Forward looking statements

advertisement

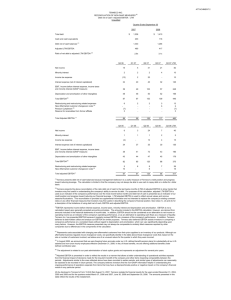

Investor Presentation Q2 2015 Sirius XM Canada Holdings Inc. April, 2015 FORWARD LOOKING STATEMENTS This presentation contains certain information that may constitute forward-looking statements within the meaning of securities laws. In some cases, such statements can be identified by the use of forward-looking terminology such as “expects,” “may,” “will,” “should,” “intend,” “plan,” or “anticipates” or the negative thereof or comparable terminology. Forward-looking statements include estimates, plans, strategies, expectations, opinions, forecasts, projections, targets, expected dividends, guidance, or other statements that are not statements of fact, including with respect future performance. Statements regarding our past performance should not be interpreted as projections or forecasts of future performance. Although SiriusXM Canada believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that such expectations will prove to have been correct, including with respect to the ability of the Company to pay dividends in the future. SiriusXM Canada's forward-looking statements are expressly qualified in their entirety by this cautionary statement. SiriusXM Canada makes no commitment to revise or update any forward-looking statements in order to reflect events or circumstances after the date any such statement is made, except as required by applicable law. Additional information regarding forward-looking information and identifying certain risks and uncertainties is contained in SiriusXM Canada's filings with the Canadian securities regulators, available at www.sedar.com, including SiriusXM Canada’s most recent annual information form and MD&A. Please see the Company’s MD&A filed October 30, 2014 for more details on the Company’s Q4 and FY2014 results and the Company’s MD&A filed April 9, 2015 for more details on the Company’s Q2 fiscal 2015 results. The non-GAAP measures used in this document should be used in addition to, but not as a substitute for, the analysis provided in the audited consolidated statement of operations and comprehensive income. Please see the Company’s MD&A filed April 9, 2015 for complete definition of non-GAAP measures. 2 INVESTMENT HIGHLIGHTS Large subscriber base • Over 2.5 million as of Q2 F2015 Over 120 channels • Unmatched, curated, commercial-free music, talk, news and sports content Long-term agreements with OEMs • Factory-installed in >65% of new cars Long-term growth prospects • • SXM enabled vehicles of 6.5 million to reach 10.5 million by FY18 Pre-owned gaining traction, 71% YoY increase in Gross Adds from pre-owned Consistent and predictable cash flows • Annual dividend of $0.42 (dividend yield of 7%*) * Based on the closing stock price of $6.03 as of April 10, 2015. LARGE SUBSCRIBER BASE Sirius XM is a leading Canadian media subscription business Subscribers (Millions) 2.6 1.9 2.6 2.0 1.8 0.9 0.9 Shaw Telus TV 0.8 Cogeco (TV) Note: Source: Company filings. 