Simmons_TheSoutheastEnergyInitiative

advertisement

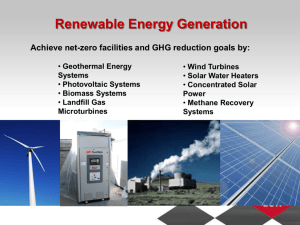

The Southeast Energy Initiative Considerations for Installation Energy Security and Surety Gordon L. Simmons, P.E. Chief, Engineering Division Savannah District Energy Considerations in the Southeast Issues: • Population in the South Atlantic states expected to grow by ~32% by 2030 with a related increases in energy demand • Greenhouse gas emissions reduction by replacing coal plants with other forms of alternate and renewable sources • Requirements toward energy and fossil fuel reductions (EPAct05, EISA07, EO 13423, and EO 13514) Solutions: • Increased focus on reducing energy intensity and increasing conservation • Providing a level of energy security to Installation Commanders while adding resiliency to the “Grid” … All while protecting the interest of the tax payer and being good stewards of the environment 2 Savannah District Focus Areas The overall Complex Existing Buildings Alternate Energy, Smart Grids, Modernization, Critical Infrastructure, Energy Security Conservation, Retrofit, Recommission Facility Design being enhanced by the SAS/SAM Center of Energy Excellence 3 What’s coming New Construction Large renewable or alternate power – The SAS Southeast Energy Initiative Pilot Projects Conclusions Energy savings are site and facility specific EISA 2007 energy targets are a high bar to achieve Higher the internal loads the more difficult energy savings become Dining facilities are difficult, barracks are easier, admin somewhere in between Generally speaking, dependent on facility type: o 25-35 % energy savings: the building yields the maximum energy savings for the lowest investment o 35-60 % energy savings: each increment of energy saved comes at an increasingly higher investment o Above 60 %: May be cost prohibitive for facility types with high internal loads. Requires that we introduce renewable sources. Introduction of renewable energy rarely pays back in the life of a single facility. Need to aggregate sources and needs across a grid. 4 Large Scale Renewable or Alternate Power SAS Energy Cx designs or retrofits existing buildings to the more cost effective energy efficient solution Ft. Anywhere Renewable Energy Generation 5 Work with EITF and Installation for large scale secure power solutions on the installation 6 Large Scale Renewable Projects The EITF Phase 1 Opportunity Identification “Identify and Prioritize Opportunities” Target: 90 Days Phase 2 Project Validation “Developing an Opportunity Into a Project” Target: 90-180 Days Current: 1-3 years •Conduct GIS Screening to ID installations w/ RE potential •Analyze maturity of effort •Assess top level economics •Identify sites on installations w/ master plans •Visit installation and confirm data on sites •Assess Environmental and Operational Issues •Conduct Go/No Go Assessment •Prioritize sites in portfolio on Army RE goals •Sign MOU with installations •Conduct initial legal and regulatory review •Initiate NEPA assessments •Provide full Economic Case Analysis (ECA) •Coordinate Off-Take and other Stakeholder Input •Define Real Estate strategy •Define System Integration approach •Assess Mission Operation and Security Impacts •Obtain Required Approvals and Clearances •Define Acquisition Approach Phase 3 Acquisition Phase 4 Building Infrastructure “Getting a Binding Agreement” Target: .5-1 Years Current: 1-3 Years “Constructing Assets; Structuring Services” Target: 1-3 Years “Managing the Operation and Transition to Closure” Target: 10-30 years •Develop Acquisition Requirements and Evaluation Criteria •Solicit Proposals from Industry •Select “Highest Ranking Offeror” •Obtain Required Approvals and Clearances •Finalize Business Arrangements •Award Contract or Execute Lease •Monitor and Enforce performance, quality, schedule and warranty commitments •Structure and Implement Support Service Agreements to Developer •Structure and Account for Lease Payments or In-Kind Consideration •Structure and Account for Power Purchase Payments •Structure and Implement Service Agreements with Developer •Structure REC transactions and accounting mechanisms •Track PPA Payments •Track REC management •Conduct enforcement of performance, quality, and warranty commitments with operator •Conduct validation of O&M activities vs O&M plan/schedule (case by case) •Manage Counterparty Risk (credit monitoring) •Develop transition/maintenance/decommissioning plan •Update installation energy plan The EITF Renewable Energy Project Development Guide 7 Phase 5 O&M and Closure Current EITF Assessments WA OR NY PA IA NV UT CA CO IL MD KS NC AZ OK NM TX Fewer opportunities here HI Current Installation Engagements 8 Fort Bliss, TX Fort Bragg, NC Fort Carson, CO Fort Detrick, MD Fort Drum, NY Fort Hunter Liggett, CA Fort Irwin, CA Fort Lewis, WA Fort Riley, KS Fort Sill, OK Iowa Army Ammo Plant, IA Kahuku Training Area, HI Letterkenny Army Depot, PA Oregon Army National Guard, OR Parks Reserve Forces Training Area, CA Rock Island Arsenal, IL Sierra Army Depot, CA Tooele Army Depot, UT USAG-Hawaii, HI West Point (U.S. Military Academy), NY White Sands Missile Range, NM Yuma Proving Ground, AZ AFB Ft. Anywhere Biomass Regional Energy Initiative Other Federal Installation 9 Tenant Agency Navy Yard SMR Introduction to Regional Initiatives Obtain secure regional renewable energy at the best value possible: Combining and resolving the needs of multiple Federal partners on multiple sites with a best value solution that provides economy of scale and shared investment. Providing a focus on regional solutions