Floaters

advertisement

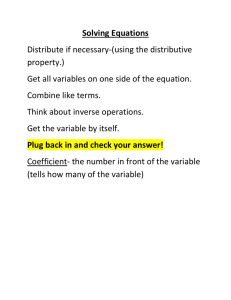

International Fixed Income Topic IC: Fixed Income Basics Floaters Introduction • A floating rate note (FRN) is a bond with a coupon that is adjusted periodically to a benchmark interest rate, or indexed to this rate. – Possible benchmark rates: US Treasury rates, LIBOR (London Interbank Offering Rates), prime rate, .... • Examples of floating-rate notes – Corporate (especially financial institutions) – Adjustable-rate mortgages (ARMs) – Governments (inflation-indexed notes) Floating Rate Jargon • Other terms commonly used for floating-rate notes are – – – – FRNs Floaters and Inverse Floaters Variable-rate notes (VRNs) Adjustable-rate notes • FRN usually refers to an instrument whose coupon is based on a short term rate (3-month T-bill, 6month LIBOR), while VRNs are based on longerterm rates (1-year T-bill, 2-year LIBOR) Cash Flow Rule for Floater • Consider a semi-annual coupon floating rate note, with the coupon indexed to the 6month interest rate. – Each coupon date, the coupon paid is equal to the par value of the note times one-half the 6month rate quoted 6 months earlier, at the beginning of the coupon period. – The note pays par value at maturity. • Time t coupon payment as percent of par: ct t 0.5 rt / 2 Cash Flows E a c h c o u p o n i s b a s e d o n t h e p r e v i o u s 0 . 5 y e a r r a t e O n l y t h e f i r s t c o u p o n i s k n o w n . ~ ~ ~ r / 2 r / 2 r / 2 1 r / 2 0 1 t T 0 . 5 0 . 5 t 0 . 5 T 0 . 5 0 . 5 . . . . . 0 1 t. T Example • What are the cash flows from $100 par of the note? – The first coupon on the bond is 100 x 0.0554/2=2.77. – What about the later coupons? They will be set by the future 6-month interest rates. For example, suppose the future 6-month interest rates turn out as follows: 5 . 5 4 % 6 . 0 0 % 5 . 4 4 % 6 . 1 8 % F l o a t e r C a s h F l o w s : 0 . 5 . 5 0 11 2 1 0 3 . 0 9 2 . 7 7 3 . 0 0 2 . 7 2 Valuation C o n s i d e r $ 1 0 0 p a r o f a f l o a t e r m a t u r i n g a t t i m e T . W h a t i s i t s p r i c e o n t h e c o u p o n d a t e b e f o r e t h e m a t u r i t y d a t e , t i m e T 0 . 5 ? PT 0.5 Time T cash flow 1+T 0.5 rT / 2 100(1 T 0.5 rT / 2) 1+T 0.5 rT / 2 100 Valuation continued... W h a t i s t h e p r i c e o f t h e f l o a t e r t w o c o u p o n d a t e s b e f o r e t h e m a t u r i t y d a t e , t i m e T 1 ? PT 1 PT 0.5 + coupon 1+T 1 rT 0.5 / 2 100 100T 1 rT 0.5 / 2 1+T 1 rT 0.5 / 2 100 Valuation continued... • Working backwards to the present, repeatedly using this valuation method, proves that the price of a floater is always equal to par on a coupon date. Why? • The coupon (the numerator) and interest rate (the denominator) move together over time to make the price (the ratio) stay constant. Risk of a Floater • A floater is always worth par on the next coupon date with certainty…..So a semi-annually paying floater is equivalent to a six-month par bond. • The duration of the floater is therefore equal to the duration of a six-month bond…..Their convexities are the same, too. For example, 0. 