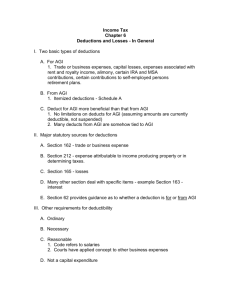

Deductions: General Concepts and Trade or Business Deductions

advertisement

CCH Federal Taxation Basic Principles Chapter 6 Deductions: General Concepts and Trade or Business Deductions ©2003, CCH INCORPORATED 4025 W. Peterson Ave. Chicago, IL 60646-6085 800 248 3248 http://tax.cchgroup.com Chapter 6 Exhibits 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. Four Types of Usage for Expenses and Property Tax Treatment for the Four Types of Usage Business Expenses—Seven Criteria Defending Tax Treatment for a Business Activity Hobby Expenses—Template for Problem Solving Home Office Deductions—Template for Problem Solving Computing Home Office Deductions for SelfEmployed Persons Computing Home Office Deductions for Employees Interest Expense—An Overview Investment Interest Expense—Example Taxes—An Overview Chapter 6, Exhibit Contents 12. Property Taxes—Allocation Between Buyer and Seller 13. Depreciation—Code Sec. 179 Election 14. Amortization 15. Research and Experimental 16. Depletion 17. Political Contributions and Lobbying 18. Business Start-Up Expenses 19. Meals and Entertainment 20. Moving Expenses 21. Student Loan Interest CCH Federal Taxation Basic Principles 2 of 48 Four Types of Usage for Expenses and Property “Personal-use” property refers to the function of property. It means that the property is held for the taxpayer’s own enjoyment. “Personal” property refers to the physical nature of the property. It means that the property is mobile, i.e., not affixed to “real” property. The following examples illustrate the four types of usage for expenses, personal property, and real property. Chapter 6, Exhibit 1a CCH Federal Taxation Basic Principles 3 of 48 Four Types of Usage for Expenses and Property Type of Usage Expense Personal Property (property that is mobile) Tangible (value lies in its physical substance) Business Use Chapter 6, Exhibit 1b Airfare to Lawnmower meet with used by client to landscape firm discuss cost control Intangible (value lies in its nonphysical substance) Stock held as inventory by dealer CCH Federal Taxation Basic Principles Real Property (property that is immobile) Office building 4 of 48 Four Types of Usage for Expenses and Property Type of Usage Expense Personal Property (property that is mobile) Tangible (value lies in its physical substance) Hobby Use Chapter 6, Exhibit 1c Airfare to attend Barbie™ doll collectors convention Intangible (value lies in its nonphysical substance) Lawnmower N/A held by one who tinkers with old motors in spare time CCH Federal Taxation Basic Principles Real Property (property that is immobile) Home office used exclusively for stamp collecting 5 of 48 Four Types of Usage for Expenses and Property Type of Usage Expense Personal Property (property that is mobile) Tangible (value lies in its physical substance) Investment Use Chapter 6, Exhibit 1d Airfare to attend investment seminar Intangible (value lies in its nonphysical substance) First lawnmower Stock held by ever sold by investor John Deere Co. held by private individual CCH Federal Taxation Basic Principles Real Property (property that is immobile) Raw land 6 of 48 Four Types of Usage for Expenses and Property Type of Usage Expense Personal Property (property that is mobile) Tangible (value lies in its physical substance) Personal Use Chapter 6, Exhibit 1e Airfare to visit grandmother Intangible (value lies in its nonphysical substance) Lawnmower N/A used for personal lawn care CCH Federal Taxation Basic Principles Real Property (property that is immobile) Principal residence 7 of 48 Tax Treatment for the Four Types of Usage The tax treatment for losses and expenses varies according to their type of usage. Usage Tax Treatment for Losses and Expenses Business Unlimited deductions, except for passive activity losses (usually offers the most favorable tax treatment) Hobby Limited to net hobby income Investment Capital loss limited to $3,000; investment expenses limited to net investment income Personal Generally not deductible unless specifically allowable as with itemized deductions (usually results in the least favorable tax treatment) Chapter 6, Exhibit 2 CCH Federal Taxation Basic Principles 8 of 48 Business Expenses—Seven Criteria Business expenses are generally deductible without limitation when the following seven criteria are met: 1. Purpose is business related. If part business, part personal, use a reasonable allocation (e.g., mileage for automobiles). 