Lecture 21

advertisement

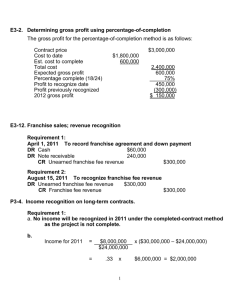

PART II: Corporate Accounting Concepts and Issues Lecture 21 Revenue Recognition: Completed Contract Method Instructor Adnan Shoaib 1 Learning Objectives 2 1. Apply the completed-contract method for long-term contracts. 2. Identify the proper accounting for losses on long-term contracts. 3. Describe the installment-sales method of accounting. 4. Explain the cost-recovery method of accounting. Revenue Recognition Current Environment Guidelines for revenue recognition Departures from sale basis 3 Revenue Recognition at the Point of Sale Sales with discounts Sales with right of return Sales with buybacks Bill and hold sales Principal-agent relationships Trade loading and channel stuffing Multiple-deliverable arrangements Revenue Recognition before Delivery Percentage-ofcompletion method Completedcontract method Long-term contract losses Disclosures Completion-ofproduction basis Revenue Recognition after Delivery Installment-sales method Cost-recovery method Deposit method Summary of bases Revenue Recognition Before Delivery Completed Contract Method Companies recognize revenue and gross profit only at point of sale—that is, when the contract is completed. Under this method, companies accumulate costs of long-term contracts in process, but they make no interim charges or credits to income statement accounts for revenues, costs, or gross profit. 4 LO 1 Apply the completed-contract method for long-term contracts. Completed Contract Method Illustration: Casper Construction Co. Contract price Cost incurred current year Estimated cost to complete in future years Billings to customer current year Cash receipts from customer Current year 2010 $675,000 150,000 2011 $675,000 287,400 2012 $675,000 170,100 450,000 135,000 170,100 360,000 0 180,000 112,500 262,500 300,000 A) Prepare the journal entries for 2010, 2011, and 2012. 5 LO 3 Apply the percentage-of-completion method for long-term contracts. Completed Contract Method Illustration: 2010 2011 2012 $ 150,000 $ 437,400 $ 607,500 Estimated cost to complete 450,000 170,100 Est. total contract costs 600,000 607,500 Costs incurred to date Est. percentage complete 25.0% 72.0% 100.0% Contract price 675,000 675,000 675,000 Revenue recognizable 168,750 486,000 675,000 (168,750) (486,000) Rev. recognized prior year Rev. recognized currently 168,750 317,250 189,000 Costs incurred currently (150,000) (287,400) (170,100) Gross profit recognized 6 607,500 $ 18,750 $ 29,850 $ 18,900 LO 3 Apply the percentage-of-completion method for long-term contracts. Completed Contract Method Illustration: 2010 150,000 150,000 2011 287,400 287,400 2012 170,100 170,100 Accounts receivable Billings on contract 135,000 360,000 180,000 Cash Accounts receivable 112,500 Construction in progress Cash 135,000 360,000 262,500 112,500 180,000 300,000 262,500 300,000 Construction in progress Construction expense Construction revenue 67,500 607,500 Billings on contract Construction in progress 675,000 7 675,000 675,000 LO 1 Apply the completed-contract method for long-term contracts. Completed Contract Method Illustration: Income Statement Revenue on contracts Cost of construction Gross profit Balance Sheet (12/31) Current assets: Accounts receivable Cost & profits > billings Current liabilities: Billings > cost & profits 8 2010 $ - 22,500 15,000 2011 $ - 120,000 2012 $ 675,000 607,500 67,500 - 57,600 LO 1 Apply the completed-contract method for long-term contracts. Completed Contract and Percentage-ofCompletion Methods Compared 9 Accounting for the Cost of Construction and Accounts Receivable With both the completed contract and percentage-ofcompletion methods, all costs of construction are recorded in an asset account called construction in progress. 10 Gross Profit Recognition—General Approach In both methods the same amounts of revenue, cost, and gross profit are recognized. 11 In both methods we add gross profit to the construction in progress asset. Gross Profit Recognition—General Approach The same journal entry is recorded to close out the billings on construction contract and construction in progress accounts under the completed contract and percentage-of-completion methods. 12 Timing of Gross Profit Recognition Under the Completed Contract Method Under the completed contract method, all revenues and expenses related to the project are recognized when the contract is completed. 