EPCG Schemeand CENVAT Credit

advertisement

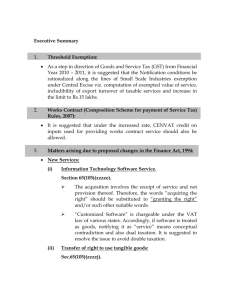

EPCG Scheme and CENVAT Credit 14 January 2009 Essar House, Mahalaxmi By K. R. Choudhary 14 January 2009 EPCG and CENVAT 1 Part A Export Promotion Capital Goods Scheme (EPCG) 14 January 2009 EPCG and CENVAT 2 The General Provisions 1. Under the EPCG scheme, an Authorization holder can import Capital goods (i.e. plant, machinery, equipment, components and spare parts of the machinery) at a concessional rate of Customs Duty of 3% 2. Capital goods can be imported for pre-production, production and post production Works 3. Capital goods imported in CKD / SKD to be assembled in India 4. Spares, tools, spare refractories and catalysts for existing plant and machinery 14 January 2009 EPCG and CENVAT 3 The General Provisions (continued) 5. The capital goods imported under EPCG scheme may be transferred to any of the Units / Group Companies of the applicant 6. Import of spares of Capital goods including refractory, catalyst as required for installation and maintenance of Capital is permitted, without any limits. Jigs, fixtures, dies, moulds will be allowed to the extent of 100% of CIF value of Authorization 14 January 2009 EPCG and CENVAT 4 The General Provisions (continued) 7. Second-hand Capital goods can also be imported under EPCG Scheme. However, second-hand Capital goods of Indian Origin are not permitted under the EPCG scheme 8. Merchant exporters can also import Capital goods under EPCG scheme, provided the goods are installed in the factory of their supporting manufacturer 14 January 2009 EPCG and CENVAT 5 The General Provisions (continued) 9. EPCG Authorization holder can opt for technological up-gradation of existing Capital goods imported under EPCG Authorization after five years and when minimum export obligation of 40% of earlier EPCG Authorization is fulfilled. 10. An application for the grant of an Authorization may be made to the Regional Authority 11. Installation Certificates: The Authorization holder shall produce from the concerned Central Excise Authority within 6 months from the date of completion of Imports 14 January 2009 EPCG and CENVAT 6 The General Provisions (continued) 12. Authorization holder who are not registered with Central Excise Authorities and service providers can give a certificate either from the jurisdictional Excise authority or an independent Chartered Engineer 13. In case of spares, the installation certificate shall be submitted within three years from the date of import 14. EPCG Authorization is issued with validity period of 36 months 14 January 2009 EPCG and CENVAT 7 The General Provisions (continued) 15. The import is permitted only through a specified port of registration 16. Exports can be made from any of the ports specified 17. For clearance at a port other than port of registration, TRA (Telegraphic Release Advise) is required 18. EPCG scheme will be issued on basis of nexus between goods allowed and products exported as certified by a Chartered Engineer 19. Authorization issued after date of shipment but before clearance from Customs bonded warehouse is acceptable 14 January 2009 EPCG and CENVAT 8 The General Provisions (continued) 20.Replacement of Capital Goods: The Capital goods imported under the scheme and found defective may be exported and Capital goods in replacement thereof be imported under the scheme. In such cases, while allowing export, the Customs shall credit the Duty benefit availed which can be debited again at the time of import of such replaced Capital goods 21.The import of refurbished spares shall be permitted under EPCG scheme 22. An EPCG Authorization holder may, on the basis of firm contract between the parties, source the Capital goods from a domestic Leasing Company 14 January 2009 EPCG and CENVAT 9 Duty 1. Customs Duty @ 3% is payable 2. HE & SHE Cess on Customs Duty are payable @ 2% and 1% respectively 3. Special CVD (SAD) of 4% is not payable 4. An importer can either claim exemption of CVD or pay CVD in cash 5. If an importer avails of the option to pay CVD in cash, the incidence of CVD would not be taken for computation of Net Duty saved provided the CENVAT Credit of CVD has not been taken 6. If the goods are not exported as per obligation, differential Custom Duty plus 15% interest is payable 7. Since Customs Duty @ 3% is payable on imported goods, 3% Duty has to be paid even in cases