2. Ordinary (common, acceptable response to a business situation) and necessary (helpful, but not essential). (Welch v. Helvering) 3. Reasonable in amount. This is of main concern to closely held corporations, particularly regarding officers’ salaries. One way to substantiate reasonableness is by presenting documentation of similar expenses by comparable businesses. 4. Capital expenditures are not deductible (but may be depreciable). Sales tax on capital expenditures must be capitalized. 5. Activity must be related to a business, not to investments, hobbies, or personal-use property. There must be (1) an intent to make a profit the IRS is generally satisfied if 3 of 5 years are profitable) and (2) an entrepreneurial effort. 6. Exempt income must not be connected with the business expense (e.g., business interest expense on a loan used to buy local utility bonds is not deductible). 7. Public policy must not be violated by the expense. Fines, kickbacks, bribes, etc. are not deductible. (Tank Truck Rentals) Chapter 6, Exhibit 3 CCH Federal Taxation Basic Principles 9 of 48 Defending Tax Treatment for a Business Activity Whether losses or expenses receive favorable business treatment is an issue of fact. The taxpayer wins if the facts meet the statutory requirements; the IRS wins if they do not. Reg. §1.183-2(b) provides the statutory framework. It states that all facts and circumstances of an activity are to be taken into account and that no one factor makes the determination. It lists the following nine factors that should normally be taken into account in making the determination. Taxpayers and the IRS should make their factual arguments within the context of these nine factors. Chapter 6, Exhibit 4a CCH Federal Taxation Basic Principles 10 of 48 Defending Tax Treatment for a Business Activity Nine Factors Cited in Reg. §1.183-2(b) Facts Supporting Business Status Facts Supporting Nonbusiness Status 1. Financial status of taxpayer No substantial income from other sources Substantial income from other sources 2. Asset appreciation potential Asset appreciation potential may satisfy the profit requirement Neither profit potential nor asset appreciation potential are evident 3. Recreational elements Absence of personal or recreational motives Evidence of personal or recreational motives 4. Manner of conducting activity Complete and accurate records, separate bank account, separate phone line Records compiled when annual return is filed, deposits and checks written out of personal account, no dedicated phone line 5. Time and effort Substantial personal time and effort Minimal time and effort devoted to the activity 6. History of success with similar/dissimilar businesses Successful track record with other activities No track record 7. Expertise of taxpayer Extensive personal study or hiring of outside consults to understand the activity No concept of the economics underlying the activity 8. Profit frequency Consistent profits beyond start-up stage Inconsistent profits beyond start-up stage 9. Profit size Any past losses overshadowed by current profits Future profit potential not sufficient to recoup accumulated losses Chapter 6, Exhibit 4b CCH Federal Taxation Basic Principles 11 of 48 Hobby Expenses—Template for Problem Solving If an activity is a hobby, expenses are deductible in the following three tiers: Hobby income (Revenue - Cost of goods sold) FIRST-TIER EXPENSES (reported on Schedule A) – Taxes (property tax and state and local income tax allocable to hobby) – Interest (interest on principal residence mortgages and home equity loans allocable to hobby) – Casualty loss deductions (related to principal residence and allocable to hobby) = First-Tier Limit Chapter 6, Exhibit 5a CCH Federal Taxation Basic Principles 12 of 48 Hobby Expenses—Template for Problem Solving = First-Tier Limit SECOND-TIER