insurance and features of types of coverage. 5% 18% 5% 4% 8% 4% 18% 4% 12% 5% 10% 5% 12% 4% 8% 4% 12% 4% 4% 17% 6% 5% 6% 10% 5% 18% 5% 4 Sept 26- Oct 2 4 3 Oct 3- Oct 8 Oct 9- Oct 11 3 Oct 14- Oct 16 3 Oct 17 - Oct 21 Oct 22- Oct25 4 Oct 29- Nov 1 4 Nov 3- Nov 6 3 Nov 7- Nov 11 3 3 3 Nov 12 – Nov 14 Nov 15- 19 5 4 5 Nov 20- 26 Dec 2- Dec 5 Dec 6- Dec 12 Dec 13- Dec 18 4 Dec 19- Jan 7, 2014 4 Review for Final Exam Jan 8- Jan 10 Exam TBA