Part 2: Transfer Pricing

advertisement

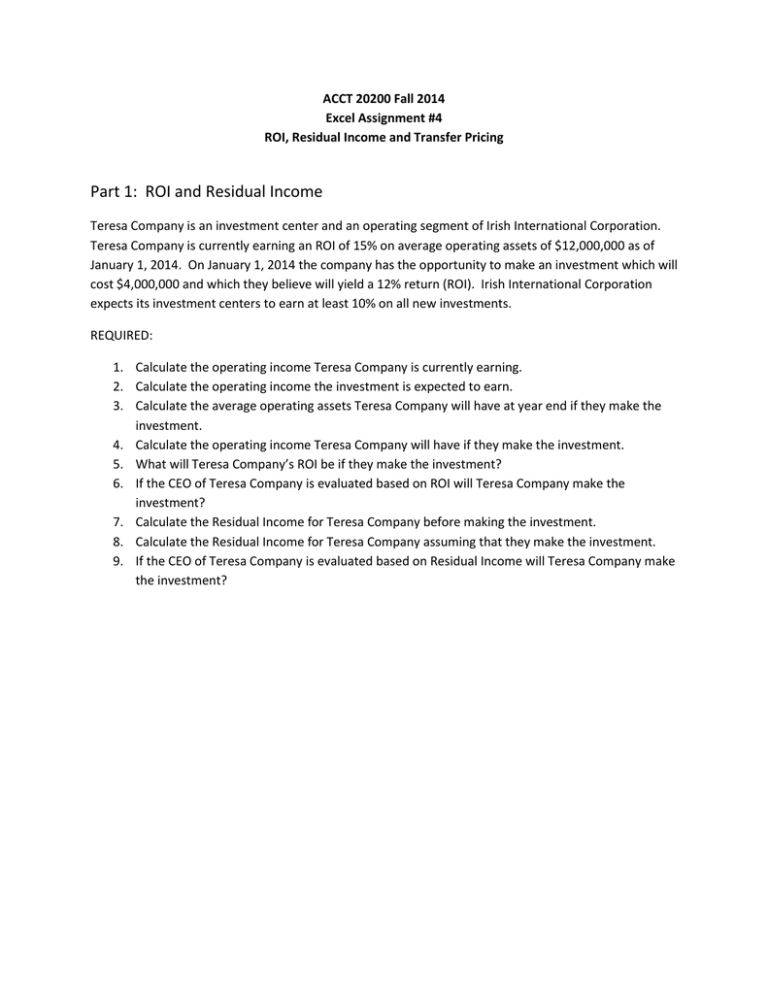

ACCT 20200 Fall 2014 Excel Assignment #4 ROI, Residual Income and Transfer Pricing Part 1: ROI and Residual Income Teresa Company is an investment center and an operating segment of Irish International Corporation. Teresa Company is currently earning an ROI of 15% on average operating assets of $12,000,000 as of January 1, 2014. On January 1, 2014 the company has the opportunity to make an investment which will cost $4,000,000 and which they believe will yield a 12% return (ROI). Irish International Corporation expects its investment centers to earn at least 10% on all new investments. REQUIRED: 1. Calculate the operating income Teresa Company is currently earning. 2. Calculate the operating income the investment is expected to earn. 3. Calculate the average operating assets Teresa Company will have at year end if they make the investment. 4. Calculate the operating income Teresa Company will have if they make the investment. 5. What will Teresa Company’s ROI be if they make the investment? 6. If the CEO of Teresa Company is evaluated based on ROI will Teresa Company make the investment? 7. Calculate the Residual Income for Teresa Company before making the investment. 8. Calculate the Residual Income for Teresa Company assuming that they make the investment. 9. If the CEO of Teresa Company is evaluated based on Residual Income will Teresa Company make the investment? Part 2: Transfer Pricing Irish International Corporation has two operating divisions: Addison Company and Lily Company. Addison Company makes a product that is sold to outside customers but could also be used in the production of products manufactured by Lily Company. Below are three separate scenarios. 1 Scenarios 2 3 Addison Company Capacity in Units Number of Units Sold to Outside Customers Selling Price per unit to Outside Customers Variable Cost per unit Fixed Costs per unit (based on capacity) 400,000 400,000 $120 $85 $14 400,000 360,000 $120 $85 $14 400,000 300,000 $120 $85 $14 Lily Company Number of units needed for production Purchase Price per unit New Being Paid to an Outside Supplier 50,000 $95 50,000 $95 50,000 $95 REQUIRED: 1. For each scenario calculate the excess capacity. 2. For each scenario calculate the number unit sales Addison Company would lose if they were to fill all of Lily Company’s production needs. 3. For each scenario calculate the minimum price per unit that Addison Company would require from Lily Company to fulfill its production needs. 4. For each scenario determine the maximum price per unit Lily Company would be willing to pay Addison Company for its production needs. 5. For each scenario determine whether you believe that a price could be negotiated that would be acceptable to both Addison Company and Lily Company. Excel Rules: 1. You must use the Excel Templates provided on the ACCT 20200 website (www.acct20200.com). Note that each template is individualized for each student with an ID code for each student. It will be assumed a Honor Code VIOLATION if you use a template with someone else’s ID Code. 2. You must use Microsoft EXCEL and not any other spreadsheet program. Failure to use MS Excel will result in a zero grade. 3. You must work individually on this assignment. Working with another student is a violation of the Notre Dame Honor code and will be enforced when discovered. 4. You must use links and formulas where ever possible. Failure to exploit Excel will result in a zero grade. There are only a couple of instances where typing numbers may be necessary. 5. You must sign your name to the honor code statement (the first sheet of the Excel template). Failure to sign your name (by typing your name) will result in a zero grade. 6. You must name your Excel file as: last name first name Excel 4. Failure to name your file in this exact syntax will result in a zero grade. 7. You must save your file as either an xls or xlsx file so that it can be read by your instructor. Failure to turn in a file that is readable by your instructor will result in a zero grade. 8. You must upload your completed template BEFORE the due date and time in order to receive credit.