of domestic procurement 14 January 2009 EPCG and CENVAT 10 Fulfillment of Export Obligations 1. The Authorization holder under the EPCG scheme shall fulfill the export obligation over the specified period in the following proportions: Period from the date of issue of Minimum export obligation to Authorization be fulfilled Block of 1st to 6th year 50% Block of 7th and 8th Year 50% 14 January 2009 EPCG and CENVAT 11 Fulfillment of Export Obligations (continued) 2. In respect of Authorization, on which the value of Duty saved is Rs.100 Crores or more, the export obligation shall be fulfilled over a period of 12 years in the following proportion: Period from the date of issue of Authorization Minimum export obligation to be fulfilled Block of 1st to 10th year 50 % Block of 11th and 12th year 50 % 14 January 2009 EPCG and CENVAT 12 Export Obligations 1. The export obligation of a particular Block of year may be set off by the excess exports made in the preceding Block of the years 2. Royalty payment received from abroad and testing charges received in free foreign exchange will be counted for discharge of export obligation under the EPCG scheme 3. In respect of Capital goods imported for technological up-gradation, export obligation will be six times the Duty saved 4. Agricultural units will have export obligation of 6 times the Duty saved 5. In respect of EPCG authorization for Rs 100 Crores or more, the export obligation shall be required to be fulfilled over a period of 12 years 6. Sick companies under BIFR and units under the Agricultural Export Zone can fulfill export obligation in 12 years 14 January 2009 EPCG and CENVAT 13 Export Obligations (continued) 7. Exports of goods / services by Group Companies will also be considered towards fulfillment of export obligations 8. Shipments made under Advance Authorization, DFRC, DEPB and Drawback are all counted for fulfillment of EPCG obligations 9. Supply by EPCG Authorization holder to a SEZ unit or Developer / Co-developer will be counted towards discharge of export obligation (required under EPCG scheme), even if payment is received in Indian currency or any other currency 10. If 75% of the export obligation is completed in half or less than half the prescribed period, Companies will be freed from their obligation in the remaining period – in the form of incentives for fast track Companies 11. Waiver of export obligation can be granted by a committee in case of non-fulfillment due to unforeseen reasons or circumstances beyond control 14 January 2009 EPCG and CENVAT 14 Export Obligations (continued) 12. Monitoring of fulfillment of export obligations is assigned to DGFT and Customs will redeem the bond/bank guarantee on the basis of DGFT’s EO Discharge Certificate 13. The goods imported shall not be disposed of or transferred by sale or lease or any other manner till export obligation is completed 14. If export obligation is not fulfilled or partially fulfilled, Customs Duty with interest is payable which is proportionate to export obligation not fulfilled BUT machinery should not be confiscated and penalty need not be imposed 15. In case, EPCG Authorization holder fails to fulfill the prescribed export obligation, he shall pay Duties of Customs plus 15% interest per annum to the Customs authority 16. Case wise waiver of export obligation in case of force majeure / unforeseen circumstances have also been provided for 14 January 2009 EPCG and CENVAT 15 Clubbing of EPCG Authorizations 1. Clubbing of EPCG Authorizations: The clubbing of two or more EPCG Authorizations of the same Authorization holder would be permitted subject to the following conditions: The EPCG Authorizations have been issued during the same licensing year The EPCG Authorizations have been issued under the same Customs Notification The EPCG Authorization must be for the export of the same product / same service 2. No clubbing would be permitted in the case of expired EPCG Authorizations 14 January 2009 EPCG and CENVAT 16 Clubbing of EPCG Authorizations (continued) 3. On clubbing, Authorizations for all purposes shall be deemed to be a single EPCG Authorization issued under the said Customs Notification and the export obligation period for the clubbed Authorization shall be reckoned from the date of issuance of the first Authorization 4. However, in cases where the clubbed CIF/Duty saved value exceeds Rs 100 Crores, no corresponding