Younkman_Final_Assignment

advertisement

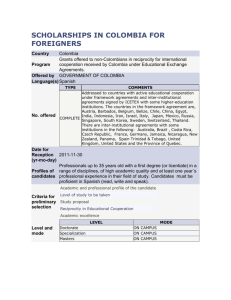

Ben Younkman May 5th, 2013 Business Development Opportunities In Colombia Determining Optimal Areas for Micro and Small Business Development Academic Summary Project Question: Which areas of Colombia currently offer the most attractive environment for business and entrepreneurial development in Colombia, and which areas offer the greatest potential for entrepreneurial development? This project was conducted in conjunction with my capstone project in addition to an independent consultancy for an online educational organization that are trying to target high-growth potential entrepreneurs via a mobile learning platform. In order to effectively build a platform to reach these entrepreneurs, one must understand a) where they are located and b) what which areas offer additional attractive environments. While discerning this at distance via national statistic data is difficult, by graphically mapping the trends that support entrepreneurial development as well as areas that appear similar, the hope is that a greater range of potential entrepreneurs can be reached rather than relying on traditionally successful areas for entrepreneurial development. This project focused on identifying the areas that have the greatest entrepreneurial densities, best environments for micro and small development, and which areas could most benefit from future investment of resources and services to develop SMEs. Socio-economic data were included in addition to density of Micro and Small enterprises to draw theories of what areas have the most potential to improve MSE development. Project Overview In the past decade Colombia has transformed itself from a politically volatile state into one of the most dynamic economies in Latin America, achieving recognition by the World Bank as one of the best areas in Latin America to start an enterprise in 2010. The government has been emphasizing entrepreneurship as a primary policy for economic stimulus and poverty reduction since 2006, and has implemented national reforms to spur business creation in all sectors of commerce. As the ease of doing business increases and the cost of launching an enterprise drops, Colombia has nearly doubled the number of companies created annually to over 55,000 in 2012 according to the World Bank. By laying a strong institutional foundation for positive business development, the government has created an attractive environment for increased investment of funds and resources into the Colombian market. As public and private organizations realize the increasing growth potential of the Colombian economy, foreign direct investment (FDI) and enterprise support networks are growing across the country and determining which areas offer the greatest potential for entrepreneurial development becomes increasingly important. While Bogota and Medellin have served as natural beach heads for business support networks and FDI, alternative geographic locations may offer similar potential. By identifying where micro and small enterprises currently exist as well as population and government indicators that positively affect the development of a new business, this study aims to identify optimal areas for micro and small business development in Colombia in order to channel funds, investment and resources to nascent enterprises. Colombian Enterprises The Colombian Government defines a type of businesses in a number of different ways, but this study used the National Administrative Statistic Department (DANE) classification by number of employees. Businesses are defined as follows: Type of Enterprise Micro Small Medium Large # of Employees 1 – 10 11 – 50 50 – 200 > 200 These businesses are further categorized by sector, with the three primary sectors including service, industry and commerce. This study made no attempt to differentiate between the three sectors, and aggregated the information to geographically illustrate business locations and frequency over a district. While this study attempted to explore the entrepreneurial landscape of different districts inside Colombia to identify optimal growth areas, attaining data on entrepreneurs proved difficult. As a proxy, this study concerned itself with micro and small enterprises as they are most representative of newly launched ventures in Colombia. Additionally, many businesses offer different growth potential – for instance a tech company can typically grow much faster and at a larger scale than a restaurant or a flowershop. Categorizing the growth potential of a business is a difficult exercise, especially with limited data, but this study attempted to target higher-growth potential businesses by factoring specific socio-economic variables that correlate with high-growth companies. Methodology This study was conducted by selecting six socio-economic factors that affect the business development potential of a district and assigning each factor a score: 1 for unfavorable and 4 for most favorable. Scores were then tallied (total potential favorable weight of 24). The socio-economic factors included in the final study were: 1. 