Chapter 8 powerpoint

advertisement

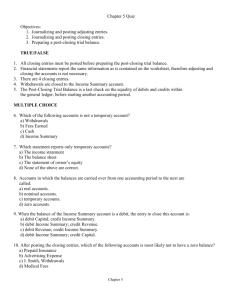

Chapter 8 Recording Adjusting and Closing Entries for a Service Business Objectives Define accounting terms Identify accounting concepts and practices Record adjusting entries Record closing entries Prepare a post-closing trial balance Concepts Accounting period cycle-when changes in financial info are recorded for a specific period of time in the form of financial statements Adequate disclosure-when financial statements contain all info necessary to understand a business’s financial condition Matching expenses with revenue-when revenue and expenses associated with earning that revenue are recorded in the same accounting period Work Sheet A work sheet is prepared at the end the fiscal period to summarize the general ledger and prepare financial statements 8-1 Adjusting Entries Adjusting Entries - Journal entries recorded to update general ledger accounts at the end of the fiscal period. Recorded on the next journal page following the page on which the last daily transactions for the month are recorded. Entered in the General Debit and General Credit columns of a journal. Adjusting Entry for Supplies Supplies expense has an up-to-date balance of $715.00, which is the value of supplies used during the fiscal period. Supplies Expense Adj. (a) 715.00 Supplies Bal. (New Bal.) 1,025.00 310.00 Adj. (a) 715.00 Adjustments Account Title Debit Credit Supplies (a) Supplies Expense (a) 715.00 715.00 Debit Journal PAGE 1 Account Title Date Doc No. Post Ref 2 General Dr Cr Adjusting Entries 20-- Aug 31 Supplies Expense Supplies 715.00 715.00 Credit 3 Sales Credit 4 3 5 Cash Dr Cr Adjusting Prepaid Insurance Insurance expense has an up-to-date balance of $100, which is the value of insurance used during the financial period Insurance Expense Adj. (b) 100.00 Prepaid Insurance Bal. 1,200.00 (New Bal.) 1,100.00 Adj. (b) 100.00 Adjustments Account Title Debit Credit Prepaid Insurance (b) Insurance Expense (b) 100.00 Journal PAGE 1 Account Title Date Adjusting Entries Doc No. Post Ref 2 3 General Dr Cr Debit 20-- Aug 31 715.00 Supplies Expense 715.00 Supplies 31 Insurance Expense Prepaid Insurance 100.00 100.00 Credit 100.00 Sales Credit 4 3 5 Cash Dr Cr 8-2 Recording Closing Entries Permanent Accounts-accounts used to accumulate info from one fiscal period to the next (real accounts) Assets Liabilities Capital Temporary Accounts-accounts used to accumulate info until it transferred to the owner’s capital account (nominal accounts) Revenue Expenses Drawing Income Summary New Fiscal Period Permanent accounts maintain the balance they had from the previous fiscal period Temporary accounts always begin a new fiscal period with zero balances Need for Closing Temporary Accounts Closing Entries-Journal entries used to prepare temporary accounts for a new fiscal period (zero out temporary accounts) To close a temporary account, an amount equal to its balance is recorded in the account on the side opposite of its balance Example If rent expense has a debit balance of $4,411 then the account must be credited for the same amount in order to close the account out. Since you need an equal debit, the Income Summary account will be used. Need for Income Summary Account Used only to close out temporary accounts Used to summarize the closing entries for the revenue and expenses Does not have a normal balance side When revenue is greater than total expenses (net income) Income Summary account will have a credit balance When total expenses are greater than revenue (net loss) Income Summary has a debit balance Because Income Summary is also a temporary account, it too must be closed out (into capital) Income Summary Debit Total expenses Credit Revenue (greater than expenses) (Credit balance is the net income.) Debit Total expenses Income Summary Debit Total expenses (greater than revenue) (Debit balance is the net loss.) Credit Revenue TechKnow Consulting records four closing entries: 1. An entry to close income statement accounts with credit balances; 2. An entry to close income statement accounts with debit balances; 3. An entry to record net income or net loss and close Income Summary; and 4. An entry to close the owner’s drawing account. Closing Entry for an Income Statement Account with a Credit Balance Account Title Income Statement Debit Credit Sales 3,565.00 Journal PAGE 1 Account Title Date Closing Entries 31 Sales Doc No. Post Ref 2 3 General Dr Cr Debit 3,565.00 Income Summary 3,565.00 Credit 4 Sales Credit 3 5 Cash Dr Cr Closing Entry for Income Statement Accounts with Debit Balances Account Title Income Statement Debit Credit Advertising Expense 213.00 Insurance Expense 100.00 Miscellaneous Expense (Credit to close) 28.00 Rent Expense 300.00 Supplies Expense 715.00 Utilities Expense 110.00 Journal PAGE 1 Account Title Date 31 Income Summary Doc No. Post Ref 2 General Dr Cr 1,466.00 Advertising Expense 213.00 Insurance Expense 100.00 Miscellaneous Expense 28.00 Rent Expense 300.00 Supplies Expense 715.00 Utilities Expense 110.00 3 Sales Credit 4 3 5 