13 Timing of Gross Profit Recognition Under the Percentage-of-Completion Method Using the percentage-of-completion method, we recognize a portion of the estimated gross profit each period based on progress to date. We determine the amount of gross profit recognized in each period using the following logic: 14 Percentage-of-Completion Method Allocation of Gross Profit 15 Percentage-of-Completion Method Allocation of Gross Profit Notice that the gross profit recognized in each period is added to the construction in progress account. 16 Percentage-of-Completion Method Allocation of Gross Profit The income statement for each year will report the appropriate revenue and cost of construction amounts. 17 Income Recognition The same total amount of profit or loss is recognized under both the completed contract and the percentage-ofcompletion methods, but the timing of recognition differs. 18 Balance Sheet Recognition Billings on construction contract are subtracted from construction in progress to determine balance sheet presentation. 19 CIP > Billings Asset Billings > CIP Liability Balance Sheet Recognition The balance in the construction in progress account differs between methods because of the earlier gross profit recognition that occurs under the percentage-ofcompletion method. 20 Revenue Recognition Before Delivery Long-Term Contract Losses Loss in the Current Period on a Profitable Contract ► Percentage-of-completion method only, the estimated cost increase requires a current-period adjustment of gross profit recognized in prior periods. Loss on an Unprofitable Contract ► Under both percentage-of-completion and completed- contract methods, the company must recognize in the current period the entire expected contract loss. 21 LO 2 Identify the proper accounting for losses on long-term contracts. Long-Term Contract Losses Illustration: Loss on Profitable Contract Casper Construction Co. Contract price Cost incurred current year Estimated cost to complete in future years Billings to customer current year Cash receipts from customer Current year 2010 $675,000 150,000 2011 $675,000 287,400 2012 $675,000 215,436 450,000 135,000 215,436 360,000 0 180,000 112,500 262,500 300,000 b) Prepare the journal entries for 2010, 2011, and 2012 assuming the estimated cost to complete at the end of 2011 was $215,436 instead of $170,100. 22 LO 2 Identify the proper accounting for losses on long-term contracts. Long-Term Contract Losses Illustration: Loss on Profitable Contract 2010 2011 2012 $ 150,000 $ 437,400 $ 652,836 Estimated cost to complete 450,000 215,436 Est. total contract costs 600,000 652,836 Costs incurred to date Est. percentage complete 25.0% 67.0% 100.0% Contract price 675,000 675,000 675,000 Revenue recognizable 168,750 452,250 675,000 (168,750) (452,250) Rev. recognized prior year Rev. recognized currently 168,750 283,500 222,750 Costs incurred currently (150,000) (287,400) (215,436) Gross profit recognized 23 652,836 $ 18,750 $ (3,900) $ 7,314 LO 2 Identify the proper accounting for losses on long-term contracts. Long-Term Contract Losses Illustration: Loss on Profitable Contract 2010 Construction in progress Construction expense Construction revenue Construction in progress Construction expense Construction revenue 24 2011 2012 18,750 150,000 7,314 215,436 168,750 222,750 3,900 287,400 283,500 LO 2 Identify the proper accounting for losses on long-term contracts. Long-Term Contract Losses Illustration: Loss on Unprofitable Contract Casper Construction Co. Contract price Cost incurred current year Estimated cost to complete in future years Billings to customer current year Cash receipts from customer Current year 2010 $675,000 150,000 2011 $675,000 287,400 2012 $675,000 246,038 450,000 135,000 246,038 360,000 0 180,000 112,500 262,500 300,000 c) Prepare the journal entries for 2010, 2011, and 2012 assuming the estimated cost to complete at the end of 2011 was $246,038 instead of $170,100. 25 LO 2 Identify the proper accounting for losses on long-term contracts. Long-Term Contract Losses Illustration: Loss on Unprofitable Contract 2010 2011 2012 $ 150,000 $ 437,400 $ 683,438 Estimated cost to complete 450,000 246,038 Est. total contract costs 600,000 683,438 Costs incurred to date Est. percentage complete 25.0% 683,438 64.0% 100.0% Contract price 675,000 675,000 675,000 Revenue recognizable 168,750 432,000 675,000 (168,750) (432,000) Rev. recognized prior year Rev. recognized currently 168,750 263,250 243,000 Costs incurred currently (150,000) (290,438) (243,000) Gross profit recognized $ 18,750 $ (27,188) $ $675,000 – 683,438 = (8,438) cumulative loss 26 - Plug LO 