0.9 Corus (Movie Central) Videotron (Cable) Shaw Video Rogers (TV) Sirius XM BCE (TV) 4 CONTINUED REVENUE GROWTH $310.7 $303.5 $288.9 $259.6 $238.7 $202.5 2010 2011 2012 2013 2014 LTM Q2FY15 STRONG ADJUSTED EBITDA GROWTH 85.5 79.0 68.7 46.6 26.5 6.6 2010 2011 2012 2013 * Based on Adjusted EBITDA for last 4 reported quarters. Normalized for $16.0 M provision for withholding tax. 2014 LTM Q2FY15* OUR STRATEGIC PRIORITIES Acquire subscribers Retain subscribers More content Technology innovation 7 STRENGTHENED POSITION IN THE NEW VEHICLE MARKET >65% OEM PENETRATION SIRIUS XM INSTALLED IN MORE THAN 250 VEHICLE MODELS MORE THAN 1.2 MILLION VEHICLES EACH YEAR ARE SIRIUSXM-ENABLED LONG-TERM AGREEMENTS WITH OEM MANUFACTURERS BMW MINI 8 NEW AUTO SALES TREND 1.90 1.84 1.80 1.56 1.58 1.66 1.71 1.46 >65%* 64.3% 59.0% 56.6% 54.5% 33.1% 36.4% 2009 2010 2011 2012 New Vehicle Sales (Mil) Source: DesRosiers Automotive Consultants *2015 estimate 2013 2014 SXM Enabled Vehicles 2015F 2016F PRE-OWNED VEHICLE OPPORTUNITY ~ 33% Franchise and CPO programs 2.8M ~ Pre-owned vehicles sold per year ~ 33% Independent dealers ~ 33% Private sales 10 EXPANDED PRE-OWNED VEHICLE PROGRAM 2,000 Franchise dealers* 71% Q2 YoY Increase in gross additions from Pre-Owned 7 Certified pre-owned dealers Partners AMVOQ CarProof * As of end of calendar 2014. 11 MORE VEHICLES SATELLITE RADIO EQUIPPED ~7M satellite radio equipped cars by F2015* * Both new and used 10.5M > satellite radio equipped cars by F2018* 12 THERE’S A SOUND FOR EVERY TASTE 120+ CHANNELS EXCLUSIVE ENTERTAINMENT LIVE PLAYBY-PLAY FROM EVERY MAJOR SPORT COMEDY AND TALK WORLD-CLASS NEWS COMMERCIALFREE MUSIC ANYTIME, ANYWHERE ACCESS SATELLITE RADIO, STREAMING SERVICES… IN-VEHICLE AT HOME AT WORK ON THE GO PERSONALIZED ONLINE STREAMING SERVICE ON-DEMAND SHOW ALERTS START NOW AND TUNE START CAPABILITIES FINANCIAL REVIEW COMPELLING BUSINESS MODEL Recurring revenue subscriber model Powerful operating leverage Modest cap-ex needs High FCF conversion STRONG FREE CASH FLOW Own the content and distribution SUSTAINABLE DIVIDEND 16 SUBSCRIBERS ANNUAL QUARTERLY THOUSANDS THOUSANDS 2,552 2,612 2,388 1,727 1,852 1,769 1,862 F2013 F2014 Q2/14 Q2/15 2,427 Self-paying Paying & non-paying promotional 17 REVENUE ANNUAL* QUARTERLY $ MILLIONS, LTM ENDED FEB 28 $ MILLIONS, QUARTER ENDED FEB 28 310.7 75.5 303.5 F2014 * LTM – Latest 12 Months. LTMQ2/15 Q2/14 80.1 Q2/15 18 ADJUSTED EBITDA ANNUAL QUARTERLY $ MILLIONS, LTM ENDED FEB 28 $ MILLIONS, QUARTER ENDED FEB 28 85.5 22.5 23.3 79.0 F2014 LTMQ2/15* Q2/14 * Based on Adjusted EBITDA for last 4 reported quarters. Normalized for $16.0 M provision for withholding tax. Q2/15 19 Q2 F2015 PER SUBSCRIBER METRICS SELF-PAY ARPU SAC $ QUARTER ENDED FEB 28 $ QUARTER ENDED FEB 28 40 12.48 35 11.92 Q2/14 Q2/15 Q2/14 Q2/15 20 FREE CASH FLOW ANNUAL 1 QUARTERLY $ MILLIONS, LTM ENDED FEB 28 45.9 F2014 1Includes $ MILLIONS, QUARTER ENDED