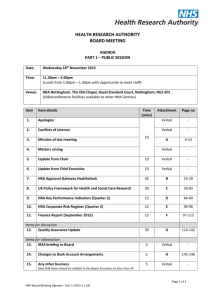

O.C.A. Benefit Services Stacked HSA/HRA Proposal

advertisement

2011 O.C.A. Benefit Services Stacked HSA/HRA Proposal Broker Name Company Name 3/28/2011 O.C.A. Executive Summary For more than 20 years, O.C.A. Benefit Services, LLC (O.C.A.) has been a leader in the employee benefits arena with a commitment to customer service through creative and cost efficient benefit plan designs. We are not just an administration company, but rather an “Employee Benefits Delivery Organization” established to provide employers, agents, brokers, and plan participants with the most cost efficient and effective benefit packages available. We believe that quality healthcare is actually less expensive to deliver than poor quality healthcare. While we recognize the very nature of human behavior is to resist change, we also need to embrace the reality that Consumer Empowered Health Plans (CEHP) are the cure to rising health care costs and poor quality health care delivery. Our approach is candid, open, and honest. We believe in setting fair and reasonable expectations with all the parties involved. We understand that keeping the process easy is critical to the implementation of the program, but we also understand that sacrificing compliance will eventually catch up with a client in direct or hidden costs. Our role is more than just a Third Party Administrator, but as a portal of reliable information and education. The Plan Participant will once again seek the rewards of being a consumer of health care. O.C.A. Benefit Services offers a complete suite of Administrative Services including the following: Plan Design Consultation Cafeteria Plan Administration (POP/FSA/DCAP) Transportation & Parking Administration HRA Administration HSA Administration COBRA Administration Electronic Payment Cards (MySource Card) Wellness 24/7 Secure Web Portal and I.V.R. Phone System Employer Compliance Reporting HSA/HRA Administration Proposal for: Address: Phone: Number of Eligible Employees: General Company Information: Plan Design Consultation Plan design is the first, and probably most important, step in creating an effective employee benefit program. Each worksite situation is unique, so the key is to design a plan to achieve your specific goals. The options can seem endless, and understanding your needs is the best place to start. Whether you choose plans that are fully-insured, self-insured, company provided, traditional, or consumer-driven, O.C.A. representatives have proven and effective skills to develop an ''employee benefit strategy'' that reflects your organizational objectives. For instance, you may want to offer an FSA, HRA, or HSA as a standalone plan. Or you may see the benefit of stacking the plans to include a combination of the three. You may even offer a ''menu'' of plans from which your employees can choose. O.C.A. Plan Design Services include: 1. 2. 3. 4. 5. Complete analysis of your benefit program Establish a goal for the plan, ex: benefit coverage, cost savings Plan formulation to provide a variety of options for your employees Final Plan Design Provide customized on site education to all employees What is a stacked HSA/HRA with a “Turbo charged FSA?” By partnering with O.C.A Benefit Services, your company can successfully institute the “stacked HSA/HRA”. With the customization of these unique plan designs, we can effectively work around the 10% “premium tax” being applied by certain carriers who find their HRA plans to be funding greater than 50% of an employee’s medical deductible. By implementing the “stacked HSA/HRA” plan design, employers will not only have the ability to maintain cost, but they will also have the comfort of offering high level benefits to their employees. We address the legitimate concerns and needs of having employees “skin in the game”. Please see below an example of a successfully implemented stacked HSA/HRA. Company “ABC” has a HSAc plan- $2,500/$5,000 deductible i. Employee funded HSA Account: Employee can fund up to $3,050 in 2011 for single coverage and $6,150 for employee with dependent coverage, less any employer HSA contribution. Contributions funded through the 125 plan are pretax for Federal & FICA, however not for state tax in NJ, AL, & CA. ii. Once the employee has incurred the minimum annual deductible of $1,200 (single) or $2,400 (employee + dependent), employer funded HRA will reimburse 100% of the remaining $1,300/$2,600 of deductible for any employee reaching this out of pocket level. iii. If the employee decides to fund the HSA account over the federal minimum ($1,200/$2,400), they now have what we like to call a “Turbo Charged FSA account” with no use it or lose it rules applicable, flexibility to change their elections at anytime for any reason, all in an interest bearing account. What is a Health Reimbursement Arrangement? A Health Reimbursement Arrangement (HRA) is an employer sponsored plan used to reimburse employees for certain qualified medical-related expenses on a non-taxable basis. HRA’s were approved under Treasury and IRS Notice 2002-45 and Revenue Ruling 2002-41. While not required, it is usually offered in conjunction with a high-deductible medical plan which significantly lowers the premium. A portion of this premium savings is used to reimburse plan participants for un-reimbursed medical care expenses as defined by Code Section 213(d) or those limited by