ME Unit-3

advertisement

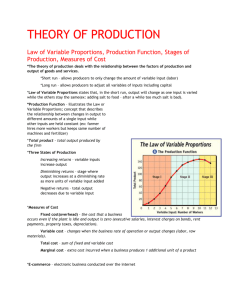

Unit-3 supply The supply of a commodity is the amount of the commodity which the sellers or producers are able and willing to offer for sale at a particular price, during a certain period of time. According to J.L. Hanson- “By supply is meant that amount that will come into the market over a range of prices.” Determinants of supply 1. 2. 3. 4. 5. 6. 7. 8. Price of the commodity Seller’s Expectations about the future prices Nature of Goods Natural Conditions Transport conditions Cost of Production The State of Technology Government’s Policy Law of supply The Law of Supply states that- “Other things remaining unchanged, the supply of a commodity rises i.e., expands with a rise in its price and falls i.e., contracts with a fall in its price.” Price (in Rs.) Quantity supplied (in ‘000 per week) 10 10 20 13 30 20 40 25 40 30 20 10 0 10 15 20 25 30 Types of supply Market Supply- It is also called very short period supply. Another name is day-to-day supply. Eg- fish, vegetables, milk etc. In this supply is not made according to the demand of purchasers but as per availability of the goods. Short-term supply- In short period supply, the demand cannot be met as per requirements of the purchaser. The demand is met as according to goods available. Long-term Supply- In this, if demand has been changed the supply can also be changed because there is sufficient time to meet the demand by making manufacturing goods and supplying them in the market. Joint Supply- It refers to the goods produced or supplied jointly e.g. cotton and seed; mutton and wool. In joint supplied products one is main product and the other is the by-product of its subsidiary. Composite Supply- In this, supply of a commodity is made from various sources and is called the composite supply. We normally get light from electricity, gas, kerosene and candles. Thus, the way of supplying the light is called composite supply. Assumptions underlying the law of supply 1. 2. 3. 4. 5. 6. 7. 8. No change in the income No change in technique of production There should be no change in transport cost Cost of production be unchanged There should be fixed scale of production There should not be any speculation The prices of other goods should remain constant. There should not be any change in the government policies. Exceptions to the Law of supply In some exceptional cases where supply may tend to fall with the rise in price and tend to rise with the fall in price. Such exceptional cases may beExceptions about future prices. 2. Supply of Labour 3. Rate of Interest and Savings position. 1. Elasticity of supply Elasticity of Supply = Percentage change in supply Percentage change in Price When elasticity of supply is equal to unity Percentage change in price is equal to percentage change in supply. Eg- If price rises by 25% then supply also rises by 25%. 1. 2. When elasticity of supply is more than unity Percentage change in supply is more than percentage change in price. Eg- If price rises by 50% then supply also rises by 75%. 3. When elasticity of supply is less than unity Percentage change in price is more than percentage change in supply. Eg- If price rises by 50% then supply also rises by 25%. What is production? “Production is the process that transforms inputs into output.” “Production is the process by which the resources (input) are transformed into a different and more useful commodity. Various inputs are combined in different quantities to produce various levels of output.” Production Management Inputs Labour, Capital, Land, Manpower, Equipments Transformation Process Control Goods & Services Pollution Output Production Function Production function is defined as “the functional relationship between physical inputs ( i.e., factors of production ) and physical outputs, i.e., the quantity of goods produced”. Production function may be expressed as under: Q = f ( K,L) Where ; Q = Output of commodity per unit of time. K = Capital. L = Labour. f = Functional Relationship. Production function depends on : ○ Quantities of recourses used. ○ State of technical knowledge. ○ Possible process. ○ Size of firms. ○ Relative prices of factors of production. ○ Combination of factors. Production decisions of a firm are similar to consumer decisions Can also be broken down into three steps Production Technology Cost Constraints Input Choices Production Decisions of a Firm 1. Production Technology Describe how inputs can be transformed into outputs ○ Inputs: land, labor, capital and raw materials ○ Outputs: cars, desks, books, etc. Firms can produce different amounts of outputs using different combinations of inputs Production Decisions of a Firm 2. Cost Constraints Firms must consider prices of labor, capital and other inputs Firms want to minimize total production costs partly determined by input prices As consumers must consider budget constraints, firms must be concerned about costs of production Production Decisions of a Firm 3. Input Choices Given input prices and production technology, the firm must choose how much of each input to use in producing output Given prices of different inputs, the firm may choose different combinations of inputs to minimize costs ○ If labor is cheap, firm may choose to produce with more labor and less capital Relationship between tp, ap & mp Qty of Labour TP AP MP 1 100 100 100 2 210 105 110 3 330 110 120 4 430 107.5 100 5 520 104 90 6 600 100 80 7 670 95.7 70 8 720 90 50 9 750 83.3 30 10 760 76 10 11 740 67.2 -20 Laws of Production Short Run One variable input (Law of Variable) Two variable inputs (Isoquant analysis) Long Run All inputs variable (Returns to Scale) Short Run Production Function: The Law of Variable Proportions Statement of the law: “The law of variable proportions states that when more and more units of the variable factor are added to a given quantity of fixed factors, the total product may initially increase at an increasing rate reach the maximum and then decline”. This is the new name given to Law of Diminishing Returns. Assumptions 1. The law applies only in the short run. 2. One factor of production is variable & others are fixed. 