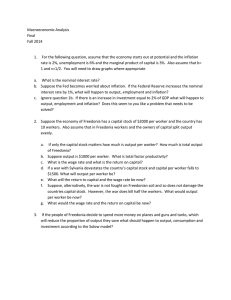

Economics Exam Questions: Growth, Solow Model, Macro Equilibrium

advertisement

1. According to Robert Lucas’s article Industrial Revolution: Past and Future, up to about two centuries ago, the per capita incomes in all societies were stagnated at around: a. $200 to $600 per year b. $400 to $800 per year c. $600 to $1,000 per year d. $800 to $1,200 per year e. $1,200 to $1,600 per year 2. Suppose an average Australian consumes 20 units of food and 10 units of clothing every year. For an average Bangladeshi, the consumptions of food is 25 units and clothing is 5 units per year. In Australia, the price of food is AUD10 per unit and the price of clothing is AUD20. In Bangladesh, the price of food is 312 Takas per unit, and the price of clothing is 600 Takas per unit. The market exchange rate is given AUD1 = 63 Takas. Using the purchasing power parity method, what is the expenditure of an average Bangladeshi in AUD? a. AUD194 b. AUD171 c. AUD350 d. AUD400 e. AUD450 3. Given the production function is: q=4L0.5+4K, where L is the quantity of labour, K is the quantity of capital and q is the quantity of output. This production function exhibits: a. Constant returns to scale, constant returns to capital and constant returns to labour. b. Increasing returns to scale, decreasing returns to capital and constant returns to labour. c. Decreasing returns to scale, decreasing returns to capital and constant returns to labour. d. Constant returns to scale, constant returns to capital and decreasing returns to labour. e. Decreasing returns to scale, constant returns to capital and decreasing returns to labour. 4. If output per capita grows by a constant 6% per year, then the standard of living would grow by about ________ over 3 years. a. 12% b. 17% c. 18% d. 19% e. 20% 5. According to Robert Lucas’s article Industrial Revolution: Past and Future, What occurred around 1800 that is new, that differentiates the modern age from all previous periods, is: a. Technological progress b. Increases in population c. Reduction in fertility d. Reduction in income inequality among countries e. Both technological progress and reduction in fertility 6. Over the past fifty years, convergence has generally occurred for all of the following groups of countries with the exception of: a. The European Union countries b. The African and Latin American countries c. The 'four tigers' in Asia. OECD countries. d. The high income countries 7. According to the Solow Model without technological progress and population growth, an increase in the saving rate leads to all of the followings EXCEPT: a. Without technological progress, output per worker will eventually stop growing in the long run. b. A temporary increase in the growth rates of output per worker and capital per worker. c. A permanent decrease in the level of consumption per worker. d. A permanent increase in the levels of output per worker and capital per worker. e. Investment must equal to depreciation in the new steady state. 8. Suppose the production function is given by Y=2√𝐾√𝑁where Y is the amount of output, K is the amount of capital, and N is the number of worker. Suppose further that there are no technological progress and population growth. What is the steady-state output per worker given the saving rate is 0.15 and the deprecation rate is 0.1? a. 3 b. 6 c. 9 d. 12 e. All the answers listed here are incorrect. 9. Suppose the production function is given by Y=2√𝐾√𝑁where Y is the amount of output, K is the amount of capital, and N is the number of worker. Suppose further that there are no technological progress and population growth. What is the expression in terms of the saving rate, s, and the depreciation rate, for the level of consumption per worker in the steady state? 4𝑠(1−𝑠) 𝛿 10. According to the Solow Model, an economy cannot rely on increasing the amount of capital to increase the growth rate of output per worker in the long run because: a. We need to consume a part of our output. b. Capital is subject to decreasing returns. c. Depreciation is equal to investment in the steady state. d. Saving is equal to investment in the steady state. e. We have a limited supply of workers. 11. In the Solow Model without technological progress and population growth, which of the following condition does not characterize the steady state? a. There will be zero capital accumulation once the steady state is reached. b. Investment must be equal to depreciation. c. Capital per worker will increase if it is below the steady-state level of capital per worker. d. Output per worker remains unchanged in the steady state. e. Consumption per worker reaches its maximum in the steady state. 