Economic Growth

advertisement

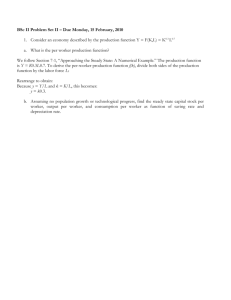

Economic Growth I Chapter Seven Introduction Having analyzed the overall production, distribution, and allocation of national income, we now consider the determinants of long-run growth. Stylized fact – in developed economies, output grows over time (although irregular at times); the trend is upward Different countries also enjoy very different standards of living in terms of income per person; standard of living means what? Our goal is to understand what causes these differences in income over time and across countries. What determines a country’s output at any point in time? So where must the differences across countries come from? Solow growth model – shows how saving, population growth, and technological progress affect the level of an economy’s output and its growth over time International Differences in the Standard of Living: 1999 Income and poverty in the world selected countries, 2000 100 Madagascar % of population living on $2 per day or less 90 India Nepal Bangladesh 80 70 60 Botswana Kenya 50 China 40 Peru 30 Mexico Thailand 20 Brazil 10 0 $0 Chile Russian Federation $5,000 $10,000 S. Korea $15,000 Income per capita in dollars $20,000 The Accumulation of Capital • Starting with the production function, Y = F(K,L), what are the 3 possible sources of long-run output growth: 1. 2. 3. • • • Increase in capital stock, K Increase in labor force (population increase), L Increase in technology; the production function F changes Our analysis of economic growth considers all of these factors, but focuses primarily on the determination of the capital stock. Assumption – there is no technological progress and no growth in population; we relax these later What is the fundamental difference between our analysis of economic growth and our previous analysis of income determination? Static vs. dynamic? The Supply and Demand for Goods The Supply of Goods and the Production Function: Supply of goods depends on production function, Y = F(K,L) F exhibits constant returns to scale, zY = F(zK,zL) z = 1/L Y/L = F(K/L,1) The amount of output per worker, Y/L, is a function of the amount of capital per worker, K/L. Does the size of labor force affect the relationship between output per worker and capital per worker? Write all variables in per-worker terms: y = Y/L, k = K/L, y=f(k) Example: Y = (KL)1/2; y = f(k); f(k) = ? The Production Function What does the slope of this perworker production function represent? MPK = f(k+1) – f(k) Why is it that as the amount of capital per worker increases, the production function becomes flatter? When k is small (large), is MPK large (small)? Why? … The Supply and Demand for Goods The Demand for Goods and the Consumption Function: The demand for goods in the Solow model comes from consumption and investment. Y/L = C/L + I/L y = c + i; output per worker is divided between consumption per worker and investment per worker The Solow model assumes that each year people save a constant fraction s of their income and consume (1-s) c = (1-s)y; what assumptions have we made thus far about demand? G = T = NX = 0 What does this consumption function imply about investment? y= (1-s)y + i i = sy; investment equals saving, what is adjusting to ensure these two equate? For a given k, what determines per capita output? What determines the allocation of output between consumption and investment? Growth in the Capital Stock and the Steady State Capital stock is a key determinant of output, if capital grows over time then so will output 2 forces that influence change in the capital stock: Investment – expenditure on new plant/equipment and causes capital stock to rise Depreciation – wearing out of old capital, causes capital to fall i = sy i = sf(k); investment per worker is a function of capital stock per worker; Figure 7-2 What governs output? What governs output allocation? We assume that a certain fraction of the capital stock wears out each year; - depreciation rate How much capital depreciates every year? k Output, Consumption, and Investment Depreciation Capital accumulation The basic idea: Investment makes the capital stock bigger, depreciation makes it smaller. … Growth in the Capital Stock and the Steady State The overall change in the capital stock is the net effect of new investment and depreciation: k = i - k = sf(k) - k Figure 7-4, The higher the capital stock the higher the amount of output, investment, and depreciation At what level of capital is investment = depreciation? If the economy finds itself at this capital stock, k*, will the capital stock continue to change? Why or why not? The only investment being undertaken is replacement investment. At k*, k = 0, so k and y=f(k) are steady over time. Thus, k* is called the steady-state level of capital. Investment, Depreciation, and the Steady State … Growth in the Capital Stock and the Steady State The steady state level of capital is significant for two reasons: 1. 