Implementing Activity Based Costing for Job Shops

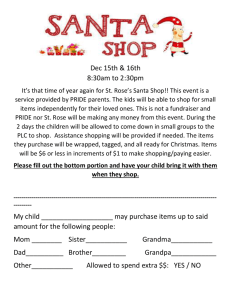

advertisement

Implementing Activity Based Costing for Job Shops Presented by Dave Lechleitner Business Productivity Analyst Exact Software—JobBOSS Division Your presenter today is Dave Lechleitner Business Productivity Analyst Why are we doing this session? Knowing your “winners” from your “losers” is critical. It’s not getting any easier out there—you have to remain competitive. Flat shop rates don’t provide a true cost picture. ABC provides a simple approach to analyze true cost and is now being applied even to small job shops. Key Questions Why do traditional flat shop rates fall short? What are the characteristics of shops implementing Activity Based Costing (ABC)? How does ABC work and how can a shop correctly and accurately allocate activity costs to jobs? What key tools should you look for in an ERP system to review costs and especially application of overhead? How should a shop implement ABC? Why Do Flat Shop Rates Fall Short in Determining True Job Cost? Flat Shop Rate vs. ABC Flat shop rate costing methods were generally developed when a shop owner first started the business and may have increased or decreased based on “gut feel” or “what the market may bear.” Normally includes some provision for profit “built in.” Hides the real picture of what is going on. Generally has no basis on reality of the true cost structure of the shop. Inherent problem in a flat shop rate is that it has an averaging effect. Difficult jobs are under-quoted/costed and easy jobs are over-quoted/costed. Flat Shop Rate vs. ABC Flat Shop Rate vs. ABC Two employees VERY different cost structure Employee #1 Employee #2 Flat Shop Rate vs. ABC Opponents of ABC often fall prey to the following arguments or behavior-• We don’t charge THAT cost to the customer because the customer won’t pay it (i.e. engineering, quality control, customer service, etc.) • We can’t win the job quoting our actual cycle times so let’s “fudge” the cycle times to get the price the customer will pay. • We have to sharpen our pencils and lower our cost estimates (i.e. ignore the real costs and put down anything to get to the price the customer will pay.) Characteristics of Shops Implementing Activity Based Costing Shop Characteristics “Activity Based Costing is 30% understanding and using techniques correctly, and 70% the ability to convince others to accept beneficial change. No matter how brilliant the measurement, if people reject it, nothing has been achieved and the analyst has failed.” -- Ralf Sorenson (Head of SAS Airlines) Shop Characteristics Has your time come to evaluate a new method of measuring and collecting data as it relates to job costing? It has if. . . 1. Your shop is implementing new, technologically advanced processes into your operations without making adjustments to your costing processes. 2. You only currently use one basis for charging manufacturing costs to products—direct labor hours, direct labor dollars, machine hours. Shop Characteristics 3. You have only one plant wide overhead rate, a couple of rates, or worse—no overhead rate at all. 4. You automatically change costing rates as volume levels change. 5. You find yourself competitive in one product line but not another or at one volume level but not another. Shop Characteristics 6. Your shop manufacturing operations do not always require the same number of operators— partially attended operations or team operations—or one employee operating a work cell. 7. It has some customers, markets, or product lines that require different levels of selling, scheduling, service, or other support activity but only have one company wide G&A rate. What is ABC and How Can Shops Accurately Allocate Costs What is ABC? Very simple concept and key management tool. • Jobs and contracts require a company to perform activities. • Activities cause a company to incur cost. • Cost should be associated with jobs and contracts that made the activity necessary. What is ABC? Resources Activities Cost Objects What is ABC? So, how does ABC work? • Identification of “cost pools” or activities which a product/service must pass. • Estimation of total cost of each activity must be estimated for time period. • Estimation of number of hours spent on each activity for same time period. • Determination and assigning of “cost driver” (i.e. quantity, # of labor hours, # of machine hours, # of parts). How Does a Shop Allocate Costs? • Project a normal level of production activity. • Review over a longer period of time, such as a 12-month period. • Costs based upon shorter periods, such as weekly or monthly periods, may fluctuate too much. How Does a Shop Allocate Costs? Assign costs that are directly attributable to a job and not subject to ABC cause/effect analysis Direct labor (use actual