2005 First Quarter Results Presentation

advertisement

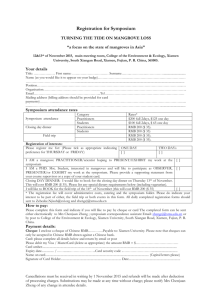

China Petroleum & Chemical Corporation Q1 2005 Results Announcement April 29, 2005 1 Market Environment in Q1 • Chinese economy maintained fast growth • Domestic demand of oil and chemical products sustained growth momentum • Crude oil prices were volatile • Prices of chemical products remained at high levels 3 Results of OperationSignificant Earnings Growth 1Q05 1Q04 Change % (RMB million) Revenue 174,127 129,608 34.35 EBITDA 24,970 21,526 16.00 EBIT 16,880 14,388 17.32 Profit after taxation 11,042 9,448 16.87 Minority Interests 1,405 1,142 23.03 9,637 8,306 16.02 0.111 0.096 16.02 Profit attributable to shareholders of the parent EPS (RMB/share) 4 Sound Financial Position (RMB million) At 31 March 2005 At 31 December 2004 Short-term Debt 37,154 32,307 Long-term Debt 69,906 60,822 202,677 193,040 Shareholders’ funds attributable to shareholders of the parent 1Q05 Net Cash Flow from Operating Activities 12,793 Net Cash Flow used in Investing Activities 13,112 Net Cash Flow from Financing Activities Cash and Cash Equivalent – Ending Balance 2,101 18,165 5 E&P 1Q05 Crude Production (‘000 tonnes) Gas Production (billion cubic meters) Crude Realized Price (RMB / tonne) Gas Realized Price (RMB / ’000 cubic meters) Lifting Cost (USD / bbl) EBIT (RMB million) 1Q04 Change % 9,530.5 9,538.3 -0.08 1.469 1.395 5.30 2,127.29 1,678.63 26.73 655.36 606.47 8.06 6.47 6.37 1.57 6,394 4,545 40.68 Note: 1 tonne = 7.1 barrel ,1 cubic meter = 35.31 cubic feet 6 Refining - Adjusted Product Mix, Increased Throughput 1Q05 1Q04 Change % (million tonnes) Crude Oil Throughput 34.33 32.37 6.05 5.82 5.73 1.57 13.11 12.04 8.89 Light Chemical Feedstock Production 4.99 4.53 10.15 Kerosene Production 1.68 1.48 13.51 Light Yield (%) 73.48 73.85 -37 bps Refining Yield (%) 92.63 92.82 -19 bps Gasoline Production Diesel Production 7 Refining Earnings Refining Margin/ Cash Operating Cost (USD/bbl) Refining Segment EBIT (RMB million) (USD/bbl) 5 2.5 4.2 3,000 2,500 2,187 4 3.49 2,000 1,671 3 2.0 1,500 1.97 1,000 1.89 2 500 1 1.5 1Q04 Refining Margin 1Q05 0 1Q04 1Q05 Cash Operating Cost 8 Marketing – Increased Volume, Optimized Structure 1Q05 1Q04 Change % Domestic sales of refined oil product (million tonnes) 24.13 21.70 11.20 Incl. Retail (million tonnes) 13.46 11.98 12.35 5.35 4.40 21.59 Total No. of gas stations (site) 30,164 30,416 -0.83 Incl. Owned and operated (site) 26,682 24,680 8.11 3,482 5,736 -39.30 2,018 1,757 14.85 Distribution (million tonnes) Franchised (site) Annual throughput per station (tonne/site) 9 Marketing Earnings Domestic RON 90# Gasoline Guidance Price (RMB/Tonne) Marketing Segment EBIT (RMB million) 5000 4000 5,000 3000 4,118 2000 Jan Mar May 2003 Jul 2004 Sep Nov 2005 3,542 3,000 Domestic 0# Diesel Guidance Price (RMB/Tonne) 5000 4,000 2,000 4000 1,000 3000 2000 Jan 0 Mar May 2003 Jul 2004 Sep Nov 1Q04 1Q05 2005 10 Chemicals – Increased Volume (‘000 tonnes) 1Q05 1Q04 Change % Ethylene 1,121.8 1,041.5 7.71 Synthetic Resins 1,683.1 1,544.9 8.95 845.6 725.8 16.51 158.1 152.1 3.94 1,595.6 1,515.2 5.31 400.0 407.1 -1.74 195.1 133.7 45.92 388.3 541.5 -28.29 Incl. Performance Compound Synthetic Rubber Synthetic Fiber Monomer & Polymer Synthetic Fiber Incl. Differential Fiber Urea 11 Chemicals Earnings Chemicals Segment EBIT Chemicals Price Spread (1990 through Mar 2005) (RMB MM) 7,000 USD/tonne 1200 6,000 1000 5,000 5,911 4,175 800 4,000 600 3,000 400 2,000 200 LDPE-Naphtha PP-Naphtha 1,000 0 Jan1990 Jan1992 Jan1994 Jan1996 Jan1998 Jan2000 Jan2002 Jan2004 0 1Q04 1Q05 12 Capital Expenditure • E & P – Newly added crude production capacity of 600 thousand tonnes/year and newly added gas production capacity of 90 million cubic meters/year RMB million E&P 4,451 Refining 1,256 Chemical 804 • Refining – the 2nd phase of Ningbo-ShanghaiNanjing crude pipeline is close to completion; crude pipeline along the Yangzi River is under construction; some revamping projects were on schedule • Chemicals –major chemical revamping projects, incl. Maoming ethylene progressed smoothly Corporate & Others 129 Marketing 4,719 • Marketing – oil product pipeline in southwestern China is close to completion and upgrading of retail network progressed smoothly • Corporate and Others –IT projects including ERP Total:RMB11.359 billion progressed smoothly In addition, Capex for JV projects, incl. ShanghaiSecco and BASF-YPC was RMB 1.292 billion. 13 For Further Information http://www.sinopec.com.cn Investor Relations Media Relations Beijing: Tel: (8610) 64990092 Fax: (8610) 64990093 Email: media@sinopec.com.cn Tel: (8610) 64990060 Fax: (8610) 64990489 Email: ir@sinopec.com.cn Hong Kong: Tel: (852) 28242638 Fax: (852) 28243669 Email: ir@sinopechk.com New York: Tel: (212) 759 5085 Fax: (212) 759 6882 Email: fangzq@sinopecusa.com 14