Ex 20:3 “Do not have other gods besides Me.”

advertisement

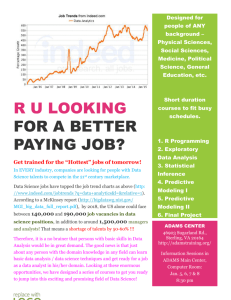

• Money is a training ground for God to develop our trustworthiness, Luke 16:11 1 Principle 1 Start by Putting God in Charge of Your Finances • Ex 20:3 “Do not have other gods besides Me.” • To determine who is in charge of your finances, answer the following true/false questions – God is my ultimate financial advisor. I will trust Him with everything I have. – I understand the importance of being a careful steward of the money that God has entrusted to my care. – I will be generous with my tithes and offerings because I understand that everything I have ultimately belongs to God. – When I have a question about my finances, I’m willing to pray about it. 2 Elizabeth Elliot • I lived with Indians who made pots out of clay which they used for cooking. Nobody was interested in the pot. Everybody was interested in what was inside. The same clay taken out of the same riverbed, always made in the same design, nothing special about it. Well, I’m a clay pot, and let me not forget it. But, the excellency of the power is of God and not us. 3 Pray About Your Finances • Is prayer a habit? Without ceasing? 1 Thess 5:17 • Is it a hit or miss activity? • Consider – God hears your prayers and answers them Jer 29:11-12 – God promises that the prayers of righteous men and women can accomplish great things James 5:16 – God invites you to be still and to feel His presence Ps 46:10 4 • Prayer is not an emergency measure that we turn to when we have a problem. Real prayer is a part of our constant communion with God and worship of God. • Allow your dreams a place in your prayers and plans. God-given dreams can help you move into the future He is preparing for you. 5 Kay Arthur Have you prayed about your resources lately? Find out how God wants you to use your time and your money. No matter what it costs, forsake all that is not of God. 6 Develop specific steps to take to keep God first in your life • • • • • • 1 2 3 4 5 6 7 Principle 2 Seek God’s Wisdom in Every Aspect of Your Life • Matt 7:24-25 “Therefore, everyone who hears these words of Mine and acts on them will be like a sensible man who built his house on the rock. The rain fell, the rivers rose, and the winds blew and pounded that house. Yet it didn’t collapse, because its foundation was on the rock.” 8 Enhance Your Earning Power and Keep Enhancing Your Earning Power • Opportunities to learn are limitless and change is inevitable. – Senior classes at COM – Continuing ed computer classes @ COM • In today’s competitive workplace, those who stand still are, in reality, moving backwards … fast. (Prov 28:19) 9 • Live within your means and save money from every paycheck. Never spend more than you make. (Ecc 5:1) • Use Credit wisely. Don’t borrow money for things that rapidly go down in value. And if you borrow money for things that are likely to go up (your home) borrow only the amount that you can comfortably afford to repay (don’t max out your mortgage) (Prov 21:5) 10 • Don’t be an impulsive buyer. Savvy salespeople want you to buy “right now.” Savvy buyers take their time. (Prov 21:5) • Don’t fall in love with “Stuff”. We live in a society that worships “stuff” – don’t fall into that trap. Remember “stuff” is highly overrated. Worship God almight, not the almighty dollar. (Prov 11:28) • Make sure that everybody in your family understands the need to spend wisely. Financial security is a team sport. 11 • Give back to the Lord. God is the giver of all things good. What does He ask in return? A tiny ten percent. Don’t withhold it from Him. (Mal 3:10) • Never stop studying God’s Word. Even if you’re very familiar with your Bible, there’s always something new to learn. God still has many lessons to teach you … and you should be willing to learn. (Ps 27:11) 12 Your value system will determine how you earn, how you spend, and how you save money. • Build your value system upon the firm foundation of God’s wisdom and God’s Word. 13 Examine Your Priorities • Are you investing your life in a way that makes the most of the talents God has given you … or are you squandering those talents by allowing your skills to be underutilized? • If your spending habits are undisciplined – or if your skills are not being maximized – it’s time to rearrange your life and your priorities. 