EXPENSES (qpplied only if the first-tier limit is a positive value) – Out-of-pocket expenses (reported on Schedule A as miscellaneous itemized deductions, subject to 2% AGI floor) = Second-Tier Limit – THIRD-TIER EXPENSES (only if the second-tier limit is a positive value) – Depreciation expense (reported on Schedule A as a miscellaneous itemized deduction, subject to 2% AGI floor) = Hobby income (A hobby loss is not allowed for tax purposes.) Chapter 6, Exhibit 5b CCH Federal Taxation Basic Principles 13 of 48 Home Office Deductions— Template for Problem Solving The rules for deducting home office expenses are similar to the hobby expense rules except as follows: Business expenses not related to the home office (e.g., advertising, wages) are deductible without limitation before the three-tiered limitations take effect; hobby expenses not related to the home office are subject to the second-tier limitation. Self-employed persons report business expenses (deductible within the three-tiered limitations) on Schedule C, not on Schedule A as is the case with hobby expenses. Employed persons report unreimbursed business expenses (deductible within the threetiered limitations) on Schedule A (similar to the hobby rules). Chapter 6, Exhibit 6a CCH Federal Taxation Basic Principles 14 of 48 Home Office Deductions— Template for Problem Solving Business income =(Revenue – Cost of goods sold) – Business expenses not related to home office (e.g., advertising, wages) = Net business income before home office expenses – FIRST-TIER EXPENSES (reported on Schedule C, not Schedule A as is the case with hobbies) – Taxes (property tax and state and local income tax allocable to home office) – Interest (interest on principal residence mortgages and home equity loans allocable to home office) – Casualty loss deductions (related to principal residence and allocable to home office) = First-Tier Limit Chapter 6, Exhibit 6b CCH Federal Taxation Basic Principles 15 of 48 Home Office Deductions— Template for Problem Solving First-Tier Limit – SECOND-TIER EXPENSES (applied only if the first-tier limit is a positive value) – Out-of-pocket expenses (e.g., utilities, maid service, pest control) = – Second-Tier Limit THIRD-TIER EXPENSES (applied only if the second-tier limit is a positive value) – Depreciation expense (allocable to home office) = Net business income Chapter 6, Exhibit 6c CCH Federal Taxation Basic Principles 16 of 48 Computing Home Office Deductions for Self-Employed Persons Example 1. Home office maintained on an exclusive and regular basis that occupies 10% of the home’s total space. Sales and Expenses Total Amount Sales Allocable Amount $300,000 $ 300,000 200,000 200,000 Business expenses not allocable to home office use (e.g., supplies, wages paid) 94,000 94,000 Real estate taxes 10,000 1,000 Mortgage interest 20,000 2,000 Utilities (water, electricity, gas, sewer) 8,000 800 Repairs, maintenance, and maid service 12,000 1,200 Depreciation 15,000 1,500 Cost of goods sold Chapter 6, Exhibit 7a CCH Federal Taxation Basic Principles 17 of 48 Computing Home Office Deductions For Self-employed Persons Example 1 Calculation Allocable Amount Sales $ 300,000 Cost of goods sold (200,000) Gross income $ 100,000 Business expenses not allocable to home office use LIMIT ON ALLOCABLE TAXES AND INTEREST (94,000) 6,000 Real estate taxes (1,000)* Mortgage interest (2,000)* LIMIT ON ALLOCABLE OUT-OF-POCKET EXPENSES Utilities (water, electricity, gas, sewer) Repairs, maintenance, and maid service LIMIT ON DEPRECIATION Depreciation allowed (of $1,500 total) NET INCOME (LOSS) FROM RETAIL BUSINESS 3,000 (800)* (1,200)* 1,000 (1,000)* 0 *Total home office deduction (total of items marked “*”) 6,000 Unused depreciation expense carried over ($6,500 - $6,000) (500) Chapter 6, Exhibit 7b CCH Federal Taxation Basic Principles 18 of 48 Computing Home Office Deductions For Self-Employed Persons Note: The $500 unused depreciation expense may be deductible in the next year even if the home office is converted to residential use at the beginning of the next year, so long as the deduction does not create a business loss. Chapter 6, Exhibit 7c CCH Federal Taxation