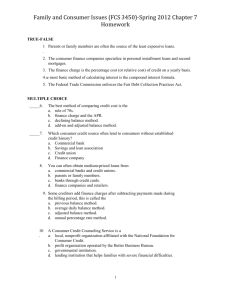

Consumer Education Mr. Rubin de Celis Chapter 16 Review When

advertisement

Consumer Education Mr. Rubin de Celis Chapter 16 Review 1 2 3 4 5 6 7 When credit first began in this country, did loans have high interest rates? Explain. Yes, loans had high interest rates that exceeded 25 to 50%, and loans were made only in emergencies. Most people and banks knew little about how credit worked. Banks charged high interest rates and were reluctant to lend large sums of money. Also, most people did not accept debt. Why, when credit began, were brokers and merchants reluctant to lend money and give credit? They were reluctant to lend money because they knew very little about credit. Merchants and banks did not want to take on big risks with their own clients. How has credit affected the American economy? The American economy grew at a healthy pace. People were buying luxuries as well as necessities with help of credit. The American’s standard of living rose, and business and consumers benefitted. What kinds of jobs are created by credit? Both government and private agencies were formed to assist consumers with their rights and responsibilities. In the 1970’s credit counselors came on the scene because people were beginning to overuse credit. 1990’s saw a record number of individuals were declaring bankruptcy. List four advantages of using credit. Expand your purchasing power Making payment on time helps establish credit Provides for emergency funds – line of credit Credit is convenient List four disadvantages of using credit. Credit purchases can cost more Finance charge are too high You tie up future income Over spending What are the four major types of credit? Open ended credit o Charge cards o Credit cards – revolving credit Closed end credit o Installment credit – for specific amount Service Credit 8 9 10 11 12 13 14 How is open end credit different from closed end credit. Open ended credit – an unsecured loan based entirely on your character and credit history 30 day account – charge card Revolving account – credit cards Closed end credit – installment credit or short term credit where there is collateral pledged. Give three examples of service credit. Doctors Lawyers Dentists Hospitals Utility companies How are consumer finance companies different from sales finance companies? Finance companies – Consumer loans buying durable goods Sales Finance Companies – make loans through authorized representatives to purchase high end products – General Motor cars – GMAC List the five major sources of credit for consumers. Retail stores Finance companies Sales finance companies Banks and credit unions Pawnshops Private lenders Life insurance companies Why do credit unions offer lower interest rates on loans than do Commercial Banks. Credit unions make loans available to their members only. Interest rates are generally lower because credit unions are nonprofit and are for members only. Credit unions are more willing to lend money to their members because each member has a stake in the success of the Union. Why do finance companies charge high rates of interest on their loans? Finance companies charge higher rates because they are willing to take on higher risk. Fiancé companies are second to banks in volume of credit. Finance companies are allowed to lend up to $5,000. Explain how pawnshops work. Pawnshop is a legal business that makes high interest loans based on the value of the pledged collateral. A pawnbroker will only give 10 – 25 % of the value of any article. The loan is usually for 2 weeks to 6 months. Explain the difference between a secured and an unsecured loan. In your discussion please include an example of each. Secured loan is also referred to as a closed end loan. This loan is an installment loan in which you pledge either a down payment or the article you are buying as collateral. Unsecured loan is referred to as a open ended loan because your line of credit is based on your credit history. The type of credit can be both a charge card – 30 day account or a credit card – revolving account. What is your liability and responsibility if your credit card is lost or stolen. Your liability amount if your card is lost or stolen is $50. 15