2 Identify the proper accounting for losses on long-term contracts. Long-Term Contract Losses Illustration: Loss on Unprofitable Contract 2010 Construction in progress Construction expense Construction revenue Construction in progress Construction expense Construction revenue 27 2011 2012 18,750 150,000 243,000 168,750 243,000 27,188 290,438 263,250 LO 2 Identify the proper accounting for losses on long-term contracts. Long-Term Contract Losses Illustration: Loss on Unprofitable Contract For the Completed-Contract method, companies would recognize the following loss : 2010 Loss on construction contract Construction in progress 28 2011 2012 8,438 8,438 LO 2 Identify the proper accounting for losses on long-term contracts. Revenue Recognition Before Delivery Disclosures in Financial Statements Construction contractors should disclosure: the method of recognizing revenue, the basis used to classify assets and liabilities as current (nature and length of the operating cycle), 29 the basis for recording inventory, the effects of any revision of estimates, the amount of backlog on uncompleted contracts, and the details about receivables. LO 2 Identify the proper accounting for losses on long-term contracts. Revenue Recognition Before Delivery Completion-of-Production Basis In certain cases companies recognize revenue at the completion of production even though no sale has been made. Examples are: 30 precious metals or agricultural products. LO 2 Identify the proper accounting for losses on long-term contracts. Revenue Recognition After Delivery When the collection of the sales price is not reasonably assured and revenue recognition is deferred. Methods of deferring revenue: 31 Installment-sales method Cost-recovery method Deposit method Generally Employed LO 3 Describe the installment-sales method of accounting. Revenue Recognition After Delivery Installment-Sales Method Recognizes income in the periods of collection rather than in the period of sale. Recognize both revenues and costs of sales in the period of sale, but defer gross profit to periods in which cash is collected. Selling and administrative expenses are not deferred. 32 LO 3 Describe the installment-sales method of accounting. Revenue Recognition After Delivery Acceptability of the Installment-Sales Method The profession concluded that except in special circumstances, “the installment method of recognizing revenue is not acceptable.” The rationale: because the installment method does not recognize any income until cash is collected, it is not in accordance with the accrual concept. 33 LO 3 Describe the installment-sales method of accounting. Revenue Recognition After Delivery Cost-Recovery Method Recognizes no profit until cash payments by the buyer exceed the cost of the merchandise sold. A seller is permitted to use the cost-recovery method to account for sales in which “there is no reasonable basis for estimating collectibility.” In addition, use of this method is required where a high degree of uncertainty exists related to the collection of receivables. 34 LO 4 Explain the cost-recovery method of accounting. Cost-Recovery Method Illustration: In 2012, Fesmire Manufacturing sells inventory with a cost of $25,000 to Higley Company for $36,000. Higley will make payments of $18,000 in 2012, $12,000 in 2013, and $6,000 in 2014. If the cost-recovery method applies to this transaction and Higley makes payments as scheduled, Fesmire recognizes cash collections, revenue, cost, and gross profit as follows. Illustration 18-41 35 LO 7 Cost-Recovery Method Illustration: Fesmire’s journal entry to record the deferred gross profit on the Higley sale transaction (after recording the sale and the cost of sale in the normal manner) at the end of 2012 is as follows. Sales 36 36,000 Cost of Sales 25,000 Deferred Gross Profit 11,000 LO 4 Explain the cost-recovery method of accounting. Cost-Recovery Method Illustration: In 2013 and 2014, the deferred gross profit becomes realized gross profit as the cumulative cash collections exceed the total costs, by recording the following entries. 2013 Deferred Gross Profit 5,000 Realized Gross Profit 2014 Deferred Gross Profit Realized Gross Profit 37 5,000 6,000 6,000 LO 4 Explain the cost-recovery method of accounting. Revenue Recognition After Delivery Deposit Method Seller reports the cash received from the buyer as a deposit on the contract and classifies it on the balance sheet as a liability. The seller does not recognize revenue or income until the sale is complete. 