Basic Principles 19 of 48 Computing Home Office Deductions for Employees Example 2. Home office maintained for employer’s convenience occupies 10% of the home’s total space; employee’s AGI is $50,000 Example 2 Calculation Total Amount LIMIT ON ALLOCABLE HOME OFFICE EXPENSES (i.e., employment income) N/A Allocable Amount Deductible Amount $50,000 Fully deductible home office expenses: Real estate taxes $ 10,000 $1,000 Mortgage interest 20,000 2,000 Total amount fully deductible 30,000 3,000 8,000 800 Repairs, maid service, etc. 12,000 1,200 Depreciation 15,000 1,500 Total amount subject to 2% AGI limitation 35,000 3,500 $3,000 Expenses subject to 2% AGI limitation: Utilities (water, electricity, etc.) Total home office deductions 2,500 * 5,500 * $2,500 = [$3,500 – ($50,000 AGI x 2% floor)] Chapter 6, Exhibit 8 CCH Federal Taxation Basic Principles 20 of 48 Interest Expense—An Overview Code Section Description Tax Treatment Code Sec. 1662 Business interest expense Deductible “for” AGI Code Sec. 163(d) Production of income (PI) interest expense ( i.e., investment interest expense or portfolio interest expense) Deductible “from” AGI, limited to net investment income (NII) Code Sec. 163(h)(2) Consumer interest Not deductible Code Sec. 163(h)(3) Qualified residence interest Deductible “from” AGI Code Sec. 221 Student loan interest Deductible “for” AGI, limited to $2,500 in 2003 Code Sec. 265(a)(2) Interest on funds used to buy taxexempt securities Not deductible Code Sec. 469 Interest expense connected with passive activities Deductible “for” AGI, limited to passive income Chapter 6, Exhibit 9 CCH Federal Taxation Basic Principles 21 of 48 Investment Interest Expense—Example CALCULATING THE DEDUCTION FOR PRODUCTION OF INCOME INTEREST EXPENSE AGI (includes $10,000 dividend income from stock) $80,000 Production of income interest expense Investment expense other then interest State ad valorem tax on stock 8,000 No 2% AGI Floor Limitation Subject to 2% AGI Floor $3,000 Safe deposit box rental $120 Investment counseling fee 1,200 Noninvestment misc. expenses Unreimbursed business travel expenses 850 Uniforms 600 Chapter 6, Exhibit 10a CCH Federal Taxation Basic Principles 22 of 48 Investment Interest Expense—Example 1. How much of the miscellaneous investment expenses are deductible? The lesser of: INVESTMENT miscellaneous itemized deductions, WITHOUT REGARD to the 2% AGI floor: 120 + 1,200 = 1,320 ALL miscellaneous itemized deductions AFTER SUBTRACTING the 2% AGI floor: (120 + 1,200 + 850 + 600) – (2% x 80,000) = 1,170 [Answer] Chapter 6, Exhibit 10b CCH Federal Taxation Basic Principles 23 of 48 Investment Interest Expense—Example 2. How much is the net investment income? (This sets the limit on deductible investment interest expense for the tax year.) Investment income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $10,000 Investment expense other than interest: Fully deductible ad valorem taxes . . . . . . . . . . . . . . . . . . . (3,000) Deductible miscellaneous investment expenses . . . . . . . . (1,170) Net investment income . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,830 Interest expense that is deductible (of $8,000 production of income expense) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,830 Interest expense that is carried over to next year . . . . . . . . 2,170 Chapter 6, Exhibit 10c CCH Federal Taxation Basic Principles 24 of 48 Taxes—An Overview Most Common Types of Taxes Business Use Personal Use Federal income tax Not deductible Not deductible State income tax Deductible “for”AGI Deductible “from” AGI FICA employee Not deductible N/A FICA employer Deductible “for”AGI N/A Sales tax on capital asset Capitalize and depreciate Capitalize only Sales tax on deductible expenditure Deductible “for”AGI Not deductible Property taxes Deductible “for”AGI Deductible “from” AGI Chapter 6, Exhibit 11 CCH Federal Taxation Basic Principles 25 of 48 Property Taxes— Allocation Between Buyer and Seller Property taxes are generally deductible without limitation if they are “ad valorem” (i.e., based on value). Property taxes should be allocated between seller and buyer based on the number of days held, not