REQUEST FOR TENDER

FOR

PROVISION OF SERVICES FOR THE AUDIT OF THE

FINANCIAL STATEMENTS OF

AUSTRALIAN GOVERNMENT SUPERANNUATION

ENTITIES

AND

COAL MINING INDUSTRY (LONG SERVICE LEAVE

FUNDING) CORPORATION

FOR THE

AUSTRALIAN NATIONAL AUDIT OFFICE

TENDER NO:

2012/1529

CLOSING TIME (LOCAL): 2 pm (AEST), 19 November 2012

10998447_5

REQUEST FOR TENDER OUTLINE

Part 1

- Summary of Requirement

Part 2

- Conditions of Tender

Part 3

- Statement of Requirements

Part 4

- Draft Conditions of Contract

Part 5

- Tender Response

Part 6

- Background Information on the Client

10998447-5

TABLE OF CONTENTS

PART 1 - SUMMARY OF THE REQUIREMENT

1.1

1.2

1.3

Scope of the Requirement

Background to the Requirement

Disclaimer

PART 2 - CONDITIONS OF TENDERING

2.1

2.2

2.3

2.4

2.5

2.6

2.7

2.8

2.9

2.10

2.11

2.12

2.13

2.14

2.15

2.16

2.17

2.18

2.19

2.20

2.21

2.22

2.23

2.24

2.25

2.26

2.27

2.28

2.29

2.30

2.31

2.32

2.33

2.34

2.35

2.36

2.37

2.38

2.39

2.40

2.41

2.42

2.43

2.44

2.45

2.46

2.47

2.48

2.49

2.50

Structure of the Request for Tender

Contract Authority

Inquiry by Prospective Tenderers

Place for Lodgement of Tenders

Closing Date and Time for Lodgement of Tenders

Extension of Deadline

Late Tender Policy

Packaging and Identification of Tenders

Copies of Tenders

Addenda to the Request for Tender

Requests for Additional Information by ANAO

Correction of Errors

Alterations, Erasures or Illegibility

Clarification

Supporting Material

Tender Validity Period

Proposed Contract Period

Acceptance and Proposed Contractual Arrangement

Evaluation Criteria

Evaluation Process

Tender Response

No Contract

Tenderer Profile

Insurance

Tender Interviews

Language

Public Statement by Tenderers

Freedom of Information

Tenderers to Inform Themselves

Tenderer’s Obligations of Confidentiality

Inconsistency

Costs and Expenses

Termination of Request for Tender

Request for Tender Information Disclaimer

Applicable Law

Collusive Tendering and false and misleading claims

Conflict of Interest

Unlawful Inducements

Improper Assistance

Privacy

Equal Employment Opportunity for Women in the Workplace Act 1999

ANAO’s Rights

Auditor-General Act

Security, financial and probity checks

Subcontractors

Expressions of price and measurement

Tenderer confidential information

Anti-terrorism measures

Fair Work Principles

Ombudsman Act 1976

10998447-5

2.51

2.52

Accountability and Transparency

Compliance with laws and Commonwealth policies

PART 3 - STATEMENT OF REQUIREMENT

3.1

3.2

3.3

3.4

3.5

3.6

3.7

Introduction

Outcomes and Reporting

Background to the Requirement

Contract Authority and Project Manager

Required Standards of Performance

Conditions Applying to the Delivery of the Services

Conflict with Agreement

PART 4 - DRAFT CONDITIONS OF CONTRACT

PART 5 – TENDER RESPONSE

PART 6 - BACKGROUND INFORMATION ON THE CLIENT

10998447-5

PART 1

SUMMARY OF THE

REQUIREMENT

10998447-5

PART 1 - SUMMARY OF THE REQUIREMENT

1.1

Scope of the Requirement

1.1.1

The Australian National Audit Office (ANAO) is seeking the services of organisations for

provision of audit services of following entities on behalf of the ANAO:

ENTITY

Commonwealth Superannuation Corporation

REQUIREMENT

A

Commonwealth Superannuation Scheme (CSS)

Public Sector Superannuation Scheme (PSS)

Public Sector Superannuation Accumulation Plan (PSSap)

Military Superannuation and Benefits Scheme (MSBS)

ARIA Investments Trust

B

B

B

B

C*

PSS/CSS A Property Trust

PSS/CSS B Property Trust

ARIA Property Fund

ARIA Co Pty Ltd

ARIA Alternative Assets Trust

PSS/CSS Investments Trust

Property Management Trust

CSC Treasury Trust

CFM Australian Equities Fund

CSS/PSS Pty Ltd

F

F

F

F

F*

F*

G*

F*

D

E

Commonwealth Superannuation Administration (Comsuper)

F

Coal Mining Industry (Long Service Leave Funding) Corporation

F

Key

* Denotes a special purpose financial report.

Services Required

The audit work required in each area includes:

A

financial statement opinion AFSL – FS71 opinion and a Risk Management Strategy

review opinion.

B

financial statement audit opinion for each entity, an APRA return forms audit opinion

(including compliance opinion, risk management plan and risk management strategy

audit opinion (for CSC)) and the Risk Management Plan review opinion.

C

financial statement audit opinion, an APRA return forms audit opinion (including

compliance opinion, risk management plan and risk management strategy (for CSC)

audit opinion) and the Risk Management Plan review opinion. The entity does not

present consolidated financial statements.

D

financial statement opinion, an APRA return forms audit opinion (including

compliance opinion, risk management plan and risk management strategy (for

10998447-5

CSS/PSS Pty Ltd) audit opinion and RSE Licensee conditions C1 and C5 opinion)

and a Risk Management Plan review opinion.

E

financial statement audit opinions and Risk Management Strategy review opinion.

F

financial statement audit opinion.

G

financial statement audit opinion for the consolidated group.

Background to the CSC Group of entities:

With effect from 1 July 2011 the Governance of Australian Government Superannuation Schemes Act

2011 created the Commonwealth Superannuation Corporation (the CSC). The CSC acts as the

sole Trustee body following the merger of Australian Reward Investment Alliance (ARIA), the

Military Superannuation and Benefits Board and the Defence Force Retirement and Death Benefits

Authority (DFRDB). CSC is subject to the Commonwealth Authorities and Companies Act 1997

(CAC) Act and essentially exists to govern the Schemes’ operations. The financial statements are

prepared in accordance with Australian Accounting Standards (which include the Australian

equivalent of International Financial Reporting Standards) and Interpretations and the Finance

Minister’s Orders.

The Commonwealth Superannuation Scheme (CSS) and Public Sector Superannuation Scheme

(PSS) are defined benefit schemes which provide benefits to employees of the Commonwealth. The

Public Sector Superannuation Accumulation Plan (PSSap) is a defined contribution fund. The

Military Superannuation and Benefits Scheme (MSBS) is a hybrid accumulation-defined benefit

Scheme which provides benefits to its members under the Military Superannuation and Benefits Act

1991. ARIA Investments Trust (AIT) is a pooled superannuation trust which is an investment

vehicle for CSS, PSS, MSBS and PSSap. The Trustee of CSS, PSS, PSSap, MSBS and AIT is

Commonwealth Superannuation Corporation (CSC).

The Schemes are operated for the purpose of providing for employees (and their dependents or

beneficiaries) of the Commonwealth, lump sum and pension benefits upon retirement, termination of

service, death or disablement.

Primary business and accounting processes operating with the Schemes are:

Meeting performance standards agreed with relevant stakeholders and complying with the

superannuation regulatory framework, schemes legislation, trust deeds as well as Government

policy;

Administration of the Schemes is primarily conducted by Comsuper (CSS, PSS and MSBS)

and, through a Comsuper Commonwealth contract, Pillar (PSSap). Custody of investments is

conducted by Northern Trust. The financial statements of the funds are prepared in

accordance with Australian Accounting Standards for Superannuation funds (AAS25).