14 Prioritize Your Savings Goals* • Chinese proverb says, “Do not wait until you are thirsty to dig a well.” • Becoming part of the landed gentry – real estate, your own home • Retiring: sitting on a rocking chair? Discontinuing full-time work? Not even working for pay at all • Educating the kids • Owning your own business *Personal Finance for Dummies, Wilely Publishing, p. 8 15 Prov 21:17 “Those who love pleasure become poor; wine and luxury are not the way to riches” • Minimize unnecessary expenditures while maximizing your skills (and, presumably, your income). • Your priorities, passions, goals, and fears are shown clearly in the flow of your money. (Dave Ramsey) 16 Draft your personal mission statement • Your personal value system will determine the quality and direction of your life, you must choose those values carefully; and you should choose them in accordance with God’s commandments. • Make your life a mission instead of an intermission • Clarify your thoughts and crystallize your plans 17 Develop specific ways to apply God’s wisdom; use God’s Word • • • • • • 1 2 3 4 5 6 18 Principle 3 Know Where You Stand by Making a Financial Plan • A reflection of your faith and your values • Outgrowth of your commitment to obey God’s Holy Word • Doing it “your way” is building on sand 19 Improving your skills will improve your earning potential so you can • • • • Tithe Purchase Insurance Have a cash cushion Develop a retirement strategy 20 Common-Sense Ideas About Investing Your Money • • • • Have an Investment Plan Diversify Understand Your Investments Pay attention to your investments, but not too much attention • Invest consistently • Don’t follow the Herd, buy on the Bubble, or attempt to get rich quick 21 Common-Sense Ideas About Investing Your Money, cont’d • Invest in businesses that make money today, not in those that hope to make money some day • Understand the principle of compound interest • Understand the need for adequate liquidity • While you’re investing, invest in yourself 22 Make a Budget “The plans of the diligent certainly lead to profit, but anyone who is reckless only becomes poor.” Prov 21:5 • As a believer, you are called to lead a life of moderation, maturity, and discipline • If you’re not saving money, your budget isn’t working 23 Budgeting Basics • Your budget should be realistic • Write your budget down on paper, or if you’re computer savvy, use money-management software to organize your finances • Take into account all major and minor expenses • Create your budget in cooperation with your spouse 24 Budgeting Basics, cont’d • Leave room for surprises, expect surprises • Review your budget monthly and compare with your actual expenses • Strive to live at a profit; income should be more than what you spend on expenses 25 Principle 4 Live Within Your Budget • “Discipline yourself for the purpose of godliness.” 1 Tim 4:7 • “Apply your heart to discipline and your years to words of knowledge” Prov 23:12 • “Make every effort to supplement your faith with goodness, goodness with knowledge, knowledge with self-control, self-control with endurance, endurance with godliness” 2 Pet 1:5-6 26 Common-Sense Tips for Saving Money • • • • • • • • Plan Ahead Generic? Absolutely! More Convenience Usually Costs More Coupons! Off-season Purchases Save Money Low-cost alternatives to traditional retailers Understand the Bills You Pay Wholesale Clubs? Yes, but …. 27 Make the Choice to Live at a Profit • Don’t collect for yourselves treasures on earth, where moth and rust destroy and where thieves break in and steal. But collect for yourselves treasures in heaven, where neither moth nor rust destroys, and where thieves don’t break in and steal. For where your treasure is, there your heart will be also. Matt 6:19-21 28 Debt • Indentured servitude is when you go into debt to purchase items that immediately go down in value • When you finance your purchase, you pay more 29 Teach Your Children To Manage Money • Your actions speak far more loudly than your words – teach by example • Give them the opportunity to manage their money 30 Identify Your Biggest Budget-Busters • • • • • • 1 2 3 4 5 6 31 Principle 5 Avoid Debt • “The borrower is a slave to the lender.” Prov 22:7 • Pay credit card balances off every month • Never buy consumer goods such as clothes, furniture, or electronics on credit • Don’t rent consumer good or electronics on “rent-to-own” plans • It’s better to drive a clunker with a small note than a luxury car that’s “loaded” with debt 32 Learn from Your Mistakes • “The one who conceals his sins will not prosper, but whoever confesses and renounces them will find mercy.” Prov 28:13 • Take responsibility; prayerfully ask God to help you become a better steward of the resources He has entrusted to you 33 Principle 6 Build Up Your Reserves • Prov 21:20 “The wise man saves for the future, but the foolish man spends whatever he gets.” TLB 34 Emergency Fund • How big should your nest egg be? – If you’re not overly burdened by debt, 2 income family, living at a profit: 4-6 months living expenses in cash – If income is unpredictable then probably keep cash to support you and your family for a year • Keep these monies in insured, readily available, interest-bearing accounts 35 Reserves for differing circumstances • Three months’ living expenses: choose this option if you have other accounts, such as a 401k or family members and close friends whom you can tap for a short-term loan. • Six months’: appropriate if you don’t have other places to turn for a loan or you have some instability in your employment situation or source of income • One year: if your income fluctuates wildly from year to year or if your profession involves a high risk of job loss, finding another job could take a long time and you don’t have other places to turn for a loan *Personal Finance for Dummies, Wilely Publishing, p. 8 36 Self-discipline Every Day • A self-disciplined lifestyle requires consistency. And if you want to enjoy the financial security that belongs to those who adopt a disciplined approach to life, then you must learn to control yourself seven days a week. 2 Chron 15:7 “But you, be strong and do not lose courage, for there is reward for your work.