Chapter Seven POF - HCC Learning Web

advertisement

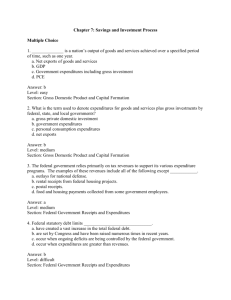

Chapter 7 Savings and Investment Process © 2011 John Wiley and Sons Chapter Outcomes Identify and briefly describe the major components of the gross domestic product Describe how the balance between exports and imports affects the gross domestic product Describe recent developments in the aggregate level of personal and corporate savings 2 Chapter Outcomes (Continued) Describe the principal sources of federal government revenues and expenditures Discuss the historical role of savings in the United States and how savings are created Identify the major sources of savings in the United States 3 Chapter Outcomes (Concluded) Identify and describe the factors that affect savings Describe the major capital market securities that facilitate the savings and investment process Discuss the role of individuals in the recent financial crisis 4 Gross Domestic Product (GDP) and Capital Formation Gross Domestic Product: Measures the output of goods and services in an economy over a specified time period Capital Formation: Process of constructing real property, manufacturing producers’ durable equipment, and increasing business inventories 5 Gross Domestic Product (GDP) Components GDP is composed of: Personal Consumption Expenditures Government Expenditures including Gross Investment Gross Private Domestic Investment Net Exports of Goods and Services 6 Gross Domestic Product (GDP) Components (continued) Equation: GDP = PCE + GE + GPDI + NE Personal Consumption Expenditures (PCE): Expenditures by individuals for durable goods, nondurable goods, and services Government Expenditures (GE): Purchases of goods and services by the government 7 Gross Domestic Product (GDP) Components (continued) Equation: GDP = PCE + GE + GPDI + NE Gross Private Domestic Investments (GPDI): Investments in residential & nonresidential structures, producers’ durable equipment, & business inventories Net Exports (NE): Exports minus imports of goods & services 8 Recent Gross Domestic Product (GDP) Amounts ($ Billions) GDP PCE GPDI NE GE 2006 2009 $13,253.9 $14,258.7 9,270.8 10,092.6 2,218.4 1,622.9 -761.8 -390.1 2,526.4 2,933.3 9 Link Between Saving and Investment Gross Saving = Net Saving + Consumption of Fixed Capital For 2008 (in $ Billions): Net Saving = -$23.0 Consumption of Fixed Capital = $1,847.1 Gross Saving = $1,824.1 10 Link Between Saving and Investment Net Saving = Net Private Saving + Net Government Saving For 2008 (in $ Billions): Net Private Saving = $659.8 Net Government Saving = -$682.7 Net Saving (rounded) = -$23.0 11 Link Between Saving and Investment Consumption of Fixed Capital = Private + Government For 2008 (in $ Billions): Private = $1,536.2 Government = $310.9 Consumption of Fixed Capital = $1,847.1 12 Federal Government Receipts and Expenditures 1970-1997: Annual deficit budgets 1998-2001: Annual surplus budgets 2002-Present: Annual deficits with fiscal 2009 and 2010 deficits each exceeding $1.0 trillion [National Debt now exceeds $12 trillion] 13 Federal Government Dollar: Fiscal Year 2008 Where It Comes From (Income): --Personal Income Taxes (39%) --Social Security and other Retirement Taxes (30%) --Borrowing to Cover Deficit (15%) --Corporate Income Taxes (10%) --Excise, Estate, and other Taxes (6%) 14 Federal Government Dollar: Fiscal Year 2008 (continued) Where It Goes (Outlays): --Social Security, Medicare, and other retirement (37%) --National Defense, veterans, and Foreign Affairs (24%) --Social Programs (including Medicaid)(20%) --Physical , Human, and Community Development (9%) --Net Interest on the Debt (8%) --Law Enforcement and General Gov’t. (2%) 15 Debt Financing Budgetary Deficit: Occurs when expenditures are greater than revenues Federal Statutory Debt Limits: Limits on the federal debt set by Congress 16 Historical Role of Savings in the United States Foreign investors initially purchased large amounts of the securities sold by government & private promoters to develop the U.S. The American family later took over the function of providing savings for the capital formation process 17 Creation of Savings Savings: Income that is not consumed but held in the form of cash and other financial assets Savings Surplus: Occurs