2. An economy at the steady state will stay there. An economy not at the steady state will eventually go there regardless of the level of capital with which the economy begins. The steady state represents the long-run equilibrium of the economy. Suppose economy starts with k1 < k*, why will the capital stock rise? Suppose economy start with k2 > k*, why will the capital stock fall? Approaching the Steady State: A Numerical Example Production Function: Y = (KL)1/2 Derive the per-worker production function f(k). Assume 30% of output is saved and the capital stock depreciates at a rate of 10%. Assume the economy starts off with 4 units of capital per worker. See Excel Worksheet Over time what level of capital stock, output, consumption, investment, and depreciation does the economy approach? Is there another way to derive the steady-state without so many calculations? Case Study: The Miracle of Japanese and German Growth Japan and Germany experienced rapid economic growth following World War II. The war destroyed a large portion of their capital stocks (plants, equipment, heavy machinery). Between 1948 and 1972 real GDP per capita grew at 8.2% per year in Japan and 5.7% per year in Germany while the U.S. experienced a meager 2.2% per year in comparison. Does this make any sense from the standpoint of the Solow growth model? What happens to output after a collapse in the capital stock? What happens to saving and investment? Should output begin to grow at a faster rate? Why or why not? How Saving Affects Growth Low levels of initial capital is not the only thing that affects the rate of economic growth; the fraction of output devoted to saving/investment affects economic growth Consider an increase in the saving rate from s1 to s2: What happens to the investment schedule? At the initial saving rate s1, and the initial capital stock k1*, the amount of investment just offsets what? What happens immediately after the saving rate rises? Where will the new steady-state end up? The Solow model shows that the saving rate is a key determinant of the steady-state capital stock. If the saving rate is high (low), the economy will have a large (small) capital stock and a high (low) level of output. … How Saving Affects Growth What does the Solow model say about the relationship between saving and growth? Is the relationship permanent or temporary? Can we more fully explain the impressive performance of Japan and Germany after WWII? Case Study: Saving and Investment Around the World Revisit: why are some countries rich and some poor? What answer does the Solow model provide? Does international data support this theoretical result? The data clearly show a positive relationship between the fraction of output devoted to investment and the level of per capital income. The Golden Rule Level of Capital The Solow model shows how the rate of saving and investment determines the long-run levels of capital and income. Is higher saving always a good thing since it always leads to higher income? What amount of capital accumulation is optimal from the standpoint of economic well-being? Assume that we can set our nation’s savings rate, what rate should we choose? What should be our goal? Policymakers should aim for a savings rate that delivers a steady state with the highest level of consumption possible. The steady-state value of k that maximizes consumption is called the Golden Rule level of capital, kg. Comparing Steady States Where is the golden rule level of capital? Steady-state consumption: y = c + i c=y–i Substitute steady-state values for output and investment: c* = f(k*) k* Increase in steady-state capital has two opposing effects, what are they? Steady-state consumption is the gap between output and depreciation (investment) kg is the capital level that maximizes s.s. consumption … Comparing Steady States What happens to output and depreciation when we increase the capital stock when capital is below the golden rule level? (Figure 7-7) What happens when the capital stock is above the golden rule level? Do the relative slopes of the production function and the depreciation schedule tell us anything? What does this imply about consumption? Again, do the relative slopes give us any information? What happens to consumption? At the golden rule level of capital what is the relationship between the slopes of the production function and the depreciation schedule? … Comparing Steady States Because the 2 slopes are equal at kg, the golden rule is described by: MPK = Suppose s.s. capital is k* and we are considering increasing capital to k*+1: How much extra output is produced? How much extra depreciation? What is the net effect on consumption? What should we do if MPK- < 0? MPK >0? … Comparing Steady States At the golden rule