12. In the Solow Model without technological progress and population growth, an increase in the depreciation rate will, a. Decrease the levels of capital per worker and output per worker permanently. b. Decrease the growth rates of capital per worker and output per worker permanently. c. Increase the levels of capital per worker and output per worker permanently. d. Increase the growth rates of capital per worker and output per worker permanently. e. Decrease the level of capital per worker, but leave the level of output per worker unchanged in the long run. 13. For a poor developing economy, which of the following should contribute most to increasing the economy’s output per worker? (1.5 marks) a. Increasing the proportion of population acquiring a PhD degree b. Increasing the proportion of population acquiring a Master degree c. Increasing the proportion of population acquiring a secondary education d. Increasing the proportion of population that can read and write e. Increasing the proportion of population speaking and writing English 14. According to the Solow model discussed in 12.1, output per effective worker on the balanced growth path is: (1.5 marks) a. Growing at the rate of technological progress plus the rate of labour force growth (gA + gN) b. Growing at the rate of technological progress (gA) c. Growing at the rate of labour force growth (gN) d. Growing at the rate of output growth (gY) e. Constant 15. According to the Solow model discussed in 12.1, output per worker on the balanced growth path is: (1.5 marks) a. Growing at the rate of technological progress plus the rate of labour force growth (gA + gN) b. Growing at the rate of technological progress (gA) c. Growing at the rate of labour force growth (gN) d. Growing at the rate of output growth (gY) e. Constant 2 16. Suppose that the economy’s production function is 𝑌 = 𝐾 3 (𝐴𝑁)1/3 and that the saving rate, s, is equal to 20% and that the rate of depreciation, ߜ , is equal to 10%. Further, suppose that the number of workers grows at 2% per year and that the rate of technological progress is 4% per year. The steadystate value of output per effective worker is: (2.5 marks) a. 1.08 b. 1.25 c. 1.56 d. 1.95 e. All the answers here are incorrect 17. According to the Solow model discussed in 12.1, a reduction in the growth rate of the labour force keeping all other things constant leads to: (1.5 marks) a. An increase in the steady-state level of output per effective worker b. No change in the growth rate of output per worker on the balanced growth path c. No change in the growth rate of capital per worker on the balanced growth path d. A reduction in the growth rate of output on the balanced growth path e. All the answers here are correct 18. According to the Solow model discussed in 12.1, a reduction in the growth rate of technological progress keeping all other things constant leads to: (1.5 marks) a. A reduction in the steady-state level of output per effective worker b. A reduction in the growth rate of output per worker on the balanced growth path c. No change in the growth rate of output on the balanced growth path d. No change in the growth rate of capital on the balanced growth path e. All the answers here are correct 19. The paradox of saving tells us that if everyone starts to reduce consumption, saving in the economy in the short run will: (1.5 marks) a. Increase b. Decrease and then increase c. Decrease d. Not change e. Be uncertain 20. Which of the following is NOT a condition of equilibrium in the goods market in a closed economy? (1.5 marks) a. All of the answers here are equilibrium conditions in the goods market b. S = I + G – T c. Y = C + I + G d. I = (1 – c1)*(Y – T) + (T – G) – c0 e. Y = [c0 + I + G – c1*T] + c1*Y 21. A closed economy is described by the following behavioral equations: C = c0 + c1.YD T = t0 t1 Y YD = Y T where c0 = 480, c1 = 0.5, t0 = 80, t1 = 0.25, G = 120 and I = 50. When the government increases its spending, G, by 30, how much does the equilibrium output, Y*, increase? a. 34 b. 48 c. 60 d. 81 e. All the answers here are incorrect 22. Which of the following is an example of automatic stabilizers? (1.5 marks) a. The government cuts spending to balance the budget during recession b. The government cuts tax during a recession c. The government builds a new high school d. The government decides to increase military spending e. All of the answers here are not automatic stabilizers 23. A closed economy is described by the following behavioral equations: C = c0 + c1.YD T = t0 t1 Y YD = Y T where c0 = 480, c1 = 0.5, t0 = 80, t1 = 0.25, G = 120 and I = 50. What is the equilibrium output, Y*, for this economy? a. 695 b. 976 c. 1,220 d. 1,627 e. All the answers here are incorrect 24. If the government is required to balance its budget in every financial year, the effect of this policy on the economy in the short run will be: (1.5 marks) a. Stabilizing the business cycle as the government needs to cut