File

advertisement

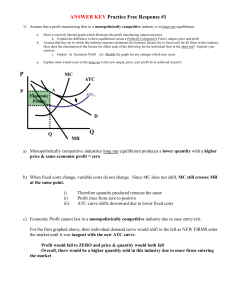

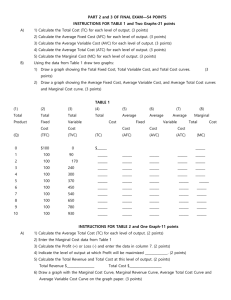

Theory of the firm: Profit maximization 1 Theory of the firm: Outline Types of markets (degrees of competition) Economic profit Firm entry & exit behavior * Production theory & diminishing marginal returns Short-run unit cost curves * Perfect competition Profit maximization Competitive market efficiency * Market intervention Efficiency-reducing interventions Efficiency-enhancing interventions 2 Buyers and Sellers • Buyers – “Should I buy another unit?” – Answer: If the marginal benefit exceeds the marginal cost • Sellers – “Should I sell another unit? – Answer: If the marginal revenue exceeds the marginal cost of making it 3 Seller’s goal? • Maximize profit • Decisions: – What to produce (what market)? – How much to produce? – What inputs to use? – What price to charge? • Firm behavior depends on the competitive environment they operate in. 4 Types of Markets (degrees of competition) One firm 2-12 firms many firms Monopoly Oligopoly Monopolistic Competition many, many firms Perfect Competition 5 Basic principles • There are some basic ideas that apply to all types of firms: – What “profit” means – Production theory & implications for unit costs 6 Economic profit v. Accounting profit 7 Profit Maximization Accounting Profit The difference between the total revenue a firm receives from the sale of its product minus explicit costs (“expenses”). Economic Profit The difference between the total revenue a firm receives from the sale of its product minus all costs, explicit and implicit. Note: this includes opportunity cost, and is therefore different than profit in a traditional accounting sense. 8 2 Types of Costs and 2 Types of Profit • Explicit Costs (“accounting costs” or “expenses”) – Actual payments made to factors of production and other suppliers • Implicit Costs (opportunity costs) – All the opportunity costs of the resources supplied by the firm’s owners • Eg: opportunity cost of owner’s time • Eg: opportunity cost of owner-invested funds 9 Two Types of Profit • Accounting Profit – Total Revenue – Explicit Costs • Economic Profit – Total Revenue – Explicit Costs – Implicit Costs • Economic Loss – An economic profit less than zero 10 The Difference Between Accounting Profit and Economic Profit 11 The Difference Between Accounting Profit and Economic Profit • Revenue – Acct Costs = Acct Profit • Revenue – Econ Costs = Econ Profit • Revenue – Explicit Costs = Acct Profit • Revenue – (Explicit + Implicit costs) = Econ Profit • Acct Profit – Implicit Costs = Econ Profit • If Acct Profit exactly = Implicit Costs => Econ Profit = 0, and the firm is said to be earning a “normal profit” 12 Econ vs. Acct Profits • True or False: Economic profits are always less than or equal to accounting profits. TRUE • If some implicit costs exist… economic cost > accounting cost economic profit < accounting profit (ie: we are subtracting more costs from the same revenue) 13 To Farm or Not To Farm? • Farmer Dave sells corn – his revenues are $22,000/yr – he pays $10,000/yr in explicit costs – he could earn $11,000 at another job he likes equally well (implicit costs) • Dave’s economic profit is – $22,000 - $10,000 - $11,000 = $1,000 – Dave is earning a positive economic profit – Dave is earning more than a normal profit 14 Example • After graduation you face the following job choice: • Option 1: IBM • Salary = $50,000/year • Option 2: your own firm in Wilmington • You choose option 2 and withdraw $20,000 from savings to start the business. Assume that you could have earned 5% on that money. 15 Example continued You chose option 2 and have the following info after 1 year: 1st year analysis: Revenue = $50,000 Costs of inventory = $8,000 Labor expenses = $15,000 Rent = $12,000 Cost categories: accounting - inventory - rent - wages for worker economic - inventory - rent - wages for worker - opp cost of Labor = $50,000 - opp cost of funds = $1,000 16 Example continued • Accounting profit = 50 – 8 – 15 – 12 = 15 • Economic profit = 50 – 8 – 15 – 12 – 50 – 1 = -36 • Your firm is earning negative economic profit – What does this mean? – Did you make a bad decision? – What will happen when firms in a market are characterized by negative economic profits? 17 What if economic profits are > 0? • What does it mean when economic profits are positive? – The firm owner is doing better than their next best alternative – The firm owner is more than covering opportunity costs • What will happen in markets where firms are characterized by positive economic profits? 18 What if economic profits are = 0? • What does it mean when economic profits are zero? – The firm owner is doing just as well as their next best alternative – The firm owner is exactly covering opportunity costs • What will happen in markets where firms are characterized by zero economic profits? 19 “Normal Profit” If market wages for your labor and market interest rates for your funds were accurate reflections of the value of your time and money, how much accounting profit should your firm have earned? What is a “normal profit” for your firm? Normal profit = the (accounting) profit required to exactly cover opportunity costs. Normal profit = the accounting profit required to earn exactly zero economic profit 20 Functions of Price • Where price is relative to average total costs of production (ATC) will determine firm profits and serve to allocate firm resources. – P > ATC => positive profits – P < ATC => negative profits • Changes in price may therefore reallocate resources. 21 Market Forces and Economic Profit • Positive Economic Profit means the firm (owner) is more than covering opp costs • Doing better than the next best alternative • Price must be higher than ATC – Firms enter this industry • Supply increases • Price falls • Profits fall 22 Fig. 8.2 The Effect of Economic Profit on Entry 23 Market Forces and Economic Profit • Negative Economic Profit means the firm (owner) is not covering opp costs • Doing worse than the next best alternative • Price must be below ATC – Firms exit this industry • Supply decreases • Price rises • Losses fall • Zero profit tendency of competitive markets 24 Fig. 8.3 The Effect of Economic Losses on Exit 25 Choosing Output • How much to produce? – The goal is to maximize profit • Profit = TR – TC – A perfectly competitive firm chooses to produce the output level where profit is maximized • Cost-benefit principle & quantity decisions – A firm should increase output if marginal benefit (revenue) exceeds the marginal cost 26 Choosing Output • Cost-Benefit Principle – Increase output if marginal benefit exceeds the marginal cost • For a perfectly competitive firm – Marginal benefit = marginal revenue = price – Only true if demand is perfectly elastic • Cost-benefit principle for a price taker – Keep expanding as long as the price of the product is greater than marginal cost – Choose the output where P = MC 27 Profit Maximizing Condition • • • • Profit = TR – TC Max Profit with respect to Q d Profit / dQ = (dTR/ dQ) – (dTC/dQ) = 0 therefore maximum profit occurs where MR = MC 28 Profit Maximization P ATC = Total Cost / Q so, TC = ATC x Q P > ATC means profit > 0 MC ATC D = MR 10 = P* 8 Q* 100 Quantity 29 Suppose Price Falls to Min ATC P P = ATC means profit = 0 MC ATC 7 = P* D = MR Q* Quantity 30 Suppose Price Falls below Min ATC P P < ATC means profit < 0 MC ATC 7 = P* D = MR Q* Quantity 31