your plan documents. The dollar limit required to fund the HRA is set by the employer’s plan documents. Any unused amounts can carry forward from year to year or are more commonly refunded back to the employer. While each plan is unique, we are seeing a net employer’s benefit cost reduction in the range of 10-25% and an improvement in the quality of healthcare delivered to members. A properly designed HRA encourages the employees to become better health care consumers. As a consumer, quality of care improves and costs are reduced. We will provide employees with access to quality information that can assist their decisions when they need to access care. O.C.A. HRA Administrative Services: Preparation of plan documents O.C.A. will create a customized legal document outlining the provisions of an employee benefit plan. Annual discrimination testing and necessary information provided for employers to complete their 5500 forms Annual discrimination tests are designed to show that eligibility and plan benefits are applied fairly and consistently, which in turn allows the plan sponsor to avoid unfavorable tax consequences. Customized employee communication material Whether it’s a group of two or a group of five hundred, O.C.A. will create customized employee communication material based upon the groups plan design. O.C.A. provides industry expertise with top of the line representation. We represent our clients by educating and assisting employers, employees and their families. Daily claim adjudication processing With O.C.A. Benefit Services, claims are typically processed within 48 hours of receipt. All claims are 100% manually audited. Direct Deposit of claim payments Direct deposit of employee claims is efficient, environmentally friendly, and saves money. Imagine submitting a claim in to O.C.A. Benefit Services at 9:00 a.m. and having that claim processed either the same day or at the latest, the next business day. Once processed, the funds hit the Federal Clearing House which typically clears in two to three business days. Once cleared, it will then hit your bank to clear for deposit. You are then free to access those funds to pay your provider for the services that were rendered. For an additional small fee, O.C.A. will pay providers directly on the employee’s behalf. Electronic Payment Card for HRA & FSA plan design Electronic payment cards are becoming more prevalent and vital in a successful benefit plan offering. Introducing an electronic payment card into a reimbursement account plan empowers employees and gives them an option to avoid inconvenient out-of-pocket expenses. Card Services provided: Initial card enrollment and account set up Initial delivery of cards to employer by overnight mail Transaction monitoring and reconciliation Customer service to employees Employer and employee access to a 24/7 secure web portal Employers and their employees will have 24/7 access to our secure web portal called Myrsc (My Resource Center). Myrsc.com provides each user a customizable view based on whether the user is the employee, supervisor, manager, employer, human resource administrator, payroll processor, benefit consultant, insurance agent, third party administrator, plan service provider, insurance carrier or any person with appropriate access permissions and role authority. Mrysc.com focuses on human resources, payroll, benefits information and administrative tasks. The single most distinctive characteristic of the site is its adaptability and its ability to fit the purpose of any user. That, combined with the site's emphasis on security and privacy, makes myRSC.com the premier human resource and employee benefits site on the Internet. Pricing Schedule and Fees *There is an additional $1 fee per month per debit card issued for Debit Card eligible plans. ** On-site massage fee is $15 for 15 minute chair massage Option Inclusive of the following: Annual Plan Consultation & Annual Plan Renewal Employer Annual Fee Cafeteria Plan, HRA, COBRA Customized Enrollment Materials Annual Discrimination Testing Customized Re-enrollment Materials Online Re-enrollment setup Monthly Administration Fee per employee per month Flexible Spending Account (FSA) Per Participant (Minimum monthly fee of $115.00) Health Reimbursement Account (HRA) Per Participant (If selected, minimum monthly fee of $115.00) Up to Two Debit Cards per Family for Participants COBRA* Wellness- My Wellchoice+ $1,000.00 $ included $ included $ included $ included $11.50 $ included $ included $ included $ included $ included *Generation of any COBRA notification notice (including cost of proof of mail) is $2.25 per notice. **O.C.A. retains 2% premium administrative fee billed to COBRA participants. Monthly Fee Includes: Online Account Balances, Payment History, Documents and forms Claim Adjudication (daily for FSA & HRA reimbursements) Reimbursement via Direct Deposit Discrimination Testing Payroll Reconciliation Reporting Interactive Voice Response Service (IVR) for Cafeteria Plan Reimbursement Fees: Reimbursement by Check Reimbursement by direct deposit (ACH) Requested Quote for HRA Administration (xxx) Lives HRA Set Up Annual Fee N/A $500 Rate Per Par/Per Month Total Monthly Cost $9 per/par $xxx $115 monthly Minimum For additional information please contact: O.C.A. Benefit Services Sales Department (609) 514-0777 or sales@oca125.com 3705 Quakerbridge Road, Suite 216 Mercerville, NJ 08610