Bipartisan Campaign Reform Act of 2002

advertisement

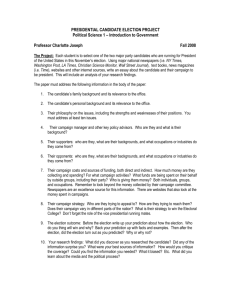

AP United States Government & Politics – Nichols Campaign Finance Primer Naval Appropriations Bill of 1867 – The first federal effort to regulate campaign finance. It was aimed to stop the practice of soliciting naval yard workers for political donations. Pendleton Act of 1883 – Applied the Naval Appropriations Bill to all federal workers. Tillman Act of 1907 - Clean government was a major theme of Theodore Roosevelt's Presidential campaign. The act specifically prohibited direct contributions from corporations and businesses to political parties and election committees. It was the first law on the books to specifically address campaign funding on the federal level and was later amended to extend to primaries. The Hatch Act of 1939 - prohibited Federal employees from participating in or contributing to Federal political campaigns. This legislation grew out of FDR's attempts to professionalize government, and from a legislative and public perception that major changes were needed to save the economic viability of the country. The Smith Connelly Act of 1943 - when the steel workers' union went on strike for higher wages during the war, Smith Connelly was enacted. It extended the Tillman and the Federal Corrupt Practices Act, effectively banning political contributions from labor unions until the end of the war. Congress of Industrial Organizations (CIO) - Congress applied the Tillman Act’s corporate money ban to unions and the unions react by creating the first political action committees (PACs) to raise money for campaign contributions. Taft Hartley Act of 1947 – made Smith Connelly permanent. This came about due to the anti-union, anti-Democrat wave in the country after the war. Long Act of 1968 - set up a voluntary contribution check-off box on the Federal income tax form. The money raised in this manner would be allocated to all "major party" candidates in the presidential primary and general elections. Federal Election Campaign Act, FECA of 1971 - Common Cause was founded and became a watchdog and leader in the area of campaign finance reform. The major provisions were: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. It repealed the Federal Corrupt Practices Act of 1925. It broadly defined elections to include primaries, caucuses and conventions, as well as general and special elections. The Act broadly defined expenditures and contributions. It prohibited promises of patronage. It prohibited contracts between a candidate and any Federal department or agency. The Act exempted from regulation contributions and expenditures for non-partisan or non-candidate based get out the vote and voter registration drives by unions and corporations. It exempted from regulation contributions and expenditures for voluntary fundraising and its administration by unions and corporations. It established caps on the amount individuals could contribute to their own campaign: Presidential and Vice Presidential candidates, $50,000 each; Senatorial candidates, $35,000 each; and House candidates, $25,000 each. The Act established caps on television advertising at 10 cents per voter in the last election or $50,000, whichever was higher. It established disclosure guidelines for contributions of $100 or higher. Expenditure and contribution reports were made due by March 10 of each year. The Watergate Scandal (1973) Amendments to the FECA (1974) - In light of the Watergate scandal, distrust of public officials was at a peak. Even more so than in 1971, the new--and now more numerous--reformers in Congress pushed for campaign finance reform. The 1974 Amendments to the Federal Election Campaign Act passed quickly and were signed by President Ford. The law legitimated Political Action Committees, changed contribution limits, and established the Federal Election Commission (FEC). Details of the Amendments are as follows: 1. The Federal Election Commission a. It created a six-member, full-time, bi-partisan commission to administer election laws and the presidential election public financing program. b. The President, Speaker of the House, and President Pro Tempore of the Senate each appointed two commissioners, subject to approval by Congress. c. The commissioners were appointed for a six-year term, with annual rotations in the chair. 2. Contribution Limits a. $1,000 limit per individual for each primary, run-off or general election, and an aggregate contribution limit of $25,000 to all federal candidates annually. b. $5,000 limit per union or corporate election committee, or political party for each election with no aggregate limit. (This is the section that legitimated PACs.) c. $50,000 limit for Presidential or Vice Presidential candidates, $35,000 for Senatorial candidates, and $25,000 for House candidates for contributions by themselves and their families to their own campaign. d. $1,000 limit for independent expenditures on behalf of a specific candidate. e. No cash contributions over $100. 3. Spending Limits a. Total spending limits for Presidential candidates: $10,000,000 for primaries; $20,000,000 for the general election; and $2,000,000 for nominating conventions. b. Total spending limits for Senatorial candidate: $100,000 or $.08 per eligible voter, whichever is higher, for primaries; $150,000 or $.12 per eligible voter, whichever is higher, for general elections. c. Total spending limits for House candidates: $70,000 each for primaries and general elections. 4. Public Funding for Presidential Races a. It defined a "major party" as one which received at least 25% of the vote in the last federal election. b. It set up a system by which private gifts to a presidential candidate would be matched by funds raised through the Long Act. 5. Disclosure and Enforcement a. It treated loans as contributions. b. Fines for not reporting could be as high as $50,000. c. Violators could be prevented from running for federal office for the length of the term of the office sought, plus one year. d. The Act gave the FEC the power of advisory opinions. e. It required full reports of contributions and expenditures to be filed 10 days before and 30 days after each election. f. It required candidates to set up one campaign banking headquarters for easy research and accountability. Buckley v. Valeo (1976) Amendments to FECA (1976) - The amendments Congress did pass in 1976 were largely insignificant. Amendments to the FECA (1979) 1. They restrict federal employees' ability to contribute to or work on political campaigns. 