spending during booms and increase spending during recessions. b. Destabilizing the business cycle as the government needs to cut spending during booms and increase spending during recessions. c. Stabilizing the business cycle as the government needs to increase spending during booms and cut spending during recessions. d. Destabilizing the business cycle as the government needs to increase spending during booms and cut spending during recessions. e. All of the answers here are incorrect 25. Which one of the followings is included in the central bank money? (1.5 marks) a. All of the answers here are NOT central bank money b. Checkable deposits c. Bank loans d. Currency in circulation e. Treasury bills 26. Suppose the public holds 20% of their money as currency and the rest as deposits in their banks. Moreover, the central bank requires banks to maintain a reserve-deposit ratio of 10%. What will be the change in the total money supply if the central bank buys $5 million of government bonds from the public and pays for them by creating money? (2.0 marks) a. The money supply will decrease by $25.0 million b. The money supply will decrease by $16.7 million c. The money supply will increase by $17.9 million d. The money supply will increase by $50.0 million e. The money supply will increase by $62.5 million 27. In the financial markets, if the interest rate is higher than the equilibrium interest rate that equates money demand (Md ) and money supply (Ms ), we can say that: (1.5 marks) a. All of the answers here are incorrect b. The central bank has to increase the money supply to return the markets to equilibrium c. The markets have excess supply of bonds d. The markets have excess demand for bonds e. The markets have excess demand for money 28. The following are the money demand and money supply functions in an economy. Md= 40000(0.2 - i) and MS =6000. What is the equilibrium interest rate? a. 2% b. 5% c. 10% d. 15% e. All of the answers here are incorrect 29. Suppose that a person’s wealth is $100,000 and that her yearly income is $50,000. Also suppose that her money demand function is given by Md= $Y(0.35 – i) Suppose the interest rate increases by 5 percentage points. Her demand for bonds: a. Decreases by $8,500 b. Increases by $2,500 c. Increases by $5,000 d. Increases by $8,500 e. All of the answers here are incorrect 30. Which one of the followings best describes a contractionary open market operation carried out by the central bank? a. All of the answers here are incorrect b. Buying government bonds from the public leads to an increase in the money supply with a decrease in the price of bonds and an increase in the interest rate c. Buying government bonds from the public leads to an increase in the money supply with an increase in the price of bonds and a decrease in the interest rate d. Selling government bonds to the public leads to a reduction in the money supply with a decrease in the price of bonds and an increase in the interest rate e. Selling government bonds to the public leads to a reduction in the money supply with an increase in the price of bonds and a decrease in the interest rate 31. According to Glenn Stevens, which one of the following statements is correct? a. All of the answers here are incorrect. b. Fine-tuning fiscal policy for stabilizing the business cycle is easier than fine-tuning monetary policy for stabilizing the business cycle. c. Unlike fiscal policy, monetary policy is a precise instrument. d. Monetary policy has its full effects with a long lag, but its direction can be reversed quickly. e. Implementation of monetary policy for stabilizing the business cycle usually involves more time delay than that of fiscal policy. 32. The cash flow channel of monetary policy refers to the effect of monetary policy on: a. All of the answers here are incorrect b. Investor risk preference c. Mortgage payments by households d. The costs of debts for firms e. Household saving rate 33. Consider the goods market model where C = c0 + c1.YD I = b0 b1 Y –b2.i YD = Y T And G and T are given. Assuming c0= 100, c1=0.6, b0= 150, b1=0.2 and b2=1000. Keeping all other things constant, what will be the change in the equilibrium output (Y*) in the goods market if G is increased by $100? a. $100 b. $125 c. $250 d. $500 e. All of the answers here are incorrect 34. If the government and the central bank both desire to achieve simultaneously the policy goals of increasing the level of investment, decreasing the level of consumption, and keeping the level of output, Y, constant, they should conduct: a. Expansionary monetary alone is sufficient to achieve all of the policy goals b. Both monetary and fiscal policies should be expansionary c. Expansionary fiscal but contractionary monetary policies d. Expansionary monetary but contractionary fiscal policies e. Both monetary