and economics and the development of regional expertise. Development of partnerships with industry, utilities, investors, and customers for successful, repeated, distributed RE projects within the region. Providing available Federal land at no cost Providing land with NEPA clearance to reduce risk Providing a guaranteed customer base of Federal users Shared risk and reward with the goal of providing the best value solution 10 BLUF - Southeast Energy Initiative (SEEI) Savannah District is leading Army/ Federal Partners to produce commercial RE Power in various states in the southeast: Army/Federal Partners – Customers / Initial Investment / Strategic Mgmt USACE Savannah District – Regional Leadership/ Planning/ Execution/ Oversight of PPA DOE/ Savannah River National Lab – RE/Alternate Technology/ Existing Pilot Project/ Feasibility Local Utilities – Business Plan / RFP / PPA/ Transmission/ Marketing 11 Goal: Secure Energy Solutions, renewable, alternate, hybred Private investment $400-$600 million to $1 billion Biomass, Solar, Waste-to-energy, small modular reactors Power Purchase Agreement (PPA) or ESPC The Savannah District/Savannah River National Lab Team The Savannah River National Lab is a premier research, development and execution agent on the leading edge of all state-of-the-art clean energy opportunities Existing partnership with USACE and Savannah District Proven applications of Private-Public partnerships in the development of renewable energy projects that supplement the Site’s power requirements Active in applying multiple forms of energy independence research and development that will be a benefit to the Army and the nation: 12 Regional Industrial Hydrogen Fuel cells Small Modular Reactors and fuel repurposing Carbon neutral fuels (Biomass, algae, recycled CO2) Carbon fuels recycling Southeast Energy Initiative SRS Model - Biomass It’s not just a theory… Pilot Project at Savannah River Site: Commercially funded biomass plant 40% of site’s required electricity 100% of site’s required steam Design/build/operate by a commercial firm for 19 years (ESPC) The government still owns the plant from day one Minimum Federal investment Actively partnering and holding discussions for expansion into the region: Ameresco Federal Services Forts Gordon, Stewart, Bragg, Jackson Utility Consortiums (SCANA, Duke…) DOE, DHS, others 13 Ameresco is providing turn-key delivery of this 20 MWe/200,000 pph steam biomass cogeneration plant at the Savannah River Site under an ESPC. Completed in Sept 2011 and now fully operational. Southeast Energy Initiative SRS Model – Waste to Energy Private – Public Partnership Three Rivers Solid Waste Authority (Local) Government Owner Gas Collector Kimberly-Clark Gas Purchaser (15 years) Siemens Building Technologies Plant Operator/Pipeline Financier Landfill Gas to Energy Project 14 Provides 40% of K-C’s energy needs, increasing to 90% as plant grows Reduces greenhouse gases by 170,000 tons per year Generates $150,000 revenue/month SEEI Future Strategies For Example - Biofuels Energy Independence Reducing dependence on foreign oil Small scale demonstrations underway in US Producing ~2000 gal/acre/yr Utilize large quantities of land and carbon dioxide Algae farm Carbon source • Biomass Plants • Landfill SEEI is looking beyond the immediate need toward applying other developed solutions to the southeast’s demands 15 Algae farm project in Hawaii REI Keys to Success – Giving All Parties What they Need Developers need “shovel ready” projects to back up PPA RFPs – Completed environmental and real estate reviews, resource assessments, etc. Financiers need PPA (with developer) that “guarantees” repayment of invested capital – Profitable sale price, provisions for full repayment if contract terminated, right to lien, etc. Ability to assume contract from the developer once construction is complete. Utilities need protection from new generation affecting power quality, reliability, and cost to other customers. That is a state requirement for all retail utilities and a Federal requirement for all wholesale providers (generators, transmission owners, etc.). 18 REI Challenges – There is no cookbook yet States regulate retail power, and crossing state lines on a REI may present issues. Federal agencies are bound by State regulations per 40 USC 591 Connection to the transmission grid highly regulated Adding to the grid is a long process The frequency response of the grid must be maintained Smart Grid technologies not mature Transmission lines between sites decrease security issues Different agencies have different authorities with respect to entering into such agreements How to share/purchase RECs if necessary How to define “secure” energy 19 Particular Challenges of SEEI • Regulated markets – profit fixed and controlled • Who gets the projects? How much is needed for 25% in 2025? • Economic downturn changes demand curves – looks like it may be flat for the next 10 years. • $/KWh in the SE already low – hard to compete with new capital costs • Natural gas prices remain low, discouraging renewables 20 Particular Challenges of SEEI • Utility Companies Integrated Resource Plans vs. Installation renewable requirements • Master planning of utility infrastructure on installations being lost in privatization – Privatized firms may not report their plans/vulnerabilities – Installations may not adequately share future plans with utility companies • Infrastructure not in place to “manage” new power sources – Microgrid/Secure Grid – Definitions of Critical Infrastructure 21 How do you eat an elephant? 22 23