2. They set up a new process for selecting FEC members. Members would be nominated by the President and confirmed by the Senate, with a provision that no more than three members of the six-member commission could be of the same political party. 3. They established guidelines by which contributions to political parties for the purposes of party building would be unlimited. For example, one could give a million dollars for a voter registration campaign, but would be restricted to giving $1,000 for a specific candidate's campaign. (This allowed for what is called "soft money.") Colorado Republican Federal Campaign Committee v. FEC (1996) Bipartisan Campaign Reform Act of 2002 – also referred to as McCain-Feingold. This legislation bans soft money donations to campaigns, increases the amount of hard money individuals may donate to candidates, and imposes new restrictions on political advertising close to an election. The chart follows. Bipartisan Campaign Reform Act of 2002 Contribution Limits 2009-2010 The FECA places limits on contributions by individuals and groups to candidates, party committees and PACs. The chart below shows how the limits apply to the various participants in federal elections. The chart below shows the specific contribution limits for 20092010. Contribution Limits 2009-10 To each candidate To state, district & To national party or candidate local party committee per committee per committee per calendar year election calendar year To any other political committee per calendar year1 Special Limits $115,500* overall biennial limit: Individual may give National Party Committee may give State, District & Local Party Committee may give PAC (multicandidate)4 may give PAC (not multicandidate) may give Authorized Campaign Committee may give $45,600* to all candidates $69,900* to all PACs and parties2 $2,400* $30,400* $10,000 (combined limit) $5,000 $5,000 No limit No limit $5,000 $42,600* to Senate candidate per campaign3 $5,000 (combined limit) No limit No limit $5,000 No limit $5,000 $15,000 $5,000 (combined limit) $5,000 No limit $2,400* $30,400* $10,000 (combined limit) $5,000 No limit $2,0005 No limit No limit $5,000 No limit * These contribution limits are indexed for inflation. 1. A contribution earmarked for a candidate through a political committee counts against the original contributor's limit for that candidate. In certain circumstances, the contribution may also count against the contributor's limit to the PAC. 11 CFR 110.6. See also 11 CFR 110.1(h). 2. No more than $45,600 of this amount may be contributed to state and local party committees and PACs. 3. This limit is shared by the national committee and the national Senate campaign committee. 4. A multicandidate committee is a political committee with more than 50 contributors which has been registered for at least 6 months and, with the exception of state party committees, has made contributions to 5 or more candidates for federal office. 11 CFR 100.5(e)(3). 5. A federal candidate's authorized committee(s) may contribute no more than $2,000 per election to another federal candidate's authorized committee(s). 11 CFR 102.12(c)(2). Proliferation of 527s after BCRA – Issue Advocacy Groups – Must report to the IRS The 527 (FEC) - Entities organized under section 527 of the tax code are considered "political organizations," defined generally as a party, committee or association that is organized and operated primarily for the purpose of influencing the selection, nomination or appointment of any individual to any federal, state or local public office, or office in a political organization. All political committees that register and file reports with the FEC are 527 organizations, but not all 527 organizations are required to file with the FEC. Some file reports with the Internal Revenue Service (IRS). For additional information on 527 organizations, please visit the IRS web site. The 527 (IRS) - A political organization subject to section 527 is a party, committee, association, fund, or other organization (whether or not incorporated) organized and operated primarily for the purpose of directly or indirectly accepting contributions or making expenditures, or both, for an exempt function. A political organization must be organized for the primary purpose of carrying on exempt function activities. A political organization's primary activities must be exempt function activities. A political organization may engage in activities that are not exempt function activities, but these may not be its primary activities. To be exempt, a political organization must file a timely notice with the IRS that it is to be treated as a tax-exempt organization. McConnell v. FEC (2003) Randall v. Sorrell (2006) Federal Election Commission v. Wisconsin Right to Life (2007) Davis v. Federal Election Commission (2008) Citizens United v. Federal Election Commission (2010) – “Hillary the Movie” - http://www.hillarythemovie.com/ SpeechNow.org v. FEC (2010) Proliferation of Super PACs after the Citizens United decision – Must report to the FEC - Super PACs, officially known as "independent expenditure-only committees," can take unlimited company, union and individual donations and explicitly urge voters to support or oppose candidates, unlike ordinary PACs and nonprofit groups. The only real restriction is that they are not allowed to coordinate directly with candidates or political parties. Like other PACs, they must register with the Federal Election Commission and disclose donors - most are only starting to do so because they are so new and will file the first disclosure reports in mid-October of 2010. American Crossroads - http://www.americancrossroads.org/ SpeechNow.Org - http://www.speechnow.org Commonsense Ten - http://www.commonsenseten.com/ Club for Growth Action - http://www.clubforgrowth.org/action/ Non-profits with 501(c)(4), 501(c)(5), 501(c)(6), aren’t even registering as PACs and will be able to spend millions on ads without disclosing their contributors as long as they steer clear of expressly advocating for or against a candidate. Teamsters Union - http://www.teamster.org/ Crossroads GPS - http://www.crossroadsgps.org/ See “Tracking Campaign Money” – separate handout Sources: http://www.cbsnews.com/elements/2003/10/21/in_depth_politics/timeline579267.shtml http://www.ctn.state.ct.us/civics/campaign_finance/Support%20Materials/Campaign%20Finacne%20Timeline.pdf http://www.fec.gov/pages/brochures/fecfeca.shtml#Contribution_Limits http://www.fec.gov/pages/bcra/rulemakings/Electioneering_Communications.shtml#resources http://www.npr.org/templates/story/story.php?storyId=121293380 http://www.oyez.org http://www.irs.gov