The Military Lending Act - Defense Credit Union Council

advertisement

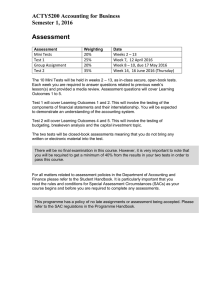

The Military Lending Act – NCUA’s Enforcement and Supervisory Role Defense Credit Union Council Defense Issues 2016 The information contained in this presentation is for informational purposes only and is provided as a public service and in an effort to enhance understanding of the statutes and regulations administered by the NCUA. It expresses the views and opinions of staff of NCUA and is not binding on NCUA or NCUA Board Members. Any representation to the contrary is expressly disclaimed. Agenda • Background and Overview • 2015 Changes – Old vs. New • Prohibitions • Penalties and Civil Liability • Effective Dates • Next Steps National Credit Union Administration – Defense Issues 2016 Meeting 2 Background and Overview • Talent Amendment, a.k.a. Military Lending Act – 10 U.S.C. § 987 • Regulations – 32 C.F.R. Part 232 – Amended and published in the Federal Register July 22, 2015, at 80 F.R. 40560 National Credit Union Administration – Defense Issues 2016 Meeting 3 Previous Scope • Covered Borrowers: Active duty service members and their dependents • Covered Products: – Payday loans – Vehicle title loans – Refund anticipation loans National Credit Union Administration – Defense Issues 2016 Meeting 4 Scope After Amendments Amended regulation issued July 22, 2015 • Covered Borrowers: Still active duty servicemembers and their dependents (dependents re-defined) • Covered Products: Expanded to cover TILA credit (with exceptions) – Credit offered or extended to a covered borrower primarily for personal, family, or household purposes, and that is: • (i) subject to a finance charge or • (ii) payable by a written agreement in more than four installments National Credit Union Administration – Defense Issues 2016 Meeting 5 Coverage Products not covered • Mortgage loans • Loans/credit to purchase a vehicle or personal property if secured by the vehicle or personal property • Business loans/credit • Loans/credit to non-covered borrowers • Other Reg. Z exempt credit – such as federal student loans, over $54,600 for most products, securities, public utility credit, home fuel budget plans National Credit Union Administration – Defense Issues 2016 Meeting 6 Military APR (MAPR) • MAPR to covered borrowers capped at 36 percent • MAPR = APR under Reg. Z plus some excluded items • For PALs, exclude 1 application fee in a rolling 12-months period • Bona fide fees excluded for credit card MAPR National Credit Union Administration – Defense Issues 2016 Meeting 7 Required Disclosures • All TILA/Regulation Z disclosures • Statement of MAPR • Clear description of payment obligation National Credit Union Administration – Defense Issues 2016 Meeting 8 Identifying Covered Borrower • Credit union can use its own method • Changes to safe harbor provision • Must check before consummation • Must keep record of checking National Credit Union Administration – Defense Issues 2016 Meeting 9 Covered Transactions PREVIOUS VERSION AMENDED VERSION Applied to: Applies to: -Payday loans (“Closed-end credit with -Consumer credit covered by a term of 91 days or fewer in which the TILA/Reg. Z (includes credit card amount financed does not exceed accounts, overdraft credit lines) $2,000”) Not covered: -Vehicle title loans -Mortgage loans -Tax refund anticipation loans -Vehicle/personalty purchase loans secured by the vehicle/personalty purchased -Non-consumer loans -Loans to non-covered borrowers -Other credit exempt under Reg. Z National Credit Union Administration – Defense Issues 2016 Meeting 10 Covered Borrowers PREVIOUS VERSION AMENDED VERSION At time credit incurred: -Active duty A, N, MC, AF, CG (or under call/order >30 days) -Active Guard/Reserve duty -Member’s spouse, child (38 USC 101(4)), and person getting >1/2 support from member At time credit incurred: -Member of armed services on active duty per title 10, 14, 32 USC (or under call/order >30 days) -Active Guard/Reserve duty -Dependent (per 10 USC 1072(2)(A), (D), (E), (I)) -Coverage ends when member’s service ends National Credit Union Administration – Defense Issues 2016 Meeting 11 Covered Creditors PREVIOUS VERSION AMENDED VERSION -As per Reg. Z -As per Reg. Z; and -Assignee of Reg. Z creditor National Credit Union Administration – Defense Issues 2016 Meeting 12 Military APR (MAPR) PREVIOUS VERSION AMENDED VERSION -Capped at 36 percent -Slightly different, but contrast to APR is of greater significance -Capped at 36 percent total for closed-end -Capped at 36 percent for any billing cycle for openend National Credit Union Administration – Defense Issues 2016 Meeting 13 Payday Alternative Loans (PALs) PREVIOUS VERSION AMENDED VERSION -No special provision -Special provision for “short-term, small amount loan” (defined term) • Closed-end loan • 36 percent APR cap • Made under federal law, w/<36 percent rate cap for FCU or “insured depository institution” under Fed. Deposit Insur. Act • Made under rule w/ a 9-mo. max. term & numerical fee max. -One application fee in rolling 12month period excluded from MAPR National Credit Union Administration – Defense Issues 2016 Meeting 14 Credit Card Accounts PREVIOUS VERSION AMENDED VERSION -Not covered -Covered – 36 percent MAPR cap in any billing cycle -MAPR calculated per Reg. Z, but fees for opening, renewing or continuing account are included in MAPR -No fees allowed in billing cycle with zero balance (except for annual participation fee of <$100) -Exclude from MAPR all bona fide and reasonable fees (with exception), except fees for credit