Debit Credit

advertisement

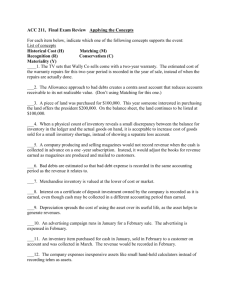

Prepaids (also called Deferrals) Cash flows occur BEFORE the revenue or expense is recognized Revenues Down Payments Unearned rent Deposits Expenses Prepaid Insurance Prepaid rent Prepaid taxes Accruals Cash flows occur AFTER the revenue or expense is recognized Revenues Sales Notes receivable Interest on loans Expenses Purchases on account Accrued salaries Warranty costs Pensions and benefits Depreciation of assets • Warranty costs and Pensions are also know as Contingency Obligations Contra Accounts • These are special accounts that are established to decrease the balance in another account indirectly. – They preserve the identity of the primary account. – Provides an account to debit or credit when one does not exist. • Examples: Primary Account Accounts Receivable Fixed Assets Sales Revenue Loans Receivable Contra Account Allowance for Doubtful Accounts Accumulated Depreciation Accumulated Amortization Sales Returns and Allowance Sales Discounts Allowance for Doubtful Loans Prompt Payment Discounts • It is common for a billing invoice to have the follow type of verbiage added: 2 percent, 10 days/net, 30 days – A 2 percent discount may be taken off the bill if paid within 10 days – The full amount is expected to be paid within 30 days. – The 2 percent savings is forfeit if the bill is paid after day 10. Calculating the Interest • Accounts Payable is considered non-interest borrowing but in reality this is only true if the Prompt Payment Discount is taken. • By not paying within the first 10 days, the customer is essentially borrowing money (the discounted amount) and paying 2 percent interest. • Calculating the Interest: – The interest rate is based on 2 percent interest for 20 days of borrowing. – There are 18 1/4 of these 20 day periods in a year (365/20 = 18 1/4). – Therefore, the yearly Interest Rate is 36.5% (2% x 18 1/4). • At this interest rate it would benefit of the company to use the discount. Accounting for Prompt Payment Discounts • There are two methods of accounting for Prompt Payment Discounts: – Net Method: • Used when the Discount is attractive and most customers are expected to take advantage. – Gross Method • Used when the Discount is not attractive or neutral and most customers are not expected to take advantage. Net Method of Accounting for Prompt Payment Discounts It is expected that customers will take the discount! • The sale is recorded at the discounted amount. Sale = $1000 with terms of 2 percent, 10 days/net, 30 days. Accounts Receivable Sales $980 $980 • When the receipt of cash if the discount is taken. Accounts Receivable $980 Cash $980 • Recording the receipt of cash if the discount is not taken. Accounts Receivable $980 Cash $1000 Other Income $20 Gross Method of Accounting for Prompt Payment Discounts It is expected that customers will not take the discount! • The sale is recorded at the full, billed amount. Sale = $1000 with terms of 1/2 percent, 10 days/net, 30 days. Accounts Receivable Sales $1000 $1000 • When the receipt of cash if the discount is taken. Accounts Receivable $1000 Discounts Allowed Cash $995 $5 Recording the receipt of cash if the discount is not taken. Accounts Receivable $1000 Cash $1000 Accounting for Inventory • Inventory – Purchased goods on hand to be sold. • Two systems for valuing inventory that is sold – Perpetual Inventory System • Accounts for the cost of goods sold with each sale • Most precise and highest investment – Periodic Inventory System • Tracks inventory purchase but not inventory sold • Physical inventory count at end-of-period • Can only estimates the Cost of Goods. The Perpetual Inventory System • Accounts for each individual purchase or sale. – More applicable to inventory that is high cost and low volume. – Does not require end-of-period adjustments. • Purchases of Inventory: Inventory Cash or Accounts Payable Debit $500 Credit $500 • Sale of product (two entries): Cash or Accounts Receivable Sales Revenue Cost-of-goods-sold Inventory Debit $800 Debit $500 Credit $800 Credit $500 The Periodic Inventory System • Requires physical inventory counts. • Best for low cost, high volume inventory. • Purchases of inventory: Purchases Cash or Accounts Payable Debit $500 Credit $500 • Sale of product: Debit Cash or Accounts Receivable $800 Sales Revenue Credit $800 The Periodic Inventory System • Calculating Inventory consumed over the accounting period: Beginning Inventory + Purchases - Returns = Inventory Available Ending Inventory = Inventory Sold (COGS) $2500 $800 ($250) $3050 $1500 $1550 • End-of-period adjusting entries: Ending Inventory Returns Beginning Inventory Purchases Cost of Goods Sold Debit $1500 $250 Credit $2500 $ 800 $1550 Inventory Accounting • Issues in valuing Inventory and Cost-ofGoods-Sold: – Different prices are paid for inventory depending on when items were purchased. – Price level changes due to Inflation and Deflation. – Currency fluctuations. FIFO and LIFO • The FIFO (First-in, First-out) convention: – The value of the oldest inventory, the First-in, is the value of the Cost-of-Goods-Sold for current sales, the First-out. • The LIFO (Last-in, First-out) convention: – The value of the newest inventory items, the Last-in, is used to value Cost-of-Goods-Sold for current sales, the First-out. Price Level Changes • Price level changes due to Inflation and Deflation are a fact of life. – Inflation: