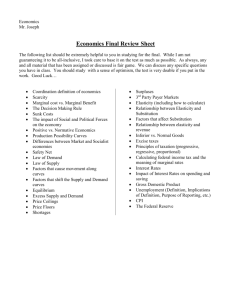

Figure 1A.1 Indifference Curves

advertisement

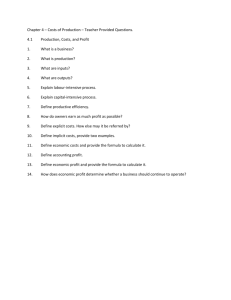

Chapter 1 Appendix 1 Indifference Curve Analysis Market Baskets are combinations of various goods. Indifference Curves are curves connecting various market basket combinations of goods that make an individual equally happy. 2 Assumptions about Preferences Persons can rank market baskets. Rankings are transitive. More is preferred to less. The marginal rate of substitution is diminishing. 3 Indifference Curves and Indifference Maps 4 Expenditure on Other Goods per Month (Dollars) Figure 1A.1 Indifference Curves 60 50 B1 B2 U1 0 40 50 Gasoline per Month (Gallons) U2 U3 Qx 5 The Marginal Rate of Substitution The amount of expenditure on other goods that a person will give up in order to get an additional unit of one good is called the marginal rate of substitution. 6 The Budget Constraint The budget constraint is the combination of goods that a person can afford. 7 The Budget Constraint in Algebraic Terms I = PxQx + SPiQi Where: I is income Pi is the price of good i Qi is the amount of good i purchased 8 Expenditure on All Expenditure on Other Goods Except Gasoline per Gasoline per Month Month Expenditure on Other Goods per Month (Dollars) Figure 1A.2 The Budget Constraint 100 60 A C F D B Qx 0 40 100 Gasoline per Month (Gallons) 9 Expenditure on Other Goods per Month (Dollars) Figure 1A.3 Consumer Equilibrium A E 40 U3 U2 U1 B 0 60 Qx Gasoline per Month (Gallons) 10 Equilibrium Condition PX = MBX 11 Expenditure on Other Goods per Month (Dollars) Figure 1A.4 Changes in Income A' A 0 B Qx per Month B' 12 Expenditure on Other Goods per Month (Dollars) Figure 1A.5 Changes in the Price of Good X A 0 B'' B Qx per Month B' 13 Income and Substitution Effects The income effect is the change in the monthly (or other period) consumption of a good due to changing purchasing power of fixed income caused by the good’s price change. The substitution effect is the change in the monthly (or other period) consumption of the good due to the change in its price relative to other goods. 14 Figure 1A.6 Income and Substitution Effects Expenditure on Other Goods per Month (Dollars) 150 50 100 E' E1 20 E2 40 45 The Income Effect U2 U1 60 The Substitution Effect Qx Gasoline per Month (Gallons) 15 The Law of Demand The demand curve slopes downward. As the price rises, the quantity demanded falls. 16 Price Figure 1A.7 The Law of Demand D = MB 0 Qx per Month 17 Price Elasticity of Demand ED = % Change in Quantity Demanded % Change in Price = DQD/QD DP/P 18 Consumer Surplus Net benefit that consumers obtain from a good Total benefit to consumers from obtaining a good, less the money they give up to get the good. 19 Figure 1A.8 Consumer Surplus A Price Consumer Surplus B P Market Price D = MB 0 Q1 Gasoline per Month 20 Figure 1A.9 The Work Leisure Choice Income per Day A 40 0 E U3 U2 U1 16 Leisure Hours per Day B 24 21 Budget line for time allocation I = w(24 – L) Where: I is income W is wage L is the amount of time devoted to leisure 22 Analysis of Production and Cost The Production Function is the expression of the maximum output obtainable from any combination of inputs. The Short Run is the period of time in which some inputs cannot be changed. The Long Run is the period of time in which all inputs can be changed. 23 Marginal Product The increase in output associated with a one unit increase in an input is called the Marginal Product. 24 Isoquants Isoquants are curves that show alternative combinations of variable inputs that can be used to produce a given amount of output. The Marginal Technical Rate of Substitution is the amount of one input that can be given up with one additional unit of another input while keeping output constant. It is the slope of the isoquant. 25 Isocost Lines Lines that show combinations of variable inputs that cost the same are called Isocost Lines. C = PLL + PKK Where: C is the total cost PL is the price of labor (typically the wage). L is the units of labor employed. PK is the price of capital (typically a rental price or an interest rate to reflect the opportunity cost of that capital). K is the units of capital employed. 26 Figure 1A.10 Isoquant Analysis Labor Hours per Month Isocost Lines E L* Monthly Output = Q1 0 K* Machine Hours per Month 27 Cost Minimization Costs are minimized for every level of output where: MRTSKL = PK/PL 28 Cost Functions Total Cost Variable Cost Average Cost Average Variable Cost Average Fixed Cost Marginal Cost 29 Returns to Scale Constant Returns to Scale Increasing Returns to Scale AC = MC AC and MC are constant. AC < MC AC is diminishing. Decreasing Returns to Scale AC > MC AC is increasing. 30 Profit Maximization Assumption: All firms seek to maximize profits. Operationally, that means that firms will set production where Marginal Revenue equals Marginal Cost; MC = MR. 31 Perfect Competition The situation where: There are many buyers and sellers so that no one buyer or seller has market power. The product being sold is homogenous. There are no legal or economic barriers to entry. Information is freely available. In such a case, the market price is the Marginal Revenue to the firm and that firm will maximize profits where P = MC. 32 Figure 1A.11 Short-Run Cost Curves and Profit Maximization under Perfect Competition MC Price and Cost Producer Surplus AC E P D = MR AVC min = F 0 Q* Output per Month 33 Short-Run Supply Under perfect competition, Supply is the Marginal Cost curve emanating from the minimum of average variable cost curve. 34 Producer Surplus Producer Surplus is the difference between the market price and the minimum price for which the firm would sell the product. It is the area under the price line and above the marginal cost curve. It also represents the profit (less fixed costs) to the firm. 35 Normal and Economic Profit Normal Profit is the opportunity cost of resources of owner-supplied inputs. The value of the firm owners’ time (typically measured by their next job opportunity) plus any other inputs provided by the owner(s). Economic Profit is any profit to the firm that is above normal profit. 36 Long Run Supply In the long run, economic profit is driven to zero under competition. P = LRMC = LRACmin 37 Figure 1A.12 Long-Run Competitive Equilibrium LRMC Price LRAC LRAC min = P 0 D = MR Q* Output per Month 38 Figure 1A.13 Long-Run Supply: The Case of A Constant-Costs Competitive Industry Price Long-Run Supply LRACmin = P 0 Output per Year 39 Figure 1A.14 A Perfectly Inelastic Supply Curve Price Supply 0 Q1 Output per Year 40 Price Elasticity of Supply ES = % Change in Quantity Supplied % Change in Price = DQS/QS DP/P 41