advice guide - Morris Crocker

advertisement

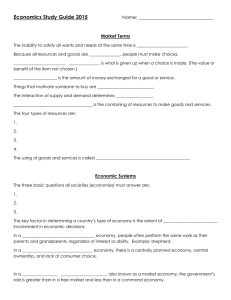

MORRIS CROCKER - CARE HOMES AND INCORPORATION INTRODUCTION As a firm we have a recognised specialism in the healthcare sector and have been helping care homes for many years. We act for a variety of types: charities, sole traders, limited companies, investors, single homes and multiple owners. Our smallest client care business is registered for 17 residents whilst our largest has 52. The services we offer include tax planning, business consultancy, structural issues, assistance with financing, business sales and acquisitions as well as everyday matters such as bookkeeping, payroll, tax compliance and annual accounts and audit. Our aim, as with all our services, is to offer a first-class client-focused personal service at a competitive price. All our clients have a director looking after them as their main contact. We pride ourselves in recruiting high quality staff who typically stay with us for many years - you can therefore be confident that the relationships you build with us will be stable and beneficial. UNINCORPORATED BUSINESS - FEATURES 1 Personal tax and national insurance liabilities are typically high. This is because sole traders and partners are taxed on the profits of the business and, very often, this includes an effective combined income tax and national insurance rate of 42% (see table on page 3). 2 Sole traders and partners are jointly and severally liable for any claims on the business. In other words, if the business fails for any reason, the creditors can claim against the owners’ personal assets. In a partnership, if one or more partners cannot afford their share, the creditors can look to the others to make up the shortfall. 3 With an unincorporated business, the assets of the business belong to the sole trader or the partners. This means that any assets not immediately required for the business (such as surplus cash) can be easily withdrawn with no further tax consequences. 4 Combined with this, there is generally a lower administrative burden and lower accountancy and associated costs than with a corporate structure. CORPORATE FEATURES 1 There is more structure involved. Firstly, we need a company and we need to adopt a constitution (articles). In some cases we will also need a shareholders’ agreement to regulate the relationship between the shareholders and outline their respective responsibilities. 2 The business owners can no longer take out cash simply when they feel like it. Withdrawals need to be in the form of salary under PAYE or dividend with the relevant documentation. 3 A limited company carries limited liability. In other words, any claim against the company is limited to the company’s ability to pay - only in certain very restricted circumstances (involving wrongdoing) can directors or shareholders find themselves personally liable for business claims. The main exception to this is where personal guarantees are given, typically to the company’s bankers. 4 As shown by the table on page 3, companies generally pay less tax proportionately than sole traders and partners. This is, for care homes, probably the principal attraction of the limited company idea. 5 The price for this, at present, is that certain information (for example, annual accounts) has to be made available in the public domain. However, small companies can be excepted from some of this and, in the Government’s push to reduce red tape, these exceptions look to be on the increase. WHY CHANGE? 1 As already mentioned, tax rates for companies tend to be lower than for individuals. From the point of view of tax alone, it therefore makes sense to incorporate the business. 2 In addition, the corporate structure gives extra security to the owners of the business in the form of limited liability. 3 However, there is a trade-off with increased structure, administration costs and public accountability. 2 TABLE OF EFFECTIVE TAX AND NATIONAL INSURANCE RATES Income Band Personal £0 to £8,060 Company 0% 20% 9% 20% Next £31,785 to £42,385 29% 20% Next £57,615 to £100,000 42% 20% Next £21,200 to £121,200 62% 20% Next £28,800 to £150,000 42% 20% Above £150,000 47% 20% Next £2,540 to £10,600 MECHANICS 1 Firstly, you will need to form a limited company. You will need to decide on a company name, shareholders (owners), directors (who need not necessarily be the same as the shareholders), and registered office address. Professional advice is vital at this stage to help you consider all the tax and other financial implications - for example, how to involve other family members and plan for succession. We can help you with all of this including on-line formation of the company itself. 2 As part of the initial planning, you will need to consider what goes into the company. For example, will this include the premises as well as the business (goodwill) itself? 3 You will also need to decide what value should be attributed to the transfer. For tax purposes, this will need to be defensible as being a realistic assessment of market value. In some instances, it may be advisable to appoint a professional valuer. 