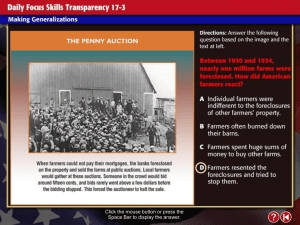

Causes of the Great Depression

advertisement

Teacher Instructions • Supplies Needed: • Copy 1-per-student, back-to-back: The Economic Collapse Fill-In Lecture (pages 1 & 2) • Copy 1-per-student, The Great Depression Story • Begin the class by playing the Power Point Presentation: The Great Depression Preview as the students enter the room. Pass out the handouts above. • Display the Pair-Share on the power point: The Causes of the Great Depression. Continue with the lecture as the students take notes. For homework have the students complete the critical thinking questions. • For each slide, have a class discussion using the questions included. • Have the students complete the Wrap-Up Activity: Storyboard Opening Activity • PAIR SHARE • The year is 1929. The U.S. economy has collapsed. • Farms, businesses, and banks nationwide are failing • There is massive unemployment and poverty. • You are out of work with little prospect of finding a job. • What would you do to feed your family? The Great Depression Introduction • • • Who was involved? Key figures • • • • • What was it? • • • Where did it occur? • • When did it happen? • • Why is it important? • • Herbert Hoover-President when the depression started Franklin Delano Roosevelt (FDR)-succeeded Hoover, credited with ending the depression Period in American history of economic downfall 1 out of every 4 Americans were unemployed Gross National Product (GNP) was cut in half from $104 billion to $59 billion Almost half of the banks closed Began in New York with the Stock Market Crash Spread across America and the world Black Tuesday October 29, 1929 to about…end date is debated upon by historians The Great Depression will change fundamentally the role of government in the lives of Americans. The government will abandon laissez faire policies for a more interventionist approach. Write it in your own words CA Standards • 11.6 Students analyze the different explanations for the Great Depression and how the New Deal fundamentally changed the role of the federal government. • Describe the monetary issues of the late nineteenth and early twentieth centuries that gave rise to the establishment of the Federal Reserve and the weaknesses in key sectors of the economy in the late 1920s. • Understand the explanations of the principal causes of the Great Depression and the steps taken by the Federal Reserve, Congress, and Presidents Herbert Hoover and Franklin Delano Roosevelt to combat the economic crisis. Objective •Students will be able to analyze the causes of the Great Depression by completing a storyboard. #1: The Postwar Economic Boom • What do you see here? • What message does the billboard send? • Describe the area surrounding the billboard. • When do you think the billboard was created? • What irony is there in this photograph? #1: The Post War Economic Boom • Twenties Prosperity • During the 1920s, Americans believed that poverty in the US would be eliminated. Due to increased earnings, many Americans had more money to spend on luxury goods such as a radios and cars. By 1929, the US Stock Market was at an all time high, over 1.1 billion shares of stock was traded. • The Depression Foreshadowed • By late 1929, problems began to surface. Unemployment was on the rise, farmers were losing their land, and stock prices were dropping. The number of Americans living in poverty increased, and few people could afford luxury goods. On October 29, 1929 the stock market crashed. • Causes of the Great Depression • 1.Republican laissez faire in domestic affairs 2. Stock speculation 3. Unregulated banking institutions 4. overproduction of goods 5. decline of farming industry 6. unequal distribution of wealth. #2: Republican Economic Policies • What do you see here? • These men are all conservative Republicans. With this in mind, how do you think they dealt with business? #2: Republican Economic Policies • Domestic Economic Policies • Republican Presidents Calvin Coolidge and Herbert Hoover believed in “trickle down” economics. They believed that economic policies that benefited business and the wealthy would eventually “trickle down” to average Americans. For example, if the government gave taxes cuts to the wealthy they would invest that money into the economy for the benefit of all. However wealth did not trickle down. The wealthy spent the money on expanding their work facilities and saved it for themselves. • International Economic Policies • After WW1, European countries were in debt to the U.S. and began to default on their loans. The U.S. placed high taxes on foreign goods to discourage Americans from buying their merchandise. This meant that European goods would not be sold here causing Europeans to lose more money and further default on their loans. #3: Real Estate and Stock Speculation • Describe what you see. • What building do you see? • Who are the people on the ground? On the building? • What does this represent about stockbrokers during this period? #3: Real Estate and Stock Speculation • Unchecked Stock Market Speculation • Speculation is when a person or organization makes a risky investment on the hopes of getting rich quick. Investors believed that the stock market would go up indefinitely and that companies’ profits would continue to rise. So, investors speculated which companies’ stocks would rise and then bought large amounts of stock. They would then turn around and sell the stock for higher price, making a quick easy profit. The value of a company’s stock became artificially inflated and did not correlate to the companies’ actual worth. • Stock analysts began to predict the market was headed for a fall. They warned that stock prices could not continue to rise at such an inflated rate and that the prices were exceeding the stock’s actual worth. #4: The Stock Market