PSS/CSS A Property Trust (PCA), PSS/CSS B Property Trust (PCB) and ARIA Property Fund

(APF) (collectively “the Property Funds”) have been set up by CSC to invest in real estate in

Australia.

The Trustee of all the Property Funds is CSC. The PCA and APF have four property investments –

50% of Indooroopilly Shopping Centre, Brisbane, 50% of 101 Collins Street, Melbourne, 100% of 55

Clarence Street, Sydney and 50% of QV1 250 St Georges Terrace, Perth. The PCS and APF are

managed for CSC by Eureka Funds Management Limited. The audit of Eureka Funds Management

Limited is not part of the audit services.

10998447-5

The PCB holds ownership or a share of five property investments including 1 Chifley Square, Sydney,

City Close Industrial Estate, Alexandria, Grosvenor Place, Sydney, Eaglegate Industrial Park,

Pinkenba, QLD and Riverside Centre Industrial Estate, Rosehill, Sydney. The PCB is managed for

CSC by Arcadia Funds Management Limited. The audit of Arcadia Funds Management Limited is not

part of the audit services.

The Property Management Trust (PMT) acts as property manager for direct property held by PCA

and APF. Consolidated financial statements are prepared for the entity. Subsidiaries are

Indooroopilly Property Management Pty Ltd, 101 Collins Street Pty Ltd, Eureka Asset Management

Pty Ltd and Car Park QV1 Pty Ltd. The entity is 50% owned by both APF and PCA.

CSC Treasury Trust was established on 17 May 2012 for the purpose of providing debt funding (via

a facility with ANZ) to both APF and PCA.

The Trustee for PMT and CTT is Eureka Funds Management Limited. As noted above, the audit of

the financial report of Eureka Funds Management Limited is not part of the audit services.

ARIA Co Pty Ltd is Trustee of ARIA Alternative Assets Trust (AAAT) and PSS/CSS Investments

Trust (PCIT) and does not have any employees. The net profit of the entity is nil as the entity does

not earn any revenue from acting as trustee. All costs relating ARIA Co Pty Ltd are borne by CSC.

The sole shareholder is CSC.

The principal activities of the AAAT and PCIT are to invest funds in accordance with their objectives

as set out in the Trust deeds. The sole unitholder is CSC as trustee for ARIA Investments Trust.

ARIA Alternative Assets Trust is an unregistered Trust created by Trust deed dated 3 May 2007 and is

domiciled in Australia. The Trust has been set up by the CSC to invest in private equity/alternative

investments in Australia.

PSS/CSS Investment Trust is an unregistered Trust created by Trust deed dated 20 December 2001

and is domiciled in Australia. The Trust has been set up by CSC to invest in private equity/alternative

investments overseas.

CSS/PSS Pty Ltd is Trustee of CFM Australian Equities Fund and does not have any employees.

The net profit of the entity is nil as the entity does not earn any revenue from acting as trustee. All

other costs relating to CSS/PSS Pty Ltd are borne by CSC. The sole shareholder is CSC.

CFM Australian Equities Fund is a pooled superannuation trust. The sole unitholder is CSC as trustee

for ARIA Investments Trust.

As noted above, the administration of the Schemes is primarily conducted by Comsuper. Comsuper is

a Commonwealth agency required to produce financial statements pursuant to the Financial

Management Act 1997.

Background for Coal Mining Industry (Long Service Leave Funding) Corporation can be found

at Section 6 of this Tender.

Attachment A to this part identifies the relevant legislation for each entity.

1.1.2

A detailed statement of the services (Services) is contained in the Statement of Requirement

(SOR) at Part 3 of this Request for Tender (RFT).

1.1.3

Tenderers are reminded of the requirements relating to auditor appointment, independence and

rotation in Part 2M.4 of the Corporations Act 2001, where the audit is of a Corporations Act

body.

10998447-5

1.2

Background to the Requirement

1.2.1

Roles and Responsibilities of the ANAO.

1.2.2

The Auditor-General and the staff of the ANAO play an important role in the process of public

accountability by providing the Parliament, the Executive and Management with an independent

assessment of the operations of public sector organisations. The ANAO’s Executive and the

majority of staff are located in Canberra.

1.2.3

The ANAO provides its principal client, the Parliament, with approximately 50 published

operational audit reports annually. These reports cover the full range of audit services offered,

ie performance audits, financial statement audits and information services. The ANAO also has

a close working relationship with the Joint Committee of Public Accounts and Audit (JCPAA)

which reviews the audit reports on a quarterly basis.

1.2.4

In addition, the ANAO provides audit services to about 260 audit client entities, including a

number of commercially oriented entities. The majority of these clients prepare financial

statements under either the Financial Management and Accountability Act 1997 (FMA Act) or

the Commonwealth Authorities and Companies Act 1997 (CAC Act). The audit reports on the

financial statements of these clients are published in the clients' annual reports, which are tabled

in Parliament.

Financial Statement Audits are generally undertaken under the provisions of the AuditorGeneral Act 1997 and the FMA Act or the CAC Act.

1.2.5

These audits are undertaken in accordance with the ANAO Auditing Standards set by the

Auditor-General in accordance with section 24 of the Auditor-General Act 1997 (as amended

from time to time).

1.2.6

The key outcome for each financial statement audit is to provide independent assurance on the

financial statements adopted by each entity. The achievement of this outcome requires the

meeting of clients’ needs (in particular each individual entity, the Minister and Parliament)

through the delivery of quality products (in particular, the opinion on the financial statements,

the report to Ministers and Parliament) on time, within budget and at a contestable price.

1.3

Disclaimer

1.3.1

The ANAO is not legally or in any other way obligated to those organisations that respond to

this RFT. The issue of this RFT does not commit or otherwise oblige the ANAO to proceed

with the proposed Services or functions. This RFT shall not be construed, interpreted or relied

upon, whether expressly or implied, as an offer capable of acceptance by any person, or as

creating any rights, liability or obligations, whether on contractual, quasi-contractual or

restitutionary grounds. No binding contract or other understanding (including, without

limitation, quasi-contractual rights, or rights based upon similar legal theories) will exist

between the ANAO and a tenderer unless and until a formal written contract is signed by the

ANAO and the successful tenderer.

10998447-5

ATTACHMENT A

Authority for Financial

Other Obligations

Statement Audit

Commonwealth Superannuation Commonwealth Authorities and

Corporation (CSC)

Companies Act 1997

Commonwealth Superannuation Superannuation Act 1976

Superannuation

Industry

Scheme (CSS)

(Supervision) Act 1993 &

Regulations

Financial Sector (Collection of

Data) Act 2001

Corporations Act 2001 &

Regulations

Public Sector Superannuation Superannuation Act 1990

Superannuation

Industry

Scheme (PSS)

Trust deed

(Supervision) Act 1993 &

Regulations

Financial Sector (Collection of

Data) Act 2001

Corporations Act 2001 &

Regulations

PSS

Accumulation

Plan Superannuation Act 2005

Superannuation

Industry

(PSSap)

Trust deed

(Supervision) Act 1993 &

Regulations

Financial Sector (Collection of

Data) Act 2001

Corporations Act 2001 &

Regulations

Military Superannuation and Military Superannuation and Superannuation

Industry

Benefits Scheme (MSBS)

Benefits Act 1991

(Supervision) Act 1993 &

Trust deed

Regulations

Financial Sector (Collection of

Data) Act 2001

Corporations Act 2001 &

Regulations

ARIA Investments Trust

Trust deed

Superannuation

Industry

(Supervision) Act 1993 &

Regulations

Financial Sector (Collection of

Data) Act 2001

Corporations Act 2001 &

Regulations

PSS/CSS A Property Trust

Trust deed

PSS/CSS B Property Trust

Trust deed

ARIA Property Fund

Trust deed

ARIA Co Pty Ltd

Corporations Act 2001

Financial Services Reform Act

2001 - AFS licence obligations

Superannuation

Industry

(Supervision) Act 1993 &

Regulations – RSE licence

obligations

including Risk

Management

Strategy (for

trustee) and Risk Management

Plan (for each scheme)