2. 3. 4. 5. 6. Infant Mortality Rate (2007) Life Conditions Index (ICV) – 2005 Net Education Coverage (School Enrollment) 2005 Telephone Coverage (2005) District Income Generation (2010) District Performance and Legal Compliance (2011) The number of micro and small business in a district were given a similar 1-4 ranking based on number of businesses in a district (1 = few & 4 = many), and the each district was given a total ranking for the service, commercial & industrial sectors. This was done for both Micro and Small Enterprises, with a total potential weight of 24 (3 sectors x 4 potential score x 2 business size categories). Both scores were added, giving each district a ranking potential between 1 - 48 and graphed in the final map by their relative standing according to the final score. For further information about the total variables analyzed in addition to the variables used in this paper, please see the Appendix. Limitations While ambitions in scope, this project has a number of limitations. The socioeconomic factors selected depended on data availability; where internet penetration was unavailable, telephone coverage was used as a proxy. School enrollment was an indicator of the educational capacity of a district, but may not reflect the creative or innovative nature of a district. While this study tried to account for socioeconomic factors in addition to enterprise location, the given scores were standardized, and a more refined, sophisticated weight system could reveal more nuanced results. Additionally, while high-growth potential enterprises were the focus of this study, inverting the study (i.e. looking at necessity driven or base-ofthe-pyramid entrepreneurs) could yield fascinating results. Unfortunately, I was not able to complete both studies in the allotted time. Data Sources and Collection While I explored many resources in creating this project, the fundamental source I used for nearly all of my end data came from: http://sigotn.igac.gov.co/sigotn/frames_pagina.aspx Sigotn is the a component of the Colombian government that maps Census information and offers free data to members. I collected over 25 variable sheets and cleaned over 15 of them for final analysis, ultimately deciding on the twelve particular variables mentioned above. I also drew heavily from the World Bank’s Doing Business reports (primarily the 2010 edition with regionally specific data and the more general 2012 report) and the Global Entrepreneurial Monitor Global and Colombia reports. While no final data was used in the final analysis, they were critical in creating the focus of this study. Additionally, I drew from the following sources for inspiration, execution and graphical representation: 1. Ringo, Linder G. 2009. “Utilizing GIS-Based Site Selection Analysis for Potential Customer Segmentation and Location Suitability Modeling to Determine a Suitable Location to Establish a Dunn Bros Coffee Franchise in the Twin Cities Metro, Minnesota.” Papers in Resource Analysis v11. Saint Mary‟s University of Minnesota. Retrieved (date) from http://www.gis.smumn.edu 2. Roberta Brody (1999): Geographic Information Systems, Journal of Business & Finance Librarianship, 5:1, 3-18. (Retrieved from http://dx.doi.org/10.1300/J109v05n01_02) 3. Steinberg, Sheila Lakshmi, Steinberg, Steven, Eschker, Erick, Keeble, Sarah, Barnes, Jason. “Rural Ethnic Entrepreneurship: A Spatial Networks Approach to Community Development.” Institute for Spatial Analysis Report (2010). 4. Riiska, Jake. Mudd, Shannon. “MicroFinance Mapping Project – Uganda” Microfinance Consulting Club Haverford. (2012) Extracted from: http://ds.haverford.edu/wp/mappingmicrofinance/files/2012/07/Microfinance-MappingProject-Uganda.pdf Problems Encountered The most difficult problem I encountered was finding and cleaning the data necessary for the analysis. While I found impressive data from a variety of sources, most of it was not easy to join via excel to a shape file because of how it was formatted in the DANE files. Fortunately, I found a well-stocked data base that allowed me to clean and join important data and conduct my analysis. Also, trying to rank the systems required creating additional values within the excel files, which were critical in my final analysis. Appendix Socio-Economic Factors studied, and brief definitions of calculation method. All methodologies are described by DANE, the Colombian National Statistics organization unless otherwise noted. Telephone Density (Value A) (Total number of lines in service per year / year projected population) X 1000 <4 4 – 30 30 – 60 60 – 100 > 100 1 2 3 4 5 Telephone Coverage (Value AA) Number of households have telephone service / Total dwellings in the municipality) x 100 < =5 5 – 20 20 – 40 40 – 60 > 60 1 2 3 4 5 Human Capital and Education (Value