Crash and the Banking Industry Collapse • What do you see here? • Where is this occurring? • What are the people doing? Film Clip: Black Tuesday • #4: The Stock Market Crash and the Banking Industry Collapse • The 1929 Stock Market Crash • In late 1929 investors began selling their stock while they could still get a profit from them. As investors began selling, stock prices began to fall. On 10/29/29, or Black Tuesday investors flooded the NYSE with sell at any price orders. By the end of the day, investors lost $16 billion. By October’s end, the stock market was in ruins and the Great Depression had officially begun. • Unregulated Banking Institutions • Banks collapsed because of the Republican policy of laisse faire and banks’ overextension of credit to stock investors. The government did not prevent banks from speculating depositor’s money on high risk ventures. It did not also demand that banks keep a certain percentage of money on reserve and available. Therefore, when banks folded after the stock market crash, their customers had no way of getting their money. Banks permitted investors to buy stocks on large margins of credit. For example, if an investor wanted to buy $20,000 worth of stock, he only had to put up 10% (2,000) of his money. The bank would then loan the remaining 90% or $18,000. The bank would seize the stock if they could not repay the loan as if it were theirs. Banking officials thought that stocks were good as money and would not go down. • The Banking Industry Collapse: Results • Families that played the stock market lost all their -money. Investors who had bought stocks on margin had to sell them at a fraction of their original price. This meant that they could not pay the bank the amount it had loaned to him. This meant that the bank could not replace its own money, which it had used to fund the speculators loans. So, even people who didn’t invest in the stock market lost their money. Unemployment increased which meant that people began to default on their mortgages. This meant that banks lost even more money. By 1932, 1/4 of the nations banks closed. Pair-Share • The bank is failing. How do you think the depositors trying to get their money are feeling? • How do you think the bank failures affected the nation? Slide #5 Overproduction • Describe what you see. • Why are they doing this? • How might the economic collapse be explained by what you see in these two pictures? • #5 Overproduction • Industrial Goods • Consumer demands for goods was higher after WWI. Americans wanted to enjoy life after the horrors of WWI. Advertisements enticed Americans to purchase more and more goods. As a result, business owners continued to flood the market with huge supply of goods. By 1929, there were more products available than people to buy them. • Agricultural Goods • Americans farmers prospered during WWI because they provided food to the U.S. and Europe. After the war, farmers mechanized farming techniques to increase production . However, Europe did not need American food anymore resulting in an overproduction of crops. Farmers were stuck with a surplus crops they could not sell, or could only sell for a low price. #6: The Toll on the Farming Industry • Describe what you see. • Why are there no people in the picture? • Why did they leave? Where did they go? Film Clip: The Dust Bowl • #6: The Toll on the Farming Industry • The Farming Industry Decline • During the 1920’s, farmers borrowed heavily from banks to pay for new equipment. When farmers could not sell their crops, they could not pay their loans. Farmers defaulted on their loans and they lost their farms to bank foreclosures. The banks would then try to sell the farm, but there were few that could afford to buy it. This meant that the bank lost even more money. • The Dust Bowl • A severe drought caused the soil to turn into dust. Farmers and their families fled the Dust Bowl and headed west to California in search of employment. People referred to these as migrants farmers as “Okies”. Unable to pay for adequate housing, the Okies were forced to live in shacks. Pair-Share • One reason the Dust Bowl occurred was _____________________. • As a result, _________________________. • A cause of the Dust Bowl was ______________. • For this reason, __________________. • Because of the _________ many ______ _______. • An effect of the dust storms was ______. • Consequently when the dust storms came ________. Slide #7: Unequal Distributions of Wealth • Describe what you see. • Where do you think they are going? • How is their life different from the doorman? • How would the gap between the rich and the poor contribute to the economic collapse of the 1920’s? • #7: Unequal Distributions of Wealth • The Gap Between the Rich and Poor • During the 1920’s, the gap grew wider and distribution of wealth grew unequal. In 1929, 1% of the population owned 59% of the nations wealth. 60% of U.S. families lived on or below the poverty line. Workers struggled to survive in the 1920’s. Companies replaced workers with machines that produced goods faster and cheaper. Corporations rarely passed profits onto the workers with higher wages. Instead they kept wages low and used the money to improve their facilities. • Purchasing Power is Lost. • Banks and business tried to encourage consumer spending by allowing people to buy things on credit. But Americans fell deeper and deeper into debt as they purchased items they couldn’t afford and paid the high interest on them. By 1929, Americans could not afford basic necessities let alone luxury goods. A small handful of wealthy Americans could not fill in the gap for the entire nation. Sales dropped and companies began to fail. Film Clip: The Great Depression Wrap-Up Activity • Complete the Storyboard: The Great Depression Story. • The more details you give, the better grade you get!