ARIA Alternative Assets Trust

Trust deed

PSS/CSS Investments Trust

Trust deed

Reporting Entity

10998447-5

Property Management Trust

CSC Treasury Trust

CFM Australian Equities Fund

Trust deed

Trust deed

Trust deed

CSS/PSS Pty Ltd

Corporations Act 2001

Commonwealth Superannuation

Administration (ComSuper)

Coal Mining Industry (Long

Service

Leave

Funding)

Corporation

Financial Management and

Accountability Act 1997

Commonwealth Authorities and

Companies Act 1997

10998447-5

Superannuation

Industry

(Supervision) Act 1993 &

Regulations

Financial Sector (Collection of

Data) Act 2001

Corporations Act 2001 &

Regulations

Financial Services Reform Act

2001 - AFS licence obligations

Superannuation

Industry

(Supervision) Act 1993 &

Regulations – RSE licence

obligations

including Risk

Management

Strategy (for

trustee) and Risk Management

Plan (for each scheme)

PART 2

CONDITIONS OF TENDERING

10998447-5

PART 2 - CONDITIONS OF TENDERING

2.1

Structure of the Request for Tender

2.1.1

This Request for Tender (RFT) invites tenders for the provision of the requirement specified

in the Statement of Requirement at Part 3, as part of an open tender. The specified

requirements are to be provided in accordance with the terms and subject to the conditions

contained in this RFT.

2.1.2

The RFT comprises the following documents:

(a)

(b)

(c)

(d)

(e)

(f)

Part 1 - Summary of the Requirement;

Part 2 - Conditions of Tendering;

Part 3 - Statement of Requirement (SOR);

Part 4 – Draft Conditions of Contract (Contract);

Part 5 - Tender Response; and

Part 6 - Background Information on the Client.

2.1.3

In this RFT, unless the context otherwise requires, reference to a Part is a reference to a Part

of the RFT identified in clause 2.1.2.

2.2

Contract Authority

2.2.1

The Contract Authority for this RFT is:

Warren Cochrane

Australian National Audit Office

GPO Box 707

CANBERRA ACT 2601

2.3

Inquiry by Prospective Tenderers

2.3.1

Tenderers should direct any questions arising during the preparation of a tender response to this

RFT to:

For Australian Government Superannuation Entities:

Warren Cochrane

Assurance Audit Services Group

Australian National Audit Office

Phone: 02 6203 7594

Fax: 02 6203 7491

Email warren.cochrane@anao.gov.au

For Coal Mining Industry (Long Service Leave Funding) Corporation:

John Jones

Assurance Audit Services Group

Australian National Audit Office

Phone: 02 6203 7636

Fax: 02 6203 7491

Email john.jones@anao.gov.au

10998447-5

2.3.2

If considered necessary, an interview may be arranged to discuss the inquiry and a written

reply may be furnished to the inquirer at the discretion of the ANAO.

2.3.3

Where appropriate questions and requests from tenderers along with the ANAO's responses

to those questions and requests will be provided to all prospective tenderers, without

revealing the source of the original inquiry.

2.3.4

Without limitation, tenderers should expect that answers to queries that provide additional

substantive information will be provided to all other tenderers.

2.4

Place for Lodgement of Tenders

2.4.1

Tenders may be lodged by post or hand delivered to the specified place of lodgement at the

address set out below:

Tender Box

RFT 2012/1529

Australian National Audit Office

19 National Circuit

BARTON ACT 2600

2.4.2

Tenders submitted orally or by fax or email will not be accepted.

2.5

Closing Date and Closing Time for Lodgement of Tenders

2.5.1

The deadline set for lodgement of tenders at the tender box is precisely 2.00 pm (AEST) on

19 November 2012, unless extended in accordance with clause 2.6.1 (Closing Time). The

Closing Time will be as determined by Telstra’s recorded time service on the Closing Date.

2.6

Extension of Deadline

2.6.1

The Closing Date and/or Closing Time may be extended only by written notice from the

Contract Authority. Any extension notice will be given the same distribution as the original

RFT.

2.7

Late Tender Policy

2.7.1

Tenderers should be aware that, consistent with Commonwealth procurement policy, the

Closing Time is a strict deadline. A tender received after the Closing Time will not be

admitted to the evaluation process, unless the tender is late solely as a consequence of

mishandling by the Commonwealth. Mishandling by a courier or mail service provider

engaged by a Tenderer to deliver a tender will not constitute mishandling by the

Commonwealth. Accordingly, it is the responsibility of the Tenderer to ensure that a tender

is dispatched in sufficient time for it to be received by the Commonwealth by the Closing

Time.

2.8

Packaging and Identification of Tenders

2.8.1

Tenders must be enclosed in a sealed envelope or other sealed container endorsed with the

relevant RFT number and lodged in accordance with these Conditions.

10998447-5

2.9

Copies of Tenders

2.9.1

An original plus four (4) copies (one unbound) of tenders and supporting material must be

submitted. The original should be marked as such and where there are discrepancies

between the original and copies, the original version shall prevail.

2.9.2

The tender documents will become the property of the ANAO at the time of lodgement and

the documents will be retained. The ANAO is not obliged to return any copies of the tender

documents.

2.9.3

Such intellectual property rights as may exist in a tender will remain the property of the

tenderer. The tenderer licences ANAO and the entities included in this tender, their officers,

employees, agents and advisers to copy, adapt, modify, disclose or do anything else

necessary to all material (including that which contains intellectual property rights of the

tenderer or any other person) contained in the tender for the purposes of:

(a)

evaluating/clarifying the tender or any subsequent offer;

(b)

negotiating any resultant contract with the tenderer;

(c)

managing any resultant contract (if any); and

(d)

anything else related to the above purposes, including audit and complying with

governmental and parliamentary reporting requirements.

2.9.4

The ANAO may make such copies of each tender, as it requires for these purposes.

2.9.5

The ANAO reserves the right, in its absolute discretion, and without the need to notify any

tenderer, to disclose or to allow the disclosure of, at any time, any information contained in

or relating to any tender, to any Commonwealth department, agency, authority, the Minister,

the Parliament or any Parliamentary committee for the proper performance of their statutory

or governmental responsibilities.

2.9.6

The intellectual property in this RFT is at all times owned by the ANAO or applicable third

parties. It is provided to tenderers only for the purpose of preparing their tender response,

may only be used for this purpose and should be treated as commercial information provided

in confidence by the ANAO.

2.10

Addenda to the Request for Tender

2.10.1

The ANAO reserves the right to issue addenda to this RFT to all potential suppliers

participating in the tender process (if known) and published in the same manner as this RFT

at any time. Where appropriate, the ANAO will allow additional time for potential suppliers

to address an addendum. Tenderers must submit their tenders in accordance with this RFT

as amended by any such addenda.

2.11

Requests for Additional Information by ANAO

2.11.1

Should additional information to that contained in a tender be required by the ANAO, it will

be requested in writing. Such additional information will not be accepted if it serves to

materially alter the original tender.

10998447-5

2.12

Correction of Errors or Omissions

2.12.1

Amendments or correction of omissions to tender documents may be permitted by the

ANAO, but only if it can be clearly shown to the satisfaction of the ANAO no more than 7

calendar days after the Closing Date that the amendment or correction is proposed to rectify

an unintentional error which is clerical or administrative, or an unintentional error of form.

2.13

Alterations, Erasures or Illegibility

2.13.1

Tenders which contain alterations or erasures and tenders which are illegible at the time of

lodgement, may, at the discretion of the ANAO, be excluded from further consideration.

2.14

Clarification

2.14.1

Where the intention of tender documents is unclear the ANAO may seek written clarification

from the tenderer.