B) Expression: weighting factor categories: maximum schooling of the household head, average schooling of persons 12 or older, proportion of young people 12-18 years attending school / college and proportion of children aged 5-11 years attending an educational institution. <= 20 20 – 25 > 25 2 3 4 Total Education % (Value BB) (Number of students by level / population in the corresponding age group) X 100 <70 70 - 90 90 - 98 > 98 1 2 3 4 Literacy Rate (Value C) Expression: Urban and rural population over age 15 who can read and write / urban and rural population over 15 years (Excluding indigenous communities) < 70 70 - 80 80 – 90 > 90 1 2 3 4 Life Conditions Index (ICV) (Value D) The ICV is a calculated index that attempts to project what an individual can accomplish based on his conditions to life. It factors in health, education, work and access to goods and services. <= 50 50 – 70 70 – 80 > 80 1 2 3 4 Infant Mortality Rate (Value E) (Number of deaths of children under one year / Number of live births per year) x 1000 > 50 40 – 50 30 – 40 20 – 30 < 20 1 2 3 4 5 Legal Requirements Compliance (Value F) The following is the Legal Compliance definition as explained by Lucia Porras Vergara, Secretary of Depratamental Planning, Colombia. “The Legal Requirements Compliance component seeks to focus the analysis on the compliance with the provisions laid down in Article 89 of Law 715 of 2001, and Act 1176 of 2007, as supplemented, for the purpose of verify strict compliance with the conditions of implementation of resources General System of Units (GSP) by the municipalities. This component assesses two aspects: 1. The introduction and implementation of the revenue budget transferred GSP concept. 2. The analysis of total delivery of investment spending over resources assigned and received under totals and percentages of forced investment. Finally, the departmental government, through the Ministry of Planning, puts available the results of the final report of compliance assessment legal requirements Wing Comptroller General's Office, Attorney General's Comptroller's Office and the Department, which allow you to know in depth the level of compliance with the implementation of revenue and expenses of the funds allocated by CONPES documents, effective 2010. The component of compliance with legal requirements, was developed based on the information provided by local governments according to the 1101 SICEP application designed by the National Planning Department effective 2010. For the evaluation of this component was based on the book "Guidelines for the assessment of effective municipal performance 2010 ' February 2011, prepared by the National Planning Department, which provides, among others, the following parameters for departments to assess the component of legal requirements.”1 0 .1 – 50 50 – 80 80 – 95 > 95 1 2 3 4 5 Fiscal Strength (Value G) (Income tax / Total Income) x 100 < 10 10 – 20 20 – 40 > 40 1 2 3 4 Lucia Porras Vergara, Secretaria de Planeación Departamental http://sucre.gov.co/apc-aafiles/39663166316363343139313033356162/Informe_Evaluaci_n_de_Requisitos_Legales_2010_Org_de_Control.p df) 1 Unsatisfied Basic Needs (NBI) (Value H) The following is the NBI index as calculated and explained by DANE, the Colombian national statistics agency: “Percentage of people who have to satisfy some (one or more) of the basic needs for survival defined as in the society to which it belongs. Captures infrastructure conditions and supplemented with indicators of economic dependence and school attendance.” >80 70 – 80 50 – 70 30 - 50 < 30 1 2 3 4 5 Aging of the population (Value I) (Number of people older than 65 years / Number of persons under 15 years) x 100 > 30 20 – 30 10 - 20 < 10 1 2 3 4 Micro Service – Value J Number of surveyed economic units engaged in the activity occupying Services of 0-10 people per municipality <= 30 31 - 79 80 – 170 > 170 1 2 3 4 Micro Industry – Value K Number of surveyed economic units engaged in industrial activity with 0-10 people per municipality <= 6 6 - 16 16 – 33 33 – 85 > 85 1 2 3 4 5 Micro Commercial – Value L Number of surveyed economic units engaged in commercial activity with 0-10 people per municipality <= 71 71 - 160 160 – 359 > 359 1 2 3 4 Small Industry – Value M Number of surveyed economic units engaged in industrial activity with 11 – 50 people per municipality 0 0-1 1-5 >5 1 2 3 4 Small Commercial - Value N Number of surveyed economic units engaged in commercial activity with 11 – 50 people per municipality 0 0-1 1-5 >5 1 2 3 4 Small Service – Value O Number of surveyed economic units engaged in the service industry with 11 – 50 people per municipality 0 1-3 3-9 >9 1 2 3 4 Medium Service – Value P Number of surveyed economic units engaged in the service industry with 51-200 people per municipality <=1 1–8 8 – 17 > 17 1 2 3 4 Medium Commercial – Value Q Number of surveyed economic units engaged in the commercial industry with 51-200 people per municipality <=1 1-3 3-9 >9 1 2 3 4