What is IRS Code Section 105.indd

advertisement

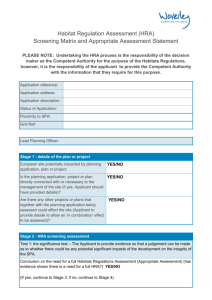

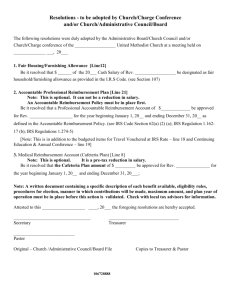

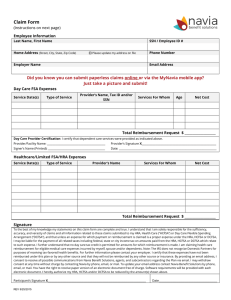

News Release Benefit Administration for the Self-Employed (BASE®) 601 Visions Parkway Adel, Iowa 50003 Contact: Shawndi Filby Phone: 888-227-3105 Fax: 515-993-5454 E-mail: shawndi@base105.com FOR IMMEDIATE RELEASE WHAT IS IRS CODE SECTION 105 AND HOW CAN IT HELP YOUR CLIENTS? Adel, Iowa, December 11, 2008: As a tax professional, you advise small business owners every day. Knowing what options are available to your clients will help them save money and grow their businesses, as well as yours. One company that can help you do just that is BASE®, an employee benefits administration firm based in Adel, Iowa. Companies like BASE® work to be a resource for you so you can stay on the cutting edge of what options exist to keep your clients financially secure. One of the greatest tax advantages for today’s small business owner is IRS Code Section 105. Simply put, this tax ruling allows small business owners to deduct up to 100% of their family’s medical expenses as a business expense. With the ever-rising costs of health care, this tax break can mean the difference of thousands of dollars over the course of a year. IRS Code Section 105 was signed into effect in 1954 to encourage small business owners to provide health coverage for their employees. It allowed mom-and-pop shops the same tax advantages as big corporations . The BASE HRA, or health reimbursement arrangement, was created to simplify the compliance and accounting procedures associated with this type of deduction. BASE’s HRA plan makes working with this complex piece of tax code much easier. Through excellent customer service, record keeping and attention to detail, BASE HRA clients are able to save an average of $3,800 on their taxes each year. Specific rulings that enabled BASE to offer such a substantial savings to your clients are: • IRS Code Section 105(b) and 106 (a): allows an employee to exclude from gross any employer-paid reimbursement for medical care expenses for the employee and employee’s spouse and dependents. • IRS Code Section 162(a): Allows the employer to deduct the cost of wages, salaries and other compensation, which includes medical reimbursements. • IRS Code Section 213: Defines the medical expenses referred to in Sections 105 and 106. Medical expenses are defined as amounts paid “for the diagnosis, cure, mitigation, treatment or prevention of disease or for the purpose of affecting any structure or function of the body; for transportation primarily for or essential to medical care; for qualified long-term care services; and for insurance.” • Revenue Ruling 71-588: Allowed the spouses of business owners, if considered employees, to be covered by an HRA. Compiling all of the necessary documentation to take advantage of an HRA can be a confusing and time-consuming task, even for a seasoned tax professional. Working with BASE makes the whole process smoother for both you and your client. About BASE® Established in 1999, BASE® is one of the nation’s leading employee benefit administrators. BASE® offers a variety of tax savings plans for small businesses, including the 105 Health Reimbursement Arrangement (HRA) and the 125 Flexible Spending Account (FSA). To find out more about HRAs, FSAs and other employee benefit plans visit www.baseonline.com today or contact a benefit specialist at 888-386-9680. ###