2.14.2

Tenderers must nominate in their tender a person to answer requests by the ANAO for

further information or to provide clarification. The name, title, address, email address,

telephone and facsimile numbers of that person must be set out in the tender.

2.15

Supporting Material

2.15.1

Supporting material is material additional to the tender which elaborates or clarifies the

tender but which does not alter it in any material respect. Supporting material may be

provided on the initiative of the tenderer or at the request of the ANAO. Supporting material

should be dispatched on or before the Closing Time unless specifically requested by the

ANAO after that time. The ANAO reserves the right to exclude from consideration any

unsolicited supporting material received by the ANAO after the Closing Time.

2.15.2

Packages containing such information must be clearly labelled ‘Supplementary

Information - RFT No 2012/1529’. The intention to submit information in this manner

must be clearly stated in the tender.

2.15.3

Material presented as supporting material which, in the opinion of the ANAO, materially

alters the tender, will not be considered.

2.16

Tender Validity Period

2.16.1

It is a condition of tender that the tendered offer remains valid for acceptance for a period of

at least three (3) months from the Closing Time. The tenderer shall state any longer period

for which its offer remains valid.

2.17

Proposed Contract Period

2.17.1

It is intended that the Contract will be for a period of 3 years with an option for renewal for a

further 2 year period.

10998447-5

2.18

Acceptance and Proposed Contractual Arrangement

2.18.1

Tenderers are required to tender for:

(a)

(b)

the entire requirement as described in the SOR; or

if the SOR indicates that parts of the Services may be tendered for, one or more of

those parts of the Services (“Eligible Tender Parts”).

Tenders for only part of the requirement will not be accepted unless Eligible Tender Parts

have been set out in the SOR. If Eligible Tender Parts have been set out in the SOR, a tender

for part of the requirement that does not correspond to an Eligible Tender Part will not be

accepted.

2.18.2

The terms and conditions on which the ANAO intends to do business with the successful

tenderer are set out in Part 4 (Conditions of Contract). If any tenderer wishes to propose a

change to these terms, this must be specified in Item 12 of Section 2 of Part 5.

2.18.3

The lowest priced tender will not necessarily be accepted and no tender shall be deemed to

have been accepted unless and until the fact of such acceptance has been notified to the

tenderer in writing for and on behalf of the ANAO.

2.18.4

Unsuccessful Tenderers may request a statement of reasons why their tender was

unsuccessful and an opportunity to be debriefed.

2.19

Evaluation Criteria

2.19.1

Tenders will be assessed to identify the tendered offer that represents overall best value for

money. For this purpose the tender evaluation process will consider the evaluation criteria

specified in the approach to the market and requested documentation and each tenderer’s

relative ability to satisfy the overall project requirements while achieving a high standard of

service at a competitive price and at an acceptable risk. Tenderers are required to provide

access to any information ANAO considers reasonably necessary in order to evaluate the

reasonableness of their tendered prices. This information will not be disclosed to other

tenderers, or other persons with whom ANAO negotiates with a view to meeting ANAO’s

requirements.

2.19.2

In order to satisfy the general principles set out in clause 2.19.1, tenders will be assessed by

reference to the evaluation criteria stated below. The evaluation criteria is divided into

conditions for participation (ie mandatory criteria) and weighted criteria.

2.19.3

Tenderers will be assessed against the conditions for participation on a pass/fail basis. If a

tender fails to meet any of the conditions for participation it will be rejected and will not be

further assessed against the weighted criteria.

Conditions for Participation (mandatory criteria)

The conditions for participation are set out as follows:

Condition 1: Identity and financial situation of tenderer

The tenderer must be a registered company auditor (as defined in the Corporations Act) and

must not be bankrupt or insolvent.

10998447-5

Required Information: Complete Item 1.2, Section 2 of Part 5. Complete the

Commonwealth of Australia Statutory Declaration contained in Section 5 of Part 5, executed

by an authorised officer of the tenderer.

Condition 1A: Security clearance

The tenderer must ensure that the specified personnel nominated to undertake the

requirements specified in the SOR:

have a security clearance to at least Baseline level; or

are eligible for and commit to achieving Baseline level of security clearance before

being authorised to perform any work in relation to the requirements specified in the

SOR.

For each specified personnel the tenderer must provide details of their security clearance or

an undertaking that the person is eligible for, and will acquire, the required level of security

clearance.

Required Information: Complete Attachment A of Section 2 of Part 5.

Condition 2: Acceptable insurance coverage

Required Information: Complete Item 9, Section 2 of Part 5.

Condition 3: Compliance with equal opportunity policy

Required Information: Complete Item 7 of Section 2 of Part 5.

Condition 4: Compliance with Commonwealth requirements

Required Information: Complete the Commonwealth of Australia Statutory Declaration

contained in Section 5 of Part 5, executed by an authorised officer of the tenderer, declaring,

amongst other things, that the tenderer and any proposed subcontractors:

do not have any judicial decisions against it relating to employee entitlements (other than

decisions under appeal) that have not been met in full by the Tenderer; and

are not currently named on the list of persons and entities designated as terrorists under

the Charter of United Nations (Terrorism and Dealing with Assets) Regulations 2008.

Condition 5: Completed Compliance Statement

Required Information: Complete Item 12 of Section 2 of Part 5 of this RFT.

Condition 6: Indication of confidential Contract Provisions

Required Information: Complete Item 3 of Section 2 of Part 5 of this RFT.

Condition 7: Provision of Fair Work Principles statutory declaration

Required Information: Complete the Statutory Declaration substantially in the form set out in

Section 7 of Part 5 executed by an authorised officer of the tenderer.

10998447-5

Tenderers should note that they will not be eligible for further consideration for this

procurement if they have not fully complied with, or are not fully complying with, any Court or

Tribunal decision relating to employee entitlements (unless the decision is under appeal).

Condition 8: Completed Deed of Confidentiality

Required Information: Complete the Deed of Confidentiality in substantially the same form

as set out at Section 6 of Part 5, executed by an authorised officer of the tenderer.

Completing the Deed of Confidentiality will allow tenderers to gain access to ANAO/Client

information during tender preparation and contract negotiation (if applicable).

Weighted criteria

Weighted criteria will be weighted according to the relative percentages stated below:

Criterion 1: The extent to which the audit methodology, approach and management

processes proposed to be used to perform the Services meets the needs of the ANAO

(30%)

Minimum Required Information:

-

an understanding of the Commonwealth Public Sector, its operating environment and

the Auditor-General’s role;

-

the measures proposed to establish and maintain an effective and professional

relationship with the ANAO and the audit client over the life of the Contract;

-

an outline of the proposed audit approach, which must enable the tenderer to comply

with the requirements of the Contract, including, without limitation, the performance

standards listed in clause 2.4 of the Contract;

- an outline of the proposed reports to be delivered;

- advice as to whether or not the tenderer performs inter office reviews;

-

the quality control policies and assurance procedures to be employed by the tenderer

throughout the audit assignment;

-

the ability to provide an organisation and management structure consistent with

implementing and managing the Services to the required standard;

-

the on-going availability of sufficient skilled personnel resources capable of

performing the Services to the required standards;

-

details of the capacity if necessary to consult internally and/or internationally with

employees/affiliates in relation to technical issues relating to the operations of the

client or on accounting/audit matters affecting the operational aspects of the client;

-

any other matters that the tenderer believes the ANAO should consider in assessing its

ability to perform the audit Services; and

-

complete the information security checklist set out in Attachment B to Section 2 of

Part 5.

10998447-5

Details of the proposed audit methodology, approach and management processes should be

provided in Item 14 of Section 2 of Part 5 to enable the ANAO to assess the tenderer against

the above criteria.