38 LO 4 Explain the cost-recovery method of accounting. Summary of Product Revenue Recognition Illustration 18-42 39 LO 7 REVENUE RECOGNITION FOR SPECIAL SALES TRANSACTIONS Franchises Four types of franchising arrangements have evolved: 1. manufacturer-retailer, 2. manufacturer-wholesaler, 3. service sponsor-retailer, and 4. wholesaler-retailer. 40 LO 5 Explain the revenue recognition for franchises. REVENUE RECOGNITION FOR SPECIAL SALES TRANSACTIONS Franchises Fastest-growing category is service sponsor-retailer: Soft ice cream/frozen yogurt stores (Tastee Freeze, TCBY, Dairy Queen) 41 Food drive-ins (McDonald’s, KFC, Burger King) Restaurants (TGI Friday’s, Pizza Hut, Denny’s) Motels (Holiday Inn, Marriott, Best Western) Auto rentals (Avis, Hertz, National) Others (H & R Block, Meineke Mufflers, 7-Eleven Stores) LO 5 Explain the revenue recognition for franchises. REVENUE RECOGNITION FOR SPECIAL SALES TRANSACTIONS Franchises Two sources of revenue: 1. Sale of initial franchises and related assets or services, and 2. Continuing fees based on the operations of franchises. 42 LO 5 Explain the revenue recognition for franchises. REVENUE RECOGNITION FOR SPECIAL SALES TRANSACTIONS Franchises The franchisor normally provides the franchisee with: 1. Assistance in site selection. 2. Evaluation of potential income. 3. Supervision of construction activity. 4. Assistance in the acquisition of signs, fixtures, and equipment. 5. Bookkeeping and advisory services. 6. Employee and management training. 7. Quality control. 8. Advertising and promotion. 43 LO 5 Explain the revenue recognition for franchises. REVENUE RECOGNITION FOR SPECIAL SALES TRANSACTIONS Initial Franchise Fees Franchisors record initial franchise fees as revenue only when and as they make “substantial performance” of the services they are obligated to perform and when collection of the fee is reasonably assured. Substantial performance occurs when the franchisor has no remaining obligation to refund any cash received or excuse any nonpayment of a note and has performed all the initial services required under the contract. 44 LO 5 Explain the revenue recognition for franchises. REVENUE RECOGNITION FOR SPECIAL SALES TRANSACTIONS Example of Entries for Initial Franchise Fee Illustration: Tum’s Pizza Inc. charges an initial franchise fee of $50,000 for the right to operate as a franchisee of Tum’s Pizza. Of this amount, $10,000 is payable when the franchisee signs the agreement, and the balance is payable in five annual payments of $8,000 each. The credit rating of the franchisee indicates that money can be borrowed at 8 percent. The present value of an ordinary annuity of five annual receipts of $8,000 each discounted at 8 percent is $31,941.68. The discount of $8,058.32 represents the interest revenue to be accrued by the franchisor over the payment period. 45 LO 5 Explain the revenue recognition for franchises. REVENUE RECOGNITION FOR SPECIAL SALES TRANSACTIONS Example of Entries for Initial Franchise Fee Illustration: 1. If there is reasonable expectation that Tum’s Pizza Inc. may refund the down payment and if substantial future services remain to be performed by Tum’s Pizza Inc., the entry should be: Cash 10,000.00 Notes Receivable 40,000.00 Discount on Notes Receivable Unearned Franchise Fees 46 8,058.32 41,941.68 LO 5 Explain the revenue recognition for franchises. REVENUE RECOGNITION FOR SPECIAL SALES TRANSACTIONS Example of Entries for Initial Franchise Fee Illustration: 2. If the probability of refunding the initial franchise fee is extremely low, the amount of future services to be provided to the franchisee is minimal, collectibility of the note is reasonably assured, and substantial performance has occurred, the entry should be: 47 Cash 10,000.00 Notes Receivable 40,000.00 Discount on Notes Receivable 8,058.32 Revenue from Franchise Fees 41,941.68 LO 5 Explain the revenue recognition for franchises. REVENUE RECOGNITION FOR SPECIAL SALES TRANSACTIONS Example of Entries for Initial Franchise Fee Illustration: 3. If the initial down payment is not refundable, represents a fair measure of the services already provided, with a significant amount of services still to be performed by Tum’s Pizza in future periods, and collectibility of the note is reasonably assured, the entry should be: 48 Cash 10,000.00 Notes Receivable 40,000.00 Discount on Notes Receivable 8,058.32 Revenue from Franchise Fees 10,000.00 Unearned Franchise Fees 31,941.68 LO 5 Explain the revenue recognition for franchises. REVENUE RECOGNITION