employee rates) Raw material Purchased components Outsourced manufacturing services Perishable tooling consumed on a job How Does a Shop Allocate Costs? Determine the costs associated with Operational Support Activities—Manufacturing Overhead • Buildings and grounds • Human resources—administrative staff required to support employees performing direct activities • Maintenance • Plant supervision and production control How Does a Shop Allocate Costs? Determine the costs associated with Customer Support Activities and Other General/Administrative Overhead • Different markets or customers may require different effort to get new business or maintain existing • Customer service activities– customers who are “jerks” often cost more to maintain than “sweethearts” • Accounting • Sales and marketing Example of Indirect Shop Expenses over previous 12 months Allocation Calculation • Determine a best method for allocating the costs by type of activity—remember to use the driver of the cost as the basis. – Percentage of direct labor dollars – Dollar rate per direct labor hour – Dollar rate per machine hour Allocation Calculation • Using the same $1,000,000 of expenses for the last 12 months. • Break expenses out by burden type: – Labor burden – Machine (Manufacturing) burden – G&A (General & Administrative) burden Allocation Calculation • Same $1,000,000 of expenses allocated by burden type. • Labor Burden ($300,000) + Machine Burden ($500,000) + General & Administrative Burden ($200,000) = $1,000,000. Allocation Calculation • Costs divided by shop hours of operation. Tools Available in ERP Systems to Analyze Costs and Application of Overhead ERP System Tools According to NTMA Key Principles of an ERP System 1. Assign a unique job (work order) number for each part number on an order you receive. 2. Identify customer, part, and delivery information on the order. 3. Post cost of material at the time it is purchased and received or drawn from stock. 4. Post all outsourced processing expenses to the order. 5. Post hours and rates for direct labor hours and machine hours to the order when they occur. 6. Assign manufacturing, selling, and general and administrative overhead to order on proportionate basis—key to ABC. ERP System Tools ERP System Tools • ERP systems should give you the option to use Actual Employee Rates to drive true ABC • Application of labor overhead by percentage yields better results if you have wide variances in employee wages and fringe benefits ERP System Tools • Once true cost is established, ability to define global markup or profit goals is practical ERP System Tools • Should allow ability to define markup or profit goals specific by quoted quantity and specific part ERP System Tools • Ability to review estimated, actual, and variance against direct labor and overhead/burden costs at end of job. ERP System Tools • Review profitability against order, produced, and shipped quantity ERP System Tools • Catch your “losers” before they get out of control—before it’s too late! ERP System Tools • Regularly monitor your allocation of your costs against the activities that drive them. How Should a Shop Implement ABC? Implementing ABC • Determine your present expertise level in ABC and commitment to it • Determine cost in both time (effort) and money • Determine a timeline for completion— beginning of a new fiscal year is perfect time • Select a project lead • Establish a pilot project • Determine action plan after pilot Implementing ABC Is it worth it? • For most mid-sized manufacturers an ABC analysis can be conducted for as low as 0.08% of total sales for small this may creep as high as 0.3%. • Most companies realize an ROI in as little as 1 – 4 months with benefits that continue to grow over time. Implementing ABC • High-powered decision making tool for managers and owners • Remember…not a system but a concept to embrace and encourage • Doesn’t have to be complex…so take small steps Implementing ABC Resources Costing, Pricing, and Financial Management -- Published by the National Tooling & Machining Association (www.ntma.org) The ABCs of Activity Based Costing -- MMS Online, Mark Albert (Article #119803) Activity Based Costing for Mold Shops—Parts I – III -- Moldmaking Technology (October – December 2004) Costing Traps for Manufacturers -- Manufacturing Engineering (December 1998) Key Questions Why do traditional flat shop rates fall short? What are the characteristics of shops implementing Activity Based Costing (ABC)? How does a ABC work and how can a shop correctly and accurately allocate costs to jobs? What key tools should you look for in an ERP system to review costs and especially application of overhead? How should a shop implement ABC? If you have additional questions, JobBOSS Customers contact your Customer Advocate Prospects contact your Sales Rep 1-800-777-4334