Types of credit

advertisement

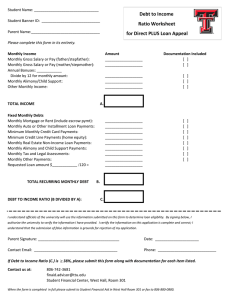

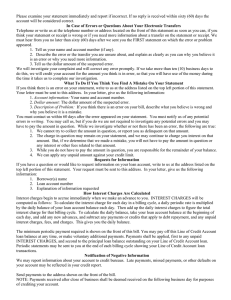

Independent Living December 8, 2015 What is a finance charge? Explain the 20-10 rule. If a questions asks you to find the safe debt load, what are the proper math steps to do so? What are the three borrowing fundamentals from the Debt Slapped video? Math problem: Harry is a monthly net income of $2,912.00. His fixed monthly expenses consist of $725 for rent. Harry’s outstanding student loan balance is $9,050 and has a $500 outstanding loan from purchasing a new broom two months ago. What is Harry’s safe debt load and how much more debt can Harry take on? Open-Ended Credit: Enables borrower to use credit up to a stated limit Closed-End Credit: A loan for a specific amount that must be repaid in full, including all finance charges, by the specified due date Service Credit: A service provided which will be paid later As payments are made, the limit allows for more use of credit Can be used again and again, as long as the balance does not exceed the credit limit Types of open-ended credit: Charge Cards Revolving Accounts https://www.youtube.com/watch?v=q7mVlnykqbU The debtor (cardholder) is obligated and required to pay the balance in full by specified due date Cannot incur interest charges and statement doen’t come with minimum payments Not paid on time = hefty late fees and other penalties may apply Often include rewards and rebates based on purchases Percentage of dollar amount charged Gift items of value Cardholder has the option of paying the balance in full by the due dates or making payments Payment installments must be equal to or greater than stated minimum amount Minimum payment will be based on amount due and set by creditor Most all purpose cards are listed as revolving credit agreements Only similarity to chard cards: offer reward and rebate programs Used to pay for big items Cars, major appliances, real estate, etc. Loan is take out then repaid in fixed payments that include principal and interest added Product purchased with loan becomes automatic collateral to assure repayment Telephone and utility services are provided for a month in advance, then you are billed Doctors, lawyers, hospitals, financial advisers: work on service credit Terms are set by individual businesses Companies are required by law to record transactions on your account and send you a bill at the end of the billing cycle Pay the bill in full at the end of the cycle, you avoid finance charges Before selecting a credit card, be sure to review the following terms which affects the overall cost of the credit you will be using