and fiscal policies should be contractionary 35. Consider the following numerical example of the IS-LM model: C = 100 + 0.3.YD I = 200 + 0.2Y – 1000i T = 100 G = 200 i = 0.01 What is the equilibrium level of output? a. 730 b. 820 c. 920 d. 1,040 e. All of the answers here are incorrect 36. When the economy is at a point below the IS curve but above the LM curve, this economy has a. Excess supplied of both goods and money b. Excess demand for goods but excess supplied of money c. Excess supplied of goods but excess demand for money d. Excess demand for both goods and money e. Excess demand for goods but the money market is in equilibrium 37. If the nominal interest rate, i, is 5%, and expected inflation equal, 𝜋 𝑒 , is 2%, the real interest rate using the exact formula is? a. 0.75% b. 2.8% c. 2.9% d. 3.0% e. 3.1% 38. A commercial bank has a balance sheet: Assets: $120 Liabilities: $100 Capital: $20 Suppose the expected rate of return on assets is 5% and the expected rate of return on liabilities is 4%. This bank’s expected profit per dollar of capital invested is: a. 2% b. 4.2% c. 7% d. 9% e. All of the answers here are incorrect 39. What is the risk premium demanded by bond holders if the return on the riskless bond is 5%, and the probability of default is 3%? a. 1.4% b. 2.0% c. 2.8% d. 3.3% e. 3.7% 40. If the expected rate of inflation were to decrease from 5% to 3%, according to the extended IS-LM model discussed in Section 6-4, a. The IS curve shifts to the left b. The IS curve shifts to the right c. The LM curve shifts downward d. The LM curve shifts upward e. Both IS and LM curves remain unchanged 41. If the risk premium is 2%, the nominal borrowing rate is 7% and the real borrowing rate is 4%, what is the real policy rate? (You can use the approximation equation for calculating the real interest rate) a. 1% b. 2% c. 3% d. 4% e. 5% 42. Which one of the following statements is correct for describing a financial crisis? a. A high cost of borrowing b. A dramatic decrease in confidence c. A high risk premium demanded by investors d. A high degree of risk aversion among investors e. All of the answers here are correct 43. Suppose the population over age fifteen is 100 million, the unemployment rate is 8 percent, and there are 70 million employed. What is the participation rate (round to the nearest whole number)? a. 70% b. 72% c. 74% d. 76% e. 78% 44. Suppose the actual unemployment rate decreases. This will cause a. An upward shift in the WS curve b. A downward shift in the WS curve c. An upward shift in the PS curve d. A downward shift in the PS curve e. All of the answers here are incorrect 45. Given the average monthly outflow from unemployment to employment is 0.6 million, the average monthly outflow from unemployment to out of the labor force is 0.5 million, the total number of unemployed workers is 5.5 million, the total number of employed workers is 45.5 million, and the total number of people out of the labor force is 25 million. What is the average duration of unemployment (round to the nearest whole number)? a. 5 months b. 8 months c. 23 months d. 41 months e. All of the answers here are incorrect 46. If the government increases the sales tax, according to the WS-PS model, this increase in sales tax will lead to: a. The natural rate of unemployment remains unchanged b. PS will shift downward and the natural rate of unemployment will increase c. PS will shift upward and the natural rate of unemployment will decrease d. WS will shift upward and the natural rate of unemployment will increase e. WS will shift downward and the natural rate of unemployment will decrease 47. If the level of competition decreases in the goods market, according to the WS-PS model, this decrease in competition will lead to: a. PS will shift downward and the natural rate of unemployment will increase b. PS will shift upward and the natural rate of unemployment will decrease c. The natural rate of unemployment remains unchanged d. WS will shift downward and the natural rate of unemployment will decrease e. WS will shift upward and the natural rate of unemployment will increase 48. Sam is a “discouraged” worker. Sam is thus: a. Being counted as a member of unemployed workers b. Not actively seeking work c. Being counted as a member of the labor force d. Not willing to accept a job if there is one available for him e. All of the answers here are correct 49. For this question, assume that the expected rate of inflation is a function of past year's inflation. Also assume that the unemployment rate has been less than the natural rate of unemployment for a number of years. Given this information, we know that a. The rate of inflation will approximately be equal to zero b. The inflation rate will be approximately equal to the natural rate of unemployment c. The rate of inflation should neither increase nor decrease d. The rate of inflation should steadily increase e. The rate of inflation should steadily decrease over time 50. Which one of the following equations most appropriately describes the original Phillips Curve relationship between inflation and the unemployment rate a. 