3. All units of variable factor are homogeneous. 4. State of technology is given & remains the same. 5. Factor proportions can he changed. Key terms in production analysis Total product (TP): The total amount of output resulting from a given production function Average product(AP): Total product per unit of given input factor. Marginal product(MP): The change in total product per unit change in given input factor. Three Stages of Production in Short Run (i) Stage of Increasing Returns. The first stage of the law of variable proportions is generally called the stage of increasing returns. In this stage as a variable resource (labor) is added to fixed inputs of other resources, the total product increases up to a point at an increasing rate as is shown in figure 11.1. The total product from the origin to the point F on the slope of the total product curve increases at an increasing rate. From point F onward, during the stage II, the total product no doubt goes on rising but its slope is declining. This means that from point F onward, the total product increases at a diminishing rate. In the first stage, marginal product curve of a variable factor rises in a part and then falls. The average product curve rises throughout .and remains below the MP curve. 1. Increasing return to a factor:- (i) Fuller utilization of fixed factor : In the initial stages Fixed factor remain under utilized its fuller utilization starts with the more application of variable factor, hence, initially additional unit of variable factors add more to the total output (ii) Specialization of Labour :- Additional application of Variable factor causes process based division of Labour that raises the efficiency of factors. Accordingly marginal productivity tends to rise. (ii) Stage of Diminishing Returns. This is the most important stage in the production function. In stage 2, the total production continues to increase at a diminishing rate until it reaches its maximum point (H) where the 2nd stage ends. In this stage both the marginal product (MP) and average product of the variable factor are diminishing but are positive. (iii) Stage of Negative Returns. In the 3rd stage, the total production declines. The TP, curve slopes downward (From point H onward). The MP curve falls to zero at point M and then is negative. It goes below the X axis. 2. Diminishing return to a factor:(i) Imperfect factor substitutability :- Factors of production are imperfect substitutes of each other. More & more of Labour, for eg. Cannot be continuously used in place of additional capital. Accordingly diminishing returns to variable factor becomes inevitable. (ii) Disturbing the optimum proportion :Continuous increase in application of variable factor along with fixed factors beyond a point crosses the limit of ideal factor ratio. This results in poor co-ordination between the fixed & variable factors which causes diminishing return to a factor. 3. Negative returns to a factor :(i)Overcrowding :- When more & more variable factors are added to a given quantity of fixed factor it will lead to over crowding & due to this MP of the Labours decreases & it goes into negative (ii) Management Problems :- When there are too many workers they may shift the responsibility to others & it becomes difficult for the management to coordinate with them. The Labours avoid doing work. All these things lead to decrease in efficiency of Laboures. Thus the output also decreases. Importance: (i) It is helpful in understanding clearly the process of production. It explains the input output relations. We can find out by-how much the total product will increase as a result of an increase in the inputs. (ii) The law tells us that the tendency of diminishing returns is found in all sectors of the economy which may be agriculture or industry. (iii) The law tells us that any increase in the units of variable factor will lead to increase in the total product at a diminishing rate. Production Function in Long Run Laws of Returns to Scale (All variable inputs) The percentage increase in output when all inputs vary in the same proportion is known as returns to scale. It obviously relates to greater use of inputs maintaining the same technique of production. Three Situations of Returns To Scale - Increasing Returns to Scale - Constant Returns to Scale - Decreasing Returns to Scale Table showing Returns to Scale Factor Combinations (in Quintals) Total Product (in Quintals) Marginal Product (in Qunitals) 1 2 2 6 2 Increasing 4 Returns 3 4 5 12 18 24 6 Constant 6 Returns 6 6 7 28 30 4 Diminishing 2 Returns Increasing 8 Decreasing Constant 7 Stage II MP (in Quintals) 6 5 4 3 2 1 0 1 2 3 4 5 6 7 8 Factors Combinations Increasing Returns to Scale- when the ratio between factors of production is kept fixed and the scale is expanded, initially output increases in a greater proportion than the increase in the factors of production. Constant Returns to Scale- Returns to scale become constant as the increase in total output