benefit of increase in export obligation period shall be admissible 5. The total export obligation for the Authorizations so clubbed would be refixed taking into account the total Duty saved or total CIF value of imports as the case may be of the clubbed Authorizations 14 January 2009 EPCG and CENVAT 17 Indigenous Sourcing of Capital Goods 1. The EPCG Authorization holder intending to source Capital goods indigenously, shall make a request to the Regional Authority for invalidation of the EPCG Authorization for direct import 2. The EPCG Authorization holder shall also give the name and address of the person from whom he intends to source the Capital goods 3. At the time of issuance of Authorization or subsequently, the Regional Authority shall make the Authorization invalid for direct import and issue an invalidation letter - in duplicate - to the EPCG Authorization holder 4. The Regional Authority shall simultaneously grant permission to the EPCG Authorization holder to procure the Capital gods indigenously in lieu of direct import 14 January 2009 EPCG and CENVAT 18 Indigenous Sourcing of Capital Goods (continued) 5. The indigenous manufacturer intending to supply Capital goods to the EPCG Authorization holder may apply to the Regional Authority for the issuance of Advance Authorization for import of inputs including components required for the manufacture of Capital goods to be supplied to the EPCG Authorization holder 6. The supplier of indigenous goods is entitled to all benefits of deemed export on production of certificate from the respective Assistant Commissioner of Customs and Central Excise Authorities 14 January 2009 EPCG and CENVAT 19 Indigenous Sourcing of Capital Goods (continued) 7. The supplier of Indigenous goods is also entitled to the refund of TED (Terminal Excise Duty). This is the duty which is paid by him on procurement of indigenously manufactured goods which are used for the production of such goods which are supplied to original EPCG holder 8. Supply of goods will be eligible for refund of TED provided the recipient of the goods does not avail CENVAT credit on such goods 9. For the refund of TED, the indigenous supplier has to make an application to the DGFT, such refund normally takes one month from the date of application 14 January 2009 EPCG and CENVAT 20 Documents For TED Refund Bills of Entry (photocopy), in case of imported raw materials Original Excise Duty paid invoices Original Invalidation letter Original Installation certificate Copy of EPCG set Original certificate of non-availment of CENVAT Purchase Order 14 January 2009 EPCG and CENVAT 21 Part B CENVAT Credit 14 January 2009 EPCG and CENVAT 22 CENVAT Credit 1. As the taxable event in Excise is manufacture, all such goods suffer Excise Duty at the hands of manufacturer 2. When such Duty paid goods are used by another manufacturer and Duty is paid by such person, then, the value of the goods includes Duty paid on inputs too. Excise Duty burden on the final products fall on Duty paid on inputs. Thus, a situation arises whereby Duty becomes payable on Duty. This results in a cascading effect and such process continues till the goods reach the ultimate consumer 14 January 2009 EPCG and CENVAT 23 CENVAT Credit (continued) 3. A manufacturer or service provider can take credit of Duty / Tax paid on inputs or Capital goods / input services and can adjust the same for payment of Duty / tax on his final products or output services 4. CENVAT scheme essentially requires that final products should be Duty paid and not exempted 14 January 2009 EPCG and CENVAT 24 Goods / Services Eligible For CENVAT Credit All goods, except High Speed Diesel Oil (HSD) Light Diesel Oil (LDO) and petrol (motor spirit), used within the factory of production / in relation to manufacture of final products directly or indirectly and whether contained in the final products or not. This includes: Accessories of the final products cleared along with the final products Paint Packing material (including the raw material used for making the packing material within the factory of production) Fuel for generation of electricity or steam used for manufacture 14 January 2009 EPCG and CENVAT 25 Input Service 1. Several services are liable to Service tax. A manufacturer / Service Provider procures such taxable service for his activity. If the taxable service satisfies the definition of Input Service as per the