FinAid - Sonoma State University

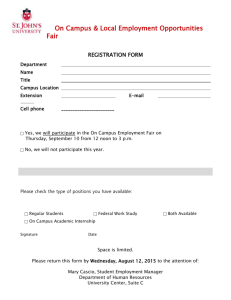

advertisement

This power point is designed by your EOP Advisors to help you understand how your financial aid applies to your educational expenses and living expenses. A typical Financial Aid offer includes a variety of grants, loans and Federal Work Study which total what the average student needs each year for everything. My Financial Award WHAT IS MY ESTIMATED TOTAL BUDGET? This is an estimate of what the “average” student spends per school year. It includes some estimated expenses you can reduce so you may not need the full amount estimated for the “average” student. No one will send you a bill for the ‘estimated total budget.’ It’s NOT a bill you owe; it’s NOT a promise of money to you. Bills you owe to SSU for fees (and dorms if you live on campus) are deducted from your financial aid, so make sure your award is not held up by an incomplete FAFSA or by missing To Do List documents needed by SSU Financial Aid Office. Ask if you need help. Log on to MY SSU and view your To Do List at least once a week! 2015-2016 Cost of Attendance Also referred to as the Student Budget, Cost of Attendance is a standard estimated total of an average student’s expenses for the school year, Fall and Spring semesters. *Beginning in Fall 2015, a $2 per term optional SIRF will be assessed. The SIRF is an optional fee, which means that students have the option of not contributing to this fee in their tuition. If students choose to opt-out of this fee, they must opt-out no later than the census date for each term. After the census date, students will no longer be able to opt out for the semester. http://www.sonoma.edu/registration/fees_2015-16.html ** On Campus Total was taking from On Campus Cost of Attendance reported on the Financial Aid Office website. (CSU fees are subject to change by the Board of Trustees.) Cost Item: At Home: On Campus: Off Campus: Registration charges* $7,324* $7,324* $7,324* Books & Supplies $1,764 $1,764 $1,764 Food & Housing $4,770 $9,886 – 14,688 by dorm room $13,434 Transportation $1,484 $1,380 $1,446 Personal & Misc. $1,392 $1,392 $1,392 TOTALS: $16,734 $24,674** $25,360 Grants & Scholarships WHAT ARE GRANTS? -Money for school expenses you don’t have to pay back -Come from your FAFSA results -From meeting FAFSA deadlines, and -From promptly turning in documents requested on your MY SSU To Do List. HOW DO I APPLY FOR GRANTS? -Submit FAFSA every January by using income estimates -Correct your FAFSA with real figures asap WHAT ARE SCHOLARSHIPS? -Money for school expenses you don’t have to pay back -Scholarships & grants are resources to pay for school -SSU Scholarship deadline is January 15 The estimated budget worksheet. Steps 1, 2 & 3. Grants & Scholarships vs. Bills You Owe SSU for the year 1. ADD up your resources: Grants from your financial aid award and any Scholarships you received -Do not include Federal Work Study; it is not a grant -Do not include Loan offers at this point 2. ADD up all the bills you owe to Sonoma for the year -Registration charges everyone owes -Cost of dorm & meal plan if living on campus (You choose the dorm and some cost more than others.) 3. SUBTRACT the smaller amount of 1 or 2 above from the larger amount to determine if you still owe money to SSU after your financial aid resources are applied or if you will receive a check to help pay other expenses. Step 4: First semester & Considering Loans If I Live ON campus? -If you owe SSU more than your grant and scholarship total, you may need to consider a loan… If I live OFF campus? -After SSU fees are deducted from your financial aid, if your check isn’t enough to pay rent, food, etc. for the semester, you may need to consider a loan Your EOP advisor will explain options: -Perkins and Subsidized loans are more desirable than Un-Subsidized or PLUS loans -Ask Financial Aid the steps to follow to take a loan -Don’t take a loan until you are sure you need one. Step 5: Other Expenses Resources vs Bills Owed to SSU model addresses the biggest school expenses of tuition, food and housing but does not include money for books, entertainment, transportation, clothing, cell phone, etc. WORKING Part Time is one solution for other expenses: -Most EOP students work during the school year -Part time is the key to academic success, 10-20 hrs/week -No one guarantees you a job -Begin job search right away while at Summer Bridge -This is where Federal Work Study (FWS) comes in as explained on the next slide -This year you must “accept” your FWS award online - Unlike a grant, no one gives you the amount on your FWS offer. You only get what you earn if you find a campus job. Federal Work Study FWS benefits students who work part-time on campus: -Increases your chances of finding a campus job -Allows you to earn whatever hourly