is in exact proportion to increase in inputs. If the scale of production is increased further, total returns will increase in such a way that the marginal returns become constant. Diminishing Returns to scale- After a limit when the quantity of factors of production is increased in such a way that the output increases in a smaller proportion as compared to increases in the amounts of the factors of production. Long run production function with two variable inputs If both, capital and labour are variable, a different set of analytical techniques is applied to determine the optimal input rates. Selection of optimal combinations will depend upon: Technical possibilities, of factor substitution (Isoquants) Prices of factors of Production (Isocost lines) isoquants An isoquant represents all those combinations of inputs, which are capable of producing same level of output. Isoquants are also called equalproduct or iso-product curves. Various combinations of X and Y to produce a given level of output, say 100 units. Factor Combination Factor X Factor Y A 1 12 B 2 8 C 3 5 D 4 3 E 5 2 14 A 12 Factor Y 10 B 8 C 6 4 D E 2 0 1 2 3 4 5 Factor X Iso-cost or equal-cost lines E C A The X-axis shows the units of factor X and Y axis the units of factor Y. When entire amount Rs. 1000 are spent on factor x we get OB and the entire amount is spent on factor y we get OA. The straight line AB which joins points A and B will pass through all combinations of Factor X and Y which the fir can buy with Rs. 1000. The line AB is called iso-cost lines. Factor y Iso-cost lines represents the prices of factors. O B D Factor X F Least combinations of factors by imposing iso-quant and isocost lines Cost analysis It refers to the study of behavior of cost in relation to one or more production criteria, namely, size of output, scale of operations, prices of factors of production and other relevant economic variables. Cost Concepts- These are relevant for Business operations and decisions. Important concepts of costs are: 1. Private and Social Cost- Private cost refers to the cost of production to an individual producer. Social cost refers to the cost of producing commodity to society in the form of resources that are used to produce it. 2. Opportunity cost and Actual CostOpportunity cost is the loss of earnings due to lost opportunities. These are foregone due to scarcity of resources. It is also called Alternative cost. Actual cost or Outlay cost or Absolute costs are the actual amount of expenses incurred for producing or acquiring a good or service. 3. Past costs and Future costs- Past costs or Historical costs are records of past costs. Future costs are based on forecasts. 4. Explicit cost and Implicit cost- Explicit costs are those which are paid by employer to the owners of the factor units which do not belong to the employer itself. Implicit costs arise when factor units are owned by employer himself. 5. Incremental (Differential) costs and Sunk costs- Incremental costs is the additional cost due to change in the level or nature of business activity. The change may take several forms- (i) Addition of new product line, (ii) Changing channel of distribution, (iii) Addition of a new machine, (iv) Replacing a machine by a better one etc. Sunk cost is one which is not affected or altered by a change in the level or nature of Buss. Activity. Eg- Depriciation. 6. Short run and Long run costs- Short run costs are costs that vary with output or sales when fixed plant and capital equipment remain the same. Long run costs are those which vary with output when all output factors including plant and equipment vary. 7. Fixed and Variable costs- Fixed costs remain constant regardless changes in volume of production and sales upto a certain level of output. Variable costs vary in total in direct proportion to changes in volume. 8. Direct and InDirect Costs- A Direct or Traceable cost is one which can be identified easily. Indirect costs or common costs are not easily traceable. 9. Shut-down and Abandonment Cost- Shutdown costs are these costs which would be incurred in the event of suspension of the plant operation. Abandonment costs are the costs of retiring altogether a plant from service. 10. Out of Pocket and Book Costs- Out of pocket costs involves current cash payments to outsiders. Book costs such as depreciation, do not require current cash payments. 11. Replacement Cost- It means the price that would have to be paid currently to acquire the same plant. 12. Economic Cost- The economic cost of a decision depends on both the cost of the alternative chosen and the benefit that the best alternative would have provided if chosen. 13. Real Cost- The cost of producing a good or service, including the cost of all resources used. 14. Money Cost- Money cost is basically the interest rate a company will pay for loans. 