5.1 - Government Economic Policy

advertisement

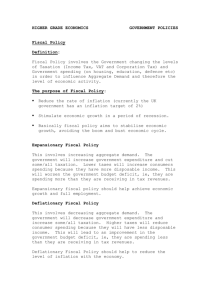

IGCSE Economics 5.1 Government Economic Policy Learning Outcomes • Describe the government as a producer of goods and services and as an employer • Describe the aims of government policies • Explain Monetary, Fiscal and Supply-side policies • Analyse the use of fiscal, monetary and supply-side policies • Discuss the possible conflicts between government aims 2 Recap…. Discuss in pairs • What is a mixed economy? • What is the public sector? • Why do governments intervene in mixed economies? • How do governments intervene in mixed economies? 3 INTRODUCTION TO GOVERNMENT OBJECTIVES AND POLICIES 4 Question…. • What’s the difference between a • Government Objective? • Government Policy? 5 Task- 10 mins • Look at the newspaper headlines in activity 5.1 (Page 283 of the textbook) • For each headline identify: 1. What is the government policy? 2. What objective are they hoping to achieve? 3. How will this work? Write your answers in a table: Government Action Government Objective How will it work? 6 Government Objectives • Low and steady inflation • Low unemployment • Steady and sustainable economic growth (%change in GDP • - A positive balance of payments – to export more than we import Two other possibles: - To reduce inequality in the country – to redistribute income and wealth in order to help the poor • - To protect the environment – to avoid pollution and congestion 7 Group Task • See what questions you can answer from the ‘Government objective questions’ sheet. • See which questions you can answer yourselves without using the internet. • Now use the internet to help you find any missing answers • Make a note of any questions you might have as you go 8 MACRO ECONOMIC OBJECTIVES – LOW AND STABLE INFLATION 9 Inflation Questions: • What is inflation? • How is it measured? • What level do governments generally like to keep inflation at? • What problems can high inflation cause for savers? • What problems can high inflation cause for businesses? • What is deflation? • What problems can deflation cause? 10 MACROECONOMIC OBJECTIVES – LOW UNEMPLOYMENT 11 Unemployment Questions…. • Which people do official ‘unemployment figures’ include? • What problems can unemployment cause for governments? • What might cause unemployment to rise in an economy? 12 MACROECONOMIC OBJECTIVES – ECONOMIC GROWTH 13 Economic Growth Questions…. • How is the size of an economy measured? • What are the benefits of economic growth in an economy to: – Households? – Businesses? – Government? 14 MACROECONOMIC OBJECTIVES – FAVOURABLE BALANCE OF PAYMENTS 15 Balance of Payment Questions…. • What is an import? • What is an export? • Why do governments want to make sure that there are more exports than imports? 16 A very brief introduction…… THE MACROECONOMY 17 Macroeconomics is….. • The study of national economies • Concerned with the allocation of a countries resources Is concerned with measuring an economy’s: • total output of all goods and services (Aggregate Supply) • Total demand for all goods and services (Aggregate Demand) Aggregate Supply and Demand What is the difference between this diagram and the supply and demand model we have looked at before? Is the government in an economy a producer or a consumer? What questions do you have about this diagram? 19 The Macro economy The important bit…. • Governments are both producers and consumers • The contribute to aggregate demand and aggregate supply within an economy • They can also affect aggregate demand and aggregate supply using other policies Government policies can be described as demand-side or supply-side 21 GOVERNMENTS AS CONSUMERS – GOVERNMENT SPENDING 22 Why do Governments spend money? A government can use its spending power to: • • • • • provide goods and services that are in the public and economic interest, such as street lighting, national parks, universal education and health care, affordable housing invest in national infrastructure such as road and railway networks, airports support agriculture and key industries to provide jobs and output, and to invest in staff training, new machinery, and the research and development (R&D) of new products manage the economy, for example to boost total spending during an economic recession to help firms and reduce unemployment reduce inequalities in incomes and help vulnerable people, for example by providing welfare payments to people and families in need Government Expenditure Current Expenditure Government Expenditure Items that will be used up within a year Capital Expenditure Purchase of long lasting items 24 Current or capital? Building new roads MR Scanner Teachers Salaries New Computers Unemployment Benefits Stationery Supplies 25 GOVERNMENT POLICIES 26 Government Policies Fiscal Policy Government Policies What can you tell me about these different policies? What is the difference? Monetary Policy Supply Side Policies 27 Government Policies Taxation Fiscal Policy Government Spending Government Policies Monetary Policy Control of money supply Interest Rates Supply Side Policies Boosting productive potential 28 Task – 2 mins • Look back to your tables from Exercise 5.1 • Are the government actions outlined in the headlines examples of: • Fiscal Policy, Monetary Policy or Supply Side? 29 GOVERNMENT POLICIES – FISCAL POLICY 30 Fiscal Policy • Changing the total level of government spending and taxation • To change the level of aggregate demand for goods and services • and therefore on output, employment and prices Price Level Changes in Aggregate Demand AS P AD Y Real Output Task - Whiteboards • Draw a fully labelled diagram showing Aggregate Supply and Demand • Now show a shift to the right of the AD curve • What happens to P and Y? What do you think would happen to unemployment? • Now draw a diagram to show a shift to the left of the Aggregate Demand Curve • What happens to P and Y What do you think would happen to unemployment? 