insurance, debt suspension/cancellation, ancillary product (safe harbor: average of same fee charged by 5 large creditors during previous 3 years) National Credit Union Administration – Defense Issues 2016 Meeting 15 Covered Borrower Status PREVIOUS VERSION AMENDED VERSION -Borrower signs “covered borrower identification statement” -If not, creditor may request applicant to provide documents proving status; or -Creditor may verify through Defense Manpower Data Center database -Any method is permissible -Safe harbor if creditor verifies through Defense Manpower Data Center database, or verifies through consumer report from nationwide consumer reporting agency or reseller -Recordkeeping required National Credit Union Administration – Defense Issues 2016 Meeting 16 Disclosures PREVIOUS VERSION AMENDED VERSION -MAPR (“X%”) and total dollar amount of MAPR charges -TILA/Reg. Z disclosures -Description of payment obligation (payment schedule suffices) -Statement of rights -Written and oral (TILA/Reg. Z written only) -Statement of MAPR (model statement) -Reg. Z disclosures -Description of payment obligation (payment schedule for closed-end and account opening disclosures for openend) -Written and oral (Reg. Z written only); oral can be in person or by toll-free number National Credit Union Administration – Defense Issues 2016 Meeting 17 Model Statement of MAPR Federal law provides important protections to members of the Armed Forces and their dependents relating to extensions of consumer credit. In general, the cost of consumer credit to a member of the Armed Forces and his or her dependent may not exceed an annual percentage rate of 36 percent. This rate must include, as applicable to the credit transaction or account: The costs associated with credit insurance premiums; fees for ancillary products sold in connection with the credit transaction; any application fee charged (other than certain application fees for specified credit transactions or accounts); and any participation fee charged (other than certain participation fees for a credit card account). 232.6(c)(3). National Credit Union Administration – Defense Issues 2016 Meeting 18 Limitations PREVIOUS VERSION -No rollovers/renewals with proceeds from other credit extended by same creditor, unless under terms more favorable to borrower -Creditor cannot require allotment AMENDED VERSION -Rollover/renewal prohibition not applicable to chartered/licensed bank, savings association or credit union (“more favorable terms” exception to rollover/renewal eliminated) -Allotment prohibition not applicable to military welfare society or service relief society -Creditor (other than chartered/licensed bank, savings association or credit union) cannot use title of vehicle as security National Credit Union Administration – Defense Issues 2016 Meeting 19 Retained Prohibitions • Waiver of rights under federal or state law – Includes Servicemembers Civil Relief Act • Mandatory arbitration • Unreasonable notice requirement before borrower brings an action • Onerous legal notice provision • Prepayment prohibition or penalty • Use of allotment to repay the obligation (new exceptions) National Credit Union Administration – Defense Issues 2016 Meeting 20 Retained Prohibitions (cont’d) • Use of check or other means to access a borrower’s account – Exceptions if MAPR less than 36 percent: • Credit union can require electronic fund transfer to pay, unless prohibited by law; • Credit union can require direct deposit, unless prohibited by law; or • Credit union can take a security interest in borrowed funds deposited into an account established in connection with the consumer credit extension, unless prohibited by law. National Credit Union Administration – Defense Issues 2016 Meeting 21 Penalties and Enforcement • Knowing violation is misdemeanor – Up to one year in prison; and – Fine • Administrative enforcement as under TILA National Credit Union Administration – Defense Issues 2016 Meeting 22 Civil Remedies • • • • • • Actual damages but not less than $500 Appropriate punitive damages Equitable relief (including injunction) Costs and reasonable attorney fees Any other relief permitted by law Must bring action within two years of discovery and not later than five years from violation National Credit Union Administration – Defense Issues 2016 Meeting 23 Civil Remedies • Defense: – Act was not intentional; and – Bona fide error, despite process in place reasonably adopted to prevent such errors (error of law not a defense) National Credit Union Administration – Defense Issues 2016 Meeting 24 Effective Dates • Changes have several effective dates – generally, October 1, 2015 – Compliance with new provisions required starting October 3, 2016 – Change in safe harbor for identifying covered borrowers effective October 3, 2016 – Credit card provisions effective October 3, 2017 – Civil liability provisions effective October 1, 2015 • Apply to transactions from January 2, 2013, to present National Credit Union Administration – Defense Issues 2016 Meeting 25 Next Steps • NCUA will issue a second Regulatory Alert with a detailed discussion of the revised MLA regulatory provisions • NCUA staff is drafting examination procedures National Credit Union Administration – Defense Issues 2016 Meeting 26 Contact Information • Matt Biliouris – matthewb@ncua.gov • Jamie Goodson – jgoodson@ncua.gov • Joe Goldberg – jgoldberg@ncua.gov • Office of Consumer Protection, Division of Consumer Compliance Policy and Outreach – Compliancemail@ncua.gov National Credit Union Administration – Defense Issues 2016 Meeting 27