4 The next thing to consider is how the company is to pay for the assets it is acquiring. In most cases, this will effectively be financed on paper by way of a loan from the business owners who now are the director and shareholders of the new company. However, where bank finance has been involved in the previous personally-owned business, it will be necessary to discuss the potential transfer with the bank at an early stage particularly if the borrowing is secured on business assets. NOTE: DIRECTORS’ LOAN ACCOUNTS As well as the attraction of generally lower tax rates, the incorporation of the business offers the opportunity to create a sum of money within the company that can be drawn out by the directors with no personal tax consequences (other than the initial 28% capital gains tax charge - see below for further explanation on this). 3 ISSUES Stamp duty land tax: there will be a liability arising on transfer of the property based on the market value. The rates are charged on the whole value of the property depending on what band the value falls in: £0 - £150,000 nil £150,001 - £250,000 1% £250,001 - £500,000 3% £500,001 + 4% For this and other reasons, it is often decided to transfer in only the business itself and leave the property in personal ownership. Capital gains tax: As mentioned above, the transfer of the business will be at market value and there is therefore a potential capital gains tax liability. These transfers no longer qualify for entrepreneurs’ relief and the full rate of capital gains tax (typically 28%) will therefore apply. OTHER POINTS 1 The CQC will need to be approached to ensure they are happy to accept the change in ownership and then to re-register the care home business as being carried on by the limited company. 2 Insurers will also need to be advised to ensure that the relevant policies are held in the correct name particularly if the building is being owned separately to the business itself. REMUNERATION 1 Here is another area where it is possible to save a significant amount of tax and national insurance by incorporating. In addition, state benefits which were previously not available are now claimable if this should become necessary. 2 Firstly, it is important to note that the self-employed status of the business owners has changed to that of employee, albeit of their own company. This means that they will acquire employment rights (including redundancy) and the right of state benefits that they previously were not entitled to. 4 3 In order to maximise the level of tax saving, it should be noted that salary attracts a national insurance liability whilst dividends do not. Therefore, it is usual to pay a low salary (generally equivalent to the tax personal allowance) and top up the drawing requirement with dividends. 4 Please note that, whilst dividends are regarded as already-taxed income, there will be further liabilities for higher rate and additional rate tax-payers. It may therefore be sensible to include the spouse as a director/shareholder in order to use their tax personal allowance and basicrate band to the maximum effect as well. With effect from 6 April 2016, the dividend tax regime is changing. The first £5,000 per annum will be tax-free; after this the rate will be 7.5%, 32.5% or 38.1% depending on whether the recipient is a basic-rate, higher-rate or additional-rate taxpayer. 5 The transfer of goodwill to the director’s loan account, as already mentioned, will create a further amount of cash which can be drawn upon without further tax liability as well as the salary and dividend. 6 There may also be the possibility of paying rent to the owners of the property but the adverse effect on the availability of capital gains tax entrepreneurs’ relief on a future sale of the property needs to be borne in mind. LONG TERM PLANNING 1 A hot topic at present is the issue of capital allowances. Consideration should be given to the question of whether there are any potential retrospective claims that need to be formulated prior to incorporation. 2 Incorporation of the business can affect the capital gains tax position on the associated property. In particular, whilst it is attractive for personal tax purposes to charge a rent to the company, this can have adverse consequences on the availability of entrepreneurs’ relief. Planning is therefore required to decide the most advantageous route. 3 Similarly, division of the business from the property ownership can affect the amount of business property relief available for Inheritance Tax purposes. It is therefore necessary to consider carefully topics such as business succession, wealth extraction and testamentary dispositions. 4 Thought also needs to be given to the long-term aims of the business. Will it remain as it is? Do the owners want to expand the business? Or do they want to develop the business with the aim of selling it? What is the best structure for achieving these goals? 5 If you are considering incorporating your care home business and would like further advice, please contact Duncan Gardner - Client Director, Morris Crocker Care Homes Team on tel 023 9222 8133 or email dmg@morriscrocker.co.uk. 6