Final - BYU Department of Economics

advertisement

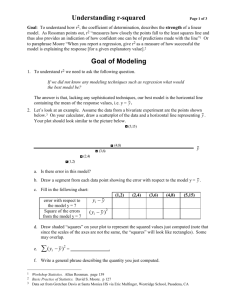

Econometrics--Econ 388 Winter 2013, Richard Butler Final Exam your name_________________________________________________ Section Problem Points Possible I 1-20 3 points each II 21 22 23 24 25 5 points 5 points 10 points 10 points 20 points III 26 27 28 20 points 20 points 30 points IV 10 points 10 points 29 30 1 I. Define or explain the following terms: 1. bootstrapping- 2. The prediction error for YT, i.e., the variance of a forecast value of y given a specific value of the regressor vector, XT (from YT X T ˆ T )- 3. formula for VIF test for collinearity-- 4. structural vs. reduced form parameters in simultaneous equations- 5. dummy variable trap - 6. endogeneous variable- 7. maximum likelihood estimation criteria- 8. F-test- 9. Goldfeld-Quandt test- 10. impure heteroskedasticity (that would lead to biased 𝛽̂ )-2 11. necessary condition (order condition) for identification in simultaneous equation models- 2 0 12-14. Let C= [ ] −1 1 12. Trace of C-13. Calculate B=C’C 14. show C’C from above (or in general) is a positive definite matrix- 15. dynamically complete models - 16. one-tailed hypothesis test- 17. model corresponding to “prais y x1 x2 x3;” procedure in STATA -- 18. show that N N i 1 i 1 ( yi y )( xi x ) ( yi y ) xi -- 19. probability significance values (i.e., ‘p-values’)- 20. central limit theorem 3 II. Some Concepts The next six questions consist of statements that are True, False, or Uncertain (Sometimes True). You are graded solely on the basis of your explanation in your answer 21. “As long as the time series are covariance stationary and weakly dependent, then the usual way we calculate the R-squared will consistently estimate the population R-squared.” 22. “For the model, 𝜇𝑡 = 𝜌𝜇𝑡−1 + 𝑒𝑡 , regressing the residuals on the lagged value of the residuals will always provide a consistent estimate of 𝜌, regardless of the null hypothesis.” 4 23. “In estimating a causal model of how skipping class affects the final exam score, an intrepid econometrician estimates the following model: 𝑠𝑐𝑜𝑟𝑒 = 𝛽0 + 𝛽1 𝑠𝑘𝑖𝑝𝑝𝑒𝑑 + 𝜇. If skipping class was related to important omitted variables, then commuting distance from a student’s residence to the class may be a good instrumental variable.” 24. “Two stage least squares is employed only for simultaneous equation models with just one omitted (from the equation being estimated) exogenous variable.” 5 25. Suppose that a 4 sided dice with numbers 1, 2, 3, and 4 are etched one each of the four surfaces respectively. The dice is fair in that each number is equally probably to be on the bottom. Define two random variables for two throws of the dice (let i=number on the bottom in the first throw, and j=number on the bottom of the second throw), and let W= i + j (the sum of the two throws) Z= | i – j| (the absolute value of the difference in the two throws) a. chart out the joint distribution of W and Z (the likelihood that W takes one feasible number and Z takes another feasible number) b. what is the marginal distribution of Z? What is its expected value? c. Is W independent from Z? Show why or why not? 6 III. Some Applications 26. Data from ATTEND.RAW generated the regression below, where # delimit ; /* attend classes attended out of 32 priGPA cumulative GPA prior to term ACT ACT score atndrte percent classes attended stndfnl (final - mean)/sd */ infile attend termgpa priGPA ACT final atndrte hwrte frosh soph skipped using "D:\BYUclasses_2013\econ388\classrm_data\wooldridge\ATTEND.RAW", clear; gen priGPAsq=priGPA*priGPA; gen ACTsq=ACT*ACT; gen priGPA_atn=priGPA*atndrte; regress stndfnl atndrte priGPA priGPAsq ACT ACTsq priGPA_atn; estat sum; WITH THESE RESULTS Source | SS df MS -------------+-----------------------------Model | 152.001001 6 25.3335002 Residual | 512.76244 673 .761905557 -------------+-----------------------------Total | 664.763441 679 .97903305 Number of obs F( 6, 673) Prob > F R-squared Adj R-squared Root MSE = = = = = = stndfnl 680 33.25 0.0000 0.2287 0.2218 .87287 -----------------------------------------------------------------------------stndfnl | Coef. Std. Err. t P>|t| [95% Conf. Interval] -------------+---------------------------------------------------------------atndrte | -.0067129 .0102321 -0.66 0.512 -.0268035 .0133777 priGPA | -1.62854 .4810025 -3.39 0.001 -2.572986 -.6840938 priGPAsq | .2959046 .1010495 2.93 0.004 .0974945 .4943147 ACT | -.1280394 .098492 -1.30 0.194 -.3214279 .0653492 ACTsq | .0045334 .0021764 2.08 0.038 .00026 .0088068 priGPA_atn | .0055859 .0043174 1.29 0.196 -.0028913 .0140631 _cons | 2.050293 1.360319 1.51 0.132 -.6206864 4.721272 -----------------------------------------------------------------------------------------------------------------------------------------Variable | Mean Std. Dev. Min Max -------------+----------------------------------------------stndfnl | .0296589 .989461 -3.30882 2.78361 atndrte | 81.70956 17.04699 6.25 100 priGPA | 2.586775 .5447141 .857 3.93 priGPAsq | 6.987682 2.892395 .734449 15.4449 ACT | 22.51029 3.490768 13 32 ACTsq | 518.8809 158.8418 169 1024 priGPA_atn | 215.3252 72.10833 14.0625 393 a). how does attendance effect final class standing (stndfnl)? b) how does ACT score affect final class standing (stndfnl)? 7 27. Prediction, and the calculation of the associated prediction confidence intervals, are important for business applications of regression analysis. a) explain intuitively how the following code gets a predicted value for wages and the associated prediction error, using our perennial FHSS professor wages and teaching experience as the example. Be as explicit as possible. input obs salary experience male_dummy pred_dummy; 1 45000 2 1 0; 2 60600 7 0 0; 3 70000 10 1 0; 4 85000 18 1 0; 5 50800 6 0 0; 6 64000 8 1 0; 7 62500 8 0 0; 8 87000 15 1 0; 9 92000 25 0 0; 10 89500 22 1 0; 11 0 12 0 -1; end; reg salary experience pred_dummy; b) Using the OLS criteria, prove that the intuitive strategy above works—that is, show the estimated coefficients for slope and intercept are unchanged with the addition of the “preddummy” variable, and that the predicted value for experience=12 is exactly derived. 8 III. Some Proofs 𝑋′𝑋 28. Under the usual assumptions, including 𝑛 converges to a matrix of finite elements as n goes to infinity, prove that the OLS estimator is consistent for the usual model: 𝑌 = 𝑋𝛽 + 𝜇 . 9 29. Describe the basics of obtaining feasible generalized least squares (also call weighted least squares) for the linear regression model when the errors are AR(1): 𝜇𝑡 = 𝜌𝜇𝑡−1 + 𝑒𝑡 30. Derive the correct variance-covariance matrix for 𝛽̂ , OLS estimator, when there is really heteroskedasticity but we don’t do weighted least squares. That is, what covariance matrix is generated by the “robust” option in STATA. 10