FEB 28 48.2 LTMQ2/15 an adjustment for a $10.4 million call premium payment related to the refinancing of the Company’s debt. 11.3 9.9 Q2/14 Q2/15 21 CONSERVATIVE TOTAL LEVERAGE NET DEBT / ADJUSTED EBITDA 4.5x 2.2x 2.0x 2.0x WELL WITHIN TARGET LEVERAGE RATIO OF LESS THAN 1.4x 3X Adj. EBITDA 2011 2012 2013 2014 LTM Q2/15 22 RETURNED CAPITAL TO SHAREHOLDERS $1.00 PER SHARE PAID IN F2014 128M $ Dividends Paid in F2014 $0.105 QUARTERLY DIVIDEND 23 STRATEGIC OUTLOOK F2015 IS ABOUT PROFITABLE GROWTH TOP-LINE GROWTH PROFITABILITY & STRONG CASH FLOW ADD SUBSCRIBERS OPTIMIZE EXPENSES INCREASE SELF-PAY ARPU STABLE FIXED EXPENSES MANAGE CHURN MANAGE CAPITAL INVESTMENTS 25 INVESTOR VALUE PROPOSITION LEADER IN CANADIAN AUDIO ENTERTAINMENT EXPANDING PRE-OWNED VEHICLE PROGRAM ~2.6 MILLION SUBSCRIBERS >65% PENETRATION WITH VEHICLE OEMS STRONG ADJUSTED EBITDA AND FREE CASH FLOW GROWING REVENUE SUBSTANTIAL OPERATING LEVERAGE MEANINGFUL DIVIDEND 26 APPENDIX CRA UPDATE ONE-TIME FACTORS IMPACTING Q2’15 NET INCOME Normalized Net Income = $9.9M Impacted by one-time items Withholding tax expense = (16.0)M Non Cash Income tax = (19.1)M Reported Net loss = $25.1M (rounded) Excluding, withholding tax expense and non cash income tax expense, Net Income Q2’15 was $9.9M from $6.2M, increase of 60% or $3.7M Q2 AND YTD 2015 INCOME STATEMENT P&L (in $000s) Q2 2015 Q2 2014 B/(W) Total Revenue $80,086 $75,466 $4,619 $159,071 Operating Expenses Cost of Revenue Revenue Share & Royalties Customer Care & Billing Ops Cost of Merchandise Broadcast and Programming Total Cost of Revenue $24,806 $5,009 $1,228 $3,771 $34,814 $21,199 $4,967 $1,109 $3,781 $31,056 ($3,607) ($42) ($119) $10 ($3,758) $48,399 $10,200 $2,385 $6,746 $67,731 General & Admin Information Technology $2,997 $2,155 $ 2,393 $2,085 ($603) ($70) $5,955 $4,058 $ 5,161 $4,518 ($794) $461 Marketing Support Subsidies & Distribution Advertising & Marketing Total Marketing $2,166 $8,189 $6,436 $16,790 $2,142 $9,069 $6,215 $17,427 ($24) $880 ($220) $636 $4,165 $18,065 $12,863 $35,094 $4,638 $19,089 $12,550 $36,277 $472 $1,024 ($313) $1,183 Adjusted EBITDA Stock Based Compensation PPA Withholding Tax EBITDA $23,331 $938 $1 $16,000 $6,392 $22,523 $809 $497 ($441) $17 $16 $0 ($16,000) $22,009 ($15,617) $46,238 $2,244 $4 $16,000 $27,990 $43,942 $2,296 $1,360 ($884) $48 $44 $0 ($16,000) $42,535 ($14,544) YTD 2015 YTD 2014 $151,902 B/(W) $7,168 $43,441 ($4,958) $9,782 ($417) $2,084 ($301) $6,745 ($2) $62,052 ($5,679) Q2 AND YTD 2015 RECONCILLIATION Adjusted EBITDA: Reconciliation In ($ 000’s) Income/(Loss) before taxes Interest expense & income Foreign exchange gain(loss) & other Amortization EBITDA Withholding tax expense Stock-based compensation Fair value adjustments Adjusted EBITDA Q2 2015 Q2 2014 (1,951) 8,650 9,613 15,505 3,864 6,056 7,575 124 243 189 295 5,190 9,252 12,132 19,159 6,392 22,009 27,990 42,534 16,000 - 16,000 - 938 497 2,244 1,360 1 17 4 48 23,331 22,523 46,238 43,942 3,029 YTD 2015 YTD 2014