FOR SPECIAL SALES TRANSACTIONS Example of Entries for Initial Franchise Fee Illustration: 4. If the initial down payment is not refundable and no future services are required by the franchisor, but collection of the note is so uncertain that recognition of the note as an asset is unwarranted, the entry should be: Cash 10,000.00 Revenue from Franchise Fees 49 10,000.00 LO 5 Explain the revenue recognition for franchises. REVENUE RECOGNITION FOR SPECIAL SALES TRANSACTIONS Example of Entries for Initial Franchise Fee Illustration: 5. Under the same conditions as those listed in case 4 above, except that the down payment is refundable or substantial services are yet to be performed, the entry should be: Cash 10,000.00 Unearned Franchise Fees 10,000.00 In cases 4 and 5 — where collection of the note is extremely uncertain— franchisors may recognize cash collections using the installment-sales method or the cost-recovery method. 50 LO 5 Explain the revenue recognition for franchises. REVENUE RECOGNITION FOR SPECIAL SALES TRANSACTIONS Continuing Franchise Fees Continuing franchise fees are received in return for the continuing rights granted by the franchise agreement and for providing such services as management training, advertising and promotion, legal assistance, and other support. Franchisors report continuing fees as revenue when they are earned and receivable from the franchisee. 51 LO 5 Explain the revenue recognition for franchises. REVENUE RECOGNITION FOR SPECIAL SALES TRANSACTIONS Franchisor’s Cost Should ordinarily defer direct costs (usually incremental costs) relating to specific franchise sales for which revenue has not yet been recognized. Should not defer costs without reference to anticipated revenue and its realizability. Indirect costs of a regular and recurring nature, such as selling and administrative expenses that are incurred irrespective of the level of franchise sales, should be expensed as incurred. 52 LO 5 Explain the revenue recognition for franchises. REVENUE RECOGNITION FOR SPECIAL SALES TRANSACTIONS Disclosure of Franchisors All significant commitments and obligations resulting from franchise agreements. Any resolution of uncertainties regarding the collectibility of franchise fees. Where possible, revenues and costs related to franchisor owned outlets should be distinguished from those related to franchised outlets. 53 LO 5 Explain the revenue recognition for franchises. Profitability Ratios Profitability Ratios Profit Margin on Sales Net Income ÷ Net Sales Return on Assets Net Income ÷ Average Total Assets Return on Shareholders' Equity Net Income ÷ Average Shareholders' Equity Return on Equity Key Components Profitability Activity Financial Leverage 54 DuPont Framework The DuPont Framework helps identify how profitability, activity, and financial leverage trade off to determine return to shareholders: Return on equity Net income Avg. total equity = Profit margin X = Net income Total sales X Asset turnover Total sales Avg. total assets X Equity multiplier X Avg. total assets Avg. total equity Because profit margin and asset turnover combine to equal return on assets, the DuPont framework can also This is called the DuPont be written as: framework because the DuPont Return on equity Net income Avg. total equity 55 = = Return on Company was a Equity pioneer in assets X multiplier emphasizing this relationship. Net income Avg. total assets X Avg. total assets Avg. total equity RELEVANT FACTS 56 The IASB defines revenue to include both revenues and gains. GAAP provides separate definitions for revenues and gains. Revenue recognition fraud is a major issue in U.S. financial reporting. The same situation occurs overseas as evidenced by revenue recognition breakdowns at Dutch software company Baan NV, Japanese electronics giant NEC, and Dutch grocer AHold NV. RELEVANT FACTS 57 IFRS has one basic standard on revenue recognition—IAS 18. GAAP has numerous standards related to revenue recognition (by some counts over 100). Accounting for revenue provides a most fitting contrast of the principles-based (IFRS) and rules-based (GAAP) approaches. While both sides have their advocates, the IASB and the FASB have identified a number of areas for improvement in this area. Under IFRS, revenue should be measured at fair value of the consideration received or receivable. GAAP measures revenue based on the fair value of what is given up (goods or services) or the fair value of what is received—whichever is more clearly evident. End of Lecture 21 58