15. Accounting Cost- The actual outlays or expenses incurred in production that shows up a firm's accounting statements or records. Cost Function- It refers to the mathematical relation between cost of a product and the various determinants of costs. C = f(O,S,P,…..) Where, C is Cost O is level of Output S is Size of Plant P is prices of factor of production Costs in Short Run In short run cost-output relationship needs to be discussed in terms of 1) Total cost 2) Average Cost 3) Marginal Cost 1) Short-Run Total Costs- The scale of organization being fixed, the short-run total costs are divided into total fixed and total variable cost. TC = TFC + TVC TC Cost 400 ($ per year) VC 300 200 100 FC 50 0 1 2 3 4 5 6 7 8 9 10 11 12 13 Output 2) Short-Run Average cost- It diminishes continuously as output increases. AFC = TFC Q 3) Short-Run Average Variable cost- The average variable costs first declines with the rise in output but eventually they began to rise. AVC = TVC Q 4) Short-Run Average Total Cost = AFC + AVC 5) Short-Run Marginal Cost- It is the addition to total cost by producing an additional unit of output. MC AC Costs (£) AVC AFC Output (Q) Long- Run Average Cost Curves SRAC1 SRAC 2 SRAC5 SRAC3 SRAC4 Costs LRAC Output In the short run the firm can be operating on any short run average cost curve given the size of plant. But in Long run, the firm will examine with which size of plant or on which short average cost curve it should operate to produce a given level of output so that total cost is minimum. Costs per unit LRATC 0 SRMC1 SRATC1 SRMC2 SRATC2 SRATC3 SRMC3 Q2 Q3 Quantity Internal economies Internal economies are economic advantages which enable a firm to get proportionately large output than increments in factor inputs. Technical economies are the cost savings a firm makes as it grows larger, and arise from the increased use of large scale mechanical processes and machinery. For example, a mass producer of motor vehicles can benefit from technical economies because it can employ mass production techniques and benefit from specialisation and a division of labour. Purchasing economies are gained when larger firms buy in bulk and achieve purchasing discounts. For example, a large supermarket chain can buy its fresh fruit in much greater quantities than a small fruit and vegetable supplier. Administrative savings can arise when large firms spread their administrative and management costs across all their plants, departments, divisions, or subsidiaries. For example, a large multi-national can employ one set of financial accountants for all its separate businesses. Large firms can gain financial savings because they can usually borrow money more cheaply than small firms. This is because they usually have more valuable assets which can be used as security, and are seen to be a lower risk, especially in comparison with new businesses. In fact, many new businesses fail within their first few years because of cash-flow inadequacies. For example, for having a bank overdraft facility, a supermarket may be charged 2 or 3 % less than a small independent retailer. Risk bearing economies are often derived by large firms who can bear business risks more effectively than smaller firms. For example, a large record company can more easily bear the risk of a ‘flop’ than a smaller record label. External economies External economies are those economies in production which depend on increase in the output of the whole industry rather than on increase in the output of the individual firm. Availability of cheaper transport and communication facilities. Availability of skilled labour. Cheaper banking and financial services. Development of specialised marketing agencies and facilities of joint publicity. Provision of adequate power, water and electricity. Interaction with other concerns in research and development by pooling manpower and financial resources and protecting the mutual interests of all to improve the production process and reduce cost of production. Easy availability of information regarding sources of supply, emerging new markets, scope of international markets, etc. Economy in disposal of wastes and effluents by use of common facilities where several firms are localized. Internal diseconomies Internal diseconomies are those factors which raise the cost of production of a firm as its scale of production is increased beyond a point. Larger firms often suffer poor communication because they find it difficult to maintain an effective flow of information between departments, divisions or between head office and subsidiaries. Time lags in the flow of information can also create problems in terms of the speed of response to changing market conditions. For example, a large supermarket chain may be less responsive to changing tastes and fashions than a much smaller, ‘local’ retailer. ‘X’ inefficiency is the loss of management efficiency that occurs when firms become large and operate in uncompetitive markets. Such loses of efficiency include over paying for resources, such as paying managers salaries higher than needed to secure their services, and excessive waste of resources. ‘X’ inefficiency means that average costs are higher than would be experienced by firms in more competitive markets. Low motivation of workers in large firms is a potential diseconomy of scale that results in lower productivity, as measured by output per worker. Co-ordination problems also affect large firms with many departments and divisions, and may find it much harder to co-ordinate its operations than a smaller firm. For example, a small manufacturer can more easily co-ordinate the activities of its small number of staff than a large manufacturer employing tens of thousands. External diseconomies External diseconomies are external costs that spill over into other firm’s costs such as: A firm in course of expanding its output may cause so much pollution that it would increase the cost of disposing waste materials for other firms in the same area. Pollution of lakes and rivers creates external diseconomy for the fishing industry and health hazards for the people. Creation of new shopping complex increases traffic causing external diseconomy to the inhabitants of that area. Concentration of firms in an area might increase the wage rates to all firms in that area.