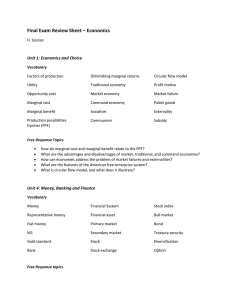

Supply-side policy

advertisement

Macroeconomics ECO 110/1, AAU Lecture 10 SUPPLY-SIDE POLICY Eva Hromádková, 26.4 2010 Overview 2 How does aggregate supply affect outcomes of the economy? The How best of both worlds: low inflation & low unempl. can we shift AS curve? Aggregate Supply Motivation for supply-side policies 3 In the 1970’s, the US economy has experienced stagflation = simultaneous occurrence of substantial unemployment and inflation. Cannot be explained by changes in the aggregate demand (Q: why? – explanation = slide 8) Alternative explanation was sought What about other side of market = production? Aggregate supply = total quantity of output that producers are willing and able to supply at alternative price levels in a given time period. Aggregate Supply Shape of the AS curve 4 The response of producers to an AD shift is expressed in the slope and position of the AS curve. If economy increases demand, will they produce more or charge higher prices? There are three views concerning the shape of the aggregate supply curve. Keynesian – very short term Monetarist – very long term Hybrid LO1 Aggregate Supply Keynesian AS 5 AS is horizontal up to full employment. => Producers increase output, not prices, when AD expanded At the full employment, AS becomes vertical. => At full capacity they cannot produce more, even if they are paid lot LO1 Aggregate Supply Monetarist AS 6 Producers make output decisions based on fundamental factors = technology, market size, capital Change in price of output = change in costs of input (no change in output level) LO1 AS is vertical and located at full employment. Aggregate Supply Hybrid AS 7 LO1 At low rates of unemployment AS is horizontal and at high rates of unemployment AS is nearly vertical. In between, AS is gently upward sloping. The closer to capacity, the greater the risk that fiscal or monetary stimulus will spill over into price inflation. Aggregate Supply The Inflation-Unemployment Tradeoff 8 Demand-side policies (fiscal and monetary) cannot reduce both unemployment and inflation at the same. Demand stimulus: as the AS curve is upward-sloping, rightward shifts of the aggregate demand curve increase both prices and output. Demand restraint: as the AS curve is upward-sloping, leftward shifts of the aggregate demand curve cause both prices and output to fall. LO2 Aggregate Supply The Inflation-Unemployment Tradeoff - Illustration 9 Aggregate supply C B A AD3 AD2 AD1 REAL OUTPUT LO2 A trade-off between unemployment and inflation. INFLATION RATE PRICE LEVEL Increases in aggregate demand causes . . . . . Phillips curve c b a UNEMPLOYMENT RATE Aggregate Supply The Phillips Curve 10 The Phillips curve = historical inverse relationship (tradeoff) between the rate of unemployment and the rate of inflation. A. W. Phillips: UK, years 1826-1957 Samuelson and Solow: USA, years 1900-1960 LO2 Aggregate Supply The Phillips curve - UK 11 The Phillips curve in the UK, 1861 - 1913 LO2 Aggregate Supply The Phillips curve - USA 12 The Phillips curve in the US, 1961 - 1969 LO2 Aggregate Supply Shifts of the AS curve 13 Many economists argue that the economy can attain lower levels of unemployment without higher inflation. rightward shift of the AS curve can reduce unemployment and inflation at the same time The Phillips curve shifts left, thus the unemployment-inflation trade-off eases leftward AS shift creates stagflation (low output, rising prices) Usually caused by supply-side shocks affecting both capital and labor force (hurricanes, tsunami) or expectations (September 11, 2001) Aggregate Supply Rightward shift of the AS curve Price Level (average price per unit of output) 14 Rightward AS shifts reduce AS1 unemployment and inflation E1 AS2 E2 AD 0 Output (real GDP per period) Aggregate Supply Rightward shift of the AS curve – Shift of Phillips curve 15 Inflation Rate (percent) PC1 Rightward AS shifts cause leftward Phillips curve shifts PC2 a 4 b 2 1 2 3 4 5 6 Unemployment Rate (percent) 7 8 Aggregate Supply Policy tools 16 Rightward shifts of the aggregate supply curve always generate desirable macro outcomes. The AS curve can shift rightward through: 1. 2. 3. 4. 5. LO3 Tax incentives for saving, investment and work. Human capital investment. Deregulation. Trade liberalization. Infrastructure development. Two Theories for Getting the Economy Moving 17 Supply-Side Theory Keynesian Theory 1 Cut tax rates to boost incentives to work and invest. 1 Cut tax rates to put more disposable income in people’s hands. 2 Firms invest more and try new ventures; jobs are created; people work harder aggregate supply increases. 2 People use increased income to buy more goods and services: aggregate demand increases. 3 New investment and labor bring increased output. 3 To meet new demand, companies expand output. 4 Employment rises, new plants go up, the whole economy expands. LO3 Supply-Side Policies 1. Tax Incentives 18 LO3 Keynesians: tax cuts are used to increase aggregate demand through increase in disposable income. Supply-side economy: analyses direct effects of taxes on the incentives to work and produce Supply-Side Policies 1. Tax Incentives 19 Supply-side theory places special emphasis on marginal tax rates = the tax rate imposed on the last (marginal) dollar of income. Progressive tax: higher income => higher relative tax payment => increasing marginal tax rate Flat tax: constant marginal tax rate LO3 1. Tax Incentives Tax systems in our countries 20 Corporate Personal Payroll Austria 25% 21-50% Belarus 24% 12% China 25% 5-45% Czech Rep 21% 15% Georgia 15% 20% Kazakhstan 17.5% 10% 11% Russia 13-20% 13% 10-26% Slovak Rep 19% 19% USA 15-39% (fed) 0-12% (state) 0-35%(fed) 0-10.3% Ukraine 25% 15% Uzbekistan 12% 13-30% 35% 47.5% Macedonia Nigeria LO3 15.3%, 2.9% (regressive) 1. Tax Incentives Effects 21 Labor supply: The marginal tax rate influences the financial incentive to increase one’s work. If the marginal tax rate is high, there is less incentive to work. Entrepreneurship: High progressive tax rates discourage entry into selfemployment. Investment: Aggregate supply will be constrained if high tax rates discourage investment. LO3 1. Tax Incentives Computational Problem #1: 22 Suppose taxpayers are required to pay a base tax $50 plus 50% on any income over $200. Suppose further that the taxing authority wishes to decrease by $30 the taxes of people with incomes of $300. If the marginal tax rates are to remain unchanged, what will the new tax base be? If the base tax of $50 is to remain unchanged, what will marginal tax rate have to be? What are the implications of these tax changes in the view of Keynesian theory? What are the implications of these tax changes in the view of supply-side theory? 