the number of months held. Furthermore, property taxes allocable to the day of closing are attributable to the buyer, not the seller. Chapter 6, Exhibit 12 CCH Federal Taxation Basic Principles 26 of 48 Depreciation– Code Sec. 179 Election Expense election. In 2003, an election may be made to expense up to $25,000 of tangible business and personal property rather than capitalize and depreciate it. This election must be made when the return is filed; it cannot be made on an amended return. If an election is made and a portion of the $25,000 creates a business loss, that portion creating the loss must be carried over to the next year’s return. Phaseout. The expense allowance is phased out on a dollarfor-dollar basis for purchases exceeding $200,000. Chapter 6, Exhibit 13 CCH Federal Taxation Basic Principles 27 of 48 Amortization Amortizable property. Intangible property that is used for business and is of limited life (e.g., goodwill, going-concern value, licenses, covenants not to compete, franchises, trademarks, patents, and copyrights). Method. Straight-line method over a minimum of 15 years. Chapter 6, Exhibit 14 CCH Federal Taxation Basic Principles 28 of 48 Research and Experimental (R & E) Qualifying expenditures. Experimental and laboratory costs for pilot models, plant processes, products, formulas, inventions, or similar properties. These costs include R&E salaries. Nonqualifying expenditures. Ordinary testing or inspection of materials or products for quality control, management studies, consumer surveys, advertising, or promotions. Tax treatment. R&E expenditures may be expensed immediately, or if elected, amortized over a minimum of 5 years. Chapter 6, Exhibit 15 CCH Federal Taxation Basic Principles 29 of 48 Depletion Cost depletion method Cost of natural resources excluding land Recoverable units Chapter 6, Exhibit 16a x (Number of units recovered AND sold) CCH Federal Taxation Basic Principles 30 of 48 Depletion % depletion method Statutory % x Gross income from natural resources (where gross income equals revenues without regard to cost of sales) Chapter 6, Exhibit 16b CCH Federal Taxation Basic Principles 31 of 48 Depletion Limitation of % Depletion • Oil and gas properties: 100% of taxable income from natural resources BEFORE depletion. (Code Sec. 613A(c)(6)(H)). • Other properties (e.g., phosphate, copper, gold): 50% of taxable income from natural resources BEFORE depletion. Chapter 6, Exhibit 16c CCH Federal Taxation Basic Principles 32 of 48 Political Contributions and Lobbying Type of Expenditure Deductible Not Deductible Direct or indirect political contributions by businesses for advertising, tickets to dinners, balls, etc. Lobbying expenses to influence federal and state legislation Lobbying expenses to monitor federal and state legislation Lobbying expenses to influence local legislation Chapter 6, Exhibit 17 CCH Federal Taxation Basic Principles 33 of 48 Business Start-Up Expenses Business Investigation Expenses Definition Expenditures that help determine whether to create or buy a business Timing Occur before a decision to make or buy is reached Examples Travel, marketing surveys, legal, accounting, and engineering Chapter 6, Exhibit 18a CCH Federal Taxation Basic Principles 34 of 48 Business Start-Up Expenses Business Start-Up Expenses Definition Preoperational costs Timing Occur after a "go for it" decision is reached, but before the doors open for business Employee training and stationery Examples Chapter 6, Exhibit 18b CCH Federal Taxation Basic Principles 35 of 48 Business Start-Up Expenses Deductibility Type Similar business? Business Yes deductible Investigation No Expenses No Business Start-up Expenses Chapter 6, Exhibit 18c “Go for it” decision? Yes Capitalize and amortize 60 months No Not deductible or capitalized, but lost Yes deductible No Capitalize and amortize > 60 months CCH Federal Taxation Basic Principles 36 of 48 Business Start-Up Expenses Tax Pointer. Avoid being trapped into capitalizing business start-up costs attributed to a dissimilar business. Instead, try to postpone as much of them as possible until after the doors are open for business. The postponement may result in immediate expensing. Chapter 6, Exhibit 18d CCH Federal Taxation Basic Principles 37 of 48 Meals and Entertainment Tax Treatment Self-Employed Individuals Nonreimbursed Employees 50% deductible 50% deductible, and limited to the 2% AGI floor “For” AGI “From” AGI as a miscellaneous itemized deduction Chapter 6, Exhibit 19 CCH Federal Taxation Basic Principles 38 of 48 Moving Expenses Amount Limitation. None. Qualified moving expenses. 