Scottish Parliament Economy, Energy, and Tourism Committee

House of Lords Select Committee

Inquiry into Small and Medium Sized Enterprises and Exports

September 2012

Introduction

The Scotch Whisky Association (SWA) is the industry’s representative body, with a remit to protect and promote Scotch Whisky worldwide. Its member companies – Scotch Whisky distillers, blenders and bottlers – account for over 90% of the industry.

Scotch Whisky is Scotland’s leading single product export and the UK’s largest consumer good export. Annual shipments, in excess of £4.2bn, in Customs value represent 25% of the UK’s food and drink exports.

The SWA is delighted to have the opportunity to respond to the Select Committee’s Inquiry into SME Exports.

Summary

Scotch Whisky is a key UK export

Irrespective of the size of business, international trade is the life blood of the Scotch

Whisky industry. Export growth supports jobs in communities which are often rural, and frequently lack any significant alternative job opportunities.

Policy decisions need to be joined up across all departments. The Government’s economic recovery strategy is based on export growth, a strategy we believe will be undermined by the planned introduction of the minimum pricing of alcohol that will negatively affect Scotch Whisky exports.

Current Export Market

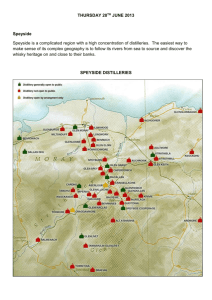

The SWA has 51 members ranging from small family owned businesses to large international drinks companies. Some operate on a global basis, others focus on niche markets. Scotch

Whisky is exported to around 200 countries across the world, with Europe accounting for around 40% of total Scotch Whisky exports.

Like other distillers, SMEs in the Scotch Whisky industry have enjoyed export growth in recent years, supporting investment in jobs and production capacity. Growth is broad-based, with emerging markets, including the BRIC countries, already delivering on their potential. Other markets, such as Africa, are also beginning to develop from a low base.

Europe remains a key market for Scotch Whisky companies, with many SMEs focused on the region. Eurozone challenges have impacted exports to markets such as Greece and Spain.

Internationalisation of SMEs

The Scotch Whisky industry is clearly export orientated given that around 90% of Scotch Whisky is exported. International growth and optimism about export potential has supported in excess of £1bn in new capital investment over the last five years. Recent announcements have demonstrated that investment in increasing Scotch Whisky production is set to continue.

SMEs in the Scotch Whisky sector have to export to stay in operation and for most SMEs 90% of turnover is from export. SMEs cite that previous experience is nearly always essential with regard to breaking into new markets and that providing credit and insurance cover are risks to exporting.

UKTI and the British Embassy network have good resources in many markets and often reach out to many Scotch Whisky companies to take part in foreign UK trade shows to enhance their visibility and meet potential distributors and clients.

The SWA believes that the Government should continue to support businesses, particularly

SMEs, in exporting and reaching new markets. The Government’s economic recovery strategy places emphasis on the growth of exports and the Scotch Whisky industry is therefore well placed to assist. This can be done by providing financial assistance to attend exhibitions, support within Embassies to identify contacts and tackling trade barriers that may work against

Scotch Whisky.

Barriers and market failures

Scotch Whisky exports are negatively impacted by tariff and non-tariff barriers to trade. In

2010, an SWA analysis identified around 660 separate barriers to the trade in Scotch Whisky in

186 markets. Efforts to improve the export environment and promote fair market access, are of the highest priority to the industry. The industry’s focus on international sales means we have considerable experience in international trade issues and the excuses that governments seek to use to discriminate against Scotch Whisky.

Issues include high import tariffs and discriminatory taxes. While these tariffs and taxes may be met by importers, Scotch Whisky SMEs may well need to hold prices down to ensure that they are able to keep their share of the market. This can be particularly difficult when SMEs begin to access a new market.

Other issues facing SMEs include burdensome bureaucracy such as restrictive certification, labelling and licensing rules. Documentation can also be very costly before a shipment even reaches its destination. This is particularly an issue for SMEs given they will face relatively higher upfront costs before they see return, including establishing often more complex distribution arrangements.

The Scotch Whisky industry works closely with the UK Government on such issues, including the

FCO, BIS, UKTI, DEFRA and the British Embassy network. The generally high quality level of support received over many years supports the industry’s market access ambitions. However, several of our members have commented that the UKTI website needs additional work to make it more effective and useful following the recent merging of regional sites within the website.

The Government could consider: a) Providing trade mentors who are experienced in the field of trade and exporting that goes wider than sales. b) Supporting individual companies who have proven track records of breaking into new markets.

Incentives

Scotch Whisky exports increased by 22% over the course of 2011. For this to be maintained, the industry needs to continue to increase its sales to both established and developing markets.

One way in which Scotch Whisky SMEs identify customers is by attending international exhibitions. The cost of these exhibitions can prove to be prohibitive and although some support from UKTI is available, it does not appear to be at a level provided by overseas

governments that offer greater support to their drinks industry. Given the link between these exhibitions and increasing exports, additional support would be welcomed in this area.

The Government could perhaps establish export budgets for active SMEs to attend exhibitions and to make one-off visits to potential new customers. Sales are often made once face to face meetings are made and this can prove to be a financial risk to small companies given the upfront spend required for such visits.

In addition, Embassies should be able to provide both small and large importers with assistance. In some instances, the capacity to do this within Embassies may be limited however, this should be viewed as an effective measure that can help to increase SME exports.

Government Actions

The SWA supports the Government’s strong focus on commercial diplomacy, market access, and export promotion. We have played an active part in assisting the delivery of commercial diplomacy training. The SWA is also involved in the development and implementation of the

DEFRA food and drink export plan. Such initiatives are welcome and show improved joint thinking across government on how to support SME exporters.

The Government’s recent announcements appointing Paul Walsh as Business Ambassador for

Food and Drink and Brian Wilson as Business Ambassador for Scotland highlights the importance of British business for the Government. Promoting the export performance of SMEs will be a key part of their roles.

UKTI is shifting its focus towards high growth and emerging markets. This is a welcome step in the right direction but it is difficult for SMEs as they work on smaller scales and need assistance identifying distributors which suit their size of export capacity.

The Government’s recognition and positive outlook of an industry such as the Scotch Whisky industry is important but joined up thinking is essential with regard to policy decisions and the delivery of initiatives to assist SMEs with exporting.

Policy is often created in a vacuum. One example is the ramifications of a minimum unit price for alcohol in the UK. If introduced it will allow health justified exemptions to trade rules.

The negative impact of such a precedent would have on domestic and international trade in alcoholic drinks is a cause for great concern. Many smaller businesses rely on a vibrant home market as a launch pad to exporting. Minimum pricing would damage that opportunity, whilst also setting a precedent that will impact market access overseas.

Overseas governments will dress protectionist barriers as ‘health measures’ to keep imports, such as Scotch Whisky out. HMG will be powerless to address these, leading to long term harm to the UK balance of trade.

To assist SMEs in exporting, an alternative approach should be adopted to tackle alcohol misuse.

Conclusion

Promoting SME export success in the Scotch Whisky industry should be central to the UK

Government given that Scotch Whisky exports account for 25% of the UK’s food and drink exports. A greater understanding and a more focussed approach is required when assisting

SMEs to exporting internationally or break into new markets. The SWA is encouraged by strong messages from the Government to introduce initiatives to assist SMEs with exporting, but policy decisions across all departments, directly impacting on Scotch Whisky also need to be considered.

The Scotch Whisky Association

September 2012