rules, credit of Service Tax paid is admissible 2. Input Service means any service: Used by a provider of taxable service for providing an output service Used by the manufacturer (directly / indirectly) or in relation to the manufacture of final products and clearance of final products from the place of removal 3. A manufacturer / consignor can take credit on the Service Tax paid on transportation up to buyer’s premises where sales takes place 14 January 2009 EPCG and CENVAT 26 Specified Duties & CENVAT Credit 1. Credit thus taken is called as CENVAT Credit and is utilizable across good and services. Duties / tax which can be availed as CENVAT Credit are: # Excise duty # Education Cess on Secondary and Higher Education Cess on Excise duty # Additional Customs Duty # Service Tax # Education Cess and Secondary Higher Education Cess on taxable services 14 January 2009 EPCG and CENVAT 27 Utilization of Credit For payment of Excise Duty on any final products (including waste & scarp) For payment of Duty on inputs removed as such or inputs removed after being partially processed under Invoice For payment of Service Tax on any Output Service Credit of Education Cess / Secondary and Higher Secondary Cess paid on inputs or Capital goods or inputs services can be utilized for payment of such Cess 14 January 2009 EPCG and CENVAT 28 Capital Goods Removed After Use If the CENVAT availed Capital goods are removed after use, the manufacturer / Service Provider shall pay an amount equal to the Credit taken on such Capital goods reduced by 2.5% for each Quarter of a year or part thereof from the date of taking credit 14 January 2009 EPCG and CENVAT 29 Capital Goods Removed After Waste If the Capital goods are cleared as waste and scrap, the manufacturer shall pay an amount equal to the Duty leviable on the transaction value 14 January 2009 EPCG and CENVAT 30 CENVAT Credit – Documents Needed The documents that can be used for taking CENVAT Credit are as follows : An invoice by a manufacturer for clearance of Inputs or Capital goods from his factory or from his depot A supplementary invoice A Bill of Entry A Challan evidencing payment of Service Tax 14 January 2009 EPCG and CENVAT 31 Conditions For CENVAT Credit 1. Credit eligibility and time limit: CENVAT Credit becomes eligible once the Duty / Tax is paid # there is no time limit to utilize the CENVAT Credit # Credit is available immediately on receipt on user factory / premises of output service provider # Credit in respect of input service shall be allowed on or after the day on which payment is made which is the value of input service and the Service Tax paid or payable as indicated in the Invoice / Bill / Challan 2. Burden of proof for admissibility of CENVAT Credit lies upon the manufacturer / output Service Provider taking CENVAT Credit 14 January 2009 EPCG and CENVAT 32 Conditions For CENVAT Credit (continued) 3. Quantum of credit on Capital goods: Credit on Capital goods is allowed up to 50% of Duty paid in the same financial year. However, the whole credit will be allowed in the same year if the Capital goods are cleared as such in the same year. Balance credit can be availed in any subsequent financial year provided Capital goods are still in possession and use of the manufacturer / provider of output service 4. Credit admissibility on lease, hire purchase or loan: Credit on Capital goods is allowed even if they are acquired on lease, hire purchase or loan agreement from a financing Company 5. Credit is not allowed on that part of the value of Capital goods which represents the amount which the manufacturer or output service provider claims as depreciation 14 January 2009 EPCG and CENVAT 33 Movement of Inputs / Capital Goods and CENVAT Credit Credit is allowed even if any input / Capital goods / inputs after being partially processed are sent to job worker for further processing: # Testing # Repair # Reconditioning or for the manufacture of intermediate goods necessary for the manufacture of final products or # Any other purpose It should be proved from the record / challans / memo / any other documents that the goods are received back in the factory within 180 days. Otherwise a manufacturer is required to debit an amount equivalent to the CENVAT Credit on such unreceived inputs Capital goods which can be restored when they are received back in the factory subsequently 14 January 2009 EPCG and CENVAT 34