wage that job pays -You can earn up to amount of your award If your job offers you enough hours Future Benefit of FWS employment: -FWS wages are taxable income on the FAFSA but won’t count against you in next year's FAFSA assessment If you earn too much at a non-FWS job, you may hurt your eligibility for some grants the next year FWS job earnings are used by you go pay for things like car expenses, toilet paper, cell phone, etc. since all your grants usually go to the bills owed to SSU. Making College Affordable Reduce expenses & need less $ than the average student: TAKE ADVANTAGE OF: -Free campus events to reduce your entertainment budget -Wear what you have to reduce your clothing budget -Use email more & consider cell phone expenses carefully AVOID: -Going home often to reduce your transportation budget USE: -Meal plan you paid for instead of spending extra on food -Free services like Tutoring, Health Center, computer labs Save $300-$600 over summer for books. Be sure before you buy & open a book that you really need that book. Consider sharing. What does all this mean? That depends on your living situation: 1) Living off campus with family, or 2) Living off campus on your own, or 3) Living on campus & which dorm room you choose Most EOP students find the Residential Suite Doubles fit best with their financial aid grants with a minimum of loans. Some “Living/Learning” communities are alternatives to the EOP Academy that require you to live in particular dorms. Always ask about dorm cost before you decide what’s best for you. Your grants will not increase to cover a higher cost dorm. EOP Freshman Year Academy is a first year social and academic transition to college community that is focused on the success and shared experiences of EOP students whatever their major. DO YOU HAVE OTHER ASSETS? Your individual situation will vary if you have savings, scholarships, or family funds to apply to your needs. Living On Campus COST for Freshmen: Academic Year: 2015-2016 1. Cabernet Triple 2. Residential Suite Double 2. Cabernet Double 3. Sauvignon Double 4. Residential Suite Single 5. Sauvignon Single Year Rate $9,886 $11,280 $12,076 $12,746 $13,222 $14,688 The above costs include your meals. All first year college students who live in the dorms are required to be on a pre-paid meal plan for their entire first year at SSU. Please visit http://www.sonoma.edu/housing/rates/ay.html for more information. Living Off Campus with Family BUDGET: You will owe only Registration fees to SSU Depending on your grants and scholarships, you may receive a check after registration fees are deducted from your financial aid award Check should help with expenses like transportation, food, clothing, books, etc. Budgeting is in your hands… Some will need a part time job Living Off Campus on Your Own BUDGET : You will owe only Registration Fees to SSU You are likely (not guaranteed) to receive a check after registration fees are deducted from your financial aid award You have to budget $ for the semester to pay rent, food, garbage, lights, water, phone, transportation, etc. Budgeting is in your hands and your check is unlikely to cover all expenses A part-time job will be critical for most living off campus on their own and a campus FWS job is preferable And you may need to consider a loan Living On Campus BUDGET: All of your grant aid is likely to be absorbed by the SSU bill for registration fees and dorm with meal plan Most will also need to consider a loan to cover what you owe to SSU, how much loan depends on your dorm cost Most won’t get a remainder check to budget unless you have a large scholarship or took out bigger loans The good news is your rent, food, PG&E, internet access, etc. are covered and you don’t need a car to drive to campus For most, a part-time job is critical to pay expenses like books, transportation, toothpaste, etc. A Final Word We first look at the year, but -Campus bills & Fin Aid will be divided into 2 semesters Financial aid packages can change: -Until all FAFSA corrections are complete and requested documents evaluated by SSU Fin Aid Office, awards can change for better or worse. Your award can be cancelled and your classes dropped, if you don’t turn in requested documents to Financial Aid. Check campus email & To Do List every week, including all summer. Documents can be requested at any time. PS: It only seems overwhelming at first. Your EOP Advisor’s goal is to make sure you understand your award and costs. UNDERSTANDING FINANCIAL AID Your EOP Advisor will help you understand your financial situation. Once you understand the basics, you are better prepared to work with your Financial Aid Representative as needed. Respond promptly to any emails, To Do List requests or calls from Financial Aid. Ask if you need help. ccreated Created by Sandra Shand, Graphics by Luis Vega