5 duration duration of 6 - month bond 0.4865 1 0.0554 / 2 0.52 0.5 / 2 convexity convexity of 6 - month bond 0.4734 2 (1 0.0554 / 2) Inverse Floating Rate Notes • Unlike a floating rate note, an inverse floater is a bond with a coupon that varies inversely with a benchmark interest rate. • Inverse floaters come about through the separation of fixed-rate bonds into two classes: – a floater, which moves directly with some interest rate index, and – an inverse floater, which represents the residual interest of the fixed-rate bond, net of the floating-rate. Cash Flows Components of a 11% Fixed-Rate Coupon Floater and Inverse Floater 12 10 8 Coupon 6 Inverse Floater 4 2 0 2% 3% 4% 5% 6% 7% 8% 9% Benchmark Interest rate Fixed/Floater/Inverse Floaters FIXED RATE BOND Fltr. Inv. Fltr Inv.Fltr. in Even Split • Suppose a fixed rate semi-annual coupon bond with par value N is split evenly into a floater and an inverse floater, each with par value N/2 and maturity the same as the original bond. • This will give the following cash flow rule for the inverse floater: – time t coupon, as a percent of par, is ct ( k t 0.5 rt ) 2 Example: 2-yr Inverse Floater • Consider $100 par of a note that pays 11% minus the 6-month rate. (We can think of this as coming from an even split of a 5.5% fixed rate bond into floaters and inverse floaters.) • The first coupon, at time 0.5, is equal to – $100 x (0.11-0.0554)/2 = $2.73. • The later coupons will be determined by the future values of the 6-month rate. Example Continued... S u p p o s e f u t u r e 6 m o n t h r a t e s a r e a s f o l l o w s : 0 0 . 5 1 1 . 5 2 5 . 5 4 % 6 . 0 0 % 5 . 4 4 % 6 . 1 8 % I n v e r s e F l o a t e r C a s h F l o w s : 0 0 . 5 1 2 . 7 3 2 . 5 0 1 0 0 x ( 0 . 1 1 0 . 0 6 ) / 2 1 . 5 2 0 2 . 4 1 2 . 7 81 Example Continued... F l o a t e r + I n v e r s e F l o a t e r ( k ) = 2 F i x e d ( k / 2 ) 0 0 . 5 1 1 . 5 2 5 . 5 4 % 6 . 0 0 % 5 . 4 4 % 6 . 1 8 % F l o a t e r C a s h F l o w s + I n v e r s e F l o a t e r C a s h F l o w s : 0 . 5 1 . 5 0 1 2 2 . 7 7 + 2 . 7 3 = 5 . 5 0 3 . 0 0 + 2 . 5 0 = 5 . 5 0 0 3 . 0 9 2 . 7 2 1 1 0 2 . 4 1 + 2 . 7 8+ 2 0 5 . 5 0 = 5 . 5 0= T o t a l i s c a s h f l o w i s s a m e a s c a s h f l o w f r o m 2 0 0 p a r o f a 5 . 5 0 % n o t e . Decomposition of Inverse Floater • Clearly, the cash flows of an inverse floater with coupon rate "k minus floating" are the same as the cash flows of a portfolio consisting of – long twice the par value of a fixed note with coupon k/2, and – short the same par of a floating rate note. • Inverse Floater(k) = 2 Fixed(k/2) - Floater Valuation of Inverse Floater • Price of Inverse Floater(k) = 2 x Price of Fixed(k/2) - 100 • For example, the 2-year inverse floater paying 11% minus floating is worth – 2 x price of 5.5% fixed rate bond minus 100. • Using the zero rates from 11/14/95, – r0.5=5.54%, r1=5.45%, r1.5=5.47%, r2=5.50%, • To discount each of the cash flows of the 2-year 5.5% fixed coupon bond, the bond is worth 100.0019. • Therefore the inverse floater is worth – 2 x 100.0019 - 100 = 100.0038 Interest Rate Risk • Dollar Duration of an Inverse Floater(k) = 2 x Dollar Duration of Fixed(k/2) - Dollar Duration of Floater • Dollar Convexity of an Inverse Floater(k) = 2 x Dollar Convexity of Fixed(k/2) - Dollar Convexity of Floater Duration • The dollar duration of $100 par of the 5.5% fixed rate bond is 186.975, while its duration is 1.87. • This means the dollar duration of the inverse floater paying 11%-floating is 2 x 186.975 - 48.65 = 325.30, which gives us a duration of 325.30/100.0038 = 3.25! – An inverse floater is roughly twice as sensitive to interest rates as an ordinary fixed rate bond. Convexity • The dollar convexity of $100 par of the 5.5% fixed rate bond is 448.76, while its convexity is 4.49. • This means the dollar convexity of the inverse floater paying 11%-floating is 2 x 448.76 - 47.34 = 850.18, which gives us a convexity of 850.18/100.0038 = 8.50.