33 Expansionary Fiscal Policy • When the government wants to increase Aggregate Demand in order to boost output and employment ??????????? • It will do this by……… Increase/Decrease • Increasing Government Spending Increase/Decrease • Decreasing Taxation • How will decreasing taxation cause aggregate demand to increase? 34 Contractionary Fiscal Policy • When the government wants decrease Aggregate Demand in order to reduce inflation ??????????? • It will do this by……… Increase/Decrease • Decreasing Government Spending Increase/Decrease • Increasing Taxation • How will increasing taxation cause aggregate demand to decrease? 35 Task - Problems with Fiscal Policy Use page 286-287 of your books to help you answer the following questions: 1. What problems can be caused by an increase in government spending? 2. What is meant by ‘crowding out’ 3. What problems can be caused by increasing taxes 4. What are the other criticisms of Fiscal Policy? 5. What are the ‘Fiscal Rules’ Government Spending and increased demand….The multiplier effect 37 GOVERNMENT POLICIES – MONETARY POLICY 38 Monetary Policy • Monetary Policy refers to actions taken by the government • to try to control the supply of money or the price of money • In order to influence spending (and therefore Aggregate Demand) in the economy Who will interest rates directly affect? People who already have debt Businesses who are deciding whether to save or invest their money People who may want to borrow in the future Stakeholders affected by interest rates Businesses who need to borrow money in the future How will each of these groups be affected by an increase in interest rates? People who have savings Businesses who already have debts INTEREST RATES AND EXCHANGE RATES 41 Exchange Rate Policy…. • Interest rates can also be used to influence the exchange rate of a national currency Questions……. • Why might a government wish to change the exchange rate? • If the government wanted to increase exports, would it need the national currency to appreciate or depreciate? • How could interest rates help this to happen? 42 Interest rates are increased Foreign capital is attracted to invest Demand for the currency increases This causes the value of the currency to appreciate Domestic goods are now expensive to foreign customers Exports are likely to decrease (and imports increase) Unfavourable for balance of payments Step by Step In each of these scenarios…..Wh at will be the impact on: • AD? • Employment? • Inflation? Interest rates are lowered Foreign capital is not attracted to invest Demand for the currency reduces This causes the value of the currency to depreciate Domestic goods are now cheap to foreign customers Exports are likely to increase (and imports decrease) Favourable for balance of payments 43 MONEY SUPPLY 44 Increasing the money supply - Quantitative Easing • The government increase the money supply by printing more notes and coins • However it can’t just randomly decide to print more money!! • Instead….. • The government uses the newly created money to buy financial assets (government and corporate bonds) from banks and other private organisations • This increases the amount of money that banks have to lend to people and firms 45 Video….. • It’s a bit complicated…… don’t worry, you only really need to get the general idea of what quantitative easing is • Watch and see if you learn something! 46 Quantitative Easing….. Put much more simply….. 47 Expansionary Monetary Policy • When the government wants to increase Aggregate ??????????? Demand in order to boost output and employment • It will do this by……… • Decreasing Interest Rates Increase/Decrease Increase/Decrease • Increasing Money Supply 48 Contrationary Monetary Policy • When the government wants decrease Aggregate Demand in order to reduce inflation ??????????? • It will do this by……… Increase/Decrease • Increasing Interest Rates Increase/Decrease • Decreasing Money Supply 49 Video – Bank of England • Watch the video ‘Interest Rates and Inflation in the UK’ 50 GOVERNMENT POLICIES – SUPPLY SIDE POLICIES 51 Supply Side Policies Supply-side policies attempt to boost the productive potential of an economy and increase aggregate supply Increased growth = more jobs + more incomes + lower inflation Supply Side Policies….. • selective tax incentives e.g. tax breaks to encourage investment • selective subsidies e.g. to support development of new technologies • improving education and training to raise skills and productivity • labour market reforms to restrict trade union power • competition policy to outlaw anti-competitive behaviour • removing barriers to trade to increase choice and competition • privatization transferring public sector activities to private sector firms • better regulation simplifying or removing old and unnecessary regulations that otherwise raise costs and restrict business activity 53 Can Policies Conflict? Yes ‘Raising public spending, cutting taxes and interest rates to boost demand and employment will increase inflationary pressures and spending on imports.’ ‘Cutting public spending, raising taxes and interest rates to control inflation will reduce demand and therefore increase unemployment and reduce economic growth.’ No ‘Keeping price inflation low and stable will make domestic goods and services more competitive. Demand for them will rise at home and overseas. This will help to improve the balance of trade and will boost jobs, incomes and tax revenues.’ ‘If workers expect inflation to remain low they are less likely to push for big wage increases. This will boost the demand for their labour. And if firms are more confident in the future they are more likely to invest in new capacity for growth. In contrast, rising inflation raises costs and lowers profits.’