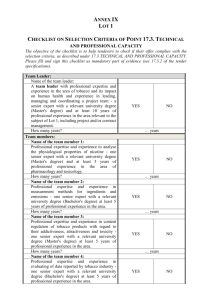

Criterion 2: Demonstrated qualifications and relative degree of experience of the

tenderer's nominated professional staff in providing the Services (25%)

Minimum Required Information:

-

details of professional staff to be employed on the audit including:

number and names of partners, managers and senior auditors;

number of years experience;

citizenship and security clearance status;

details of relevant audit experience;

proposed hours of involvement across staff levels;

percentage of time partners and managers will devote to the tendered audit;

number of intermediate and junior staff, and

confirmation of being registered company auditors.

Details should be summarised in Item 10 and Attachments A and B of Section 2 of Part 5.

Criterion 3: The relative degree of client industry and audit experience possessed by the

tenderer (25%)

Minimum Required Information:

A description of the tenderer’s relevant industry audit experience including such experience of

the senior members of the engagement team. Details should be provided in Item 14 and

Attachment A of Section 2 of Part 5.

Criterion 4: Price (20%)

Minimum Required Information: Complete Section 4 (Price Schedule) of Part 5, providing the

information required in that section.

2.20

Evaluation Process

2.20.1 The ANAO proposes to use the following evaluation methodology:

(a)

each tender will be assessed against the conditions for participation - tenderers which

fail to meet all conditions for participation will be eliminated at this stage;

(b)

of the tenders that remain, each tenderer’s claims will then be examined against the

weighted evaluation criteria - tenders which fail to meet a minimum acceptable level

of performance will be eliminated at this stage;

(c)

the claims of the remaining tenders will then be examined in detail;

10998447-5

2.20.2

2.21

2.21.1

(d)

tenderers may be offered an opportunity to make a presentation to address the Tender

Evaluation Team (TET) on the merits of their proposal. The TET may use this

opportunity to seek clarifications of the tenders;

(e)

the TET may involve the clients as part of the evaluation process and the presentations

referred to at clause 2.20.1(d) may involve client representatives; and

(f)

taking into account all the above, the TET will rank each tender in a final order of

merit.

Where a tender does not contain a response to a question or a request for information

contained in this RFT the tender shall be deemed, for evaluation purposes, to have not

complied with such question or request.

Tender Response

Tenders should be structured as follows:

Part 5 - Section 1

Summary of Tender

Part 5 - Section 2

Response to Conditions of Tender and Draft contract

Attachment A:

Personnel

Attachment B:

Information Security Checklist

Part 5 - Section 3

Compliance with Statement of Requirement

Part 5 - Section 4

Price schedule

Part 5 - Section 5

Commonwealth

(mandatory condition of participation)

Part 5 - Section 6:

Part 5 - Section 7:

Fair Work Principles Statutory Declaration (mandatory

condition of participation)

of

Australia

Statutory

Declaration

Deed of Confidentiality

2.21.2

Tenderers should provide sufficiently detailed information on any matters identified in Part

5, Sections 1-4.

2.21.3

Information on how to respond to each part of Part 5 is set out in the introduction to that

Part.

2.22

No contract

2.22.1

Nothing in this RFT should be construed to give rise to any contractual obligations or rights,

express or implied, by the issue of this RFT or the submission of a tender in response to it.

No contract will be created until a formal written Contract is executed between the

Commonwealth and a successful tenderer, if any.

2.22.2

In the event a court finds there to be a contract between the ANAO and a tenderer regarding

the conduct of this RFT process, contrary to clause 2.22.1, the tenderer acknowledges that the

ANAO’s liability for any breach of the terms of such contract is limited to the tenderer’s

costs of participation in the RFT process, and does not include liability for any lost profit, lost

opportunity or other losses of the tenderer.

10998447-5

2.23

Tenderer Profile

2.23.1 Tenderers are to provide sufficient information to enable the ANAO to clearly identify the

entity with which the Contract may be entered.

2.24

Insurance

2.24.1

The successful tenderer will be required to have in place insurance arrangements appropriate

to provision of the specified requirement, including professional indemnity insurance, public

liability insurance and workers compensation insurance to at least at the minimum levels

required by the Contract.

2.25

Tenderer Interviews

2.25.1 Tenderers may be interviewed by the ANAO as part of the evaluation process. The conditions

under which the interviews would be conducted are:

(a)

tenderers may be required to provide an oral presentation of their tender, and to

answer questions of clarification immediately following the presentation;

(b)

tenderers are not to use the presentation to provide new information and

documentation additional to the contents of the tender that has the effect of materially

altering the tender;

(c)

at the presentation, tenderers will be required to provide a copy of the written text of

their oral presentation, including copies of all presentation aids;

(d)

tenderers will be required to provide, within two (2) business days, written

confirmation of answers given to questions put by the ANAO during the interview;

(e)

the oral and written information and documents provided during the presentation and

interview will be considered by the ANAO as supporting material;

(f)

details of the timing and location of any tenderer presentations will be provided by the

ANAO after the Closing Time; and

(g)

client representatives may be present and participate at these interviews.

2.25.2 The ANAO is not obliged to conduct interviews or arrange for presentations with any or all

tenderers.

2.25.3 The tenderer shall nominate a person to answer queries that may arise during the examination

of tenders. The name, address and telephone number of that person should be included.

2.26

Language

2.26.1 All tenders and supporting material shall be in the English language.

2.27

Public Statements by Tenderers

2.27.1 No tenderer shall furnish any information, make any statement or issue any document or other

written or printed material concerning the acceptance of any tender in response to this RFT for

publication in any media without the prior written approval of the ANAO. The ANAO will

10998447-5

not withhold its approval to the extent the tenderer is required to disclose information by the

rules of a stock exchange.

2.28

Freedom of Information

2.28.1 The attention of tenderers is drawn to the Freedom of Information Act 1982 (FOI Act) which

gives members of the public rights of access to certain official documents of the

Commonwealth Government and its agencies. The FOI Act extends as far as possible the right

of the Australian community to access information (generally documents) in the possession of

the Commonwealth Government limited only by exceptions and exemptions necessary for the

protection of essential public interests and the private and business affairs of persons in

respect of whom information is collected and held by departments and public authorities.

2.28.2 Tenderers are responsible for obtaining their own advice and assessing the application of the

FOI Act to any information and documentation contained in their tenders.

2.28.3 While the Auditor-General is legally exempt from the FOI Act, the ANAO complies, to the

maximum extent possible, with the intent of the Act.

2.28.4 Tenderers may indicate which information, if any, contained in their tender or supplementary

material they consider should not be disclosed without their consent.

2.29

Tenderers to Inform Themselves

2.29.1 Tenderers shall be deemed to have:

(a)

examined the RFT and any other information made available in writing by the ANAO

to tenderers for the purpose of tendering;

(b)

examined all information necessary or convenient for the preparation of their tenders

including any information relevant to the risks, contingencies, and other circumstances

having an effect on their tender and which is obtainable by the making of reasonable

enquiries; and

(c)

satisfied themselves as to the correctness and sufficiency of their tenders and that their

tendered prices cover the cost of complying with all the conditions of this RFT and of

all matters and things necessary for the due and proper performance and completion of

the specified requirement.

2.29.2 Should a tenderer find any discrepancy, error or omission in this RFT, the tenderer shall

promptly notify the Contract Authority in writing on or before the Closing Time.

2.30

Tenderer’s Obligation of Confidentiality

2.30.1 The tenderer covenants and agrees in consideration for the ANAO agreeing to consider the

tenderer’s tender:

(a)

10998447-5

that the terms of this RFT, and all information relating to the specified requirement

provided to the tenderer by the ANAO (including without limitation the ANAO’s

agents and servants) or obtained by the tenderer from any person:

i.

shall be kept strictly confidential;

ii.

shall not be copied or reproduced in any way;

(b)

2.31

iii.

shall not be disclosed or divulged to any person in any manner whatsoever;

iv.

shall be used to the extent necessary to enable the tenderer to submit a

tender pursuant to this RFT and for no other purpose;

v.

shall be safely and securely stored when not in use;

vi.

shall remain the absolute and exclusive property of the ANAO; and

vii.

shall be immediately returned to the ANAO upon demand by the ANAO.

that the obligation referred to in clause 2.30.1(a) above:

i.

if the tenderer’s tender is accepted by the ANAO, shall continue upon entry

into the Contract;

ii.

if the tenderer’s tender is unsuccessful, shall continue notwithstanding entry

into an agreement with any third party as to the provision of the specified

requirement;

iii.

shall not apply to the extent that:

(a)

the prior written consent of the Contract Authority (obtained in each

instance) is first obtained;

(b)

the information is required to be disclosed or divulged by law; or

(c)

the information forms or becomes part of the public domain other than

due to a breach of an obligation of confidentiality.