Cash Dr Cr Income Summary Closing (expenses) Advertising Expense Bal. 213.00 (New Bal. zero) Closing 3,565.00 2,099.00 213.00 Bal. 300.00 (New Bal. zero) Closing Closing Closing 300.00 Supplies Expense 100.00 Miscellaneous Expense Bal. 28.00 (New Bal. zero) Closing (revenue) (New Bal. Rent Expense Insurance Expense Bal. 100.00 (New Bal. zero) 1,466.00 28.00 Bal. 715.00 (New Bal. zero) Closing 715.00 Utilities Expense Bal. 110.00 (New Bal. zero) Closing 110.00 Closing Entry to Record Net Income for Loss And Close the Income Summary Account Account Title Income Statement Debit Credit 1,466.00 Net Income 3,565.00 2,099.00 3,565.00 Capital: credit to record net income) 3,565.00 (Income Summary: debit to close) Debit Journal PAGE 1 Account Title Date 31 Doc No. Income Summary Post Ref 2 3 General Dr Cr 2,099.00 Kim Park, Capital 2,099.00 Credit 4 Sales Credit 3 5 Cash Dr Cr Income Summary Closing (expenses) 1,466.00 Closing 2,099.00 Bal. Net Income (New Bal. 5,000.00 2,099.00 6,474.00) Kim Park, Capital Bal. Closing (net inc.) (New Bal. 5,000.00 2,099.00 7,099.00) Closing Entry for the Owner’s Drawing Account Account Title Income Statement Debit Credit Kim Park, Capital 5,000.00 Kim Park, Drawing 625.00 (Credit to close) Debit Journal PAGE 1 Account Title Date 31 Doc No. Kim Park, Capital Post Ref 2 3 General Dr Cr 625.00 Kim Park, Drawing 625.00 Credit 4 Sales Credit 3 5 Cash Dr Cr Kim Park, Capital Closing (drawing) 625.00 Bal. Net Income (New Bal. 5,000.00 2,099.00 6,474.00) Kim Park, Drawing Bal. (New Bal. zero) 625.00 Closing 625.00 Closing Entries Summary Account Date After journalizing the closing entries, you need post the entries into the general ledger All temporary accounts should now have a zero balance. Put lines through both Balance Debit and Balance Credit Columns of the ledger Rent Expense Item Account No. 540 Post Ref Aug 12 1 Aug 31 3 Debit Credit Balance Debit 250 Credit 250 250 -------------- ------------- 8-3 Preparing a Post-Closing Trial Balance A trial balance prepared after the closing entries are posted Used to verify that debits still equal credits in the general ledger accounts after closing entries are made Only accounts with balances are included on this (unlike the Work Sheet which lists ALL accounts) so only assets, liabilities, and capital are listed General Ledger Accounts After Adjusting and Closing Entries are Posted Account Cash Date Account No. 110 Post Ref Item Debit Credit Balance Debit Credit 2006 Aug. 31 2 31 2 Account Petty Cash Date Item 8,315.00 8,315.00 3,351.00 4,964.00 Account No. 120 Post Ref Debit Credit Balance Debit 2006 Aug. 17 1 100.00 100.00 Credit Post-Closing Trial Balance TechKnow Consulting Post-Closing Trial Balance August 31, 20-Cash 4,964.00 Petty Cash 100.00 Accounts Receivable—Oakdale School 150.00 Accounts Receivable—Campus Internet Cafe 100.00 Supplies 310.00 Prepaid Insurance 1,100.00 Accounts Payable—Supply Depot 200.00 Accounts Payable—Thomas Supply Co. 0.00 Kim Park, Capital Totals 6,474.00 6,724.00 6,724.00 Accounting Cycle The series of accounting activities (steps) included in recording financial info for a fiscal period FYI: The word post means after. The Post-Closing Trial Balance is prepared after closing entries. Accounting Cycle For a Service Business Analyze Transactions Prepare Post-Closing Trial Balance 1 2 8 Post Adjusting & Closing Entries Journalize Post 3 7 *adjusting entries *closing entries Journalize Adjusting and Closing Entries *adjusting entries *closing entries 4 6 5 Prepare Work Sheet Prepare Financial Statements *Income Statement *Balance Sheet Remember the Steps Always Jump Past Water For Just Plain Power! Analyze Journalize Post Worksheet Financial Statements Journalize Post Post-Closing Trial Balance Ch 1 & 2 Ch 3 Ch 5 Ch 6 Ch 7 Ch 8 Ch 8 Ch 8 Permanent or Temporary Accounts? Cash Misc. Rent Sales Expense A/R Joe’s Place Supplies A/P Office Max Karen Denney, Capital Karen Denney, Drawing Expense Prepaid Insurance Insurance Expense Income Summary Petty Cash A/P Quality Services REVIEW Four closing entries: Close income statement accounts with credit balances (revenue) Close income statement accounts with debit balances (expenses) Record net income or net loss by closing Income Summary into Capital Close drawing account into Capital After closing entries are posted, the owner’s capital account balance should be the same as shown on the Balance Sheet for the fiscal period Review The only accounts listed on the PostClosing Trial Balance are those with balances after closing entries have been posted (assets, liabilities, capital) Info needed for journalizing the adjusting entries is obtained from the work sheet’s Adjustments columns Info needed for recording the closing entries is obtained from the work sheet’s Income Statement (revenue & expenses) and Balance Sheet (drawing) columns The ending account balances of permanent accounts for one fiscal period are the beginning account balances for the next fiscal period. Temporary accounts must start each fiscal period with a zero balance Income summary has no normal balance