1+i

advertisement

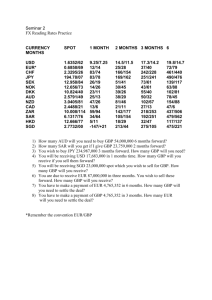

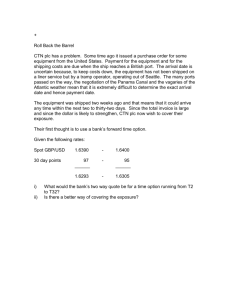

Hedging Transaction Exposure Forward Contracts Forward contracts are purchases/sales of currencies to be delivered at a specific forward date (30,90,180, or 360 days) Example CAD/USD 1 month 3 months 6 months 12 months .7641 .7583 .7563 .7537 .7525 Forward contracts are individualized agreements between the bank and the customer Futures Contracts Forward contracts are written on an individual basis. Futures are standardized, traded commodities (Chicago Mercantile Exchange) JPY: 12,500,000 Yen GBP: 62,500 Pounds Euro: 125,000 Euro CAD: 100,000 Canadian Dollars To hedge or not to hedge….that is the question” Suppose that you have signed an agreement to purchase GBP 100,000 worth of goods from England payable 90 days from now. Spot Rate: $1.88 90 Day Forward: $1.85 (-1.6%) If you were to “lock in” your price with the forward/futures contract, you would pay $185,000 for the goods (with certainty) Suppose you have the following forecast for the percentage change in the British pound over the upcoming 90 days e % Change in e ($/GBP) Mean: -1.6% Std. Dev: 2% -1.6% [ -3.6% , 0.4%] [ -5.6% ,2.4%] [ -7.6%, 4.4%] %Change Given a standard deviation, we can approximate a distribution for the exchange rate in 90 days. Current Spot Rate: $1.88 Standard Deviations Percentage Change Exchange Rate Probability -3 -7.6 $1.74 1% -2 -5.6 $1.77 4% -1 -3.6 $1.81 25% 0 -1.6 $1.85 40% 1 .4% $1.89 25% 2 2.4% $1.93 4% 3 4.4% $1.96 1% Given the distribution of exchange rates, we can estimate the expected cost of the hedge Current Spot Rate: $1.88 Exchange Rate Probability Cost w/out hedge Cost w/hedge Value of Hedge $1.74 1% $174,000 $185,000 -$11,000 $1.77 4% $177,000 $185,000 -$8,000 $1.81 25% $181,000 $185,000 $-4,000 $1.85 40% $185,000 $185,000 $0 $1.89 25% $189,000 $185,000 $4,000 $1.93 4% $193,000 $185,000 $8,000 $1.96 1% $196,000 $185,000 $11,000 Expected Value: $0 From the previous table, we can show the distribution of gains from the hedge If forward rates are unbiased, most of the weight will be at zero! 40 Probability 35 30 25 20 15 10 5 0 ($11,000) ($8,000) ($4,000) $0 $4,000 Hedge Cost $8,000 $11,000 Money Market Hedges Suppose that you have signed an agreement to purchase GBP 100,000 worth of goods from England payable 90 days from now. Spot Rate = $1.88 British 90 Day Interest Rate = 2.6% US 90 Day interest rate = 1% Spot Rate = $1.88 Money Market Hedges British 90 Day Interest Rate = 2.6% US 90 Day interest rate = 1% Today 90 Days Borrow $183,236 @ 1% for 90 Days Convert to GBP @ $1.88 Invest in 90 Day British Asset @ 2.6% GBP 100,000 1.026 Present Value of 100,000 in 90 days Collect GBP 100,000 to pay for imports Pay of loan + interest = $185,000 $1.88 = $183,236 (1.01) = $185,000 Money Market VS. Hedges Forward/Futures Hedge Recall Covered Interest Parity Forward Rate (1+i*)F = (1+i) e Spot Rate If covered interest parity holds (and it does!), then the forward rate reflects the interest differential and the money market hedge is identical to the forward/future hedge! Currency Options With options, you have the right to buy/sell currency, but not the requirement Call: The right to buy at a specific “strike price” Put: The right to sell at a specific “strike price” The option belongs to the buyer of the contract. If you sell a put, you are REQUIRED to buy if the holder of the put chooses to exercise the option. The buyer must pay an up front price for the contract Payout from a Call 0.15 0.1 0.05 1.4 1.35 1.3 1.25 1.2 1.15 1.1 1.05 1 0 0.95 Profit per Euro 0.2 Exchange Rate ($/E) Suppose you buy a 30 day call on 125,000 Euros at a strike price of $1.20 For spot rates less than $1.20, the option is worthless (“out of the money”) If the spot rate is $1.25, your profit is ($.05)*($125,000) = $6,250 