Perfectly Competitive Markets KEY

advertisement

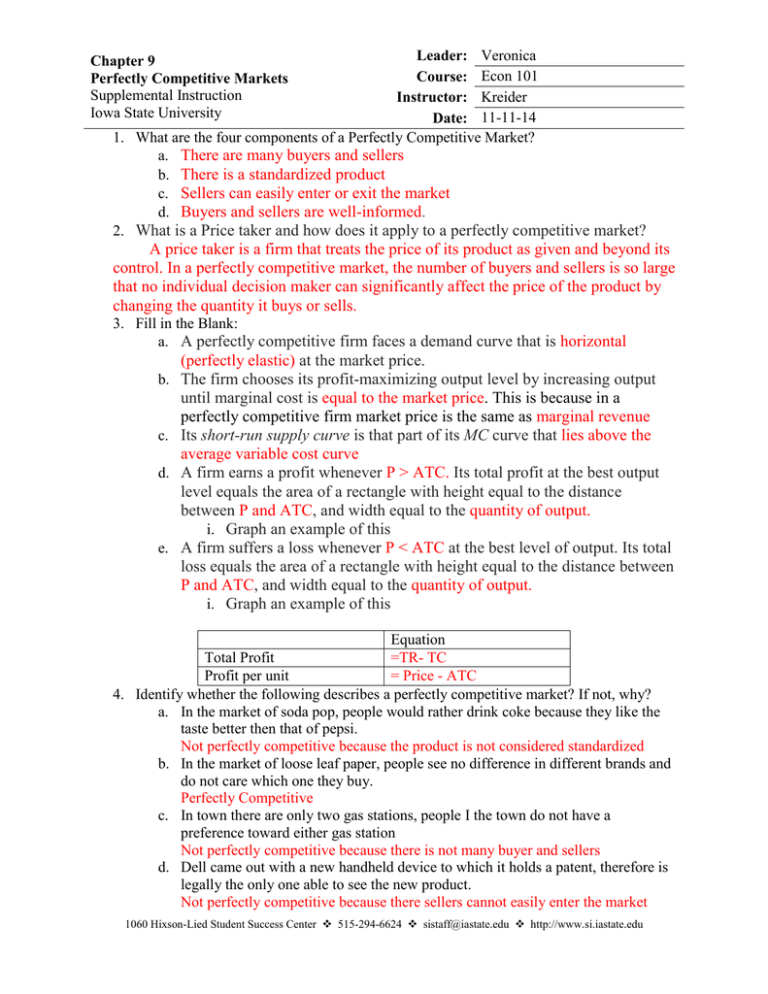

Leader: Veronica Course: Econ 101 Instructor: Kreider Date: 11-11-14 1. What are the four components of a Perfectly Competitive Market? a. There are many buyers and sellers b. There is a standardized product c. Sellers can easily enter or exit the market d. Buyers and sellers are well-informed. 2. What is a Price taker and how does it apply to a perfectly competitive market? Chapter 9 Perfectly Competitive Markets Supplemental Instruction Iowa State University A price taker is a firm that treats the price of its product as given and beyond its control. In a perfectly competitive market, the number of buyers and sellers is so large that no individual decision maker can significantly affect the price of the product by changing the quantity it buys or sells. 3. Fill in the Blank: a. A perfectly competitive firm faces a demand curve that is horizontal b. c. d. e. (perfectly elastic) at the market price. The firm chooses its profit-maximizing output level by increasing output until marginal cost is equal to the market price. This is because in a perfectly competitive firm market price is the same as marginal revenue Its short-run supply curve is that part of its MC curve that lies above the average variable cost curve A firm earns a profit whenever P > ATC. Its total profit at the best output level equals the area of a rectangle with height equal to the distance between P and ATC, and width equal to the quantity of output. i. Graph an example of this A firm suffers a loss whenever P < ATC at the best level of output. Its total loss equals the area of a rectangle with height equal to the distance between P and ATC, and width equal to the quantity of output. i. Graph an example of this Equation Total Profit =TR- TC Profit per unit = Price - ATC 4. Identify whether the following describes a perfectly competitive market? If not, why? a. In the market of soda pop, people would rather drink coke because they like the taste better then that of pepsi. Not perfectly competitive because the product is not considered standardized b. In the market of loose leaf paper, people see no difference in different brands and do not care which one they buy. Perfectly Competitive c. In town there are only two gas stations, people I the town do not have a preference toward either gas station Not perfectly competitive because there is not many buyer and sellers d. Dell came out with a new handheld device to which it holds a patent, therefore is legally the only one able to see the new product. Not perfectly competitive because there sellers cannot easily enter the market 1060 Hixson-Lied Student Success Center 515-294-6624 