Chapter 5: Revenue, Expense and Drawings

advertisement

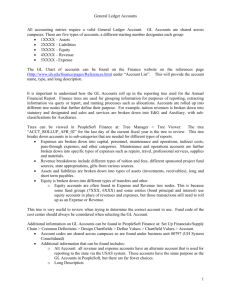

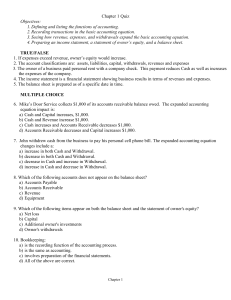

Chapter 5: Revenue, Expense and Drawings The Expanded Ledger Expanding the Ledger Any change in the equity of the business was recorded in CAPITAL account, no matter what caused the change There are 3 new accounts that affect owner’s equity. Revenue Expense Drawings Expanding the Ledger (cont) Revenues: sale of all goods Expenses: costs related to the revenues Drawings: owner’s withdrawals for personal use Purpose of Expanding the System These accounts provide essential information about the progress of the company Income Statement is prepared with the new accounts (Revenues and Expenses) Shows the profitability of the company Purpose of Expanding (cont) Revenue increases the equity of the company E.g.. Sales, Fees Earned, Revenue, Commissions, etc. Expanding the Ledger Expenses: costs associated with producing revenue (always decrease equity) E.g.. Wages Expense, Donations Expense Etc. Net Income / Loss Revenue – Expenses = Net Income or Net Loss Net Income = Revenues > Expenses Net Loss = Revenues < Expenses GAAP Principles Revenue Recognition principle: states that revenue must be recorded in accounts at the time transaction is complete Matching Principle: Each expense item related to revenue earned must be recorded in the same time period as the revenue it helped earn Drawings The owner looks to the profits of the business to provide a livelihood, the owner will be able to take funds out of the business on a regular basis, these withdrawals are a decrease in equity Account used to record withdrawals of the owner is Drawings Equity Section Summary CR Capital Equity figure at begin of fiscal period CR Revenues Sale of goods or services DR Expenses Costs of materials or services DR Drawings Owner’s loss/ withdrawals