Inconsistency

2.31.1 To the extent that there is any inconsistency between the Contract and this RFT, the provisions

of the Contract shall prevail.

2.32

Costs and Expenses

2.32.1 A tenderer’s participation in any stage of the tender process shall be at the tenderer’s sole risk,

cost and expense. In particular, all costs incurred by or on behalf of the tenderers in relation to

this RFT, including preparing and lodging the tender and providing the ANAO with any

further information, are wholly the responsibility of the tenderer. The ANAO accepts no

responsibility, liability, or obligation whatsoever for costs incurred by or on behalf of any

tenderer in connection with any tender or any participation in the tender process.

2.32.2 Offers submitted by a government owned business, a local government, a State or

Commonwealth agency or authority must be priced to comply with the applicable competitive

neutrality policy of their jurisdiction.

2.33

Termination of RFT

2.33.1 The ANAO reserves to itself the right where it has determined that it is not in the public

interest to award a Contract under this tender, to suspend, terminate or abandon this RFT at

any time prior to the execution, by an authorised officer of the ANAO and by any successful

tenderer, of a formal written agreement acceptable to the ANAO provided that the ANAO

10998447-5

gives written notice of such a decision to each of the tenderers (if known) and publishes the

decision in the same manner as this RFT.

2.34

RFT Information Disclaimer

2.34.1 The information contained in this RFT and the information upon which it is based has not been

independently verified or audited.

2.34.2 The ANAO, its officers, employees, advisers and agents:

(a) make no express or implied representation or warranty as to the currency, accuracy,

reliability or completeness of the information contained in this RFT; and

(b) make no express or implied representation or warranty that any estimate or forecast will

be achieved or that any statement as to future matters will prove correct.

2.34.3 The ANAO, its officers, its employees advisers and agents:

(a)

to the extent permitted by law, expressly disclaim any and all liability arising from

information (including with limitation, errors or omission) contained in this RFT;

(b)

(except so far as liability under any statute cannot be excluded) accept no responsibility

arising in any way from errors in, or omissions from, this RFT, or in negligence;

(c)

do not represent that they apply any expertise on behalf of any tenderer of any interested

party;

(d)

accept no liability for any loss or damage suffered by any person as a result of that

person or any other person placing any reliance on the contents of the RFT or other

information provided by or on behalf of the ANAO; and

(e) assume no duty of disclosure or fiduciary duty to any interested party.

2.34.4 The provisions of this disclaimer apply in relation to this RFT and also in relation to any other

oral or written communications or disclosures to a tenderer or to any other person by the

ANAO, its officers, employees, advisers and agents.

2.35

Applicable Law

2.35.1 The laws in the Australian Capital Territory apply to this RFT, the project and the tendering

process. Each tender must comply with all relevant legislation.

2.36

Collusive Tendering and false and misleading claims

2.36.1 Tenderers and their officers, employees, agents and advisers must not engage in any collusive

tendering, anti-competitive conduct or any other similar conduct with any other tenderer or

any other person in relation to the preparation or lodgement of tenders or the RFT process. In

addition to any other remedies available under any law or any contract, the ANAO reserves

the right, in its sole and absolute discretion, immediately to reject any tender lodged by a

tenderer which engaged in any collusive tendering, anti-competitive conduct or any other

similar conduct with any other tenderer or any other person in relation to the preparation or

lodgement of tenders.

10998447-5

2.36.2 If the tenderer is found to have made false or misleading claims or statements in or in relation

to its tender then the ANAO may, in its absolute discretion, exclude the tenderer’s tender from

further consideration. Tenderers should note that it is a serious offence under the Criminal

Code Act 1995 (Cth) to make false or misleading statements to the Commonwealth.

2.37

Conflict of Interest

2.37.1 Tenderers and their respective officers, employees, agents and advisers must not place

themselves in a position which may, or does, give rise to a conflict of interest (or a potential

conflict of interest) between the interests of the ANAO (on the one hand) or any other interests

(on the other hand) during the tender process.

2.37.2 Tenderers should identify any existing or potential conflicts of interest and the manner in

which they may be resolved in Item 4 of Section 2 of Part 5.

2.37.3 If any conflict of interest might arise for a tenderer before entering into a Contract, ANAO

may, in its absolute discretion:

(a)

enter into discussions to seek to resolve such conflict of interest; or

(b)

disregard the tender submitted by such a tenderer; or

(c)

take any other action, as it considers appropriate.

2.37.4 Once the Contract has been entered into, the Contractor must comply with the conflict of

interest provisions and other independence requirements contained in the Contract.

2.37.9 While a response to accounting issues arising from financial statement audits to ensure

compliance with accounting standards and report frameworks is appropriate, it is considered

that provision of accounting policy advice could give rise to a commercial relationship and

therefore may result in a conflict of interest.

2.38

Unlawful Inducements

2.38.1 Tenderers and their respective officers, employees, agents or advisers must not have violated

any applicable laws or Commonwealth policies regarding the offering of unlawful

inducements in connection with the preparation or lodgment of their tender and the RFT

process.

2.39

Improper Assistance and Lobbying Code of Conduct

2.39.1 Tenders which, in the opinion of the ANAO, have been compiled with by the improper

assistance of employees of the ANAO or the Commonwealth, ex-employees of the ANAO or

the Commonwealth, and/or contractors or ex-contractors of the ANAO or the Commonwealth,

or with the utilisation of information unlawfully obtained from the ANAO or Commonwealth,

will be excluded from further consideration. Tenderers must not seek in any way to obtain a

special advantage from an ANAO or Commonwealth officer in connection with the

preparation of their tenders.

10998447-5

2.39.2 Without limiting any other requirement under this RFT, tenderers must not engage in, or

procure or encourage others to engage in, any activity that would result in a breach of the

Lobbying Code of Conduct and/or the requirements of APSC Circular 2008/4 relating to the

Lobbying Code of Conduct and post-separation contact with the Commonwealth.

2.40

Privacy

2.40.1 Tenderers are advised that it is Commonwealth policy to ensure that there is no loss of privacy

protection when a Commonwealth body contracts for the delivery of Services. Hence, the

preferred tenderer will need to agree in the Contract to comply with the Privacy Act 1988,

including the Information Privacy Principles as if it were an agency for the purposes of that

Act, although there may be no legislative requirement to do so.

2.40.2 Tenderers should note that section 95C of the Privacy Act 1988 requires parties to

Commonwealth contracts to inform, in writing, any person who enquires whether the contract

contains provisions that are inconsistent with the National Privacy Principles or an approved

privacy code.

2.40.3 If the ANAO discloses any personal information to tenderers, they must also comply with the

public-sector obligations under the Privacy Act 1988, to which the ANAO is subject, in

relation to that information.

2.41

Equal Employment Opportunity for Women in the Workplace Act 1999

2.41.1 Tenderers attention is drawn to the obligations of certain employers under the Equal

Opportunity for Women in the Workplace Act 1999 ("the Act"). Enquiries by prospective

bidders for further information about the legislation should be directed to the Equal

Opportunity for Women in the Workplace Agency on (02) 9448 8500.

