Mile-a-Minute Review – Unit IV

advertisement

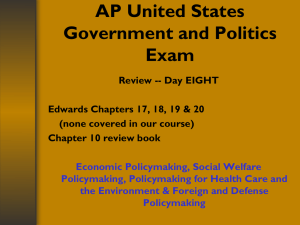

PUBLIC POLICY AP Gov’t UNIT IV “Mile-a-Minute Mini Lecture” Public Sector v. Private Sector: The Share of GDP* Taken by Taxes,** Selected Countries Sweden 49.3 Denmark 49.3 Finland 47 Norway 46.6 Belgium 45.4 France 43.6 Austria 43.5 Italy 42.4 Greece 40.5 Canada New Zealand Spain 36.5 35.9 35.8 Switzerland 32 Japan United States Australia Turkey 29.4 39.4 38.5 23.1 *GDP, groos dom estic product, m easures the total annual value of all goods and services produced w ithin a country. **Includes national and local taxes and Social Security contributions Chapter 17: Economic Policymaking I. Government and the Economy pg. 542 A. Introduction Capitalism / Communism / Mixed Economy B. Unemployment and Inflation Consumer price index C. Elections and the Economy Incumbents (esp. prez) held accountable for bad economy Voters care more about unemployment than inflation D. Political Parties and the Economy Reps more worried about inflation Dems more worried about unemployment Chapter 17: Economic Policymaking II. Policies for Controlling the Economy pg. 548 A. Introduction Laissez-faire / FDR / Reagan B. Monetary Policy and the Fed Fed manipulate the supply of $$ & credit available Raise / lower interest rates Set reserve rates Buy / sell gov’t bonds C. Fiscal Policy: Keynesian versus Supply-Side Economics Bottom up: spend to get out of recession & worry about deficits later Top down: tax breaks @ the top will “trickle down” Chapter 17: Economic Policymaking III. Obstacles to Controlling the Economy pg. 552 Budgets prepared in advance Private sector Uncontrollable expenditures IV. Arenas of Economic Policymaking pg. 556 A. Business and Public Policy: Subsidies Amid Regulations B. Consumer Policy: The Rise of the Consumer Lobby FTC & FDA & CPSC C. Labor and Government National Labor Relations Act 1935 Taft-Hartley Act 1947 Chapter 17: Economic Policymaking D. New Economy, New Policy Arenas V. Understanding Economic Policymaking pg. 559 A. Democracy and Economic Policymaking Voters have used democratic processes to avoid Marxist revolution B. Economic Policymaking and the Scope of Government Chapter 18: Social Welfare Policymaking I. What Is Social Welfare & Why Is It So Controversial? pg. 566 Means-tested v. Entitlement programs II. Income, Poverty, and Public Policy pg. 568 A. Who’s Getting What? Income v. wealth B. Who’s Poor in America? The poverty line C. What Part Does Government Play? Progressive v. proportional (flat) v. regressive taxes Earned Income Tax Credit Chapter 18: Social Welfare Policymaking III. The Evolution of American Social Welfare Programs pg. 574 A. Introduction B. The New Deal and the Elderly Social Security Act of 1935 C. President Johnson and the Great Society Medicare 1965 D. President Reagan and the Limits to the Great Society E. President Clinton & Welfare Reform in the 1990s TANF Find work within 2 yrs. 5 year lifetime max. States get Block Grant to run their own programs IRS Tax Rates 2009: Progressive Tax If taxable income is over… But not over… The tax is: $0 $8,350 10% $8,350 $33,950 15% $33,950 $82,250 25% $82,250 $171,550 28% $171,550 $372,950 33% $372,950 No limit 35% Chapter 18: Social Welfare Policymaking IV. The Future of Social Welfare Policy pg. 576 A. Entitlement Programs: Living on Borrowed Time? pg. 578 B. Means-Tested Programs: Do They Work? C. Social Welfare Policy Elsewhere pg. 582 V. Understanding Social Welfare Policy pg. 584 A. Democracy and Social Welfare Recipients of means-tested programs aren’t politically active Recipients of entitlement programs are! (AARP) B. Social Welfare Policy and the Scope of Government Chapter 19: Policymaking for Healthcare & the Environment I. Health Care Policy pg. 590 A. The Health of Americans Life expectancy & infant mortality rate B. The Cost of Health Care = 1/7 of GDP Expensive procedures Malpractice suits Insurance masks true costs Costly prescription drugs Aging population Health Care Spending in Selected Democracies Belgium 88% Britain 84% Denmark 84% Sweden 84% Percentage of Total Health Care Spending by Government Norway 83% Japan 78% New Zealand 78% Finland 77% Germany 76% Spain 76% France 74% Netherlands 73% Italy 70% Switzerland 70% Canada 70% Australia 67% United States 46% 0% 10% 20% 30% 40% 50% Percentage 60% 70% 80% 90% 100% Chapter 19: Policymaking for Healthcare & the Environment C. Access to Health Care HMO’s D. The Role of Government in Health Care pays about ½ the health care bill) Medicare Medicaid Health Care for Vets E. Policymaking for Health Care Chapter 19: Policymaking for Healthcare & the Environment II. Environmental Policy pg. 600 A. Economic Growth and the Environment B. Environmental Policies in America EPA Environmental Impact Statements Clean Air Act 1970 (Emissions Trading) Water Pollution Control Act 1972 Endangered Species Act 1973 C. Energy, the Environment D. Toxic Wastes & the Superfund Yucca Mtn.?? Chapter 19: Policymaking for Healthcare & the Environment E. Making Environmental Policy Concern over Climate Change The Kyoto Protocol?? III. Understanding Health Care & Environmental Policy pg. 610 A. Democracy and Health Care and Environmental Policy B. The Scope of Government and Health Care and Environmental Policy Sources of Energy in the US Renewable 6% Other 5% Nuclear 8% Coal 22% Petroleum 37% Natural gas 22%