CDAM Updates 2010

advertisement

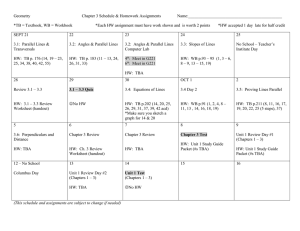

May 6, 2011 1 Annual Audit Requirement CDAM Changes Common Audit Findings Follow up on repeat findings 2 Education Code 84040(b) California Code of Regulations (CCR), title 5, section 59100-59114 Education Code 84040.6 3 Additions ◦ Section 473 – Economic and Workforce Development ◦ Section 478 - Preference for Veterans and Qualified Spouses for Federally Funded Qualified Training Programs ◦ Section 479 – To Be Arranged Hours (TBA) 4 Expansion ◦ Section 425 – Residency Determination for Credit Courses Removals ◦ Section 428 – Use of Matriculation Funds ◦ Section 434 – Scheduled Maintenance Program ◦ Section 436 – Minimum Conditions – “Standards of Scholarship” ◦ Section 440 – Compliance References for Optional Tests of Specific State Programs 5 Revisions ◦ ◦ ◦ ◦ ◦ Section Section Section Section Section 280 – Audit Findings 310.04 – Overview 331 – Auditors Report on State Compliance 410 .05, .06, .07, .08 – Overview 420 – Required State Compliance Test 6 Edits ◦ Edits were made to various sections to correct or delete dates, footnotes, information, names, numbers, references, tables, and webpage links to reflect current information. Also, emphasis was added to highlight some key information. 7 Background ◦ EWD monies are awarded to colleges/districts through grants and must be expended and deliver services to meet the needs identified in regional economic development plans. Criteria ◦ Education Code Section (ECS) 66010.4 (a)(3) ◦ ECS 88500 et seq 8 Ten Statewide Strategic Priority Initiatives in which EWD Centers are the delivery system used for the following areas: ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ Advanced Transportation Technology & Energy (ATTE) Applied Biotechnology (BioTech) Environmental Training (ETC) Health Workforce Initiative (HWI) Applied Competitive Technologies (CACT) Centers of Excellence (COE) International Trade Development (CITD) New Media & Entertainment (NMEI) Business and Entrepreneurship (BEC) Workplace Learning Resource (WKPL) Centers are the long term infrastructure of the EWD program. 9 Industry Driven Regional Collaborative (IDRC) Incumbent Worker Responsive Training Fund (IRTF) ◦ Projects are demand driven by industry needs ◦ Provides funds for colleges to allow faculty to develop new curriculum with industry partners. ◦ Expand the delivery of performance improvement training to employers and incumbent workers in high growth industries; and/or ◦ Foster “bridging” basic skills education to career technical programs in colleges that provide high-career pathways. Job Development Incentive Training Funds (JDIF) ◦ Provides training on a no-cost or low-cost basis to participating employers who create employment opportunities at an acceptable wage level for the attainment of self-sufficiency. These 3 specialized categories are all short term grants (1-2 years). 10 Districts are required to obtain approvals from the Chancellor’s Office prior to amending the district program budget. Funds allocated by the Board of Governors under this provision shall not be used by the community college districts to supplant existing courses or contract education offerings. Expenditures should be properly accounted for in the respective object codes. Assign direct and indirect costs as outlined in the grant agreement. 11 Background The Jobs for Veterans Act (JVA) requires that there be priority of service for veterans and eligible spouses in any workforce preparation, development, or delivery program or service directly funded in whole or in part, by the U.S. Department of Labor (38 U.S.C. 4215). 12 Criteria ◦ Public Law 107-288 ◦ Workforce Investment Act (WIA) ◦ Employment Development Department (EDD) Directive Number WSD08-10 ◦ U.S. Department of Labor: http://wdr.doleta.gov/directives/attach/TEN/ten2010/ten15-10a1.pdf 13 WIA Nursing and Allied Health Grant Recipients are required to provide priority admission to eligible veterans and their spouses when WIA monies are used as the source of funds for the Request for Applications (RFA). Not all RFAs have WIA as their source of funds therefore, if the source of an RFA is non-WIA, the priority accorded to veterans, while always encouraged, is not required. 14 Districts should have adequate policies and procedures to comply with the Jobs for Veterans Act (JVA) which includes: ◦ Indentifying and informing covered persons with timely and useful information on priority of service. ◦ Providing preference to covered persons in programs that are WIA funded. The individual must first qualify or meet the specific program requirements before the priority of service is applied. 15 A “covered person” is a veteran or spouse of an eligible veteran who has served at least one day in the active military, naval, or air service, and who was discharged or released from service under any condition other than a condition classified as dishonorable. 16 Eligible Spouse is defined as the spouse of any of the following: 1. Any veteran who died of a service-connected disability 2. Any member of the Armed Forces serving on active duty who, at the time of application of the priority, is listed in one or more of the following categories and has been so listed for a total of more than 90 days: i. Missing in action ii. Captured in the line of duty by a hostile force iii. Forcibly detained or interned in line of duty by a foreign government or power 3. Any veteran who has a total disability resulting from a service-connected disability, as evaluated by the Department of Veterans Affairs: 4. Any veteran who dies while a disability, as indicated in (3) above, was in existence. 17 Background ◦ Basic Requirements for “To Be Arranged Hours” or “TBA” as Part of a Course TBA Definition ◦ Some courses with regularly scheduled hours of instruction have “hours to be arranged” (TBA) as part of the total contact hours for the course. The TBA portion of the course uses an alternative method for regularly scheduling a credit course for purposes of applying either the Weekly or Daily Census Attendance Accounting Procedures pursuant to title 5, sections 58003.1(b) and (c), respectively. 