Payout from a Put 0.2 0.15 0.1 0.05 1.35 1.25 0 1.15 0.25 1.05 Suppose you buy a put on 125,000 Euros at a strike price of $1.20 For spot rates greater than $1.20, the option is worthless (“out of the money”) For example, if the spot rate is $1.15, your profit is ($.05)*($125,000) = $6,250 0.95 Hedging with Options Suppose that you have signed an agreement to purchase GBP 100,000 worth of goods from England payable 90 days from now. Spot Rate: $1.88 3 Month Call w/strike price of $1.85 is selling at a premium of $.05 (GBP 100,000) You pay $.05(100,000) = $5,000 today. Your cost of GBP in 90 days = MIN [ spot rate, $1.85] Remember, you pay (.05)*100,000 = $5,000 Today! Current Spot Rate: $1.88 Exchange Rate Probability Cost w/out Cost hedge w/hedge Value of Hedge $1.74 1% $174,000 $179,000 -$5,000 $1.77 4% $177,000 $182,000 -$5,000 $1.81 25% $181,000 $186,000 -$5,000 $1.85 40% $185,000 $190,000 -$5,000 $1.89 25% $189,000 $190,000 $1,000 $1.93 4% $193,000 $190,000 $3,000 $1.96 1% $196,000 $190,000 $6,000 Expected Value: -$3,070 The option hedge is more expensive on average, but protects you from large negative outcomes! Option Hedge 70 Probability 60 50 40 30 20 10 0 ($5,000) $1,000 $3,000 Hedge Value $6,000 Hedging Techniques Type of Exposure Forward/Futures Money Market Options Payables (Cash Outflow) Long Position Borrow Domestically/Lend Abroad Call Option Receivables (Cash Inflow) Short Position Lend Domestically/Borrow Abroad Put Option Cross Hedging Suppose that you have entered an agreement to buy PLN 100,000 (Polish Zloty) worth of imports. ($1 = 3.17PLN). Zloty futures are not traded. What do you do? You notice that the Zloty is highly correlated with the Euro (E 1 = 4.09 PLN) Act as if you are hedging (100,000/4.09) = E 24,454 Some more advanced hedging strategies… Suppose that you have signed an agreement to purchase GBP 100,000 worth of goods from England payable 90 days from now. You are in the process of negotiating a deal to sell GBP 200,000 worth of goods to Britain. Case #1: The export deal falls through and you will need to buy GBP 100,000 in one 90 days Case #2: The export deal succeeds and you will need to sell GBP 100,000 in one 90 days How do you hedge this? A currency straddle is a combination of a put (the right to sell) and a call (the right to buy) Value Value Cost = $0.06/L 1.85 e ($/L) Value Cost = $0.06/L 1.85 e ($/L) Cost = $0.12/L(L 100,000) = $12,000 1.85 e ($/L) Currency Straddles: Four Possibilities NCF = L100,000, e > $1.85 NCF = L100,000, e < $1.85 Let Put Expire Let Call Expire Buy $ in Spot Market Use Put to sell GBP Buy GPB with Call Sell GBP in Spot Market NCF = - L100,000, e > $1.85 NCF = - L100,000, e < $1.85 Let Put Expire Let Call Expire Use Call to Buy GBP Buy GBP in Spot Market Sell GBP with Put Straddles hedge your exposure under all circumstances, but are very expensive (in this case, $12,000 in premium costs) Value Value Cost = $0.04/L 1.89 e ($/L) Value Cost = $0.03/L 1.84 e ($/L) Cost = $0.07/L(L 100,000) = $7,000 Un-hedged Region 1.84 1.89 e ($/L) Another way to save money is to only hedge particular ranges (i.e. a 95% confidence interval!) Suppose that you have signed an agreement to purchase GBP 100,000 worth of goods from England payable 90 days from now. Value Cost = $0.05/L 1.85 e ($/L) Value Cost = $0.08/L 1.89 e ($/L) You could hedge the range from $1.85 to $1.89 by selling a call w/ a strike price of $1.85 and using the proceeds to buy a call with a strike price of $1.89 Value Value Cost = $0.05/L Cost = $0.08/L e ($/L) 1.85 Value 1.89 Cost = $0.08 - $0.05 = $0.03 e ($/L) 1.85 1.89 e ($/L) Hedging…the possibilities are endless! There are many different types of hedges available. Each hedge has a cost and a level of protection. Its your choice to decide what coverage you need and how much you are willing to pay for it!!