“ NAS 37 Exercise • From your personal budget, calculate the amount of cash you need. – Predictability of your income – Needs of your family – Current state of your finances 38 Principle 7 Find Work You Can Be Passionate About • Col 3:23 “Whatever you do, do your work heartily, as for the Lord rather than for men..” NASU 39 Read if necessary • This book is about happiness at work. About loving your job - or finding one you can love. Because today, happiness at work is no longer a luxury - it's essential. People are discovering, that when they love their jobs, they are more productive, creative and motivated. They're also happier in life. Similarly, happy companies find they are more efficient, innovative and make more money than their unhappy competitors. 40 Discover the work God created you for • Glorify God by honoring the talents that He gave you, not the talents that you wish He had given you. • Do not fritter precious hours in front of the television • Keep searching and praying until you find meaningful work 41 Maximize the Talents God Has Given You • Invest in yourself. The world keeps changing and so should you. • Plan for your next job now. • Cultivate and nurture your talents • Talents are on temporary loan from God to enrich the world and enrich your life • Value this gift, nourish it, make it grow, share it with the world 42 Principle 8 Keep Money in Perspective • 1 Tim 6:9-10 “For the love of money is the first step toward all kinds of sin. Some people have even turned away from God because of their love for it, and as a result have pierced themselves with many sorrows.” TLB 43 Greed • Greed is evil because it substitutes material things for the place of honor that the Creator ought to have in an individual’s life. • Don’t fall in love with “stuff” • Worship God almighty; not the almighty dollar • Think more about God’s plan for your life than about your next acquisition 44 Invite Peace In • Jesus offers us peace not as the work gives, but as He alone gives • Summon courage and determination to implement a sensible financial plan • Don’t go after the illusion of “peace and happiness” that the world promises but cannot deliver • Give yourself the peace of Jesus Christ offered freely 45 Be Generous • “Freely you have received, freely give” Matt 10:8 • Reap bountiful rewards in accordance with God’s plan for our lives when we sow seeds of generosity • God loveth a cheerful giver • Share financial blessings with others • We hurt people by being too busy, too busy to notice their needs – Billy Graham 46 Character • The content of your character is demonstrated by the way you choose to spend money • God cares about people, not possessions, and so must we • Money is not evil; worshipping money is • Do not let money be your master • Store up riches to endure throughout eternity: the spiritual kind 47 Exercise: How Important is Money to You? • How much do your possessions mean to you? • What role does money play in your life? • Jot down 10 ways you can be more generous 48 Principle 9 Avoid the Trap of Materialism 49 Luke 12:15 • And He told them, “Watch out and be on guard against all greed, because one’s life is not in the abundance of his possessions.” 50 Temptations of everyday living • • • • Money is a tool Face life with things spiritual Do not love the world more than we love God Debt is a modern-day form of indentured servitude; pay as you go • The more we stuff ourselves with material pleasures, the less we seem to appreciate life: Barbara Johnson • Reorder your priorities 51 Resist Credit • Reduce your credit limit – don’t accept increases in limits • Replace your credit card with a debit card • Never buy anything on credit that depreciates in value (meals out, cars, clothing, and shoes) • Think in terms of total cost, not monthly payment amounts • Stop the junk mail avalanche • Limit what you can spend – carry low amts of cash, no plastic or checks • Cancel credit card accounts 52 Keeping up with the Joneses • • • • Buy based on need Do not buy to impress Please God, not the neighbors Honor God in every facet of your life including how you spend money 53 • “But godliness with contentment is a great gain. For we brought nothing into the world, and we can take nothing out. But if we have food and clothing, we will be content with these. But those who want to be rich fall into temptation, a trap, and many foolish and harmful desires, which plunge people into ruin and destruction.” 