𝜋𝑡 = 𝜋𝑡−1 + (𝑚 + 𝑧) − 𝛼𝑢𝑡 b. 𝜋𝑡𝑒 = (1 − 𝜃)𝜋̅ + 𝜃𝜋𝑡−1 − 𝛼𝑢𝑡 c. 𝜋𝑡 = 𝜋̅ + (𝑚 + 𝑧) − 𝛼𝑢𝑡 d. 𝜋𝑡 = 𝜋𝑡𝑒 + (𝑚 + 𝑧) − 𝛼𝑢𝑡 e. All of the answers here are incorrect 51. Suppose that the Phillips curve is given by 𝜋𝑡 = 𝜋𝑡𝑒 + 0.12 − 2𝑢𝑡 and expected inflation is given by 𝜋𝑡𝑒 = 𝜋̅, where 𝜋̅ is constant at 2%. Suppose that the rate of unemployment is initially equal to the natural rate. In year t, the authorities decide to bring the unemployment rate down to 3% and hold it there forever. What is the inflation rate at t + 3? a. 6% b. 8% c. 14% d. 20% e. 26% 52. Suppose that the Phillips curve is given by 𝜋𝑡 = 𝜋𝑡𝑒 + 0.12 − 2𝑢𝑡 and expected inflation is given by 𝜋𝑡𝑒 = 𝜋𝑡−1 . Suppose that the rate of unemployment is initially equal to the natural rate. In year t, 𝜋𝑡−1 is assumed to be 2% and the authorities decide to bring the unemployment rate down to 3% and hold it there forever. What is the inflation rate at t + 3? a. 6% b. 8% c. 14% d. 20% e. 26% 53. Which one of the following statements is correct? a. If the inflation rate does not change, the unemployment rate should be equal to the natural rate of unemployment b. If inflation is very persistent, people are most likely to expect future inflation to be the same as the last period’s inflation c. According to the original Phillips Curve, policymakers are able to reduce unemployment by accepting a higher rate of inflation d. The modified Phillips curve is the relationship between the change in the inflation rate and the unemployment rate e. All of the answers here are correct 54. The inventor of the Phillips Curve, A. W. Phillips, was a: a. Australian b. New Zealander c. American d. Canadian e. English 55. In the short run, a reduction in the price of oil will cause a. A reduction in output b. An increase in the price level c. A reduction in the interest rate d. An increase in the natural rate of unemployment e. All of the answers here are incorrect 56. Suppose the Okun’s Law is: u- u(-1) = -0.5(gy – 3%). What should be the growth rate of output, gy, if the unemployment rate, u, is to be reduced by 1%? a. 0.5% b. 2% c. 3% d. 5% e. All of the answers here are incorrect 57. Suppose the economy is initially in the medium run equilibrium. Then the government implements an expansionary fiscal policy by reducing taxes. If people’s expectations of inflation are anchored, what will be the policy interest rate, consumption, investment, output and inflation compared to their initial values when the medium run equilibrium is restored again in the economy? a. The policy rate of interest has increased, consumption has decreased, investment has increased, but both output and inflation return to their initial values b. The policy rate of interest has decreased, consumption has increased, investment has increased, but both output and inflation return to their initial values c. The policy rate of interest has increased, consumption has increased, investment has decreased, and both output and inflation are higher than their initial values d. The policy rate of interest has increased, consumption has increased, investment has decreased, but both output and inflation return to their initial values e. The policy rate of interest has decreased, consumption has increased, investment has decreased, and both output and inflation are lower than their initial values 58. Which one of the following statements best describes “deflation spiral”? a. The central bank has already reduced the real policy rate of interest to 0%, but the nominal policy rate of interest remains high because expected inflation is very low b. The central bank has already reduced the real policy rate of interest to 0%, but the nominal policy rate of interest remains high because expected inflation is very high c. The central bank has already reduced the nominal policy rate of interest to 0%, but the real policy rate of interest remains high because expected inflation is very low d. The central bank has already reduced the nominal policy rate of interest to 0%, but the real policy rate of interest remains high because expected inflation is very high e. All of the answers here are incorrect 59. Suppose the economy is initially in the medium run equilibrium. Then the government implements an expansionary fiscal policy by increasing government spending. If the level of expected inflation is formed so 𝜋 𝑒 equals to 𝜋𝑡−1 , what should the central bank do in order to restore the inflation rate back to its original value? a. The central bank has to reduce output to potential output so that inflation