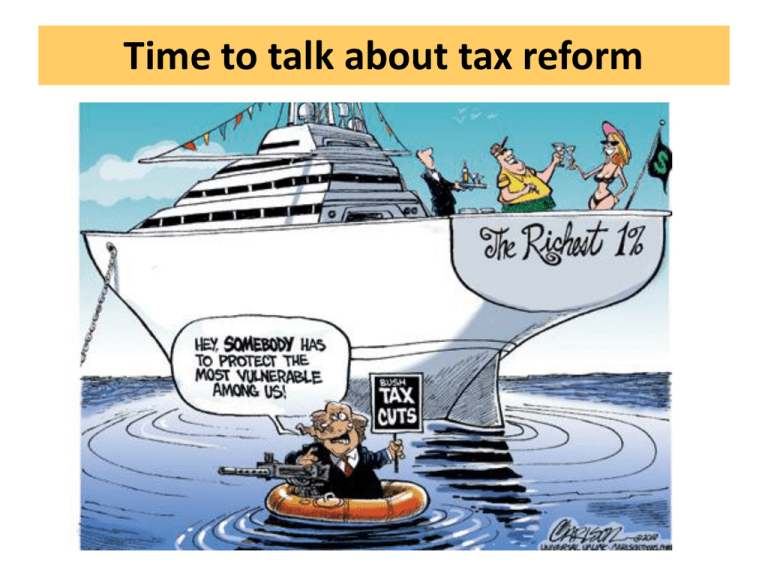

Public money

advertisement

Time to talk about tax reform Talking about money: mine and ours Private money • Wages • Investment • Inheritance Public money • Taxes • Fees Private opportunities: Housing, transport, education, recreation, healthcare, recreation, contacts, Communal opportunities: Transport, safety, green space, courts, democratic process, arts, clean air, education, recreation Protect the vulnerable Shelter, health care, crisis intervention, help for seniors, people with disabilities and children Private Money Current private income distribution Concentration of wealth since 1980 The best things in life aren’t free The cost of raising a child in a middle-income family has increased by 40 percent since 2000. Every child-rearing expense has steeply increased: day-care, education, food, gas, medical insurance, etc The 2008 recession was the worst blow Many megabanks brought down the economy by creating and selling risky financial products – with our money The losses were huge $15 trillion in personal wealth was gone -- Almost $50,000 for every man, woman and child in the US $ 6.1 trillion in housing value disappeared -- As if a hurricane destroyed every house in every state on the Atlantic coast from Maine to Florida 8.4 million jobs were lost Investors have fully recovered … Too many Americans have not… Milwaukee's poverty rate at 29.4% Public money Public money creates opportunities for everyone Public money sustains the middle class Public money sets the groundwork for economic growth and security Port of Green Bay Sewage System Sanitation system Chippewa Valley Tech College Dane County Airport Highway system Tax policy moves money City water system We can decide: • where to collect it • how much to collect • how to use it • how to keep the public informed The less money we collect, the less we have to use for the public good. The less we get from corporations and the super rich, the more they have to invest in elections and lobbying. 14 Not everybody pays their fair share Not everybody pays their fair share Corporation Profits Taxes Owed P What could we buy Mattel $1 billion $270,000,000 0 Family Caregiver Support Wisconsin Energy $1.7 billion $456,000,000 0 Senior employment and training programs Corning $2 billion $540,000,000 0 Annual funding for Alzheimer’s research Du Pont $2.1 billion $567,000,000 0 Rheumatoid arthritis meds for 60,000 people Honeywell $4.9 billion $1.3 billion 0 Health insurance for 80,000 workers Boeing $9.4 billion $2.54 billion 0 National Park Service Gen Electric $10.5 billion $2.84 billion 0 Small Business Administration Verizon $32.5 billion $8.8 billion 0 Environmental Protection Agency Wells Fargo $49.4 billion $13.34 billion 0 National School Lunch program Tax policy now grows wealth for the top 1% 28% 25% 25% 25% As low as 15% “280 consistently profitable Fortune 500 companies paid about half the statutory corporate tax rate while spending $2 billion to lobby Congress on tax policy and other issues” Top taxes are low-especially for the richest with income over $87 million Causes of the federal deficit 19 House of Rep./Ryan Budget Plan Make all Bush tax cuts permanent Maintain capital gains tax rate at 15%, no Buffet Rule Maintains current FICA cap, no increase above $110k Reduce tax rates for wealthy to 25% - average gain = $175,000 Reduce other tax rates to 10% Cut the formal corporate tax rate to 25% Eliminate taxes on overseas profits Repeal Alternative Minimum Tax and taxes in Affordable Care Act Estimated Reduction in Revenues over 10 years: $10 trillion Impact of Spending Cuts in House/Ryan Budget • 17 million people lose access to health care • 21 million low-income Americans lose Medicaid within 7 years. • 8 million people lose Food Stamps • 2 million children removed from Head Start • 1.8 million women, infants, and children lose food and healthcare support (WIC) • Over 1 million students lose Pell Grant support Making the changes we need Polls consistently show that increasing taxes on the wealthy is hugely popular. In a recent Gallup poll, 62 percent of respondents said “upperincome people” were paying too little in taxes. In a CNN poll, 68 percent of Americans agreed that “the present tax system benefits the rich and is unfair to the ordinary working man or woman,” and 72 percent said they support changing the tax code “so that people who make more than one million dollars a year will pay at least 30 percent of their income in taxes.”