level of capital, the marginal product of capital net of depreciation (MPK - ) equals zero. Will the economy naturally gravitate towards the golden rule steady-state level of capital? If a policymaker wants a specific steady-state capital stock, such as the golden rule, the appropriate savings rate must be used to support it. What happens when the saving rate is set below (above) the one required to support the golden rule? What happens to the steady-state capital stock? What happens to the steady-state consumption? Finding the Golden Rule Steady State: A Numerical Example Per-worker production function: y = k1/2, = 0.1 The policymaker chooses s in order to maximize consumption. In the steady-state: sf(k*) = k* k*/f(k*) = s/ k*/(k*)1/2 = s/0.1 k* = 100s2 What happens to steady-state capital, output, and depreciation as the savings rate climbs? What happens to consumption? What is the golden rule savings rate? What is net marginal product of capital? Why does net marginal product of capital eventually become zero? Is there an easier way to find the golden rule level of capital, consumption, and saving? Perhaps using calculus The Transition to the Golden Rule Steady State So far we have assumed that the policymaker can choose any savings rate and the economy will jump directly to the golden rule steady state; unrealistic assumption Rather, suppose economy has reached a steady state other than golden rule: What happens to consumption, investment, and capital when the economy transitions between steady states? Are there any undesirable consequences in the transition process that might deter policymakers? Consider two cases: the economy begins with more capital than in the golden rule steady state, or with less The two cases offer very different problems for policymakers. Starting With Too Much Capital With too much capital, what should policymaker do to approach the golden rule? What happens immediately following a reduction in the savings rate? Why? What happens to c, y, and i over time? Is there anything noticeable about the path of consumption? When k* > kg, reducing saving is a good policy; it increases consumption at every point in time y c i t0 time Starting With Too Little Capital y c i t0 time With too little capital, what should policymaker do to approach the golden rule? What happens immediately and over time to y, c, and i? Is there anything noticeable about the path of c? Does there appear to be any tradeoff between current and future economic well-being? When k* < kg reaching the golden rule requires an initial reduction in consumption which will rise over time. Population Growth Does the basic Solow model explain sustained (permanent) growth in output? To explain permanent growth in output we must augment the basic model with population growth. Assume population grows at a constant rate n: Example: n = .01 population grows at 1% per year What now are the 3 forces acting on the stock of capital to drive it towards a steady-state? How does population growth specifically change capital per worker? Derive: k = i – (+n)k; what do i, , and n do to k? (+n)k – break even investment – the amount of investment needed to keep the capital stock per worker constant The Steady State With Population Growth Why does break even investment include the term nk? How does population growth reduce k as opposed to depreciation? k* satisfies: k = 0 sf(k) = (+n)k s/(+n) = k/f(k) What happens if k < (>) k*? Once the economy is in the steady state, investment has 2 purposes. What are they? The Effects of Population Growth 1. 2. 3. Population growth alters the basic Solow model 3 ways: It explains sustained economic growth, but does it explain sustained growth in the standard of living? It gives another reason for why some countries are rich and some are poor. How? It affects the criterion for determining the golden rule level of capital. What is the new golden rule condition? Case Study: Population Growth Around the World Does the Solow model tell us anything about the correlation between high population growth and low steadystate income per worker? Why would high population growth tend to impoverish a country? Does the international data support this theory? Chapter Summary The Solow growth model shows that, in the long run, a country’s standard of living depends: 1. • positively on its saving rate. negatively on its population growth rate. An increase in the saving rate leads to: 2. 3. higher output in the long run faster growth temporarily but not faster steady state growth. If the economy has more capital than the Golden Rule level, then reducing saving will increase consumption at all points in time, making all generations better off. If the economy has less capital than the Golden Rule level, then increasing saving will increase consumption for future generations, but reduce consumption for the present generation.