Implicit Costs?

advertisement

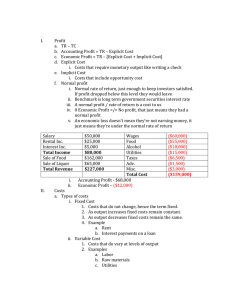

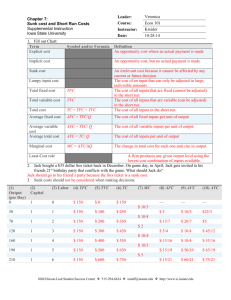

Costs of Production 1 COSTS (in Economics) that deal with forgoing the opportunity to produce alternative goods and services. The OPPORTUNITY COST of producing a good is its value or worth in its best alternative use. 2 Explicit costs are those payments a firm must make, or incomes it must provide to resource suppliers to attract these resources away from alternative production opportunities. 3 Examples: payments to hired labor payments to vendors payments for rent or mortgage payments for trucks, etc. 4 IMPLICIT COSTS Costs of self-owned, self-employed resources Money payments the self-employed resources could have earned in their next best alterative employments. 5 Examples: value lost by investing in business instead of alternative investment value lost in working for someone else value lost by not using entrepreneurial skill in another way 6 NORMAL PROFIT Amount remaining from revenue less those costs to attract and retain resources in a given line of production. Minimum return needed by entrepreneur to stay in business If not realized, entrepreneur will reallocate resources to more attractive pursuits. 7 ECONOMIC PROFITS Total Revenue minus all Costs Costs will include both explicit and implicit costs Implicit costs will include the normal profit 8 ECONOMIC PROFITS Economic profits = Total revenue —opportunity costs of all inputs Economic profit is not a cost! … it is a return in excess of the normal profit required to retain the entrepreneur 9 ECONOMIC PROFITS E C O N O M I C C O S T S Implicit Costs including Normal Profit Explicit Costs T O T A L ACCOUNTING PROFITS R E V E N U E ACCOUNTING COSTS explicit costs only 10 Gomez runs a small firm which makes pottery. He hires one helper at $12,000 per year, pays annual rent of $5,000 and materials cost $20,000 per year. Gomez has $40,000 of his own funds invested in equipment which could earn $4,000. Gomez has been offered $15,000 to work as a potter for a competitor. He estimates his entrepreneurial skills are worth $3,000 per year. Explicit Costs? Implicit Costs? 11 Explicit costs: $12,000 + $5,000 + $20,000 = $37,000 Implicit Costs: $4,000 + $15,000+ $3,000 = $22,000 12 • If Total Revenue is $72,000 Accounting Profits Explicit costs: $37,000 $72,000— $37,000 = $35,000 Economic Profits Explicit costs:$37,000 Implicit costs:$22,000 $72,000— $37,000—$22,000 = $13,000 13 What is a Fixed Cost? Cost to a firm that does not vary with the quantity of goods produced 14 What are examples of Fixed Costs? • rent or mortgage • loan payments • certain salaries • a part of utilities • property taxes 15 What are some other names for Fixed Cost? Sunk and Historical 16 What is a Variable Cost? Cost that varies with the quantity of goods produced 17 What are examples of Variable Costs? • worker’s wages • raw materials • some utilities 18 Short Run Costs of Production Total costs = Total Fixed costs + Total Variable costs TC = TFC + TVC 19 Total Fixed cost curve P/C TFC Q 20 Total Variable Cost Curve P/C TVC 0 Q 21 Total Costs, Sum of Variable and Fixed Cost TC P/C TVC TFC Q 0 22 What is Average Fixed Cost? Total fixed cost divided by the quantity of goods produced AFC = TFC/Q 23 What is Average Variable Cost? Total variable cost divided by the quantity of goods produced AVC = TVC/Q 24 What is Average Total Cost? Total cost divided by the quantity of goods produced ATC = TC/Q 25 P/C ATC AVC AFC Q 26 P/C Ave. Fixed Costs ATC AVC Q 27 What is Marginal Cost? The change in total cost generated by a change in the quantity of a good produced 28 So… MC = TC Q = TVC Q 29 P/ C MC Ave. Fixed Costs ATC AVC Q 30 Why does MC = ATC at minimum ATC? • If the margin is above the average, the average increases • If the margin is below the average, the average decrease 31