2.41.2 The Commonwealth Government has directed its staff not to purchase goods or services from

suppliers who do not comply with their obligations, if any, under the Act. It will be a term of

the Contract with the successful tenderer that it complies with it's obligations, if any, under the

Act.

2.41.3 A further term of the Contract will be that the contractor does not enter under a subcontract

with a non-complying supplier.

2.41.4

If a tenderer is currently named as non-compliant under the Act, the tenderer must submit a

compliant report and will subsequently obtain a letter of compliance from the Director. This

letter of compliance must either accompany any offer the tenderer makes to the

Commonwealth or be provided to the Commonwealth prior to the date by which offers are to

be accepted.

2.41.5

Tenderers must state in Item 7 of Section 2 of Part 5 whether or not they are currently named

as not complying with the Equal Employment Opportunity for Women in the Workplace Act

1999. Where subcontractors are specified in the tender, the tenderer should note the

subcontractors compliance or otherwise with the aforementioned Act.

2.42.

ANAO’s Rights

2.42.1 The ANAO reserves the right, in its absolute discretion, at any time:

(a)

10998447-5

to alter, amend or vary this RFT and the process (including the proposed timetable)

outlined in these Conditions of Tendering in accordance with clause 2.10.1;

(b)

if the ANAO considers that it is in the public interest to do so, suspend or terminate

this tender process at any time (including in the course of negotiations);

(c)

to require clarification of a tender or seek additional information;

(d)

to set priorities and broad weightings for evaluation criteria, or to vary those priorities

or weightings;

(e)

to negotiate or not negotiate with one or more tenderers;

(f)

to amend the Conditions of Contract during negotiations;

(g)

to allow, or not to allow, the successful tenderer to enter into the proposed contract in

the name of a different legal entity from that which provided a response to this RFT;

(h)

to enter into a contract outside this process, in circumstances where direct sourcing is

permitted by the Commonwealth Procurement Guidelines (clause 8.33); and

(i)

to publish the name of the successful tenderer.

2.42.2 Any rights reserved in this RFT is for the sole convenience of the ANAO. The establishment

of a right in this RFT does not create an obligation on the part of the ANAO to take any action

or any right in any tenderer that any action be taken. The ANAO may notify affected

tenderers if it does any of the above but shall not be obliged to provide any reasons for its

actions.

2.42.3 In any contract negotiations, the ANAO may seek variations to an offer or may seek

supplementary offers in respect of any changes to the originally stated requirements. The

ANAO reserves the right to enter into any such discussions and negotiations at its absolute

discretion (which includes dealing with any tenderer as it deems fit without the need to

correspond with other tenderers during this period).

2.43

Auditor-General Act 1997

2.43.1 The attention of tenderers is drawn to the Auditor-General Act 1997, which provides the

Auditor-General or an authorised person with a right to have, at all reasonable times, access to

information, documents and records.

2.43.2 In addition to the Auditor-General's powers under the Auditor-General Act 1997, if the

tenderer is chosen to enter into a Contract, the tenderer will be required to provide the

Auditor-General or an authorised person, access to information, documents, records and

ANAO's assets, including those on the tenderer's premises. This will be required at reasonable

times on giving reasonable notice for the purpose of carrying out the Auditor-General's

functions and will be restricted to information and assets which are in the custody or control of

the tenderer, its employees, agents or subcontractors, and which are related to the Contract.

Such access will apply for the term of the Contract and for a period of ten (10) years from the

date of expiration or termination. Additionally, the ANAO will require the contractor to give

all the associated working papers to the ANAO at the completion of each year’s financial

statement audit and on the expiry or termination of the contract. Note however, that the

contractor may keep a copy for its own records.

2.43.3 Each tenderer should obtain, and will be deemed to have obtained, its own advice on the

impact of this legislation on its participation in the RFT process.

10998447-5

2.44

Security, financial and probity checks

2.44.1 The ANAO reserves the right to perform such security, probity and/or financial checks and

procedures as the ANAO, at its absolute discretion, may determine are necessary in relation to

the tenderer, its officers, employees, partners, associates or related entities including

consortium members and their officers or employees. The tenderer agrees to provide, at its

cost, all reasonable assistance to the ANAO in this regard.

2.45

Subcontractors

2.45.1 If a Tenderer proposes that any part of the requirement in this RFT is to be performed under

subcontract, the names of the proposed subcontractors and details of the work proposed to be

undertaken by them must be set out in Item 8 of Section 2 of Part 5.

2.45.2 This does not prevent the successful Tenderer subsequently changing its subcontracting

arrangements, subject to the provisions of the Contract entered into by the successful

Tenderer.

2.45.3 Tenderers should be aware that details of the successful Tenderer’s subcontractors and their

role may be publicly disclosed by the ANAO. Each Tenderer warrants that its proposed

subcontractors have agreed to that disclosure.

2.46

Expressions of price and measurement

2.46.1 When providing pricing details, Tenderers should note that unless otherwise specified, prices

tendered must:

(a)

be expressed in Australian dollars, except for any component which the Tenderer

considers will involve foreign currency risk. It is Commonwealth policy not to impose

foreign currency risk on contractors. Accordingly, if a Tenderer considers any element

of their pricing will involve foreign currency risk, they should prepare an adjustment

mechanism for inclusion in the Contract rather than inflating their prices to cover this

risk;

(b)

be inclusive of goods and services tax (GST) and any other taxes and duties, with the

GST and other tax and duty components separately identified;

(c)

remain unalterable for the period of tender validity;

(d)

not vary according to the mode of payment;

(e)

take into account the liability, indemnity and other relevant provisions regarding risk

in the Contract; and

(f)

any measurements must be expressed in Australian legal units of measurement.

2.46.2 Tenderers must provide their proposed mechanism for price increases during the term and for

any option.

2.46.3 The Tenderer must seek their own tax advice (including GST) in relation to this tender.

10998447-5

2.47

Tenderer confidential information

2.47.1 Subject to this clause, the ANAO will keep all Tenders confidential prior to the award of a

Contract. Unsuccessful Tenders will be kept confidential after award of a Contract, subject to

the exceptions outlined in clauses 2.47.6 to 2.47.8 below.

2.47.2 Once a Contract is awarded, the confidentiality of the successful Tenderer’s information will

be governed by the Contract.

2.47.3 Tenderers should identify any information that they regard as confidential in their Tenders in

Item 3 of Section 2 of this RFT, with a view to that information being identified in the

Contract as confidential if they are successful. Consistent with Commonwealth policy,

information should not be classified as confidential unless there is a sound reason to maintain

the confidentiality of the information. Tenderers should provide the reasons why the

information is regarded as confidential.

2.47.4 Tenderers should have regard to the Commonwealth’s “Guidance on Confidentiality in

Procurement - July 2007”. This policy may be found at the website:

http://www.finance.gov.au/publications/fmg-series/03-guidance-on-confidentiality-inprocurement.html.

2.47.5 The ANAO will make its own assessment of the confidentiality of information.

Exceptions to confidentiality

2.47.6 The obligation of confidentiality in clause 2.47.1 does not apply if the relevant information:

(a)

is disclosed by the ANAO to its advisers or employees solely in order to consider the

tender responses;

(b)

is disclosed by the ANAO to the responsible Minister;

(c)

is disclosed by the ANAO, in response to a request by a House or a Committee of the

Parliament of the Commonwealth of Australia;

(d)

is authorised or required by law to be disclosed; or

(e)

is in the public domain otherwise than due to a breach of clause this clause 2.47.

2.47.7 Tenderers should also be aware that the Commonwealth is subject to a number of specific

requirements, which support internal and external scrutiny of its tendering and contracting

processes. These include:

(a)

the requirement to publish details of agreements, contracts and standing offers with an

estimated liability of $10,000 or more on AusTender;

(b)

the requirement to report a list of contracts valued at $100,000 or more; and

(c)

identifying confidentiality requirements in accordance with the Senate Order on

Department and Agency Contracts.