1. Transporting household goods and personal effects 2. Traveling from old residence to new residence 3. Lodging during the move Chapter 6, Exhibit 20a CCH Federal Taxation Basic Principles 39 of 48 Moving Expenses Nonqualified moving expenses. 1. 2. 3. 4. Premove house hunting Temporary living quarters at new location Meals during a qualified move Real estate commissions on sale of old residence Chapter 6, Exhibit 20b CCH Federal Taxation Basic Principles 40 of 48 Moving Expenses Time Requirement for the Moving Expense Deduction Self-Employed Employee Work full time at new job > 39 weeks during first 12 months, AND Work full time at new job > 78 weeks during first 24 months Chapter 6, Exhibit 20c Work full time at new job > 39 weeks during first 12 months CCH Federal Taxation Basic Principles 41 of 48 Moving Expenses Distance Requirement for the Moving Expense Deduction Self-Employed If the move is due to a relocation: Distance, which must be 50 miles, between (b) and Distance from the old residence to the new job, and the Distance from the old residence to the old job. Chapter 6, Exhibit 20d Employee Same as for self-employed CCH Federal Taxation Basic Principles 42 of 48 Moving Expenses Reporting Requirement for the Moving Expense Deduction: Self-Employed “For” AGI Chapter 6, Exhibit 20e Employee “For” AGI (i.e., same tax treatment) CCH Federal Taxation Basic Principles 43 of 48 Student Loan Interest Tax Treatment. Deductible “for” AGI. Thus, a student can claim the student loan interest deduction even if the standard deduction is used. Deductible Limitation: Chapter 6, Exhibit 21a $2,500 CCH Federal Taxation Basic Principles 44 of 48 Student Loan Interest Time Limitation. The deduction for interest paid on a student loan is allowed for all months in which interest payments are required. Chapter 6, Exhibit 21b CCH Federal Taxation Basic Principles 45 of 48 Student Loan Interest Qualified Student Loans. To be eligible for the deduction, the education loan must be used solely to pay for any of the following expenses: tuition, student activity fees, room and board, books and supplies, and other related expenses. Note: The qualified purpose of a student loan is similar in scope to the qualified purpose of “education withdrawals” from ordinary IRAs and education IRAs. On the other hand, the student loan is much broader in scope than the Hope Scholarship or Lifetime Learning Credits. Chapter 6, Exhibit 21c CCH Federal Taxation Basic Principles 46 of 48 Student Loan Interest Phaseout of Student Loan Interest Deduction Filing Status Threshold for Modified AGI Floor Ceiling Single, head of household, $50,000 $65,000 surviving spouse Married filing jointly $100,000 $130,000 Married filing separately N/A N/A Chapter 6, Exhibit 21d CCH Federal Taxation Basic Principles Phaseout Range $15,000 $30,000 N/A 47 of 48 Student Loan Interest Example: Phaseout of Student Loan Interest Deduction FACTS: A married couple files jointly. The wife has been paying interest on a student loan for 3 years. In the current year, $6,000 of interest was paid. If the couple’s modified AGI is $110,000, how much of the interest may be deducted? (a) Actual student loan interest paid during the year (b) Deductible limitation for the current year (c) = lesser of (a) or (b) Amount subject to phaseout $ 6,000 2,500 2,500 (d) Modified AGI 110,000 (e) Modified AGI threshold, floor 100,000 (f) = (d) – (e) Excess modified AGI 10,000 (g) Phaseout range 30,000 (h) = (f) (g) Phaseout percentage ($10,000 $30,000) 33.3% (i) = (c) x (h) Phaseout amount ($2,500 x 33.3%) (j) = (c) – (i) Allowable interest deduction ($2,500 – $833 = $1,667) Chapter 6, Exhibit 21e CCH Federal Taxation Basic Principles 833 1,667 48 of 48