CHAPTER 14

CHAPTER 14

COMPENSATING

SALESPEOPLE

THE SALES FORCE

REWARD SYSTEM

Financial compensation

Non-financial compensation

IMPORTANCE OF SALES

FORCE REWARDS

Sales force

Company

Customer relations and goodwill

Strategic planning

DESIGN CONSIDERATIONS

Inherent conflicts

No plan fits all situations

Internal equity

External equity

COMPENSATION PLAN

OBJECTIVES

Correlate efforts, results, and rewards

Control activities

Ensure proper treatment of customers

Attract and keep good salespeople

BASIC REQUIREMENTS

Provision for two types of income

Flexibility and stability

Simplicity

Economy and competitiveness

Fairness

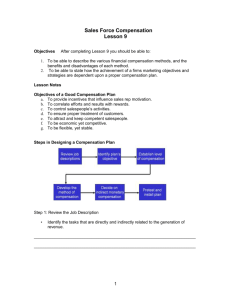

STEPS IN DESIGNING A

PLAN

1.

Review job analysis/description

2.

Determine objectives

3.

Determine job elements

4.

Establish level of compensation

5.

Pretest

6.

Administer/Evaluate

REVIEW JOB DESCRIPTION

Review nature, scope, and difficulty of job

SET OBJECTIVES

Increase volume

Obtain new accounts

Minimize expenses

ESTABLISH JOB

ELEMENTS

Controllable

Measurable

LEVEL OF COMPENSATION

Type of plan

Size of company

Age of salespeople

Industry

COMPENSATION ISSUE

Should sales managers always be paid more than the people they manage?

PRETEST

Start with one or two sales divisions

ADMINISTER/EVALUATE

Implement

Review and modify where necessary

METHODS OF

COMPENSATION

Straight salary

Straight commission

Combination

Team Selling

Optimum Pay Plans

STRAIGHT SALARY PLANS

Salary is a fixed element

Degree of security

Lower turnover

“Full” approach to selling

No direct incentive

WHEN TO USE

While in a training mode

Entering a new territory/new product market

Tremendous time to sell to one account

Missionary sales positions

Joint selling

STRAIGHT COMMISSION

PLANS

Based on a unit of accomplishment

Base, rate and starting point

Advances (drawing account)

Provides incentive

Weeds out poor performers

Supervision problems

Split commissions

WHEN TO USE

Company is weak financially

Great incentive required

Little non-selling work required

Supervision not possible

Long term relationships not important

Part-time sales people/manufacturer’s agents

RATE SCHEDULES

Progressive rate schedule

– 5% on first $20,000

– 7% on next $80,000

– 10% on amount over $100,000

Regressive rate schedule

COMBINATION PLAN

Most popular plan

Overcomes some of the weaknesses of straight salary and straight commission plans

TEAM SELLING

More common today

Difficult to provide rewards

Shared commissions/group bonuses

OPTIMUM PAY PLANS

Commission based on gross margin

Forces individuals to focus on items which maximize profits for the company

OTHER COMPENSATION

ISSUES

Bonuses

Drawing Accounts

Expense Accounts

BONUSES

Payment for above normal performance

No obligation to provide regularly

DRAWING ACCOUNT

Cash advance called a “draw”

DRAWING ACCOUNT

MTH DRAW SALES COMM EOM

PYMT

Jan $1,800 $40,000 $4,000 $2,220

Feb $1,800 $15,000 $1,500 0 (owes

$300)

Mar $1,800 $30,000 $3,000 $900

(10% commission rate)

EXPENSE ACCOUNTS

Reimbursement for travel and other sales related costs

A troublesome task for the sales manager!

EXPENSE BREAKDOWN

Meals

Air Travel

Automobile

Lodging

Entertainment

Other

16%

26%

24%

18%

13%

3%

CHARACTERISTICS OF A

GOOD EXPENSE PLAN

No net gain/loss

Equitable treatment

No curtailment of beneficial activities

Simple and economical

Avoidance of disputes

Company control/elimination of padding

CONTROLLING EXPENSES

Type of plan

– salary versus commission

– unlimited versus per diem

Automobiles

Training

Travel planning

FROM THE TEXT

Read everything in Chapter 14!!