overview of fcpa - Troutman Sanders LLP

advertisement

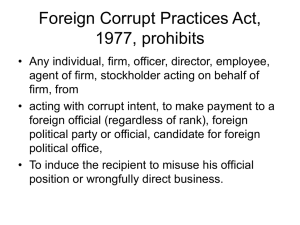

Foreign Corrupt Practices Act (FCPA) DOJ & SEC Focus On China Roscoe C. Howard, Jr. phone: 202.274.2960 roscoe.howard@troutmansanders.com Atlas Legal - Doing Business in China Doubletree Metropolitan, NY, New York December 13, 2007 OVERVIEW OF FCPA 15 U.S.C.§§ 78dd-1, et seq. PROHIBITS BRIBERY OF “FOREIGN OFFICIALS” IN ORDER TO OBTAIN OR RETAIN BUSINESS ANTI-BRIBERY PROVISIONS ARE ENFORCED BY DEPARTMENT OF JUSTICE 2 OVERVIEW OF FCPA “ACCOUNTING PROVISIONS” REQUIRE U.S. COMPANIES TO: MAINTAIN BOOKS AND RECORDS THAT ACCURATELY REFLECT TRANSACTIONS IN REASONABLE DETAIL; AND ESTABLISH INTERNAL ACCOUNTING CONTROLS DESIGNED TO ENSURE THAT EXPENDITURES ARE AUTHORIZED BY MANAGEMENT ACCOUNTING PROVISIONS ARE ENFORCED BY THE SECURITIES AND EXCHANGE COMMISSION 3 WHO IS SUBJECT TO THE FCPA? • Any U.S. Citizen or Resident • Any Other Person Within the U.S. • Any U.S. Company – – – – Officers, Directors, Employees Foreign Subsidiaries Agents Consultants • Foreign Companies Listed On U.S. Exchanges (Issuers) 4 ELEMENTS OF AN ANTI-BRIBERY VIOLATION • • • • • Payment, Authorization Or Offer to Pay Anything of Value To A Foreign Official, Political Party Or Candidate Directly or Indirectly Corruptly For The Purpose of – Influencing An Official Act or Decision of The Recipient – Inducing The Recipient to Do or Omit To Do Any Act in Violation of Lawful Duty – Inducing The Recipient to Use His or Her Influence With a Foreign Government to Affect or Influence any Governmental Act or Decision • In Order to Obtain, Retain or Direct Business to Any Person 5 FOREIGN OFFICIAL An Officer or Employee of • Any Department, Agency or Instrumentality of a Foreign Government • A Public International Organization, or • Any Person Acting in an Official Capacity 6 FOREIGN OFFICIAL • Includes – Foreign Political Party or Party Official – Candidate for Foreign Political Office • Depending on their authority, a foreign official might Include – Member of Legislative Body – Employee of a State Owned Enterprise 7 PAYMENT • Payment May Be Made Directly or Indirectly – To a Relative or Any Other Person Which Might Benefit the Official – To a Third Party, Knowing That a Portion Will be Paid or Offered to the Official • Or Not At All – Offense is Complete Upon Offer, Promise or Authorization of a Corrupt Payment 8 “CORRUPTLY” • Payment or offer intended to: – Induce Recipient to Misuse His or Her Official Position; – Influence Any Official Act or Decision of a Recipient; or – Induce a Recipient to Do or Omit to Do Any Act in Violation of His or Her Official Duty 9 IN ORDER TO OBTAIN, RETAIN OR DIRECT BUSINESS TO ANY PERSON • Obtaining or Retaining a Contract • Obtaining Favorable Regulatory Treatment – Licenses – Permits – Lower Taxes – Avoiding Adverse Government Action – Zoning Variances – Product Approvals 10 ILLUSTRATIVE CASES SYNCOR INTERNATIONAL CORPORATION In 2002, Syncor paid a $500,000 civil penalty for violation of the anti-bribery, and accounting provisions of the FCPA in a case brought by the SEC based on payments to doctors employed by hospitals controlled by foreign authorities in Taiwan, Mexico, Belgium, Luxembourg and France. The payments were recorded as promotional and advertising expenses. In a related proceeding, DOJ filed criminal FCPA charges against Syncor Taiwan, which paid a $2 million fine. 11 ILLUSTRATIVE CASES SCHERING-PLOUGH CORPORATION In 2004, Schering-Plough paid a $500,000 civil penalty in settlement for violation of the accounting procedures provisions of the FCPA for making payments to a bona fide charity headed by a Polish Government Official. The SEC alleged that the payments were made to induce the official to purchase Schering-Plough’s pharmaceutical products. Although the donations were made without the knowledge or approval of any employee in the U.S., the SEC charged that the U.S. parent’s internal controls were inadequate to prevent or detect the improper payment. 