when current income exceeds investment in real assets 18 Creation of Savings Savings Deficit: Occurs when investment in real assets exceeds current income Undistributed Profits: Proportion of after-tax profits retained by corporations 19 Major Sources of Savings Personal Saving: Savings of individuals equal to personal income less personal current taxes less personal outlays Voluntary Savings: Savings held or set aside by choice for future use Contractual Savings: Savings accumulated on a regular schedule by prior agreement 20 Personal Savings in the U.S. Personal Savings Definition: Personal income Less: taxes and other payments Equals: disposable personal income Less: personal outlays Equals: personal savings Savings Rate Definition: Savings Rate = (Personal Savings)/ (Disposable Personal Income) 21 Historical Personal Savings Rates 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 5.8% 7.0 8.1 9.2 7.1 4.5 4.3 4.8 1.0 1.4 22 Corporate Savings in the U.S. Undistributed Profits Definition: Profits before taxes Less: tax liabilities Equals: profits after taxes Less: dividends Equals: undistributed profits Retention Rate Definition: Retention Rate = (Undistributed Profits)/(Profits After Taxes) 23 Corporate Savings in the U.S. Adjustments to Corporate Profits: Nonfinancial corporate profits before taxes are often shown after (1) inventory valuation and (2) capital consumption adjustments (1) Records estimated changes in inventory values over time (2) Reflects the “using up,” or depreciation, of plant and equipment assets used for business purposes 24 Factors Affecting Savings Levels of income Economic expectations Cyclical Influences (economic cycles) Life stage of the individual saver or corporation 25 Life Stages of the Individual Saver Individual Saver: --Formative/education developing --Career starting/family creating --Wealth building --Retirement enjoying 26 Life Stages of the Corporation Corporation: --Start-up stage --Survival stage --Rapid growth stage --Maturity stage 27 Capital Market Securities Capital Markets: Markets where debt securities with maturities longer than one year and corporate stocks are issued or traded Capital Market Securities: Debt securities with maturities longer than one year and corporate stocks 28 Major Capital Market Securities Securities: Mortgages Treasury bonds Municipal bonds Corporate bonds Corporate stocks Issuers: Fin. intermediaries U.S. government State/local gov’ts. Corporations Corporations 29 Major Capital Market Securities Securities: Mortgages Treasury bonds Municipal bonds Corporate bonds Corporate stocks Secondary Market: High activity High activity Moderate activity Moderate activity High activity 30 Capital Market Securities Defined Mortgage: Loan backed by real property in the form of buildings and houses Treasury bond: Long-term debt instrument issued by the U.S. federal government Municipal bond: Long-term debt instrument issued by a state or local government 31 Capital Market Securities Defined Corporate bond: Debt instrument issued by a corporation to raise long-term funds Common stock: Ownership interest in a corporation 32 Derivative Security Derivative Security: Financial contract that derives its value from a bond, stock, or other asset Use of Derivative Securities: Corporations can use derivative securities to insure or hedge against various financial risks 33 2007-09 Financial Crisis Early Factors: 2000 -- Internet or “tech” bubble burst and stock prices began declining rapidly 2001 -- Economic recession resulted (exacerbated by the 9/11/2001 terrorist attacks) 2001-2002 – Monetary policy focused on providing liquidity and fiscal policy became stimulative resulting in low interest rates and economic growth 34 2007-09 Financial Crisis Borrowing-Related Cultural Shift: U.S. consumers moved from “save now, buy later” to “spend now, pay later” with the result being increased mortgage loans and credit card borrowings U.S. government officials encouraged wider home ownership and mortgage lenders offered adjustable-rate mortgages (ARMs) and even subprime mortgages to poorly qualified borrowers The “housing price bubble” burst in mid2006 and home owners began defaulting 35 Web Links www.bea.gov www.irs.gov www.stlouisfed.org www.federalreserve.gov 36