18 TBA Definition cont. ◦ TBA hours are only an option for credit courses that apply the Weekly or Daily Attendance Accounting Procedures and not to those that apply the Alternative Attendance Accounting Procedure pursuant to title 5, section 58003.1(f) (i.e., Distance Education courses not computed using other attendance accounting procedures, Independent Study courses, and Cooperative-Work Experience education courses). 19 Criteria: ◦ Second To Be Arranged (TBA) Hours Follow-up Memorandum, June 10, 2009 ◦ To Be Arranged (TBA) Hours Follow-up Memorandum, January 26, 2009 ◦ Education Code sections 84040 and 88240 ◦ CCR, title 5, sections referred to are 55002, 55002.5, 53415, 58000, 58003.1, 58006, 58020, 58030, 58051, 58056, 58102, 58104, 58108, 58168, 58170, 58172, 59020, and 59112. ◦ Student Attendance Accounting Manual 20 Districts are required to list TBA hours in the schedule of classes, and describe them in the course outline. Districts need to track student participation carefully and make sure that they do not claim apportionment for TBA hours for students who have documented zero hours as of the census point. 21 Supporting documentation, such as actual attendance rosters or electronic attendance tracking records, will need to be retained by the district as it relates to verifying compliance with this requirement as a Class 3 record basic to audit as required by section 59020 et seq. 22 Determine that a clear description of the course, including the number of TBA hours required, is published in the official general catalog or the addenda AND in the official schedule of classes or addenda thereto. Specific instructional activities, including those conducted during TBA hours, expected of all students enrolled in the course are included in the official course of outline. 23 Cont.- All enrolled students are informed of these instructional activities and expectations for completion in the class syllabus or other document. Determine the apportionment and attendance record compliance as of census date by reviewing supporting documentation such as the attendance roster. 24 Background ◦ Districts internal fiscal controls should ensure that state apportionment for credit courses is only claimed for student attendance by statute and regulation. Student residence at the time of registration is a major factor for allowing districts to claim state apportionment for credit courses. 25 Criteria: ◦ Education Code Sections 68000-68044, 6805068080, 68082,68100,68130, 76140, 76140.5, and 76143 ◦ CCR, title 5, sections 54000-54072 ◦ California Community Colleges, Student Attendance Accounting Manual (SAAM) 26 Test the supporting residency documentation (hardcopy and/or electronic) of a sample of students in credit courses to determine whether each student has been properly classified as either a “resident or a “nonresident”. The resident questionnaire used by the district in making residence classifications must require students to certify their answers under oath or penalty of perjury. 27 (Expansion) ◦ Test a sample of student-athletes in credit courses to determine if residency status has been properly classified. A student-athlete is a participant in an organized competitive sport sponsored by the district/college in which he/she is enrolled. Compare the student’s admission application and residence questionnaire to the athlete’s Commission of Athletics Form 1 for applicable information and confirm consistency. 28 Review the selected credit course section tabulations for the students in the above samples to determine whether the attendance of nonresidents has been inappropriately claimed for State support. 29 280.01 (3) ◦ Identification of questioned costs and how they were computed. If a dollar value is unable to be quantified, provide an explanation. 310.04 ◦ GASB 54 – may be adopted for information presented in government fund format, such as in the supplementary information, as of the 2010/11 fiscal year. GASB 54 is not applicable to the BTA model used by community college district for entity wide financial statements. 30 331- Auditor’s Report on State and Federal Compliance has been revised to read ◦ “Auditor’s Report on State Compliance” ◦ The federal compliance requirements are separate from the state compliance items. 410 ◦ .05-The auditor should follow current sample size guidance provided by the AICPA and Generally Accepted Auditing Standards (GAAS) 31 410 ◦ .06-Auditor should use professional judgment and due diligence in designing the types of compliance tests performed. ◦ .07-Categorical Flexibility- districts are required to hold a public meeting to discuss redirection of funds. Districts exercising flexibility are relieved of statutory requirements, but are still required to report expenditures to the Chancellor. 32 420 ◦ .08 American Recovery and Reinvestment Act (ARRA) – Accounting for ARRA funds provided by the Chancellor’s Office through the State Fiscal Stabilization Fund (SFSF) Program ARRA funds have specific expenditure restrictions and must be tracked separately. Although the federal government has restricted these funds and the state opted not to place further restrictions, they do not have to expended on any particular program. Accounted for in the General Fund – Restricted in accordance with the Budget and Accounting Manual. 33 Concurrent Enrollment of K-12 Students in Community Colleges ◦ 07-08 ◦ 08-09 21 Findings 31 Findings ◦ 07-08 ◦ 08-09 11 Findings 12 Findings ◦ 07-08 ◦ 08-09 9 Findings 8 Findings Student Fee Instructional Materials and Health Fees Students Actively Enrolled 34 Chancellor’s Office sends the district a letter to request a more detailed action plan to prevent a repeat finding in subsequent audits. The plan should include: ◦ ◦ ◦ ◦ Steps planned to prevent a repeat of the finding Person responsible for implementing the change Due date for the change to be in place Status to date of the steps in place to create the change 35 If there are overstated in understated FTES related to any findings mentioned, the district should submit a CCFS317 to correct the district’s FTES numbers. 36 Questions? 37