sistaff@iastate.edu http://www.si.iastate.edu 5. Assume that the market for cardboard is perfectly competitive. In each of the following scenarios, should a typical firm continue to produce or should it shut down in the short run? Draw a diagram that illustrates the firm’s situation in each case. a. Minimum ATC = $2.00 Minimum AVC = $1.50 Market price = $1.75 It should continue to produce in the short run because the market price is above AVC. b. MR = $1.00 Minimum AVC = $1.50 Minimum ATC = $2.00 The firm should shut down because its MR, which equals market price, is less then the AVC. 6. Suppose that a perfectly competitive firm has the following total variable costs (TVC): It also has total fixed costs (TFC) of $6. If the market price is $5 per unit: Quantity: TVC: MC: MR: TR: TC: Profit: 0 $0 $0 $6 -$6 1 $6 $6 $5 $5 $12 -$6 2 $11 $5 $5 $10 $17 -$7 3 $15 $4 $5 $15 $21 -$6 4 $18 $3 $5 $20 $24 -$4 5 $22 $4 $5 $25 $28 -$3 6 $28 $6 $5 $30 $34 -$4 a. Find the firm’s profit-maximizing quantity using the marginal revenue and marginal cost approach. The firms maximizing is at 5 it is the last time before MC crosses MR b. Check your results by re-solving the problem using the total revenue and total cost approach. Is the firm earning a positive profit, suffering a loss, or breaking even? The firm maximizing quanity is 5 beucase that is where TR – TC is at its greatest. At 5 units the firm is operating at a loss of $3 7. Assume that the firm shown in the following table produces output using one fixed input and one variable input. Output 0 1 2 3 4 Price Total Marginal Revenue Revenue $50 $0 $50 $50 $50 $50 $50 $100 $50 $50 $150 $50 $50 $200 Total Cost $5 Marginal Cost Profit -$5 $35 $40 $10 $15 $55 $45 $35 $90 $60 $55 $145 $55 a. Complete this table and use it to find this firm’s short-run profit-maximizing quantity of output. How much profit will this firm earn? $60. b. Redo the table and find the profit-maximizing quantity of output, if the price of the firm’s fixed input rose from $5 to $10. How much profit will this firm earn now? Output 0 1 2 3 4 Price Total Marginal Revenue Revenue $50 $0 $50 $50 $50 $50 $50 $100 $50 $50 $150 $50 $50 $200 Total Cost $10 Marginal Cost Profit -$10 $35 $45 $5 $15 $60 $40 $35 $95 $55 $55 $150 $50 Profit is $55 c. Now redo the original table and find the profit-maximizing quantity of output, if the price of the firm’s variable input rose so that MC increased by $20 at each level of output. How much profit will this firm earn in this case? Output 0 1 2 3 4 Profit is $15 Price Total Marginal Revenue Revenue $50 $0 $50 $50 $50 $50 $50 $100 $50 $50 $150 $50 $50 $200 Total Cost $5 Marginal Cost Profit -$5 $55 $60 -$10 $25 $85 $15 $55 $140 $10 $75 $215 -$15