Sales and Use Tax - University of Washington School of Law

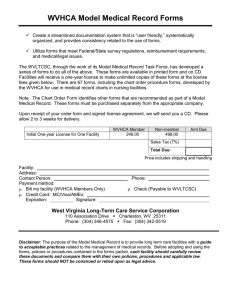

advertisement