can be reduced to its original value b. The central bank needs to create a recession so that inflation can be reduced to its original value c. The central bank needs to increase output to potential output so that inflation can return to its original value d. The central bank needs to create a boom so that inflation can return to its original value e. All of the answers here are incorrect 60. It is easier for the central bank to keep output at potential output if expectations of inflation are: a. Based on the last period’s inflation b. Changing from one period to the next c. Based on changes in the policy rate of interest d. Anchored e. All of the answers are incorrect 61. A closed economy is described by the following behavioral equations: C = c0 + c1.YD T = t0 t1 Y YD = Y T where c0 = 500, c1 = 0.8, t0 = 50, t1 = 0.4, G = 150 and I = 50. When the government increases its spending, G, by 20, how much does the equilibrium output, Y*, increase? a. 29.4 b. 33.3 c. 38.5 d. 100 e. All the answers here are incorrect 62. Suppose the production function is given by 𝑌 = √𝐾. √𝑁 where Y is the amount of output, K is the amount of capital, and N is the number of worker. Suppose further that there are no technological progress and population growth. What is the steady-state output per worker given the saving rate is 0.2 and the deprecation rate is 0.1? a. 0.25 b. 0.5 c. 2 d. 4 e. All the answers listed here are incorrect. 63. According to Lucas, prior to 1950, European colonialism brought: a. Advances in technology to much of the colonized world b. Increases in the living standards of masses of people to the colonized world c. Reductions in population to much of the colonized world d. Both a. and b e. Both a. and c 64. When the economy is at a point above the IS curve but below the LM curve, this economy has: a. Excess supplied of goods but excess demand for money b. Excess demand for goods but excess supplied of money c. Excess demand for both goods and money d. Excess supplied of both goods and money e. Excess demand for goods but the money market is in equilibrium 65. Which one of the followings is NOT a transmission channel for monetary policy as mentioned by Glenn Stevens in his speech? a. Home loan mortgage channel b. Cash flow channel that affects business c. Inter-temporal decision-making between consumption and saving d. Exchange rate channel e. All of the answers here are transmission channels as mentioned by Glenn Stevens 66. Which of the following is an example of automatic stabilizers? a. The government builds a new high school b. The government cuts tax during a recession c. The government cuts spending to balance the budget during recession d. Workers are entitled to receive payments from the government when they become unemployed e. All of the answers here are not automatic stabilizers 67. Suppose that Judy’s wealth is $100,000 and that her yearly income is $60,000. Also suppose that her money demand function is given Md= $Y.(0.35 - i) If the interest rate is 3%, how much is her total demand for bonds? a. $1,800 b. $6,100 c. $79,000 d. $80,800 e. All of the answers here are incorrect 68. According to the Solow model with technological progress and population growth, an increase in the growth rate of the labor force keeping all other things constant leads to: a. An increase in the steady-state level of output per effective worker b. An increase in the growth rate of output per worker on the balanced growth path c. An increase in the growth rate of capital per worker on the balanced growth path d. A reduction in the growth rate of output on the balanced growth path e. All the answers here are incorrect 69. Suppose the public holds 30% of their money as currency and the rest as deposits in their banks. Moreover, the central bank requires banks to maintain a reserve-deposit ratio of 10%. What will be the change in the total money supply if the central bank buys $10 million of government bonds from the public and pays for them by creating money? a. The money supply will decrease by $14.3 million b. The money supply will decrease by $25 million c. The money supply will increase by $27 million d. The money supply will increase by $33.3 million e. The money supply will increase by $100 million 70. Suppose an average Australian consumes 20 units of food and 10 units of clothing every year. For an average Bangladeshi, the consumptions of food is 25 units and clothing is 5 units per year. In Australia, the price of food is AUD10 per unit and the price of clothing is AUD20. In Bangladesh, the price of food is 312 Takas per unit, and the price of clothing is 600 Takas per unit. The market exchange rate is given AUD1 = 63 Takas. Using the market exchange rate method, what is the expenditure of an average Bangladeshi in AUD? a. AUD171 b. AUD194 c. AUD350 d. AUD400 e. AUD450