Homework #5

advertisement

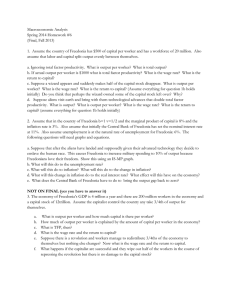

Macroeconomic Analysis Final Fall 2014 1. For the following question, assume that the economy starts out at potential and the inflation rate is 2%, unemployment is 6% and the marginal product of capital is 3%. Also assume that b= 1 and v=1/2. You will need to draw graphs where appropriate a. What is the nominal interest rate? b. Suppose the Fed becomes worried about inflation. If the Federal Reserve increases the nominal interest rate by 1%, what will happen to output, employment and inflation? c. Ignore question 1b. If there is an increase in investment equal to 2% of GDP what will happen to output, employment and inflation? Does this seem to you like a problem that needs to be solved? 2. Suppose the economy of Freedonia has a capital stock of $2000 per worker and the country has 10 workers. Also assume that in Freedonia workers and the owners of capital split output evenly. a. b. c. d. e. f. g. 3. If only the capital stock matters how much is output per worker? How much is total output of Freedonia? Suppose output is $1000 per worker. What is total factor productivity? What is the wage rate and what is the return on capital? If a war with Sylvania devastates the country’s capital stock and capital per worker falls to $1500. What will output per worker be? What will the return to capital and the wage rate be now? Suppose, alternatively, the war is not fought on Freedonian soil and so does not damage the countries capital stock. However, the war does kill half the workers. What would output per worker be now? What would the wage rate and the return on capital be now? If the people of Freedonia decide to spend more money on planes and guns and tanks, which will reduce the proportion of output they save what should happen to output, consumption and investment according to the Solow model?