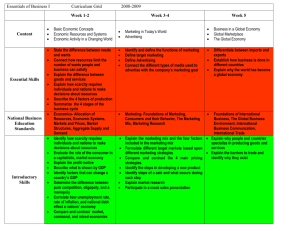

Essentials of Business II Curriculum Grid 2008

advertisement

Essentials of Business II Curriculum Grid Time Spent on Topic Content Essential Skills 3.5 Weeks Role of the Federal Reserve Monetary Policy Inflation Trickle-down Effect in Business Value of the Dollar Differentiate between a contractionary and expansionary monetary policy Identify the importance of the money supply to the ecomony Explain inflation Determine the actions the Federal Reserve can take to stabilize the money supply National Business Education Standards Introductory Skills Assessment 1.5 Weeks Introduction to course/classroom management plan Introduction to stocks and the stock market Introduction to other investment opportunities (bonds, mutual funds, real estate) Reinforcing Standards (State Standards) 2008-2009 Identify characteristics of stocks Identify different ways to make and lose money from stocks Summarize different aspects of a stock chart Explain what bonds and mutual funds are Identify the different ways stocks are classified Personal Finance- III. Managing finances and budgeting. IV. Saving and investing Participate in a stock trading simulation Identify how to buy/sell/track stocks online using a stock tracking website Compare different types of orders when purchasing stocks Evaluate different long-term stock buying strategies Differentiate between types of federal, municipal government, and corporate bonds Create investment portfolios depending on different financial scenarios 1.A.5a, 1.B.5d, 1.C.5e, 3.A.5, 3.C.5a, 3.C.5b, 4.B.5a, 4.B.5b, 6.A.5, 6.D.5, 8.A.5, 8.D.4, 10.A.4a, 10.A.4b, 10.B.4, 14.D.5, 14.F.5, 15.A.5a, 15.A.5b, Worksheets Stock Market Game Vocabulary Test Economics- II. Economic Systems, VII The Role of Government Identify how inflation effects the economy Compare and contrast a strong and weak dollar Determine how the trickledown effect impacts business and investing 1.A.5a, 1.B.5d, 1.C.5e, 3.A.5, 3.C.5a, 3.C.5b, 4.B.5a, 4.B.5b, 6.A.5, 6.D.5, 8.A.5, 8.D.4, 10.A.4a, 10.A.4b, 10.B.4, 14.D.5, 14.F.5, 15.E.5a, 15.E.5b, 15.E.5c, Test Worksheets Case Study Projects 2 Weeks Banking Services Savings Plans Identify the different savings plans (savings account, CD, checking/money market account) and their characteristics. Identify how to write a check and complete a check register Differentiate a regular savings account from a CD and money market account Personal Finance- IV Banking and Financial Institutions Evaluate risks/rewards of each different savings plan Recreate different check endorsements Create a savings plan for individuals depending upon their needs. 3.A.5, 3.C.5a, 3.C.5b, 4.B.5a, 4.B.5b, 6.A.5, 6.D.5, 8.A.5, 8.D.4, 10.A.4a, 10.A.4b, 14.D.5, 14.F.5 Test Worksheets Case Study Projects Essentials of Business II Curriculum Grid 2008-2009 2 Weeks Credit Final Exam and review Content Essential Skills Define credit Evalutate when and when not to use to use credit Identify the risk associated with owning a credit card Explain how you can develop of credit history Explain various credit terms (outstanding balance, interest rate, late fee, etc.) Personal Finance- IV Using Credit National Business Education Standards Introductory Skills Reinforcing Standards (State Standards) Assessment Identify various fees associated with credit cards Explain the factors creditors consider when granting a person credit Identify how credit card companies make money off of consumers Understand the fine print associated with credit card offers Compare and contrast the various aspects of credit cards Explain ways to maintain a good credit rating Summarize what a credit report is and how it effects you life 1.A.5a, 1.B.5d, 1.C.5e, 3.A.5, 3.C.5a, 3.C.5b, 4.B.5a, 4.B.5b, 6.A.5, 6.D.5, 8.A.5, 8.D.4, 10.A.4a, 10.A.4b, 10.B.4, 14.D.5, 14.F.5, Worksheets Vocabulary Test Case Study Final Exam