Regional Affordable Housing Project (Tunisia Activities)

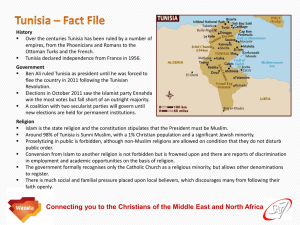

advertisement