1 Tim 6:6-9 54 55 Consider • You are the target of an endless stream of advertising information to purchase what you don’t need • Essential aspects of your life are subject to an ever-increasing flood of rules and regulations • Take firm control of your time and life, or you may be overwhelmed by a tidal wave of complexity that threatens your happiness 56 Consider • You are the target of an endless stream of advertising information to purchase what you don’t need • Essential aspects of your life are subject to an ever-increasing flood of rules and regulations • Take firm control of your time and life, or you may be overwhelmed by a tidal wave of complexity that threatens your happiness 57 Discard • Material possessions that distance you from God • Outside interests that leave little time for your family and God; get off the merry-go-round • God wants your full attention today; don’t let anybody or anything get in His way 58 Credit cards to the blender 59 Exercise • Assess your susceptibility to peer pressure to impress your neighbors; why? • Jot down ten ways to simplify your life 60 Retirement: Plan Carefully 61 • Jer 29:11 “For I know the plans I have for you," declares the LORD, "plans to prosper you and not to harm you, plans to give you hope and a future.”NIV 62 Check Points • • • • • • SS will provide a very modest lifestyle at best Add money to an IRA Investment in real estate? Financial reserves building up? Set a target age for retirement Assess of Retirement needs – What will your budget be – Sources of income 63 How Much Do you Need • 70 to 80 % of pre-retirement income to live at the same level • Or adjust your standard of living • Become employed by a company with a pension; vested in 5 years (these are rare) • Employers can take the retirement money back, unfortunately • Retire later instead of sooner *Personal Finance for Dummies, Wiley Publishing, p. 46-48 64 It wasn’t raining when Noah built the ark 65 Get-Rich-Quick Schemes • Invest in things you understand with a likelihood of success • Seek outside guidance from proven professionals • Avoid what seems too good to be true • Rewarded emotionally for good judgment 66 Diversify • • • • Reserve account Mutual funds Real estate Avoid day-trading; weekend stock-picker; become a real estate expert overnight • Don’t get greedy – High risk investments with high return potential also have the potential of NO return 67 Insurance • Life insurance to provide for your family in the event of your death • Health insurance • Auto insurance • Home or renter’s insurance • Disability policy • Shop around 68 Plan for your death • Write a will so the courts don’t decide where your assets go • List your assets to go with the will • Write down an inventory of your insurance 69 Principle 11 Expect God’s Abundance • • • • Trust God’s plans Mind stayed upon God then His peace will rule Be an expectant, faith-filled Christian Think optimistically about your life, profession, family, future, and your finances • Trust Him and His abundance will overflow 70 • Abundance and obedience go hand-in-hand • Spiritual abundance is more important than material abundance • Thank God for gifts that are simply too numerous to count • Follow Christ closely and live more abundantly • Make all plans with God’s Word as your compass, God’s Son as your guide 71 We’re Only Stewards • Challenged to be faithful stewards of resources and talents • Don’t squander time, talents or money • Nourish and grow the talent God has given you, share it with the world • Our resources are a one-of-a-kind treasure on loan from God • When you become a better steward of the resources God has given you … He gives you more resources to manage. 72 “Do not neglect the gift that is in you.” 1 Tim 4:14 73 Exercise: Assess Your Level of Stewardship • • • • • • How are you using your talents? How might I improve my skills? Do I make good use of my time? Am I giving God a fair portion of my income? Am I a cheerful giver? Do I share my testimony with others? 74 Define what abundance means to you • Assess yourself on whether you are expecting God to give you the kind of spiritual abundance He promises in John 10:10 75 Principle 12 Trust God to Handle Everything, including your finances • Trust in the Lord with all your heart, and do not rely on your own understanding; think about Him in all your ways, and He will guide you on the right paths.” Prov 3:5-6 76 God has the final word • Understand the Biblical laws that apply to your economic well-being • Apply these laws to your life • Place God at the center of your heart, trust Christ for your personal salvation, obey God’s Word; live by God’s commandments • Money is a tool, nothing more • Use money in a disciplined, thoughtful way • Never lose hope 77 78 Exercise • Jot down 50 things you are thankful for …. 79