10998447-5

2.48

Anti-terrorism measures

2.48.1 The attention of Tenderers is drawn to Part 4 of the Charter of United Nations (Dealing with

Assets) Regulations 2008. This Regulation may be found at the following website:

http://www.dfat.gov.au/un/unsc_sanctions/index.html

2.48.2 This Regulation requires anyone who holds assets or funds belonging to a person or

organisation designated as a terrorist to freeze immediately those assets or funds. It is an

offence to make any assets available to a terrorist. The list of terrorists and more information

is available at http://www.dfat.gov.au/icat/UNSC_financial_sanctions.html.

2.48.3 The ANAO will not enter into a Contract with anyone on the list referred to in 2.48.2.

Tenderers should also note that the ANAO reserves the right to exclude any Tenderer which

has been convicted of, or is being investigated for, a criminal offence (including under the

Cybercrime Act 2001 (Cwlth).

2.49

Fair Work Principles

2.49.1 Tenderers should note that the Australian Government Fair Work Principles apply to this

procurement. More information on the Fair Work Principles and their associated User Guide

can be found at www.deewr.gov.au/fairworkprinciples.

2.49.2

In particular Tenderers should note that in accordance with the Fair Work Principles and the

Commonwealth Procurement Rules, Commonwealth Entities will not enter into a Contract

with a Tenderer who:

(a)

fails, when required by the Commonwealth, to confirm it understands and complies

with all relevant workplace relations law, occupational health and safety law, or

workers’ compensation law;

(b)

is subject to an order from any Court or Tribunal decisions relating to a breach of

workplace relations law, occupational health and safety law, workers’ compensation

law or any other law relating to employee entitlements with which the Tenderer has

not fully complied or is not fully complying, unless the relevant decision is under

appeal;

(c)

has a Fair Work Act 2009 agreement that was made on or after 1 January 2010 that

does not include genuine dispute resolution procedures; and

(d)

fails to provide information when requested by the ANAO relevant to their

compliance with the Fair Work Principles;

2.49.3 For the purposes of clause 2.49.2:

(a)

a genuine dispute resolution procedure is one which provides each of the following

processes to resolve workplace disputes:

–

–

–

10998447-5

the ability for employees to appoint a representative in relation to the dispute;

in the first instance procedures to resolve the dispute at the workplace level;

if a dispute is not resolved at the workplace level, the capacity for a party to

the dispute to refer the matter to an independent third party for mediation or

conciliation; and

-

(b)

if the dispute is still not resolved, the capacity for an independent third party

to settle the dispute via a decision binding on the parties.

a decision or order with which the Tenderer has not fully complied or is not fully

complying includes any relevant penalty or order of a Court or Tribunal, but it does

not extend to infringement notices issued by workplace inspectors or a provisional

improvement notice issued by an occupational health and safety inspector, or those

instances where a penalty or a requirement has been imposed but the period for

payment/compliance has not expired.

2.49.4 To enable the ANAO to confirm the Tenderer’s compliance with the relevant requirements of

the Fair Work Principles the Tenderer must complete the Statutory Declaration contained in

Section 7 to Part 5 of this RFT, in the form it is provided and include it as part of their tender

response.

2.49.5 Clause 2.49.4 is a minimum content and format requirement for the purposes of the RFT.

Failure to comply with these clauses will result in a tender response being excluded from

further consideration.

2.49.6 Tenderers must disclose if they have not fully complied with, or are not fully complying with,

any Court or Tribunal decision relating to employee entitlements, unless the relevant Court or

Tribunal decision is subject to appeal. Tenderers should note that they will not be eligible for

further consideration for this procurement if they have not fully complied with, or are not fully

complying with, any Court or Tribunal decision (unless the decision is under appeal).

2.50

Ombudsman Act 1976

2.50.1 The attention of tenderers is drawn to the Ombudsman Act 1976 which authorises the

Ombudsman to investigate the administrative actions of Commonwealth departments and

agencies and to investigate the actions of certain Commonwealth contractors.

2.51

Accountability and Transparency

2.51.1 Tenderers acknowledge that the ANAO is subject to the legislative and administrative

accountability and transparency requirements of the Commonwealth, including disclosures to

Ministers and other Government representatives, Parliament and its Committees and the

publication of information in respect of this RFT process on the successful Tenderer and

information on any resultant Contract in the AusTender website. Any Contract resulting from

this RFT process will also be subject to these requirements, including contract terms (and

related matters) which may be disclosed to Ministers, other Government representatives,

Parliament and its Committees

2.52

Compliance with laws and Commonwealth policies

2.52.1 The successful tenderer will be required to comply, and must ensure that its personnel and

subcontractors will comply, with any law applicable to its performance of the Contract,

including:

(a)

the Crimes Act 1914;

(b)

the Racial Discrimination Act 1975;

(c)

the Sex Discrimination Act 1984;

(d)

the Disability Discrimination Act 1992;

(e)

the Equal Opportunity for Women in the Workplace Act 1999;

(f)

the Charter of United Nations Act 1945 and the Charter of United Nations (Terrorism

and Dealing with Assets) Regulations 2002;

10998447-5

(g)

the Trade Practices Act 1974;

(h)

the Criminal Code Act 1995; and

(i)

any occupational health and safety legislation applicable to the Contractor.

2.52.2 The successful tenderer will be required to comply, and must ensure that its personnel and

subcontractors comply, with any Commonwealth policies notified by the ANAO from time to

time, including, where applicable, the Charter of Public Service in a Culturally Diverse

Society and the Commonwealth Fraud Control Guidelines issued under the Financial

Management and Accountability Regulations 1997 (Cth).

10998447-5

PART 3

STATEMENT OF REQUIREMENT

10998447-5

PART 3 - STATEMENT OF REQUIREMENT

3.1

Introduction

3.1.1

The Services to be provided by the successful tenderer shall be the provision of audit services of

the financial statements of the following:

Commonwealth Superannuation Corporation

Commonwealth Superannuation Scheme (CSS)

Public Sector Superannuation Scheme (PSS)

Public Sector Superannuation Accumulation Plan (PSSap)

Military Superannuation and Benefits Scheme (MSBS)

ARIA Investments Trust

PSS/CSS A Property Trust

PSS/CSS B Property Trust

ARIA Property Fund

ARIA Co Pty Ltd

ARIA Alternative Assets Trust

PSS/CSS Investments Trust

Property Management Trust

CSC Treasury Trust

CFM Australian Equities Fund

CSS/PSS Pty Ltd

Commonwealth Superannuation Administration (Comsuper)

Coal Mining Industry (Long Service Leave Funding) Corporation

for the financial years ending 30 June 2013, 2014 and 2015 with an option for a further two year

period and shall include attest audit coverage and legal compliance as applicable.

3.1.2 In addition to the attest audit coverage the Services provided shall include reasonable services

which a professional auditor would normally supply. These may include the provision of

advice on the effectiveness and efficiency of internal control and accounting systems,

reviewing investment and provisioning procedures, providing interpretation of relevant new or

revised accounting standards, legislation, review of printer’s proofs and annual report etc.

3.1.3

Should a tender response identify any additional services or arrangements that a tenderer may

propose as part of its proposal, the tenderer should indicate whether it considers any aspects of

these to be confidential in terms of disclosure in the contract.

3.2

Deliverables

The deliverables to be provided as part of the Services include:

10998447-5

an audit plan;

a contractor’s representation letter;

a conflict of interest report;

an independence declaration (if applicable);

other material and working papers;

a draft audit strategy;

a draft auditor’s report on the financial statements;

a draft closing letter;

an annual report review (unless otherwise notified by the ANAO);

other draft letters required from time to time; and

a draft Signing Officer Review Memorandum,

as further described in Schedule 1 of the draft Contract contained in Part 4 of this RFT.

3.3

Specifications

The specifications for the Services are set out in the draft Contract contained in Part 4.

3.4

Terms and Conditions Applying to the Delivery of the Services