a decrease in the purchasing power of currency; prices increase to compensate; the value of inventory decreases. – Deflation: an increase in the purchasing power of currency; prices drop to compensate; the value of inventory increases. • Two approaches to price-level accounting: – Specific-price adjustments (SPA) – General-price-level adjustments (GPLA) Specific-Price Adjustments (SPA) Adjustments are made to specific goods and services; typically inventory and fixed assets. This identifies that only certain items may be affected by price changes. • Several methods can be used to estimate the current value of assets. • Time-adjusted value: Estimates the value of revenue streams over time. This method tends to be inaccurate both in estimating the original value as well as the new value. • Market value: Determines the replacement value of assets and requires good secondary markets to be efficient. • Price indices: Use of published indices for the asset being re-valued. Multiplying the current value by the index number will establish the current value. General-Price-Level Adjustments (GPLA) Recomputes the value of all assets and liabilities on the financial statements. Also called Constant-dollar Accounting. • Uses General Price Indices – Gross National Product (GNP) – Consumer Price Index (CPI) Currency Fluctuations • Companies operating foreign subsidiaries must account for gains or losses due to fluctuation in currency exchange rates on their consolidated financial statements. • The value of assets and liabilities must be adjusted to account for different rates of inflation between the foreign and home currencies. • The accountant must determine what exchange rate to use and when should it be applied. Fixed Asset Accounting • Fixed Assets are Non-current Assets • Revenue and Capital Expenditures – These expenditures are debited to an asset account and offset by a credit to “Cash” or “Accounts Payable”. – Revenue expenditures are for Current Assets – Capitalization expenditures are for Non-current Assets. • Fixed Assets are also used to conduct an organization’s business, rather than inventory for resale. – A truck is a fixed asset for a delivery service but an inventory item for a car dealership. Elements of Fixed Asset Accounting 1) Initial (capitalization) Cost – – Purchase price + freight + installation + major overhauls Commonly called the “basis” 2) Useful life – – – – Productive years for the present owner Dictated by wear, obsolescence and new requirements. Useful life generally shorter than the asset’s total life. Income tax laws establish guidelines 3) Salvage Value – Estimated sale value of the asset at the end of it’s useful life, usually $0. Elements of Fixed Asset Accounting 4) Depreciation – – – – – The rational, equitable, and systematic allocation of the difference between an asset’s initial cost and it’s estimated salvage value over the useful life. It allows an organization to deduct, or expense, the incremental consumption of a fixed asset to the periods that benefit from it’s use. It is a non-cash transaction. It reduces taxable income. Journal entries at the end of each accounting period and no source documents (an Internal accounting event). Methods for Depreciation • Computation uses formulas or tables • Many accepted methods for depreciation including: – – – – – Straight line; Sum-of-the-years-digits; Units of production; Declining balance; Modified accelerated cost recovery system (MACRS) • One method is allowed for financial statements and a different method may be used, for the same fixed asset, for income tax accounting purposes. Disposition of a Fixed Asset • Calculating Net Gain or Loss on Sale/Salvage Book Value = Capitalization Cost – Accumulated Depreciation Net Gain (Loss) = Sales/Salvage Proceeds – Book Value • If proceeds are greater than the Book Value = Gain • If proceeds are less than the Book Value = Loss Disposition of a Fixed Asset Consider: BV = $26,000 - $14,400 = $11,600 Sold for $12,000 (a Gain): Debit Accumulated Depreciation, Equipment ($14,400 remaining) Fixed Asset, Equipment (Capital Cost = $26,000) Cash Gain on Disposition of Fixed Asset Credit $14,400 $26,000 $12,000 _______ $400 $26,400 $26,400 Debit Credit Sold for $8,000 (a Loss): Accumulated Depreciation, Equipment ($14,400 remaining) Fixed Asset, Equipment (Capital Cost = $26,000) Cash Loss on Disposition of Fixed Asset $14,400 $26,000 $8,000 $3,600 ________ $27,184 $27,184 Depreciation and Income Taxes • A company is obligated to minimize the amount of income tax it must pay. • They are allowed to keep two sets of “books”; one for preparing financial statements and one for reporting taxable income. – For financial reporting a less aggressive method will increase a fixed asset’s net book value. – For tax reporting a more aggressive method will increase depreciation expense; decrease taxable income and decrease income taxes. • The lower income taxes are reported on the Income Statement and this improves Net Income. • Deferred Income Taxes is the difference between the two depreciation methods. Accounting for Deferred Taxes For Financial Reports For Tax Reporting Operating Profit less: Depreciation Taxable Income Income Taxes (@40%) Operating Profit less: Depreciation Taxable Income Income Taxes (@40%) Income Tax Liability 168,000 $780,000 250,000 530,000 212,000 Deferred Income Taxes 44,000 $780,000 360,000 420,000 168,000 Income Tax Expense 212,000