Financial Accounting

advertisement

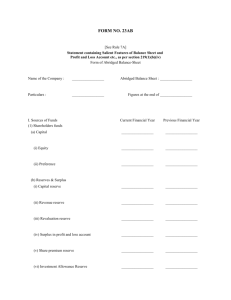

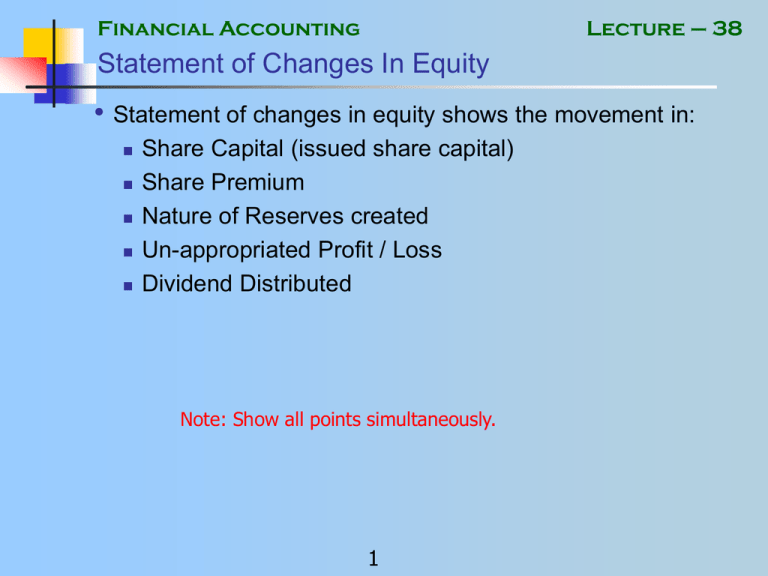

Financial Accounting Lecture – 38 Statement of Changes In Equity • Statement of changes in equity shows the movement in: Share Capital (issued share capital) Share Premium Nature of Reserves created Un-appropriated Profit / Loss Dividend Distributed Note: Show all points simultaneously. 1 Financial Accounting Lecture – 38 Statement of Changes In Equity • Capital Reserve and Fixed Asset Replacement Reserve are • used for specific purpose. These are not distributed among share holders. General Reserve and undistributed profit` can be distributed among share holders. 2 Financial Accounting Lecture – 38 Share Premium • Share • • Premium – Amount received in excess of the face value of the share. Example: if a Rs. 10 share is sold for Rs, 12 then Rs. 2 is share premium. Share Premium can not be distributed among the share holders. It can be utilized for: To issue Bonus Shares To write off Preliminary Expenses To meet the difference of face value and cash received in case of shares issued at discount To meet the expenses of issue of shares For payment of premium on redemption of debentures 3 Financial Accounting Lecture – 38 Revaluation Reserve • Revaluation • • Reserve – is created when an asset is revalued from cost to market value. Revaluation Reserve can not be distributed among the share holders. It can be utilized for: Setting off any loss on revaluation At the time of disposal of asset, the reserve relating to that asset is transferred to profit & loss account. 4 Financial Accounting Lecture – 38 Cash Flow Statement • Cash • Flow Statement – shows the movement of cash resources during the year. It is an integral part of Financial statements. Note: Show all points simultaneously. 5 Financial Accounting Lecture – 38 Notes to the Accounts • Notes to the Accounts – are the explanatory notes of all the • items shown in the profit and loss account and the balance sheet. It is the requirement of the Companies Ordinance and the International Accounting Standards. 6 Financial Accounting Lecture – 38 Contents of Notes to the Accounts • Following are explained in Notes to the accounts: Nature of business of the company Accounting Policies of the company Details and explanation of items given in the Profit and Loss Account and Balance Sheet. 7 Financial Accounting Lecture – 38 Debentures • Debenture is • an instrument for obtaining loan from general public. Mark up is paid on Debentures which is generally equal to the market rate. 8 Financial Accounting Lecture – 38 Debentures • Debentures are acknowledgement of debt, owed by the company to the public at large for a defined period of time, and has a mark up (profit) rate attached to it. 9 Financial Accounting Lecture – 38 Term Finance Certificate • Term Finance Certificate are issued for a defined period. • These are also issued to obtain loan from public at large. 10 Financial Accounting Lecture – 38 • Both Debentures and Term Finance Certificates are usually issued by Public Companies. 11 Financial Accounting Lecture – 38 Question • Beta (Private) Limited is a manufacturing company. • Following list of balances has been extracted from its books as on June 30, 2002. 12 Financial Accounting Lecture – 38 Particulars Amount Rs. Authorized Capital (face value Rs. 10 each) 500,000 Paid up / issued Capital 300,000 Debentures 240,000 Land 120,000 Building 315,000 Motor Vehicles 187,500 Furniture 34,500 Accumulated Profit and Loss Account 29,489 Stock in Trade 48,630 13 Financial Accounting Lecture – 38 Particulars Amount Rs. Debtors 42,525 General Reserve 28,000 Creditors 27,360 Proposed Dividend 15,000 Bank Balance ? Accumulated Depreciation Motor Vehicles 46,050 Building 66,000 Fixtures 11,250 14 Financial Accounting Lecture – 38 Note: • All items of profit and loss have been accounted for in calculating the balance of accumulated profit and loss account, except for Depreciation which is to be charged at 10% on WDV on all depreciable assets. Required • Prepare the balance sheet of Beta (Private) Limited As on June 30, 2002 15 Financial Accounting Lecture – 38 Solution Beta (Private) Limited Trial Balance As At June 30, 2002 Debit Rs. Credit Rs. Paid up Capital 300,000 Debentures 240,000 Accumulated Profit and Loss Account General Reserve 49,489 8,000 Creditors 27,360 Accumulated Depreciation Motor Vehicles 46,050 Building 66,000 Furniture and Fixtures 11,250 16 Financial Accounting Lecture – 38 Note: See Animation Debit Rs. Proposed Dividend 15,000 Land 120,000 Building 315,000 Motor Vehicles 187,500 Furniture and Fixture 34,500 Stock in Trade 48,630 Debtors 42,525 748,155 763,149 14,994 Bank Balance TOTAL Credit Rs. Double Under line 763,149 17 763,149 Financial Accounting Lecture – 38 Beta (Private) Limited Balance Sheet As At June 30, 2002 Particulars Note Fixed Assets at WDV Current Assets Amount Rs. 1 Debtors Stock in Trade Bank Balance Total Current Assets Current Liabilities Double Under line Creditors Proposed Dividend Total Current Liabilities Working Capital Net Assets Employed Financed By: Authorized Capital 50,000 Shares of Rs. 10 each Paid Up Capital 30,000 shares of Rs. 10 each General Reserve Accumulated Profit and Loss Account 2 Debentures Total 18 Financial Accounting Lecture – 38 Beta (Private) Limited Balance Sheet As At June 30, 2002 Particulars Fixed Assets at WDV Current Assets Note Amount Rs. 1 Debtors Stock in Trade Bank Balance Double Under line Total Current Assets Current Liabilities Creditors Proposed Dividend Total Current Liabilities Working Capital Net Assets Employed 19 Financial Accounting Lecture – 38 Note 1 – Fixed Assets at WDV Particulars Cost As At 1-7-01 Addition/ Deletion Rate As At 30-6-02 Land Building Furniture & Fixtures Vehicles TOTAL 20 Acc. Dep. As At 1-7-01 For The Year WDV As At 30-6-02 As At 30-6-02