12 ILLUSTRATIVE CASES MONSANTO COMPANY In 2005, Monsanto paid a $500,000 fine as part of a civil settlement with the SEC for violations of the anti-bribery and accounting provisions of the FCPA and paid a $1 million fine as part of a three year Deferred Prosecution Agreement with DOJ. Monsanto made a $50,000 payment to an Indonesian government official to repeal a requirement for an environmental impact study before genetically modified crops could be cultivated. The official took the money, but did not repeal the requirement and so Monsanto received no benefit. 13 ILLUSTRATIVE CASES DCP (TIANJIN) CO. LTD. DIAGNOSTIC PRODUCTS CORP. DCP’s Chinese subsidiary pled guilty to one count of bribery under the FCPA for making payments to physicians and laboratory personnel employed by government-owned hospitals in the People’s Republic of China. The Chinese subsidiary agreed to pay a $2 million criminal penalty and retain an independent monitor for three years. In a related proceeding the SEC ordered the parent company to disgorge $2.8 million in profits and prejudgment interest and to retain a compliance monitor for three years. 14 PERMISSIBLE PAYMENTS • Facilitating Payments for Routine Governmental Actions – Modest payments to government official to expedite or secure performance of routine government actions such as: • Obtaining permits, licenses or other official documents; • Processing governmental papers, such as Visas and work orders; • Providing police protection, mail pickup and delivery; • Providing phone service, power and water supply; • Loading and unloading cargo, or protecting perishable products; • Scheduling inspections associated with contract performance or delivery of goods; • Similar actions 15 AFFIRMATIVE DEFENSES • COMPLIANCE WITH WRITTEN FOREIGN LAW • REASONABLE AND BONA FIDE BUSINESS EXPENSES Travel and Lodging Expenses Incurred by the Foreign Official and Directly Related to the Promotion, Demonstration, or Explanation of Products or Services; or The Execution of Performance of A Contract With a Foreign Government 16 FCPA “RED FLAGS” • Whether the Country Has a Reputation of Corruption • News Reports of Corruption • Family or Business Ties of an Agent with a Government Official • The Agent’s Reputation With the U.S. Embassy and Local Banking Officials • The Agent is Recommended by a Government Official • Agent Insists That His or Her Role Not be Disclosed • Agent Has no Experience in the Business • Agent Has Inadequate Staff or Facilities • Agent Resists Certifying Compliance with FCPA • Agent Asks for Payment in Cash or in Another Country • Last Minute Requests for More Money • And so on…. 17 FCPA TRENDS • Increased Resources for FCPA Investigations at DOJ • Increased Reliance on Sarbanes Oxley Information • Increased Reliance on Self Disclosure • Increased Reports by Whistleblowers • Increased Scrutiny of M&A Transactions • Increased Scrutiny of Joint Ventures • Focus on Foreign Subsidiaries • Liability Based on Accounting Provisions • DOJ is regularly “pushing the envelope” 18 Roscoe C. Howard, Jr. Partner Troutman Sanders LLP 401 9th Street, N.W., Suite 1000 Washington, DC 20004 Ph: 202-274-2960 | Fax: 202-654-5665 roscoe.howard@troutmansanders.com Roscoe C. Howard, Jr. is a litigation partner in the Washington, D.C. office of Troutman Sanders, LLP. Mr. Howard served as the United States Attorney for the District of Columbia from 2001 to 2004. He was a full professor at the University of Kansas School of Law from 1994 - 2001. He has twice served as an Associate Independent Counsel and has held positions as an Assistant U.S. Attorney in the District of Columbia, and the Eastern District of Virginia in Richmond. Mr. Howard has authored numerous articles on criminal law and procedure and frequently speaks at white collar crime seminars and institutes. Mr. Howard is a 1974 graduate of Brown University and a 1977 graduate of The University of Virginia School of Law. 19