1. Tax Incentives Tax-Induced Supply Shifts 23 LO3 A reduction in marginal tax rates shifts the aggregate supply curve to the right. Work effort, entrepreneurship, and investment increase. Note: Tax rebates or lump sum deductions do not shift AS because they are one-time windfall and have no effect on marginal tax rates. 1. Tax Incentives Quantification of effect: The Tax Elasticity of Supply 24 The tax elasticity of supply is the percentage change in quantity supplied divided by the percentage change in tax rates. Tax elasticity % change in quantity supplied = of supply % change in tax rate LO3 If the tax elasticity of supply were large enough (larger than 1), a tax cut might actually increase tax revenues. Estimates of tax elasticity of supply: 0.15-0.2 1. Tax Incentives Computational Problem #2: 25 Suppose households supply 150 billions hours of labor per year and have a tax elasticity of supply of 0.25. If the tax rate is increased by 5%, by how many hours will the supply of labor decline? 1. Tax Incentives Savings and Investments Incentives 26 Supply-side economists favor tax incentives that encourage saving as well as greater tax incentives for investment. Demand side – stimulate consumption not saving (due to multiplication effect) Savings = source for investment and growth Policies that encourage investment: cutting capital gains tax rates and investment tax credits LO3 2. Human Capital Investment 27 Human capital is the knowledge and skills possessed by the work force. If the quality of work force increases, more output can be supplied at given price level Structural unemployment – mismatch between skills and jobs requirements – major cause of unemployment – inflation trade-off Firms Thus, cannot hire more workers – they raise prices policies focused on decreasing structural unemployment shift AS curve to the right LO3 2. Human Capital Investment A. Worker Training 28 Tax incentives to businesses that offer worker training is a viable policy tool for future shift in aggregate supply. In the long run they increase labor productivity = the amount of output produced by a worker in a given period of time. Measured In LO3 as output per hour (or day, etc.). the short run they impose additional labor costs 2. Human Capital Investment B. Education Spending 29 Expansion and improvement of the efficiency of the educational system => higher HC Examples: School vouchers LO3 Q: Do you like the idea? Where do you see its strengths / weaknesses? Increased gvt. spending on schools Tax incentives for college savings accounts Note: Education spending is more likely to develop human capital gradually rather than to spur short-term economic growth. 2. Human Capital Investment C. Reducing discriminatory barriers 30 Race and gender issues (as opposed to lack of skills and experience) can create artificial barriers between job seekers and job openings. Policies: Affirmative action (positive discrimination) LO3 Q: Yes/no? What is your opinion? 2. Human Capital Investment D. Transfer Payments 31 Transfer payments are payments to individuals for which no current goods or services are exchanged, such as social security, welfare, unemployment benefits. On one hand side, they serve important social needs. On the other, they can discourage workers from taking jobs. LO3 3. Deregulation A. Factor markets 32 The added costs of production due to regulation shift the aggregate supply curve to the left. Minimum wage: Mandatory benefits Health benefits, leaves of absence Occupational health and safety LO3 Main goal: ensure a decent standard of living (CR 8000 CZK) By-product: limits ability of employers to hire additional people minimum safety conditions at workplaces 3. Deregulation B. Product markets 33 Transportation costs: E.g.: Regulation of truck traffic during weekends Food and drug standards Goal = minimize health risks to consumers Approval of new drugs – long time and huge investment Fewer new drugs are brought to market They are more expensive Efficiency x harmfulness (drug neither helps nor harms) LO3 3. Deregulation Summary 34 LO3 The basic contention of supply-side economists is that the regulatory costs are now too high. They favor deregulating the production process in order to shift aggregate supply to the right. Other opinion: regulation = price of externality 4. Easing Trade Barriers A. Factor and product markets 35 Government regulation of international trade affects aggregate supply. Factor markets: Tariffs, quotas and restrictions that make foreign inputs more expensive constrain domestic AS Product markets: Tariffs, quotas and restrictions that make foreign products more expensive constrain domestic AS Policies: WTO, NAFTA, EU – common market LO3 Q1: What is the difference between tariff and quota? Q2: Why do countries introduce these protectionist measures? 4. Easing Trade Barriers B. Immigration 36 Immigration of foreign-born workers can increase the pool of skilled labor, shifting the aggregate supply curve to the right. Solution to low population growth? Policies: green card initiatives (Canada, Australia, but also CR) Dangers: Brain drain Second and third generation LO3 5.Infrastructure Development 37 Improving the nation’s infrastructure reduces the costs of supplying goods. Infrastructure is the transportation, communications, education, judicial, and other institutional systems that facilitate market exchanges. Q1: Would you say your country has an adequate infrastructure? What is the main problem? LO3